With everyone focused on the Fed’s decision on interest rates, Sprott says the gold bull may finally be unleashed!

Risks Enhance Gold As A Reserve Asset

June 14 (King World News) – Paul Wong, Market Strategist at Sprott Asset Management: Geopolitical risks enhance gold’s role as a reserve asset.

Key Takeaways

- Central banks have ramped up gold purchases driven by de-dollarization,7 the need to diversify reserves and hedge against inflation, and gold’s emerging role as a neutral reserve asset.

- While central banks are buying gold at a record pace, investment selling has reached exhaustion levels.

- As deglobalization accelerates, de-dollarization is becoming more relevant and is being exacerbated by the weaponization of the U.S. dollar and rising U.S. political risk.

- Central banks hold gold as a neutral reserve asset to mitigate increasing counterparty risks amid escalating geopolitical tensions.

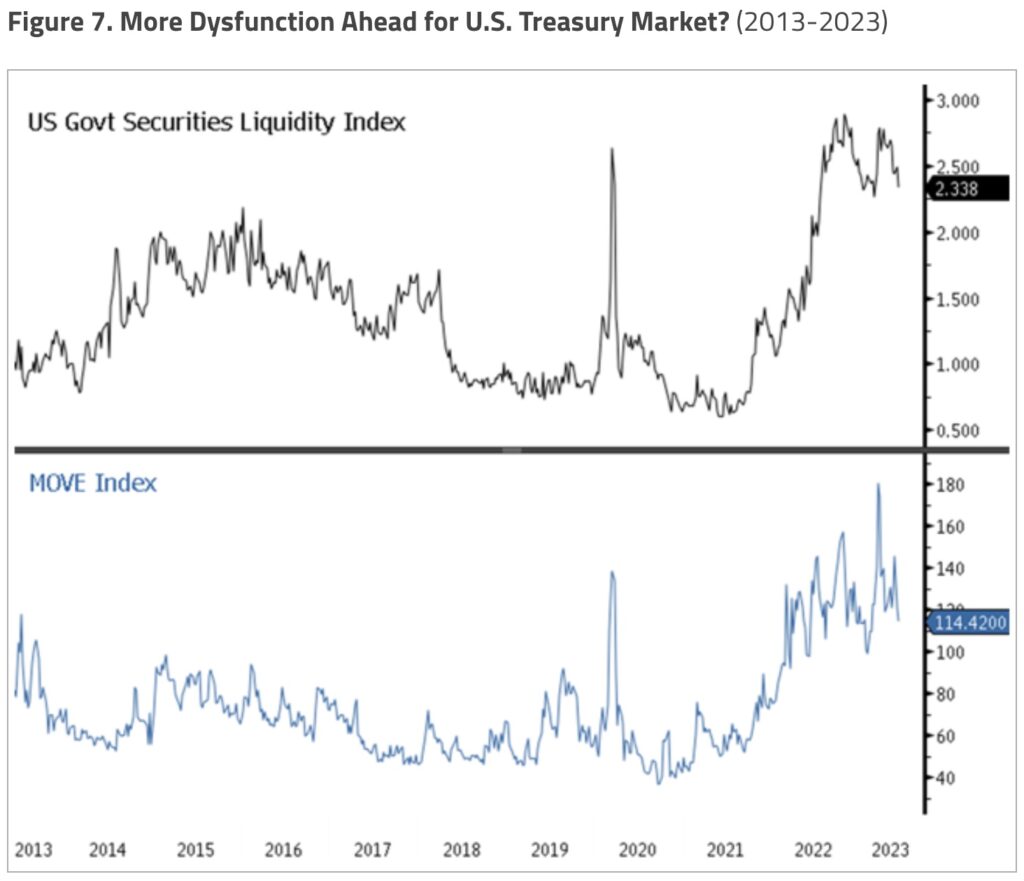

- The projected increase in net issuance of U.S. Treasury securities in the second half of 2023 may lead to liquidity challenges. This could cause dysfunction in the market, including asset price declines, tightening liquidity and further pressure on the U.S. banking system.

May in Review

Spot gold fell $27.27 per ounce (-1.37%) in May to close the month at $1,962.73. The gold price peaked in early May before drifting lower while the U.S. debt ceiling drama deepened and the U.S. dollar surged as market liquidity faded. Commodities fell sharply when weaker-than-expected economic data from China coupled with the spike in the U.S. dollar produced a wave of selling in a liquidity vacuum. In an environment with low liquidity and a rising U.S. dollar, riskier and less liquid assets (“high beta”) such as gold miners and physical silver had a much sharper pullback.

At the same time, the broader equity markets continued to display unusual activity. In early March, signs of a slowing economy led to expectations of cooling inflation and the end of Federal Reserve (Fed) tightening. This sparked a rally in long-duration assets, especially mega-cap technology stocks. Near the end of May, a dot-com-like frenzy occurred in AI (artificial intelligence) related equities, further accelerating and narrowing market breadth to a half-dozen stocks. In contrast, the equal-weighted S&P 500 Index (SPW) fell 3.99% in May (-1.43% year-to-date as of May 31, 2023), more reflective of the overall equity market…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Gold Continues to Consolidate Gains

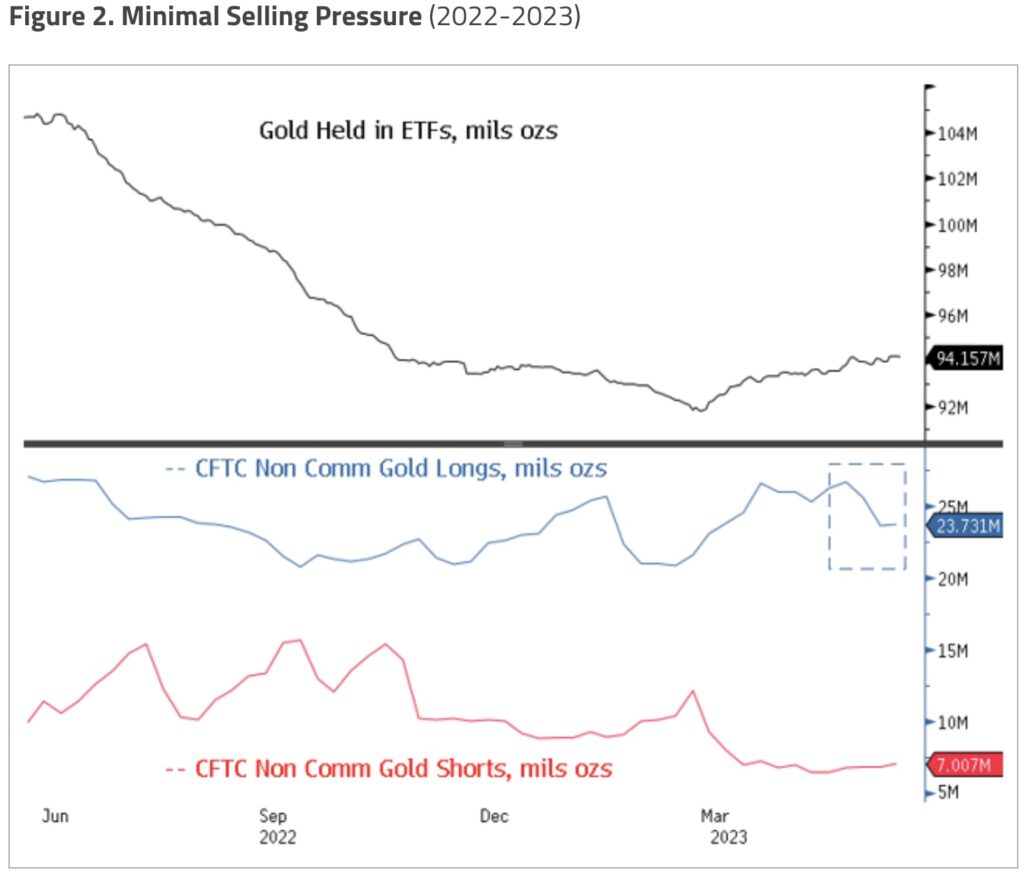

In May, spot gold reached an intraday level of $2,063, just below the March 2022 intraday high of $2,070. The gold price then fell and tested the rising trendline from the November 2022 low and its 100-day moving average (Figure 1). A thin market saw mainly CFTC futures traders active as gold held in ETFs (exchange traded funds) increased slightly. There was no indication of selling from central banks or sovereigns.

Gold appears to be consolidating its gains from the autumn 2022 lows as there is very little selling pressure — only about five million ounces from CFTC longs during May’s pullback (Figure 2, lower panel). CFTC shorts remained inactive in May and gold in ETFs continued to trend higher, albeit at a modest rate.

Central Banks and China Drive Demand, Investment Flows Fall

1. Central Banks Maintain Buying Pressure

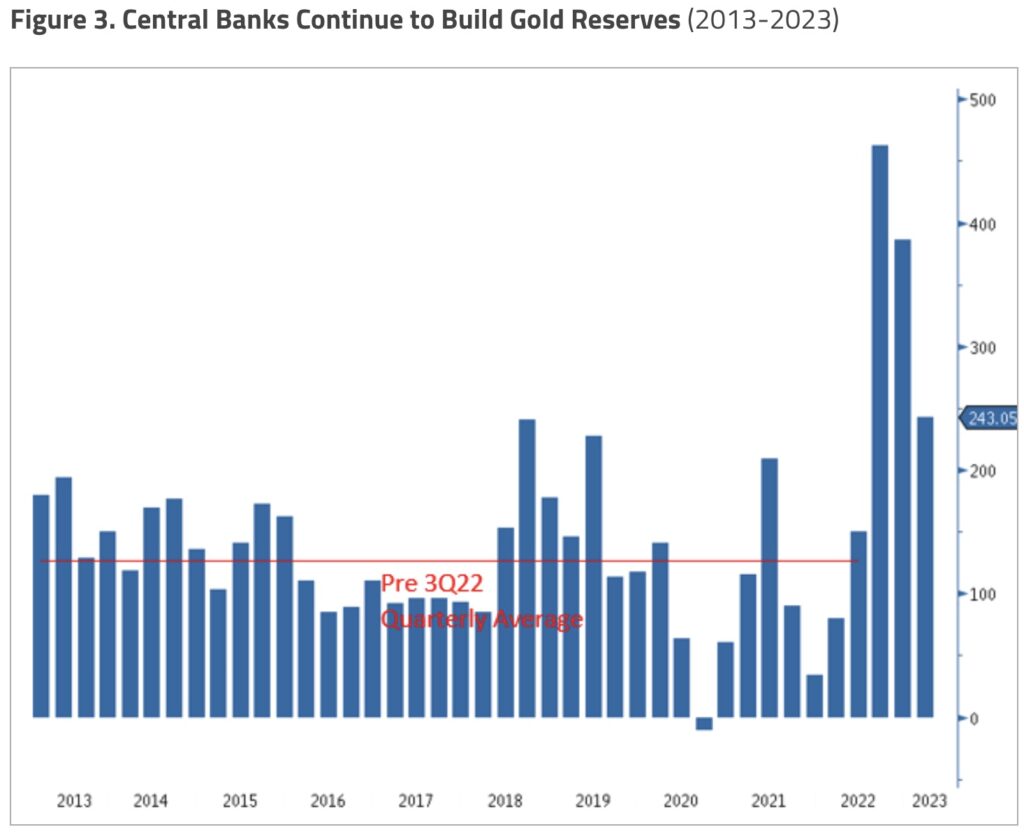

Net quarterly gold purchases by central banks rose by 243 tonnes in Q1 2023, a continuation of the robust buying trend that began at the end of last year’s second quarter (Figure 3). Since Q3 2022, central banks have been buying at an annualized rate of 1,456 tonnes, nearly three times their previous annual rate of 506 tonnes.

We have discussed the reasons for aggressive central bank buying in our past commentaries, most recently in the February 2023 commentary (“First Gold Dip Since Central Bank Buying Spree”). These reasons include the urge to diversify reserves due to sanctions and seizure risk, a need/desire for “outside money” in central bank reserves, the trend of U.S. dollar weaponization and de-dollarization, a need to hedge against inflation effects on global currencies and sovereign bonds in central bank reserves, and protection from escalating geopolitical tensions due to deglobalization.

We can add another possible reason to the list: Counterparty risk for sovereigns with large commodity exposures which we explore later.

2. China Steps Up Gold Imports

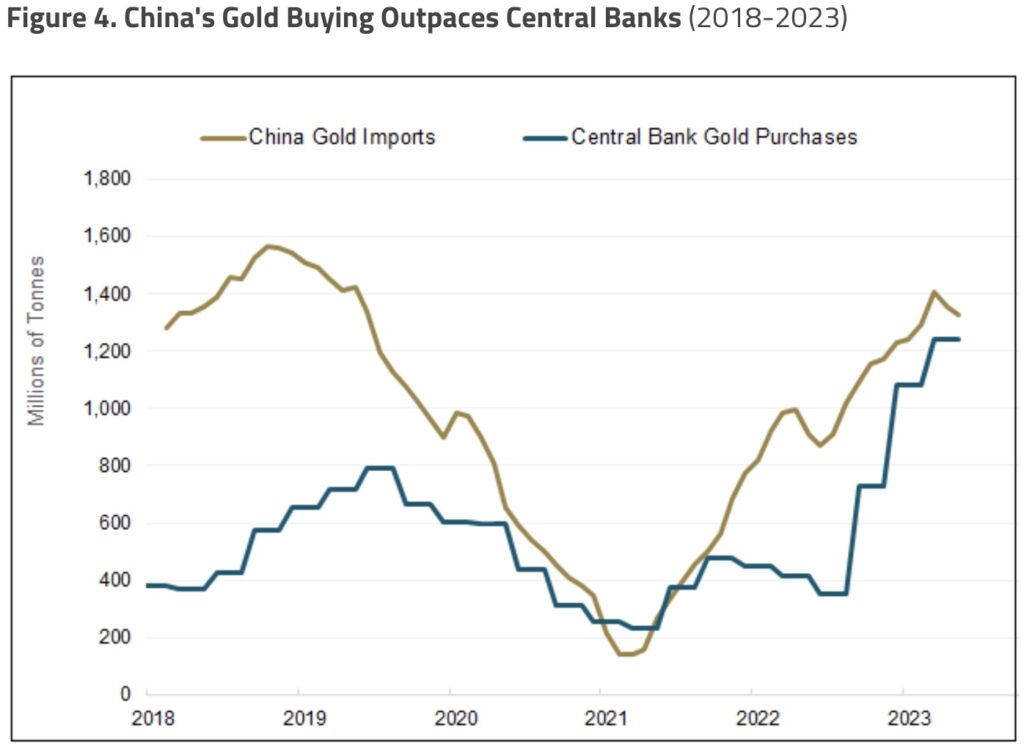

Gold demand from China continues to trend positively across all sectors. We show China’s gold imports plotted against central bank purchases in Figure 4 to demonstrate the scale of China’s gold imports. The steep decline in imports from 2020 to 2021 was due to China’s extensive and extended COVID pandemic lockdowns, which are unlikely to be repeated. Other positive gold data points out of China include:

- The average Shanghai gold premium has been trading above its 10-year mean since October 2022.

- Gold reserves held in the People’s Bank of China (PBOC) have increased every month since October 2022 to a new all-time high of 67.3 million ounces or 2,092 tonnes as of May 31.

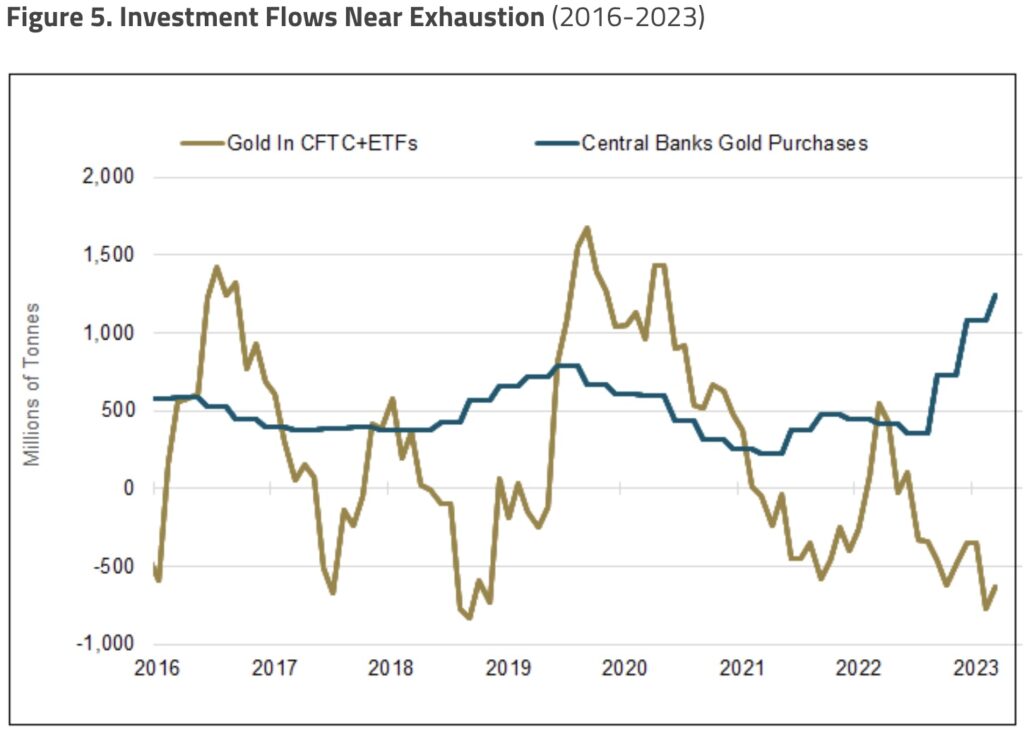

3. Investment Demand Slumps

We believe that we are in the early stages of gold becoming less of a financial asset and more of a neutral reserve asset, as witnessed by the remarkable surge in central bank sovereign gold purchases. Figure 5 highlights the stark increase in gold buying by central banks versus CFTC and ETF investment flows, which are close to their typical low readings since 2018. This indicates that gold investment selling is likely at an exhaustion level. The gap between central bank buying and investment selling has reached a record high of 1,800 tonnes, indicating how far this divergence has gone. Given this, we believe that investment flows will likely be forced higher.

The Long and Winding Road to De-Dollarization

Deglobalization is accelerating the transition to a more multipolar world, making the question of global reserve currency allocations more relevant. The U.S. dollar has slowly lost market share as a reserve currency since its peak in the late 1990s (Figure 6). History has shown that currency predominance in international trade and reserves follows economic, cultural and military dominance. Currency reallocations could move more quickly and significantly than anticipated if reserve managers increase allocations to other currencies or reserve-neutral assets. If reserve managers were to reallocate a small percentage of reserves, significant flows out of the U.S. dollar could occur because the dollar base is so large.

Currently, the risk is minor and gradual, but China has the potential to gain share as its reserve share (~2%) is lower than what is implied by its share of global gross domestic product (GDP; ~15%), global trade (~12%) and the International Monetary Fund (IMF) Special Drawing Rights (SDR) basket (10.9%). China has made structural changes to its financial markets to improve access and gain inclusion in global benchmark indices. However, substantial reforms are needed to increase the renminbi (RMB) as a reserve currency…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Increasing the use of the RMB in China’s import invoicing (for example, paying for oil in RMB) could present an opportunity for more significant global use of the RMB. Globally, foreign exchange reserves are estimated to be $12 trillion in total, which means that tiny incremental percentage changes at the margin would represent large U.S. dollar values.

The U.S. dollar is expected to remain the anchor currency for the foreseeable future due to its established base, provision of safe assets, inflows and foreign exchange strength, and perceived safety. However, the weaponization of the U.S. dollar continues to be the most substantial non-economic rationale for de-dollarization. A default over the U.S. debt ceiling would have presented another strong argument for further de-dollarization since an investment in U.S. Treasuries (or their use as collateral) would entail direct exposure to U.S. politics.

Rising Geopolitical Risk is Bullish for Gold

Counterparty risk is the potential for one party in a financial transaction to default on its contractual obligations. Geopolitical factors can significantly influence counterparty risk, impacting the stability and reliability of parties involved in a financial transaction. If one party fails to fulfill its obligations, the other party may suffer financial harm.

Counterparty risk can show itself in various forms, including credit risk stemming from financial distress, settlement risk involving the failure to deliver, sovereign risk linked to government defaults, and legal and operational risks encompassing fraud and disputes. Standard risk mitigation practices include imposing collateral requirements, implementing margining practices, using central counterparties for clearing and settlement, making credit assessments and diversifying exposures.

Default risk has been the most prevalent historically. However, other risks (settlement, sovereign, and legal/operational risks) could all trend higher in a deglobalizing world with escalating geopolitical tensions…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

As gold becomes increasingly involved in settling multicurrency energy and commodity trades — particularly in China-related trade with oil producers — the links between gold, other commodities and counterparty risks may intensify. The recent trend to nationalize commodities amid concerns over deglobalization and national economic security is likely to escalate counterparty risk on a global scale. Sovereign gold held by a country’s central bank as a neutral reserve asset could mitigate this risk. This may drive increased demand for sovereign gold to hedge against inflation by nations with high exposure to commodity markets.

Because of these factors, we believe gold is moving incrementally back into the financial system as a neutral reserve asset to settle multicurrency energy and commodity trades. Given that the global oil trade alone is ~15x the size of the gold market, we believe this is secularly bullish for gold.

Market May Struggle to Absorb U.S. Treasury Issuance

The U.S. fiscal deficit is expected to reach approximately $1.1 trillion in the second half of 2023, a fallout from the debt ceiling standoff. An additional $400-$500 billion will be needed to rebuild the Treasury General Account (used to pay the country’s obligations), and $540 billion will be required for the Federal Reserve’s quantitative tightening program. This would result in a significant net U.S. Treasury (UST) issuance of approximately $2 trillion during the second half of 2023.

The U.S. could face challenges in finding sufficient global demand to absorb this level of issuance, given its high debt level and budget deficits alongside insufficient foreign central bank buying. This could lead to asset price declines, rising yields and potentially a credit crunch. UST market dysfunction could increase again, as measured by the MOVE Index (implied bond volatility index) and the Bloomberg U.S. Government Securities Liquidity Index (Figure 7). We recommend keeping an eye on these two indices in the second half of 2023.

There is potentially a lack of private sector balance sheet capacity to finance the expected UST issuance. A starting point of higher interest rates may further exacerbate U.S. deficits and reduce private sector output while keeping inflation, employment, and nominal GDP relatively high. A capital crunch is possible as various sectors compete for limited capital.

Significant liquidity tightening would increase yields and pressure on the U.S. banking system and financial assets. Rising yields may increase capital flow into money market funds, leading to flows into the overnight reverse repurchase agreements market (ON RRP). This may drive up the borrowing costs of the U.S. Bank Term Funding Program, squeezing bank profitability further and increasing regional banking stress. In summary, less liquidity means less cash to inflate financial assets and higher credit risks.

For gold, the risk elements listed above (liquidity risk, credit stress, credit crunch, U.S. Treasury market dysfunction, bond volatility, inflation and regional banking stress) have been historically bullish for gold prices. But we are unaware of prior episodes when all these elements have converged in a narrow window of two quarters. Furthermore, if central banks and sovereigns maintain their pace of gold purchases into the second half of 2023, the potential for a squeeze higher for the gold price may likely increase.

Kirkland Lake Gold Skyrocketed From $1 To Over $50!

2 Billionaires Bought A Stock That Could Be The Next Kirkland Lake!

To find out which company two billionaires bought huge stakes in what they believe could be the next Kirkland Lake Gold CLICK HERE.

ALSO JUST RELEASED: “There Are No Free Markets Anymore, Just Interventions” CLICK HERE.

ALSO JUST RELEASED: ALERT: Look At Silver And Silver Stocks CLICK HERE.

ALSO JUST RELEASED: Big Fed Decision This Week, Plus The Credit Crunch Is Here CLICK HERE.

ALSO JUST RELEASED: The US Economic Nightmare And The Great Unwind Set To Accelerate CLICK HERE.

ALSO JUST RELEASED: Man Who Predicted The Banking Collapse Three Years Ago Says It Will Get Much Worse CLICK HERE.

***To listen to the timely and powerful audio interview with Gerald Celente where he discusses why investors need to get ready for a major takedown in the economy and global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.