With the Fed decision taking center stage, look at how preposterous the situation is…

“There are no free markets anymore, just interventions.” — Chris Powell

“One Of Them Is Lying”

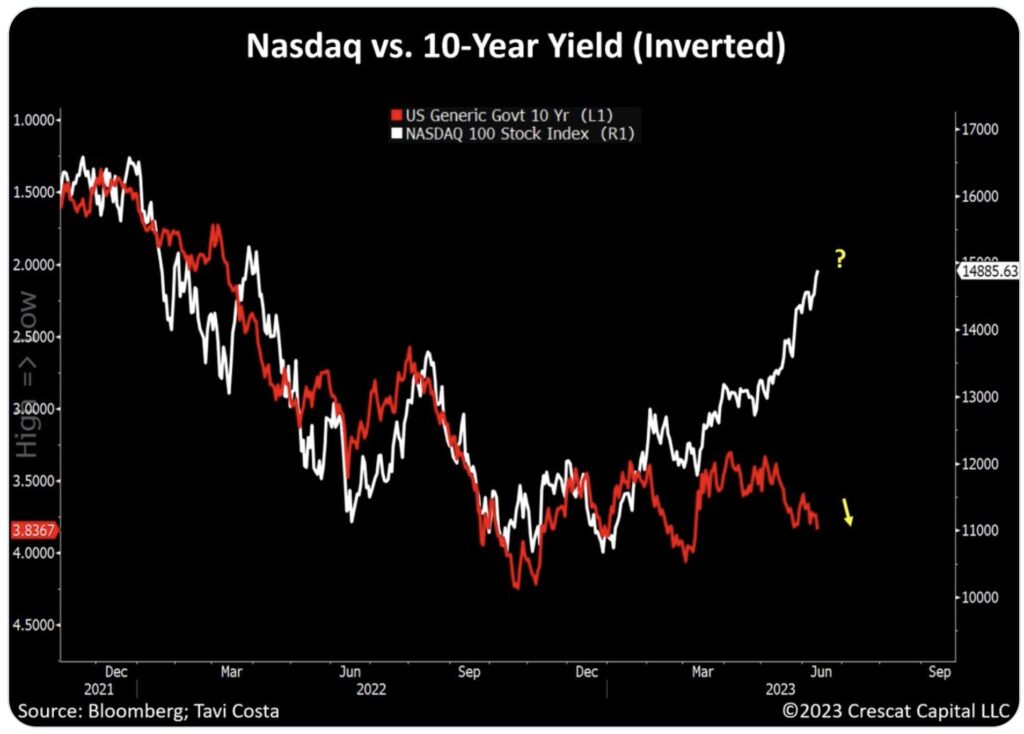

June 13 (King World News) – Otavio Costa: Nasdaq vs. 10-year yield (inverted) One of them is lying. Since the market peaked, Nasdaq has been significantly impacted by the increase in interest rates. Despite the continuous upward movement in 10-year yields, this correlation has been disrupted by the euphoria surrounding AI and, consequently, the surge in mega-cap companies. Ultimately, the present value of long-duration businesses must reflect the ongoing rise in discount rates.

This Is What Happens When You Have Rigged Markets:

Massive (Unsustainable) Chasm Between Nasdaq & 10-Year Yield

Serious Headwinds Facing Banks

Peter Boockvar: While the focus of markets again yesterday were on tech, AI and travel stocks mostly, the banks continue to badly lag because of the challenging conditions they face highlighted by what was said at the Morgan Stanley conference yesterday. Connecting the dots and the credit tightness has broad economic implications, especially for small and medium sized businesses. Here’s what was said:

Citizens Financial Group:

“If there’s another $1 trillion of liquidity needed to be redirected to the general account of the Treasury. At the same time that the Fed is continuing QT, at the same time money market yields in the reverse repurchase program remain attractive, I mean there are clearly headwinds for the banking industry. I mean I think banking deposits have fallen over the last 12 months, they’ve fallen. But over the last couple of months, they’ve actually stabilized and started to rise again…But generally, we think that the direction for deposits will be down in the near future.”

“In the NII space, I think we had indicated we would be down about 3% for the quarter. I think you could see that being down a little bit more based upon what’s going on with deposit migration and those kind of things…So that will be a little more than that 3% on the NII side of things.”

“On the credit side of things, I mean I think we are seeing some charge-offs that are a little bit higher than we had originally expected, mostly given certain valuation aspects of the book, which have come in a little lower than expected. But overall, loss content over time seems to be well controlled and as expected and certainly really strong on the reserve side of things and capital side of things.”

With regards to credit exposures in auto, educational, other retail portfolios, “I think that you’ve seen normalization outside of commercial on the consumer side, but nothing to be alarmed about, just exactly what we expected that things would normalize.”

On lending standards, “I think that we’ve tightened on the underwriting side, just being really careful about where we’re allocating in late cycle, allocating risk weighted assets (RWA) and our capital and liquidity, we’re being pretty careful about that.”

“So as it relates to loan growth, you did see that overall decline in Q1. I think you could see that again as you look out the rest of 2023 driven in large part by the auto loan runoff, which tends to run off fairly quickly.”…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Keycorp:

“So on the quarter, I’d say loans and deposits kind of pretty much where we expected. NII is going to come in softer…Then credit quality continues to be really strong.”

“As it relates to NII, we’re going to come in softer than we thought again based on funding mix and deposit cost pressures, which I think you’re hearing from a lot of people.”

“I will say just broadly, and this is no surprise, right, clients deposits are staying in place. They’re just more expensive, and they’re going to continue to be more expensive as long as rates sort of sit where they are.”

“And now that cost of raw material just went up significantly. I think it’s going to be really hard for people that just borrow money to have access they used to have. I think one of the knock-on effects of that, by the way is I think it’s going to drive a lot of lending out of the banking system.”

“And so yes, there’s a slowdown out there. Yes, there’s less demand. We’re not changing our credit box. One of the things I feel strongly about is in this business, you make money by not losing it. We’ve been really conservative, really conservative.”…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Truist Financial:

“As we sit here today, our expectation is that the top line revenue is likely to decline sort of in the 3% area during the quarter…The remixing based on disintermediation of the deposit balances into higher yielding products. Betas continue to perform a little worse than our expectations.” They expect full year revenue growth of 3% vs the 5-7% they previously anticipated.

“Well, the credit quality in C&I continues to be excellent. We’re not seeing softness there…Maybe seeing a little bit more conservatism, some less expansionary type of behavior, which is reducing demand in the C&I space. We’re seeing that across the middle market businesses, as well as even in some of the corporate space.”

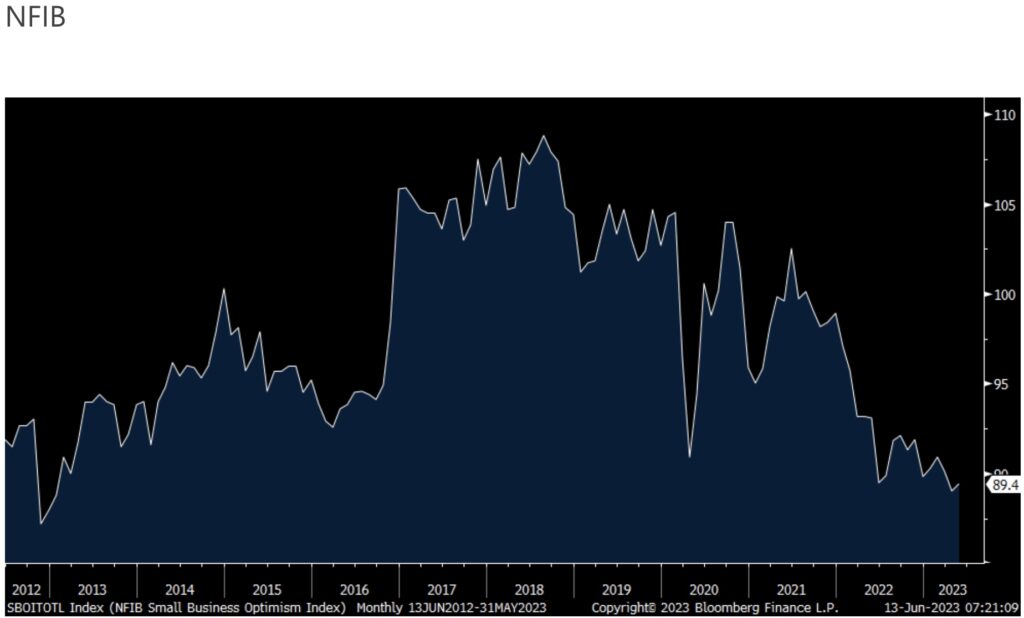

Small Businesses Concerned About Future

Off a 10 yr low, the May NFIB small business optimism survey rose a touch to 89.4 from 89.

Plans to Hire did rise 2 pts after a 2 pt increase in April while Positions Not Able to Fill fell 1 pt after rising by 2 past month. The compensation components each rose 1 pt m/o/m. Those that Expect a Better Economy dropped by 1 pt to -50 and is just off a record low. Those that Expect Higher Sales weakened by another 2 pts to -21 and that is the lowest since last July. There was no change m/o/m in those that said it’s a Good Time to Expand. Capital spending plans did bounce by a notable 6 pts and those that Plan to Increase Inventory was up by 3 pts but still below zero at -2. Higher Selling Prices was little changed, down 1 pt. There was deterioration in the earnings outlook as it fell 3 pts after the 5 pt drop in April. Credit conditions softened to -10 from -8 and that is a level last seen in November 2012.

The NFIB said “Overall, small business owners are expressing concerns for future business conditions…But until customers stop coming in, owners (especially in services) will continue to try to hire workers, increasing compensation to attract applicants and retain their current workforce.” Specifically on the credit side, “27% reported all credit needs met (down 3 pts) and 63% said they were not interested in a loan (up 4 pts)…The average rate paid on short maturity loans was 7.8%, .7 percentage pts below April’s reading.”

Meanwhile In China

Shifting to China, their 10 bps cut in the 7 day repo rate isn’t going to do much and now there is a Bloomberg News story that “China is considering a broad package of stimulus measures as pressure builds on Xi Jinping’s government to boost the world’s 2nd largest economy, according to people familiar with the matter. The stimulus proposals, drafted by multiple government agencies include at least a dozen measures designed to support areas such as real estate and domestic demand, the people said, asking not to be named because the matter is private.” Don’t expect a big levering up situation here as the Chinese government is also trying to tame the outsized debt levels…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

China also said that aggregate financing in May totaled 1.56T yuan, below the estimate of 1.9T yuan and M2 slowed to 11.6% growth from 12.4%. And this is the balancing act, how to delever at the same time you want to stimulate economic activity.

Europe

The markets response is mixed as copper and iron ore are higher but European markets are little changed as Germany in particular would benefit. Chinese stocks did trade higher but we know have been big laggards. The offshore yuan is lower on the rate cut.

In Europe, the June German ZEW investor expectations index rose to -8.5 which was a bit better than the -10.7 seen in May and above the estimate of -13.5. In contrast though, the Current Situation component deteriorated to -56.5 from -34.8. That’s a 5 month low and worse than the forecast of -40. The ZEW said “Experts do not anticipate an improvement in the economic situation during the 2nd half of the year.”

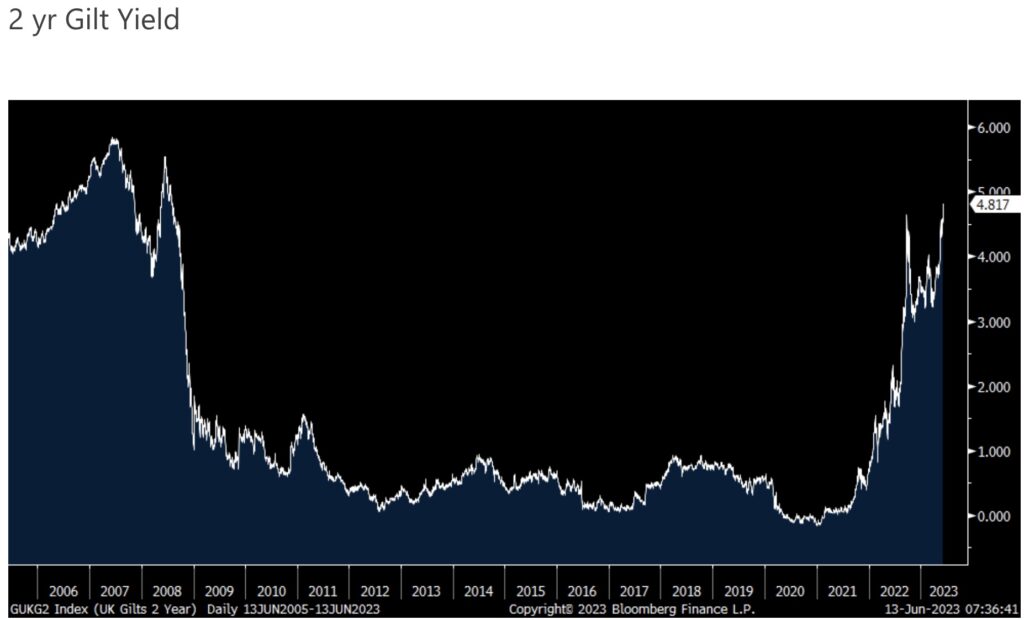

Job growth in the UK in the 3 months ended April that was better than expected, combined with stronger wage growth than estimated and the drop in May jobless claims has gilt yields jumping. The 2 yr gilt yield is rising to a 15 yr high.

ALSO JUST RELEASED: ALERT: Look At Silver And Silver Stocks CLICK HERE.

ALSO JUST RELEASED: Big Fed Decision This Week, Plus The Credit Crunch Is Here CLICK HERE.

ALSO JUST RELEASED: The US Economic Nightmare And The Great Unwind Set To Accelerate CLICK HERE.

ALSO JUST RELEASED: Man Who Predicted The Banking Collapse Three Years Ago Says It Will Get Much Worse CLICK HERE.

***To listen to the timely and powerful audio interview with Gerald Celente where he discusses why investors need to get ready for a major takedown in the economy and global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.