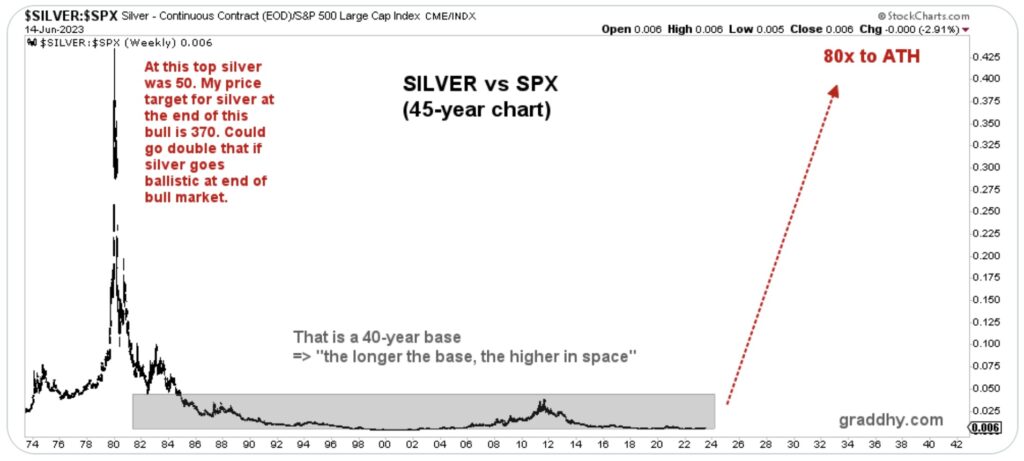

Here is a look at a $370 price target for silver and a world drowning in debt.

Silver

June 15 (King World News) – Graddhy out of Sweden: This ratio chart shows how extremely undervalued silver is right now. And on lower time frame, it has broken out, so this chart is on the move. A historical, financial system paradigm shift is in the making. For heaven’s sake – do not miss it.

Silver Price Target $370 (SHOW IN RED)

Drowning In Debt

Gregory Mannarino, writing for the Trends Journal: There has been no other time in the history of the world where global debt has risen faster than it is rising today. Moreover, the big secret is this: no matter how much debt puppet governments pump into the system, via the REAL world government system which is world central banks, the amount of debt pulled into the system is never enough.

As absolutely insane as it is, the entire world’s financial system (simply just in order to function), demands perpetual, ever-expanding debt. (This fact is probably the biggest secret being kept from the people of the world).

But it gets even worse!…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Despite every conceivable effort by puppet governments to continue to borrow cash into existence, the system itself operates in a perpetual deficit. In other words, no matter how much cash is pulled into the system, the system functions in a continual vacuum.

If you were to ask 99 percent of people what kind of financial system we have, 99 percent of people would have no answer. But the answer is this, WE HAVE A DEBT-BASED SYSTEM! And a debt-based system DEMANDS that the debt expands in perpetuity.

If you were to ask 99 percent of people, what is the product of a central bank? 99 percent of people would again have no answer. The SINGLE and ONLY product of ANY central bank is debt! And the more debt a central bank issues, or is called upon to issue, THE STRONGER THEY BECOME.

The current world financial system, which is run by central banks, demands ever-increasing debt just to function day to day. This fact is a guarantee that central banks whose sole existence depends on their ability to create debt and therefore inflate, will remain at their pinnacle of power.

Moreover, their power will grow.

Each world leader of every developed nation on Earth must find reasons to borrow more cash into existence than his, or her, predecessor. Without this mechanism, the entire system collapses…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Have you ever thought about why it is that debts and deficits are raging out of control? Or why in the face of skyrocketing debt, no real cuts to spending ever really occur? Have you ever thought about why it is that there seems to be ENDLESS cash available to fund and even expand wars?

The propagation of war generates more need for cash to be pulled into the system than any other endeavor on Earth. (ALL WARS ARE BANKER WARS).

The simple fact is this. The world today is governed by those who run the financial system, the financial markets, and the global economy—central banks. It is these same entities who will see to it that the system ALWAYS functions via a crisis-to-crisis mechanism. With each engineered “crisis” demanding ever increasing cash to be thrown at it. (Perpetual expanding debt).

Perpetual expanding debt has a couple of “side effects” which are beneficial to central banks.

The first is currency devaluation. Every time a central bank issues more currency, the newly created currency has to “steal” purchasing power from every other prior existing bill. As an example of this, look at the value or purchasing power of the U.S. dollar. Since the creation of the Federal Reserve in 1913 the U.S. Dollar has lost 98 percent of its purchasing power. Currency devaluation is positive for central banks as now they MUST create even more currency to make up for the difference of the depreciating value of the currency. Currency is debt. This is a self-feeding mechanism which increases the demand for even more currency/debt, to the benefit of central banks.

The second side effect of perpetual expanding debt is INFLATION. As every newly created central bank note lowers the purchasing power of the currency, it takes more currency to purchase goods and services. This effect is made worse by an expanding “currency pool.” By increasing the amount of overall available currency, or currency pool, you have more bills in whatever form they exist, chasing the same amount of goods—and this is inflationary. A central bank’s power resides in only ONE THING! Their ability to inflate.

What you can be assured of is this: the world as we know it will continue to exist only if more debt is created, exponentially… However, once this mechanism reaches a “maximum saturation point,” everything stops.

ALSO JUST RELEASED: The Elites’ Plan For The World Is Absolutely Terrifying CLICK HERE.

ALSO JUST RELEASED: SPROTT: The Gold Bull Market May Finally Be Unleashed! CLICK HERE.

ALSO JUST RELEASED: “There Are No Free Markets Anymore, Just Interventions” CLICK HERE.

ALSO JUST RELEASED: ALERT: Look At Silver And Silver Stocks CLICK HERE.

ALSO JUST RELEASED: Big Fed Decision This Week, Plus The Credit Crunch Is Here CLICK HERE.

ALSO RELEASED: The US Economic Nightmare And The Great Unwind Set To Accelerate CLICK HERE.

ALSO RELEASED: Man Who Predicted The Banking Collapse Three Years Ago Says It Will Get Much Worse CLICK HERE.

***To listen to the timely and powerful audio interview with Gerald Celente where he discusses why investors need to get ready for a major takedown in the economy and global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.