The price of gold was hammered this week along with silver as the war in the paper gold and silver markets continues to rage.

Gold & Silver

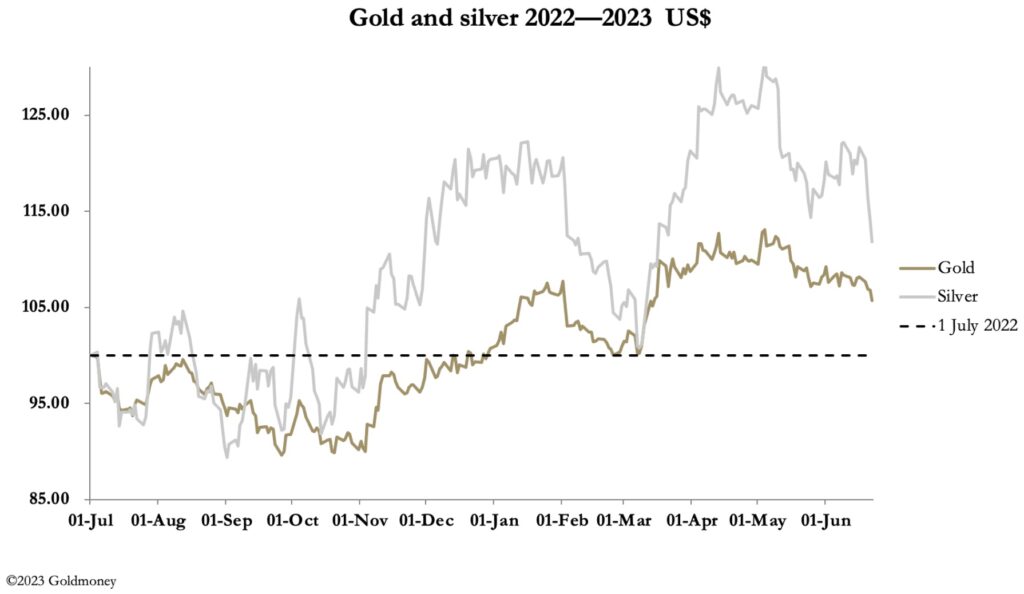

June 23 (King World News) – Alasdair Macleod: Gold and silver fell sharply this week as a number of central banks increased their interest rates, spooking traders who look for short-term profits. In Europe this morning, gold traded at $1917, down $40 from last Friday’s close, and silver at $22.30, down $1.88 over the same timescale.

Volume and Open Interest declined in both Comex contracts.

The Bank of England raised its bank rate more than expected by 50 basis points to 5%. The realisation that price inflation is not coming down easily has caused the Bank to be blamed for mismanagement, and it is becoming the scapegoat for increasing distress among homeowners faced with soaring mortgage costs. So far, sterling has tended to rise as forex traders have been attracted by higher rates. However, this is unlikely to last and the risks of holding sterling will then come to the fore. This is reflected in the chart for the sterling-dollar exchange rate.

Sterling’s nine-month rise has ended in an extremely bearish contracting triangle, a pattern which rarely fails. It indicates that when sterling breaks below $1.26, the downside will be substantial and swift. Furthermore, the nine-month rally from last September appears to be a countertrend affair, telling us that the September low will not stop sterling’s fall. The most likely resistance will be under $1.05, with a strong possibility of parity being breached for the first time ever.

For Brits, assuming no change in the dollar price of gold the sterling price would then rise from the current £1510 to over £1800. It is worth making this point because every time gold is marked sharply down, human psychology leads to despair and a panic to sell. And with gold having fallen from an intraday high of $2080 on 4 May to $1918 this morning, market sentiment today is extremely negative.

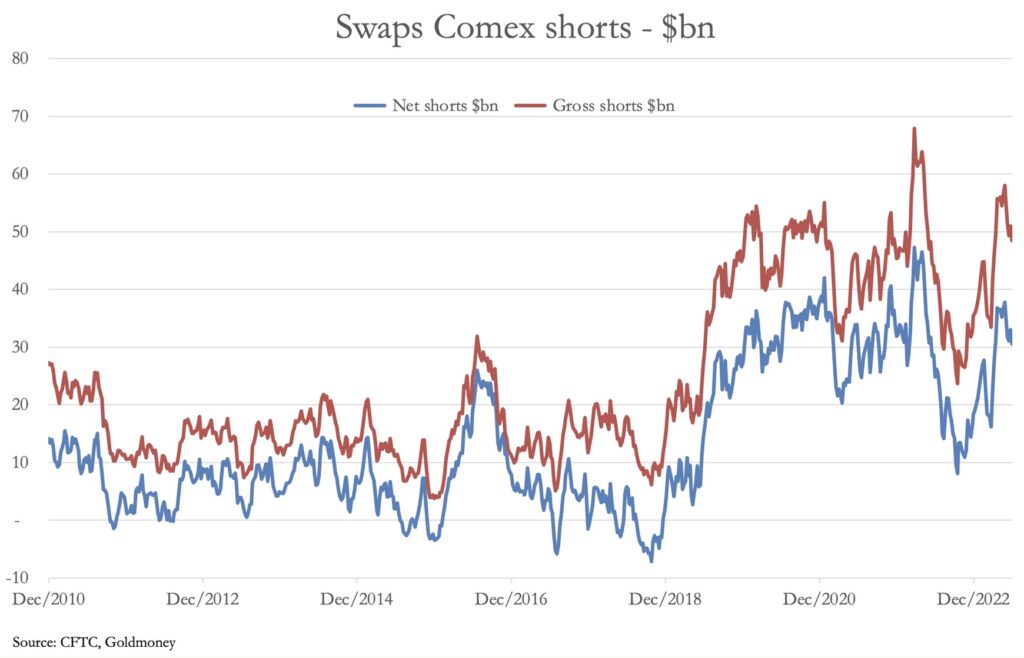

Behind this negative sentiment are the vested interests of the Swaps, who take the short side on Comex. Our next chart shows how they have recovered their mark-to-market losses on their gross and net positions.

With gross and net shorts of $48.5bn and $30.5bn respectively, there appears to be little hope of reducing their position materially from here. Even if they were able to engineer a further markdown, it is unlikely that they would be able to buy back their positions except at the margin, and a fall in the gold price from here would accelerate physical demand from central banks and other long-term holders.

Higher interest rates actually increase the attractions of gold because it is systemically destabilising for credit and currencies. As we saw with Silicon Valley Bank, higher bond yields undermine bank balance sheets, not just in the US, but everywhere. And the authorities’ response to a combination of a credit crisis and recession is always to double down on inflationary policies.

Putting negative sentiment aside, severe markdowns in gold usually prove to be a springboard for substantial subsequent rises. A rally in dollars from here could become a slingshot for prices in sterling.

ALSO JUST RELEASED: The Global Economic Slowdown Is Here And Gold Is Rallying Along With US Dollar CLICK HERE.

ALSO JUST RELEASED: $248 Price Target For Silver, Plus The Big Reversal And Something Not Seen In 31 years CLICK HERE.

ALSO JUST RELEASED: Look At What They Are Dumping To Buy Dips In Gold, Plus More Inflation On The Way CLICK HERE.

ALSO JUST RELEASED: Focused On Major Gold & Silver Bottom As Putin Declares “Beginning Of The End” For US Dollar CLICK HERE.

ALSO JUST RELEASED: THE FUTURE: Human Flesh For Fantasy And The Rise Of AI CLICK HERE.

ALSO JUST RELEASED: Crude Oil Will Soar To At Least $250-$350 And The “Perfect Gold Storm Surge” Will Skyrocket To $10,000-$15,000 CLICK HERE.

ALSO JUST RELEASED: Ignore The Gold & Silver Takedown And Look At These Surprises CLICK HERE.

ALSO JUST RELEASED: Peak Cheap Gold And A World In Chaos CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.