On the heels of the rally in gold, here is a $4,821 price target for gold, plus look at this collapse that no one is talking about.

Think Outside Of The Box

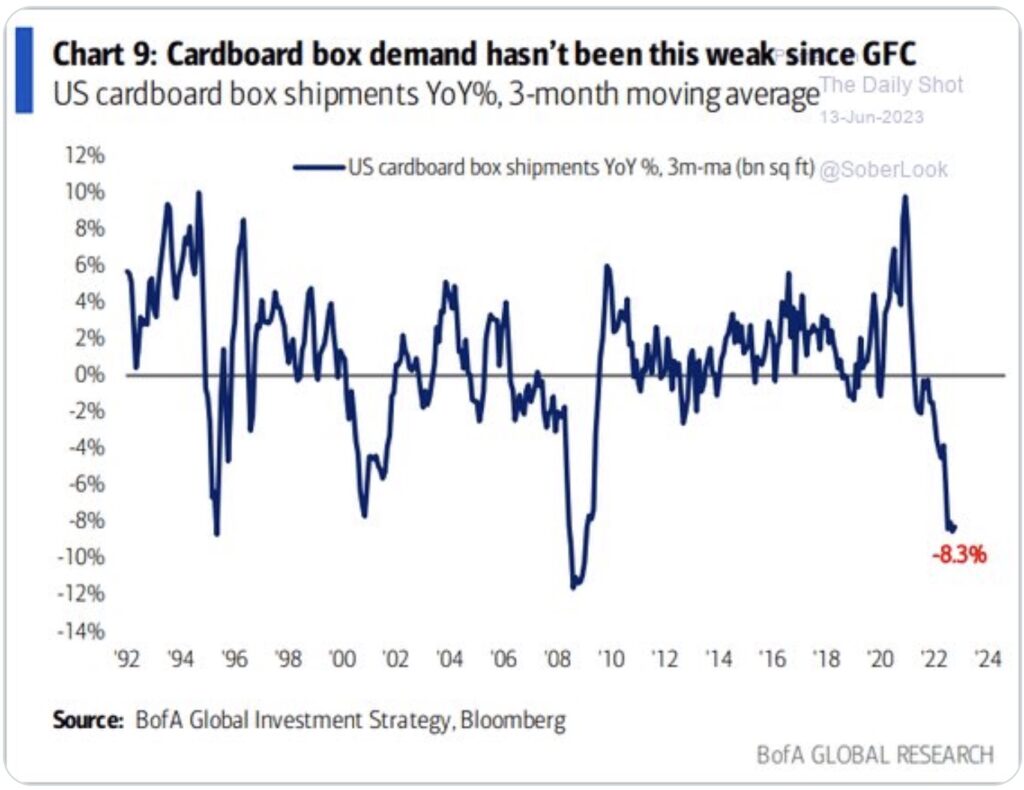

June 15 (King World News) – Albert Edwards, Former Global Strategist at Société Générale: In assessing whether the US economy is already in recession one must think out of the box – cardboard of course.

Cardboard Box Demand Collapses To Lowest Level Since The Great Financial Collapse

US Banking Crisis

Lisa Abramowicz: The fear of a US banking crisis has largely faded from market sentiment, but it seems there’s a steady, low drumbeat of distress among some firms. The amount of money lent out under the Fed’s emergency lending facility rose for a sixth straight week, remaining above $100 billion.

Drumbeat Of Bank Distress Continues As Fed’s Emergency Lending Facility Rose For 6th Straight Week

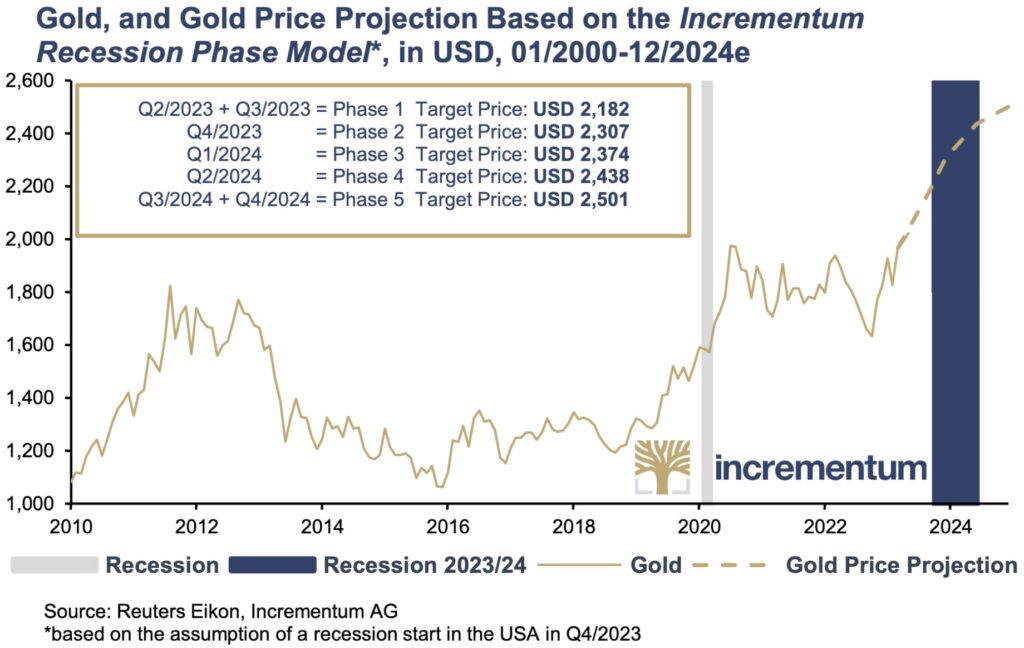

The Gold Price Forecast in Times of Recessionary Flow

Incrementum: …We think that recessionary tendencies, which are becoming more and more pronounced, as we detailed in the chapter “The Showdown in Monetary Policy”, will be the main driver for gold in the near future. Our Incrementum Recession Phase Model is ideally suited to anticipate gold price developments in this environment.

As with any forecast, numerous assumptions have to be made. Our gold price forecast was calculated based on the average gold performance in each phase, assuming the onset of a recession in the US as of Q4/2023, implying that we have already been in phase 1 of our proprietary recession phase model since the beginning of Q2/2023. The forecast extends to year-end 2024, the point at which all recession phases will have been completed under the assumptions we have made.

As a short-term price target, we have set the closing price of gold in US dollars at the end of the current year, which also marks the end of the second phase (initial phase of the recession itself). According to our projection, the gold price would be trading at around USD 2,300 at this time.

If the forecast is allowed to continue until the end of the last phase of the Incrementum Recession Phase Model, the final result is a gold price of just under USD 2,500 at the end of 2024.

However, it is important to emphasize that the fulfillment of the recession prerequisite is crucial to achieve this price development. In the absence of a recession, there is a possibility of significant deviation from the projected price…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

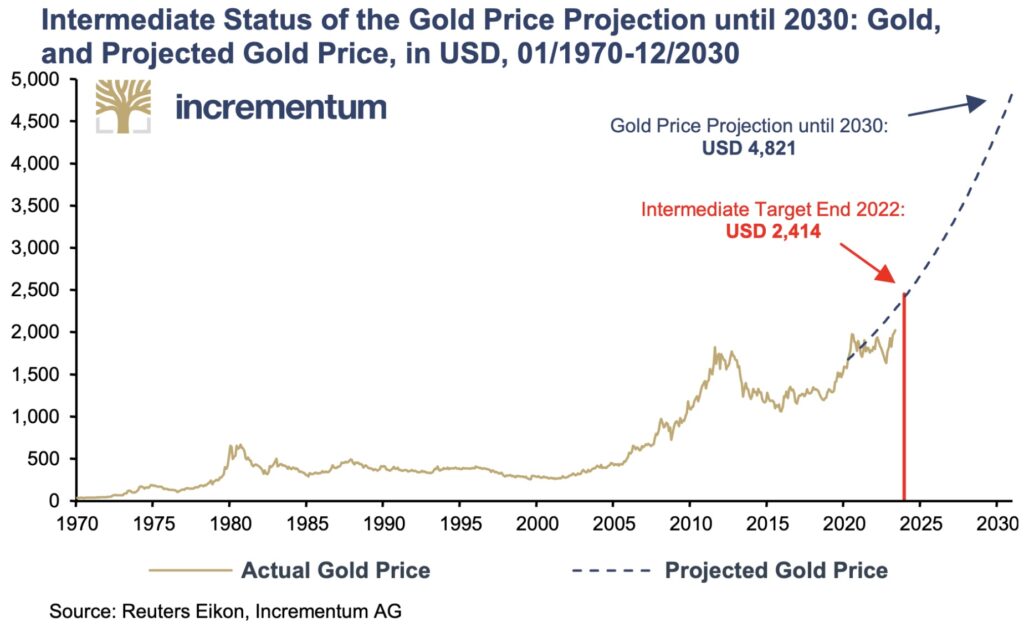

Update on gold price forecast until the end of the decade

Loyal readers will also remember the gold price forecast model we published in our In Gold We Trust report 2020,93 with a price target at the end of the decade. At that time we calculated – with the gold coverage ratio as the central input factor – a price target of just under USD 4,800 by the end of 2030.

As last year, we do not want to deprive you of the interim status of our long-term forecast. In order to remain exactly on track, the gold price would have to rise to just above USD 2,400 by the end of this year. That is just under 4.6% or around USD 100 higher than the price target of our recession phase model of USD 2,307. Based on the April 2023 closing price of USD 1,990, this would correspond to a 21.3% increase in the gold price by the end of 2023.

We acknowledge the ambitious nature of the projected price increase until the year’s end. Such a rapid price increase within a period of 8 months requires an exceptionally bullish environment for gold in the short term, which we do not consider as the base scenario but also do not want to dismiss. Nevertheless, we firmly believe it is realistic for gold to at least reach new all-time highs in USD this year.

We continue to adhere to our decade price target of approximately USD 4,800, as monetary policy dynamics, the economic outlook and, in particular, the geopolitical situation should provide considerable support for the gold price in the medium to long term. After all, should uncertainty increase further in the coming months and a recession be priced in by the market in the course of the year, gold will play out its full potential.

There are undoubtedly challenging times ahead for investors in the coming years as we find ourselves in the midst of monetary and geopolitical showdowns. Just as in a strategic move in a high-stakes poker game, gold not only plays the role of a reliable bet during uncertain times but also acts as ace in the hole, protecting the purchasing power of individuals and providing a steadfast defense against the wild swings of the financial markets. For us, gold is the expression of a strong hand for investors.

Even if it is not always easy, we would like to look to the future with optimism. The disappointments ahead will probably not be painless, but they could ultimately set in motion exciting economic and social dynamics. In these exciting times, we assert, as ever:

IN GOLD WE TRUST

ALSO JUST RELEASED: $370 Price Target For Silver And A World Drowning In Debt CLICK HERE.

ALSO JUST RELEASED: The Elites’ Plan For The World Is Absolutely Terrifying CLICK HERE.

ALSO JUST RELEASED: SPROTT: The Gold Bull Market May Finally Be Unleashed! CLICK HERE.

ALSO JUST RELEASED: “There Are No Free Markets Anymore, Just Interventions” CLICK HERE.

ALSO RELEASED: ALERT: Look At Silver And Silver Stocks CLICK HERE.

ALSO RELEASED: Big Fed Decision This Week, Plus The Credit Crunch Is Here CLICK HERE.

ALSO RELEASED: The US Economic Nightmare And The Great Unwind Set To Accelerate CLICK HERE.

ALSO RELEASED: Man Who Predicted The Banking Collapse Three Years Ago Says It Will Get Much Worse CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.