On a day when the gold and silver markets are being taken down, investors should ignore the volatility and focus on the big picture, plus look at these other surprises.

Big Picture For Gold

June 20 (King World News) – Otavio Costa: Gold looks to be getting ready to blaze through this historic resistance and move substantially higher. A surge in the metal price will likely mark the beginning of a new gold cycle that should be accompanied by a much-awaited influx of capital into the mining industry.

IGNORE THE PULLBACK:

Gold Preparing To Blastoff To New All-Time Highs

Higher Pay For Workers

Peter Boockvar: It continues to be the turn of organized labor to extract greater pay for its members as any labor agreement coming due this year was struck pre Covid when the cost of living was sharply lower (has risen 18% just since February 2020 as measured by CPI). It looks like the West Coast dockworkers will see a cumulative 32% pay raise over the next 5 years. While it averages just under 6% per year, it is somewhat front loaded as there will be an immediate raise of 8-10% in year one.

This follows the recent pilot deal with FedEx where a pay raise of 30% was seen in addition to a similar increase in pensions. Delta and Spirit workers got something equivalent, with pay gains north of 30%. We’ll see what happens with UPS workers with their labor deal expiring at the end of July. A few weeks ago the United Airlines pilots union authorized a strike vote if a deal is not had. I read on Friday too that “Teamsters at TForce Freight have overwhelmingly voted to authorize a strike. This strong mandate reflects the strength and unity of the members’ fight for a strong national contract. The Teamsters represent more than 7.000 workers at TForce nationwide.”…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Now I’m of the belief that wage gain demands of note come AFTER the rise in the cost of living and doesn’t necessarily result in further subsequent price increases as the latter depends on productivity and competitive factors. With respect to the Philips Curve concept, it’s been completely mangled by economists. The original idea was a tight labor market leads to a rise in wages which is just simple supply and demand at work. It NEVER said a tight labor market and higher wages leads to an overall increase in inflation.

Anyway, the point of this is not to highlight the inflationary possibilities, if any, of these new labor agreements but to highlight the potential profit margin squeeze for those companies that have unionized labor and whose workers have seen wage gains the last few years rise well below the rate of inflation and now want to catch up. Some companies will try to raise price to mitigate it but others will trim costs elsewhere and try to improve productivity to manage it. Either way, I expect the direction of profit margins to continue lower.

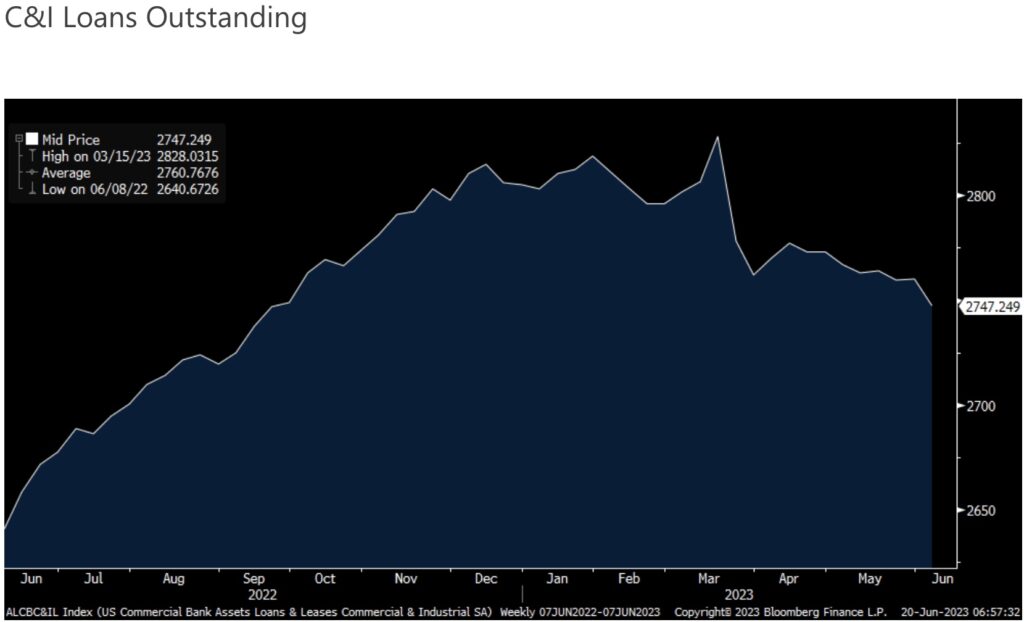

Seen last Friday, there was a $13b drop in the amount of commercial and industrial loans outstanding, the largest decline since the two weeks after SVB failed. At $2.747 trillion, that is the least since September 2022 as the bank credit squeeze continues on.

Bank Credit Squeeze Continues

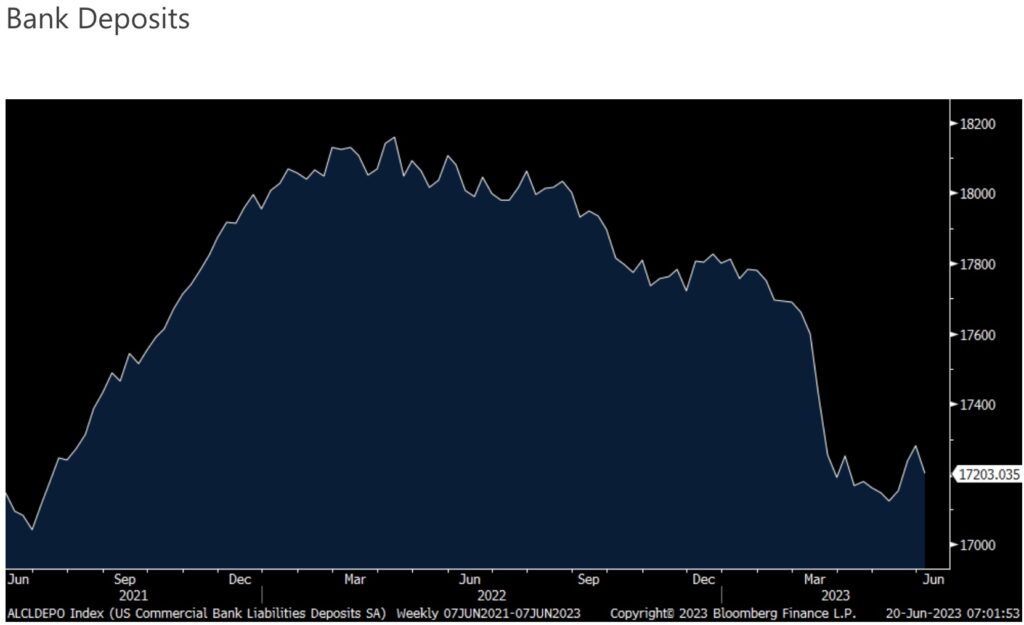

Also notable was the $79b drop in bank deposits after the rise of $160b in the 3 weeks prior which in turn followed the continued drip lower.

Bank Deposits Tumble

I’m sure every week you are hearing that there is no need to worry because private credit funds will play hero and step into the vacuum of credit lending being left by the banks. That is certainly the case as this asset class now is about $1.5 trillion in size according to Preqin, similar in size to high yield and leveraged loans each. However, you’ve got to pay to play as loans are floating rate to credits with low ratings and thus many are being struck at double digit interest rates.

China Cuts Rates

Chinese banks followed the rate cutting from the PBOC, extending it to the 1 yr prime rate and the 5 yr, lowering each by 10 bps. Pushing on a string I say but these are modest rate cuts anyway.

Taiwan said its export orders in May fell 17.6% y/o/y but that wasn’t as bad as the 21.3% drop that was expected. The decline was seen from the US, Europe, and China but ASEAN saw a rise in orders of 10.2% y/o/y. Product wise of note, there was a 16.6% y/o/y fall in orders for electronics, something we know Taiwan excels at in the production of.

ECB Rate Hike Coming

In Germany, its May PPI fell 1.4% m/o/m, double the expected decline. The y/o/y increase slowed to 1% from 4.1% in April. Lower energy prices was certainly the main catalyst. While European bond yields are down across the board, the German 10 yr inflation breakeven is unchanged in response at 2.33%. Expect the ECB to hike rates by another 25 bps in July but the September meeting is in question with hawks wanting to go again and the doves wanting to take this slow from here…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

HomeBuilders Cautiously Optimistic

Seen yesterday, the June NAHB home builder sentiment index rose 5 pts m/o/m to 55. The estimate was 51. That’s the most optimistic since one year ago with both the Present and Future components rising above 60. Prospective Buyers Traffic continues to really lag as it was 37, well below 50 but up from 33 in May.

The NAHB said “Builders are feeling cautiously optimistic about market conditions given low levels of existing home inventory and ongoing gradual improvements for supply chains. However, access for builder and developer loans has become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows.” Builders also have the ability to buy down mortgage rates and create other incentives in order to mitigate the price shock still seen in housing because of the lack of existing home supply on top of the 7% mortgage rate on offer for a 30 yr. So builder stocks continue to rip higher but the overall pace of housing turnover, both new and existing, is still pretty muted.

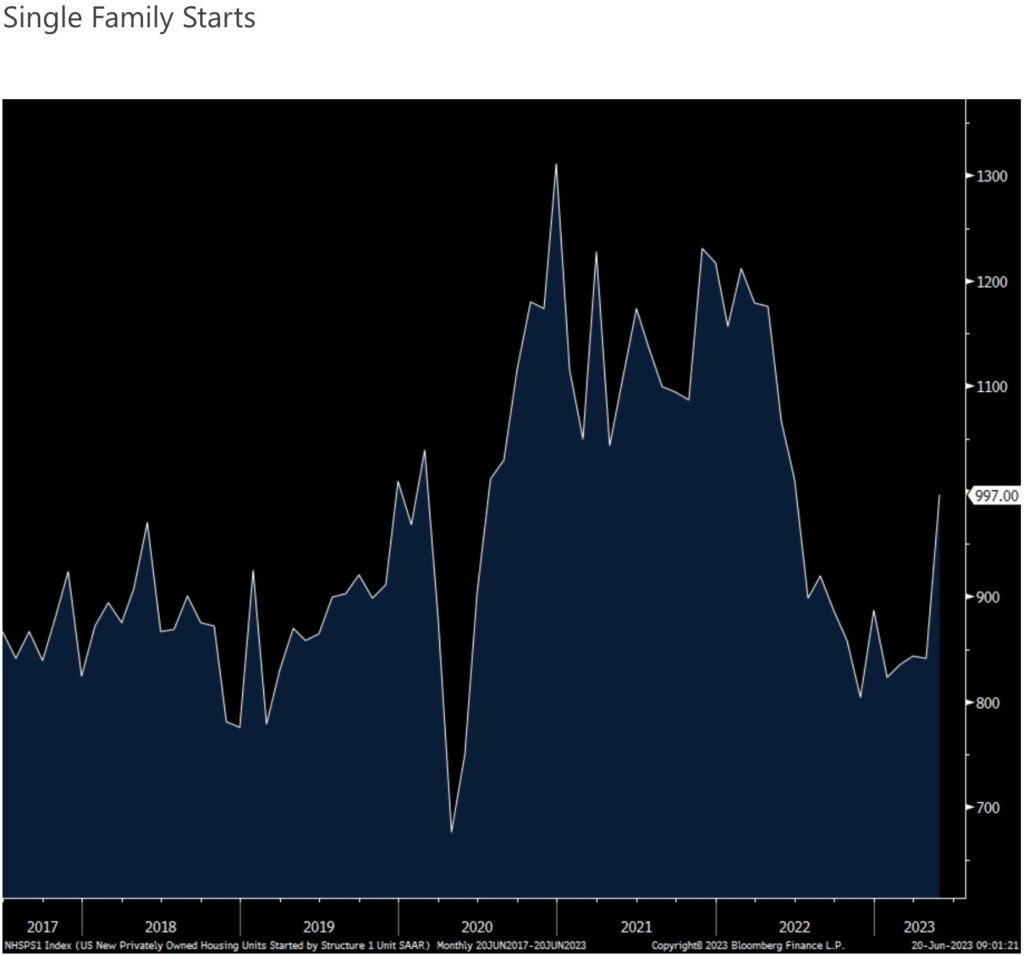

Housing starts in May totaled 1.631mm which was well above the estimate of 1.4mm, partially offset by a downward revision of 60k to April. Single family starts jumped to just under 1mm at 997 from 841 in April and that is the most since last June. For perspective it was at 1.039mm in February 2020.

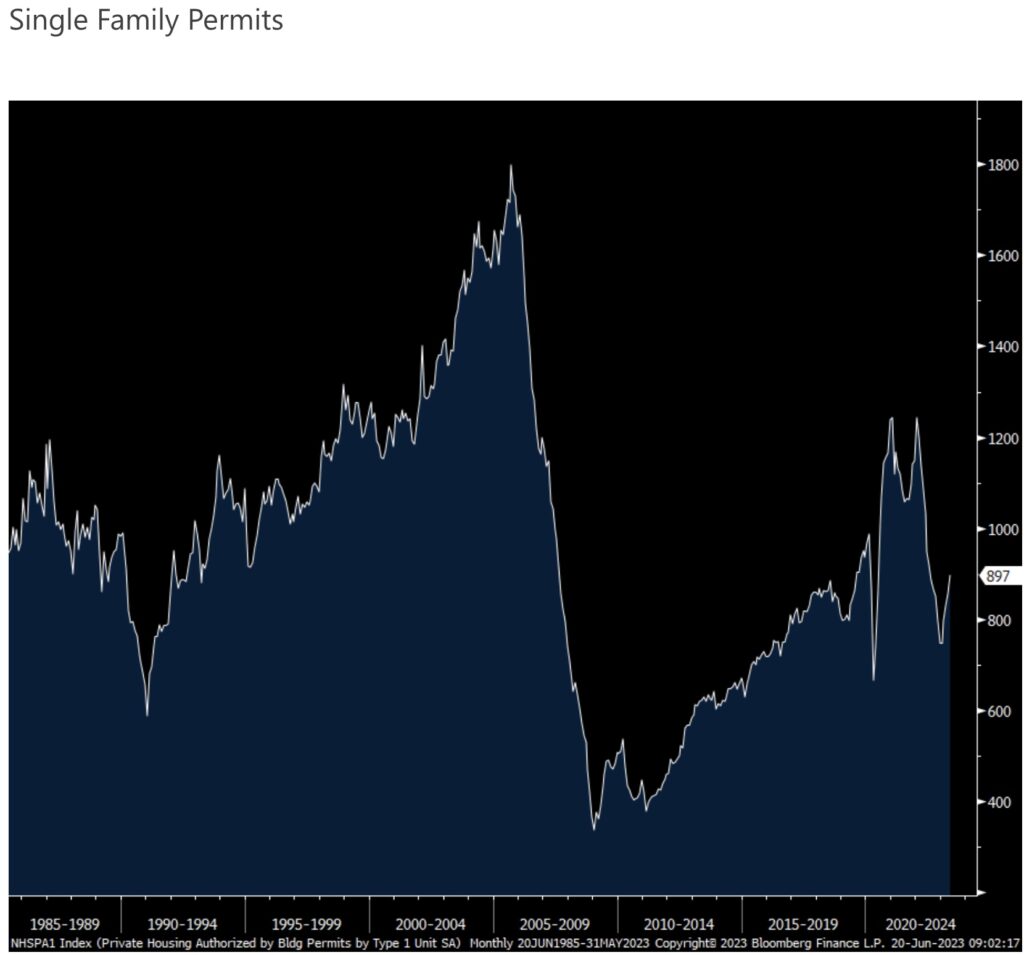

More Single Family Homes Being Built

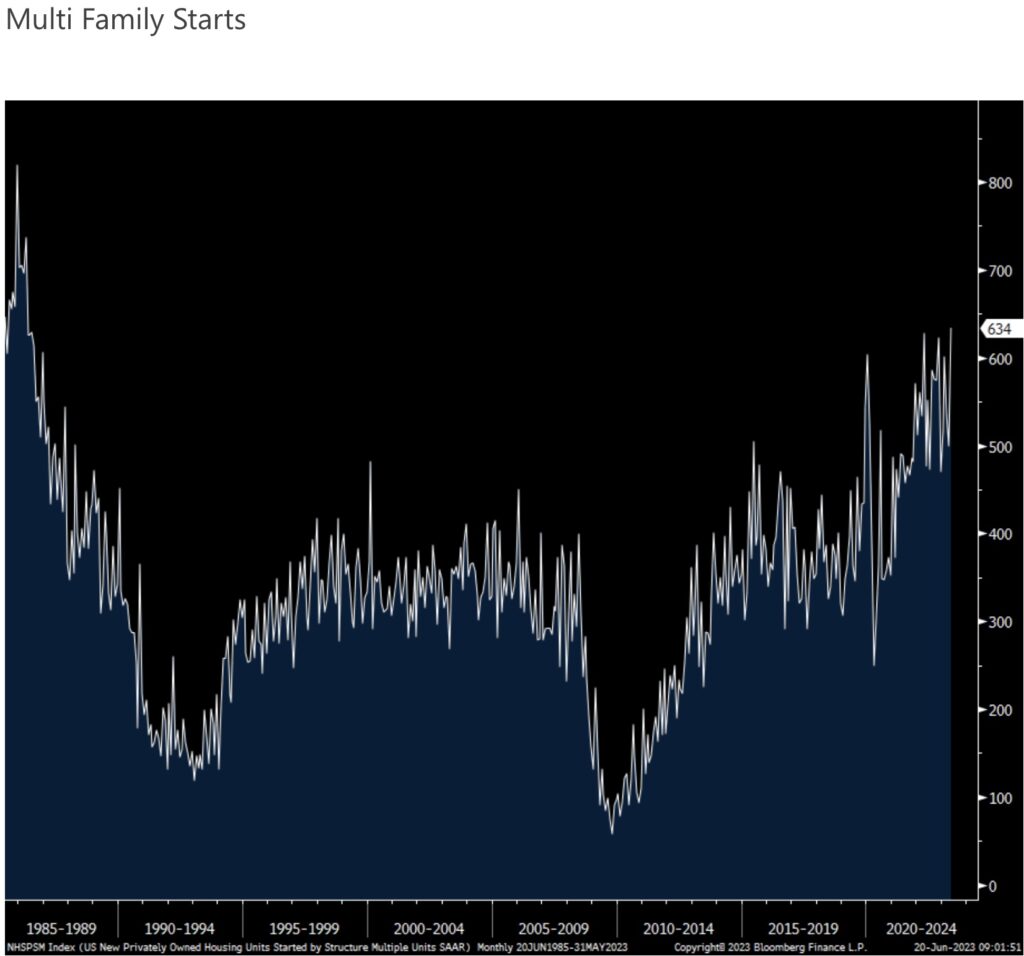

Multi family starts also added to the monthly upside as they totaled 634k vs 499k in the month before and that is the most since 1986 when the Mets last won the World Series.

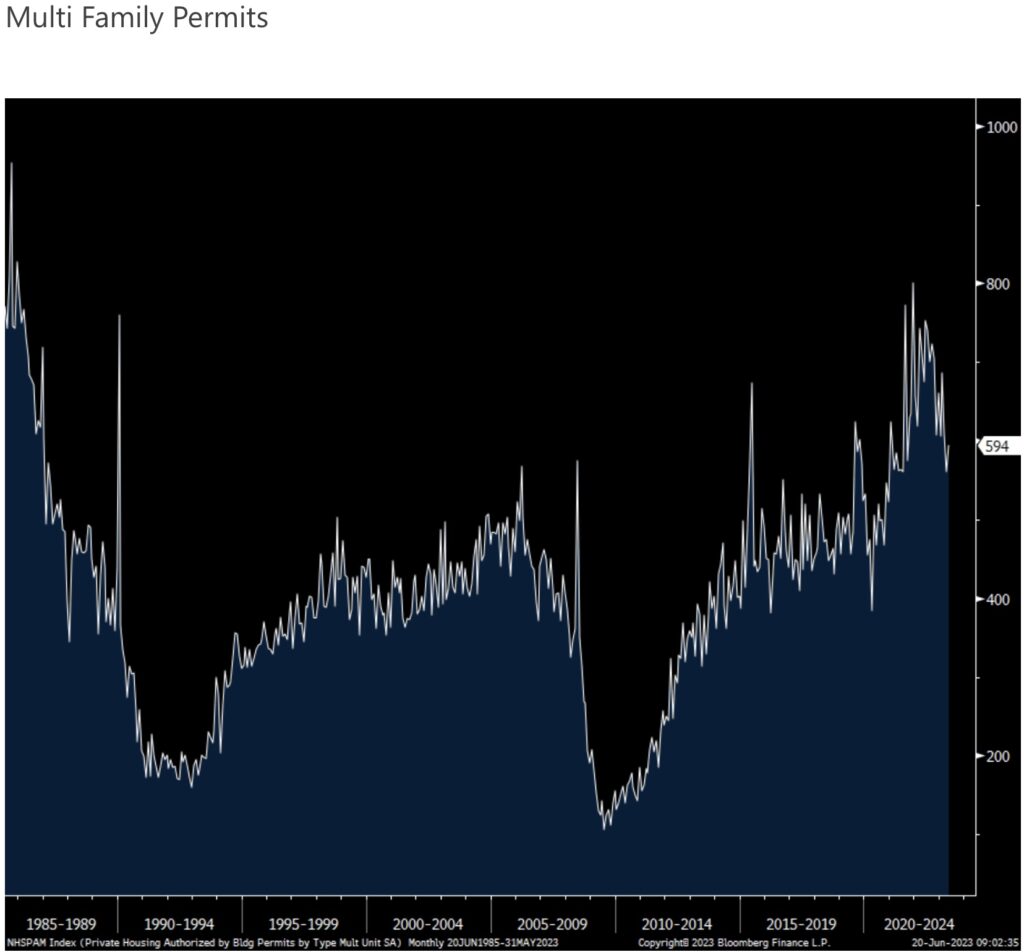

Highest Multi Family Starts In 37 Years!

Permits for single family homes rose to 897k from 856k, the highest since last July (and was 986k in February 2020) while they were up by 33k m/o/m to 594k for multi family starts.

Bottom Line

Bottom line, we know that new home sales are taking greater share from the existing home market in terms of transactions because of the supply imbalances. Also, builders are better able to cushion the price and mortgage rate blow. In the NAHB index yesterday, “56% of builders offered incentives to buyers in June, slightly more than in May (54%), but fewer than in December 2022 (62%).” With regards to the price adjustment, “The average price reduction was 7% in June, below the 8% rate in December 2022.” With existing homes, we’re still seeing price wars with 7% mortgage rates. A truly upside down housing market thanks to the manic moves in interest rates over the past 15+ years after what went on in the mid aughts.

With multi family, there is a lot of new supply coming online in the coming 12+ months, particularly in the sunbelt states.

That will help to cool rental price gains further but once these projects are done, there will be almost no new supply thereafter as nothing new is getting greenlit right now and even some projects that are being planned are now being shelved because the numbers no longer work.

ALSO JUST RELEASED: Peak Cheap Gold And A World In Chaos CLICK HERE.

***To listen to Dr. Stephen Leeb discuss why the gold market is headed higher as people across the globe move into the Metal of Kings CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the great catalyst for the price of gold and silver and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.