The price of gold will soon push to new record highs and silver will also see sharply higher prices.

Silver

June 8 (King World News) – Peter Brandt: It will be interesting to see if Silver can hold the completion of the inverted H&S today and in days to come. If it does hold, then sharply higher prices are possible.

REVERSE HEAD & SHOULDERS:

Silver May See Sharply Higher Prices

Gold’s Strength

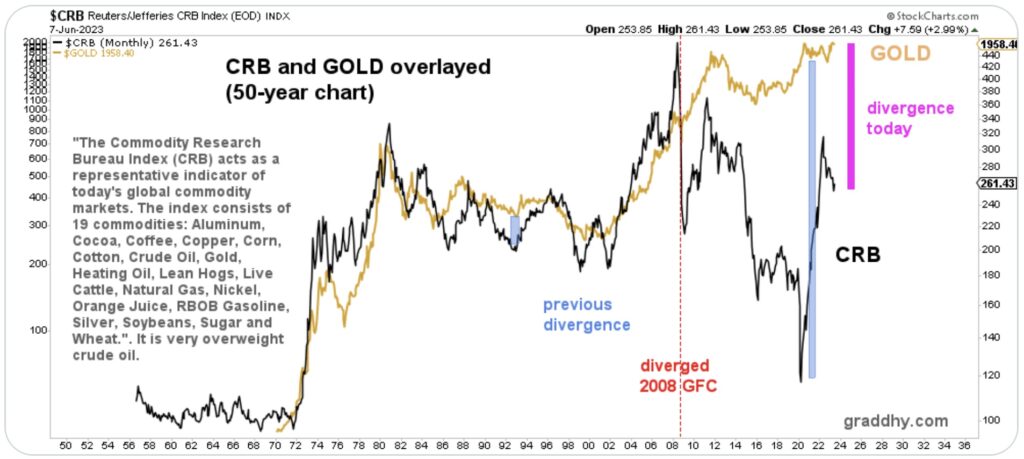

Graddhy out of Sweden: This chart shows how strong gold has been since it diverged from CRB back during the height of the last financial crisis. Many say gold has been very weak for decades. That’s not correct. And diverging like this right at the 2008 GFC was exactly what we wanted to see really.

Gold Price Has Remained Strong vs CRB

Patience With Gold

Graddhy out of Sweden: During declines & consolidations, always do remember the bigger picture:

Gold broke out vs S&P

Gold broke out vs CRB

Silver broke out vs S&P

Silver broke out vs Nasdaq

TSX broke out vs S&P

GDX broke out vs TSX

Every bull has corrections…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Gold Buyers Look Beyond Current Headwinds

Ole Hansen, Head of Commodity Strategy at SaxoBank: Key points in this gold update:

- The gold market is currently consolidating within a 50-dollar range with support in the $1930-35 area

- The current pause is being driven by uncertainties about the short-term direction of US interest rates.

- We keep a bullish outlook based on continued central bank buying, a deteriorating economy outlook bringing rate cuts back on the table, and with that fresh demand from “paper” gold investors in futures and ETFs

Gold has stabilized since our last update last month which coincided with the yellow metal falling back below $2000 on a combination of a stronger dollar, rising US Treasury yields and the market pricing in a reduced pace of US rate cuts, currently trading within a 50-dollar wide range around $1960. The investment metal market has, as mentioned, been challenged by a further delay to the timing of peak US rate after recent economic US data continued to show strength while the drop in core inflation has slowed.

While not ruling out additional short-term weakness the market is showing resilience, with silver and platinum currently outperforming gold while the miners are still struggling to find a bid amid the current stock market rally, being increasingly concentrated and centered around a few AI (Artificial Intelligence) and mega cap stocks, a situation we view with a great deal of caution as highlighted in this update from Peter Garnry, our equity strategist, titled “Equities signal calm waters, or do they?”

For now, the direction of gold continues to be dictated by developments in the short-term interest rate markets where traders place bets on the direction of Fed Funds rates and following yesterday’s surprise decision by the Bank of Canada to restart its rate-hiking campaign bullion traded lower before once again finding a bid ahead of an area of support below $1935. Sentiment suffered a small blow as the Canadian rate hike raised expectations the FOMC may not be done yet.

The market is currently experiencing another rate hike before July while the latter rate cut bets have been moderated with 5% being the end of year target, almost one percent higher than where it was projected back in April before the recent correction. Looking further into the future, by this time next year Fed funds rates are priced near 4.2%, up from around 3% last month.

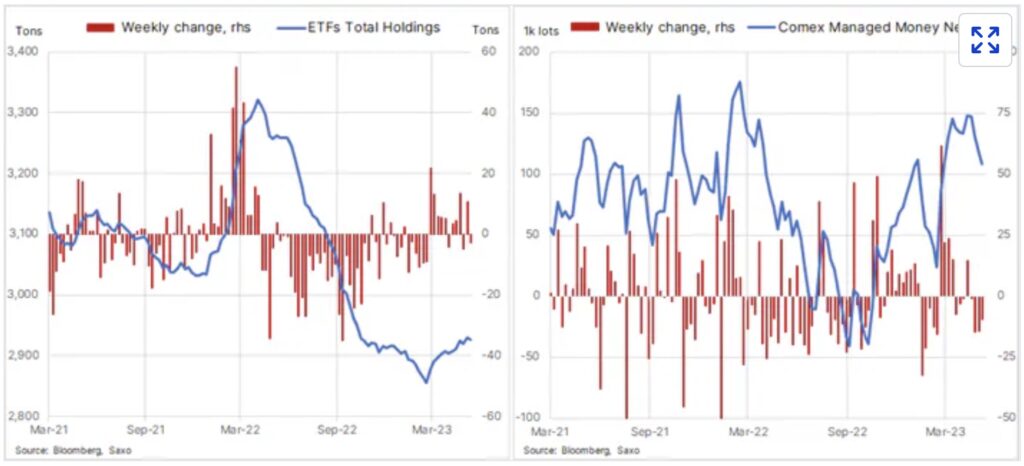

Hedge funds and investor flows

Money managers which include leveraged traders such as hedge funds and trend-following CTA’s remain key actors across the commodity market, not least gold with its deep pool of liquidity, and on a weekly basis the US CFTC through its Commitment of Traders Report give insight to the positioning among this group of traders. Instead of causing them, this group tend to anticipate, accelerate and amplify price changes that has been set in motion by fundamentals. Being followers of momentum, this strategy more often than not sees this group of traders buy into strength and sell into weakness, meaning that they are often found holding the biggest long near the peak of a cycle or the biggest short position ahead of a through in the market.

During the past few weeks, this group of traders have responded to lower prices by cutting their gold futures net long by 27% to 108,000 contracts or 10.8 million ounces. Before the March banking crisis triggered a strong rally the net position was as low as 24,100 contracts. The relatively small reduction highlights the lower entry point at which many of these positions have been entered, but also that the technical outlook has not yet deteriorated to a point where the potential for further gains is in doubt. For that to happen a deeper sell-off to and below the pre-banking crisis low around $1800 would be needed.

Total holdings in bullion-backed Exchange-traded funds meanwhile has seen a small decline during the past week, but overall, the current correction has so far been viewed as an opportunity to accumulate gold. From a three-year low at 2855 tons on March 10, total holdings have since risen to the current 2923 tons, yet well below the 2022 high at 3320 tons, let alone the record 3455 tons peak reached in October 2020 when pandemic-driven stimulus and rate cuts raised the risk of runaway inflation.

While the short-term outlook points to further consolidation as we await incoming economic data, we keep an overall bullish outlook for gold, driven among others by the following expectations:

- Continued dollar weakness as yield differentials continue to narrow.

- Raised risk of an incoming recession leading to a peak in Fed rates. On the three most recent occasions this occurred, it supported strong gains in gold in the months and quarters that followed

- Central bank demand look set to continue as the de-dollarization focus continues to attract demand from several central banks. One unknown is how price sensitive, if at all, this demand will be. We suspect it will be limited, with higher prices not necessarily preventing continued accumulation.

- We believe inflation is going to be much stickier with market expectations for a drop back to 2.5% perhaps being met in the short-term but not in the long-term, forcing a gold supportive repricing of real yields lower.

- A multipolar world raising the geopolitical temperature

- Low investor participation, recently reduced further, adding support should the above-mentioned drivers eventually supply the expected breakout.

Gold is currently stuck within a 50-dollar wide range with support in the $1930-35 area while the upside remains blocked by the 21-day moving average, currently at $1969, and then the recent highs around $1985. In the short term, a break below $1930 could see it target the 200-day moving average at $1840, but as long the price stays above $1800, the technical outlook will continue to favor a renewed push to the upside. We see an emerging US economic slowdown in the coming months eventually silence all talk about additional rate hikes, and once that happens, the potential for a fresh push to a new record high will open up.

Gold Will Soon Push To New Record Highs

In case you missed it…

Another High-Grade Gold (354 g/t) Discovery

John Lewins, K92 Chief Executive Officer and Director, stated, “We are very pleased to be announcing the discovery of a high-grade zone at the J2 vein from our drilling at Judd South, recording 2.40 m at 345.36 g/t AuEq, one of the highest grade intersections at the Kainantu Gold Mine reported to date. The discovery zone features multiple other high-grade intersections at the J2 vein including 11.20 m at 12.69 g/t AuEq and 3.80 m at 10.19 g/t AuEq, and this zone is particularly significant as the J2 vein is not part of our current resource, until recently was not an exploration priority and adds yet another prospective sub-parallel vein to target at the Kainantu Gold Mine.

Discovery Open In Multiple Directions

The discovery is open in multiple directions and located approximately 800 metres north of the A1 Porphyry target. A1 is interpreted to be the heat source for the Kora-Kora South and Judd-Judd South vein systems. Exploration drilling to test for extensions of this zone is already underway. The latest results also continue to demonstrate the high-grade, continuity and expansion potential of the Kora-Kora South and Judd-Judd South vein system. K92 Mining, symbol KNT in Canada and KNTNF in the US.

ALSO JUST RELEASED: Bank Failures And Gold, Plus Bulls & Bears, Used Car Prices And Real Estate CLICK HERE.

ALSO JUST RELEASED: Debt, Real Estate, Plus New Molecule Regenerates Nerves And Heart Tissue CLICK HERE.

ALSO JUST RELEASED: Here Is The Good News For Gold Today, Plus Economic Surprises CLICK HERE.

ALSO JUST RELEASED: INFLATION ALERT: Expect High Food Inflation To Continue, Especially In Europe CLICK HERE.

ALSO RELEASED: The Final Move For Gold, Plus Travel Booming And The Bank Credit Crunch Has Just Begun CLICK HERE.

ALSO RELEASED: The Price Of Gold Is Going To Be Unleashed To A New All-Time High CLICK HERE.

ALSO RELEASED: SHOCKER: Look At What Had A Mind-Blowing 4,256.47% Return (And It Wan’t Bitcoin) CLICK HERE.

ALSO RELEASED: The World Is About To See Serious Deflation Followed By Massive Money Printing CLICK HERE.

ALSO RELEASED: Billionaire Pierre Lassonde Says Ignore Volatility, Gold Is Headed Into A Mania CLICK HERE.

ALSO RELEASED: A Jaw-Dropping 232 Tonnes Of Gold Has Now Been Delivered Out Of COMEX CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.