There is serious trouble despite the continued propaganda as this warning was just issued: “They know how bad it’s going and they’re going to do everything they can to keep gold prices down before they skyrocket.”

Inflation

July 12 (King World News) – Gerald Celente: Inflation in the U.S. is at 4.05 percent, which is higher than the Federal Reserve’s target of 2 percent, so investors are anticipating another 25 basis points hike after this month’s meeting. The current overnight interest rate is between 5.25 percent and 5.5 percent.

The yield on the 10-year Treasury settled at 4.006 percent, which was down from 4.047 percent at Friday’s close.

Joseph Davis, global chief economist at Vanguard, told CNN that there is nothing in the jobs numbers “that would change our expectation that the Fed has more work to do.”

Up next will be June’s consumer price index due out on Wednesday. Investors are anticipating a 3.1 percent increase for the year ended in June. Unless the number moves spectacularly in any one direction, few on The Street believe the central bank would keep rates at their current levels.

TREND FORECAST:

There will be a leveling off in the summer and the economy will look to be stable, but the big decline will begin to happen in September and October.

The banking crisis is far from over, and high interest rates are going to take their toll on smaller lenders.

As we note above, banks have been flooded with money since the Panic of ’08 that gave depositors next to nothing. Now that has changed as deposit money is flowing out of banks. Thus, with small and medium size banks heavily exposed to the failing commercial office real estate market, with less reserves on hand, more banks will go bust and as with the past, they will merge with the “Bigs” and the “Bigs” will get bigger.

Banks will also need to prepare for landlords (mortgage holders) to start missing payments because workers are not returning to the office…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

OIL:

Brent crude, the international benchmark, was down 78 cents, or 1 percent, to

$77.69 a barrel and the U.S.’s West Texas Intermediate was down 87 cents, or 1.2 percent, to $72.99.

Dennis Kissler, senior vice president of trading at BOK Financial, told Reuters that oil traders are concerned about higher interest rates that could “kill demand very quickly.”

GOLD:

Spot gold was little changed yesterday and hovered around $1,925.30 per ounce [currently $1,965] as investors wait for the Fed’s next move on interest rates.

TRENDPOST: Gold

It’s worth reminding our readers that in 2022, central banks from around the world bought more gold than ever. China added 23 tons of gold to its reserves last month, according to Reuters—marking an eighth-consecutive increase.

Bloomberg reported that the People’s Bank of China holds 2,330 tons of gold in its reserves.

“They know how bad it’s going,” Gerald Celente said. “And they’re going to do everything they can to keep gold prices down before they skyrocket.”

The trend is not limited to China, and the demand for gold is up 176 percent in the first quarter of the year…

UPDATE: This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Inflation

Peter Boockvar: The market set up ahead of the CPI report already has priced in much lower inflation rates for the coming years. The one yr inflation breakeven is down to just 1.53%, the 2 yr right at 2% and the 5 yr at 2.17%. Part of this is the further moderation that we will see (more pronounced today because of the easy June 2022 comparison) but also expectations that the Fed will keep rates higher for a while with the fed funds futures currently pricing in an above 4% fed funds rate by end of 2024. As while I expect a further slowing in inflation, where maybe we’ll see a 2 handle by yr end, I still expect a multi yr inflation rate that will be more like 3-4% and thus we are buyers of TIPS here believing they are cheap relative to conventional Treasuries.

I saw the Adobe Digital Price Index yesterday for June and it showed the prices of goods sold online fell 2.6% y/o/y. They said:

“Grocery price increases have now slowed for 9 consecutive months”

and:

“Categories including electronics, computers and appliances continued to see significant price drops.”

The Fed does not need another rate hike to further slow inflation, it is already happening as long as rates stay at current levels for a while longer…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

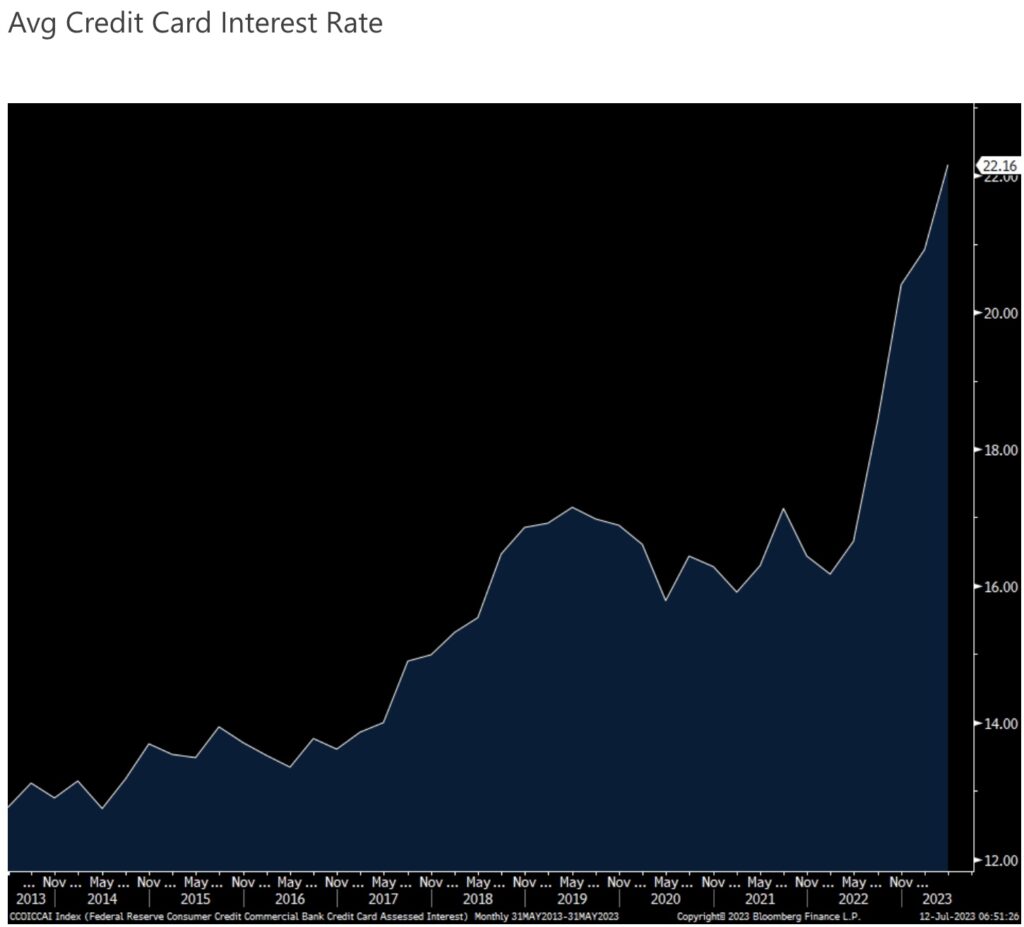

We saw the May consumer credit figure on Monday where borrowing for both revolving and non-revolving has slowed sharply but I wanted to show the chart of the 22% interest rate on unpaid credit card balances as this helps to explain the slowdown at least on the revolving side. With respect to the non-revolving side, which is mostly auto and student loans, CarDealershipGuy (an anonymous car dealer) on Twitter had an important take on what is going on and what also helps to explain the slowdown in used car prices.

He said:

“The ironic part about declining used car prices: It’s not due to waning consumer demand…A large chunk of car buyers in the US are ‘payment shoppers.’ In other words, they’re ‘price insensitive’ consumers who mostly care about their monthly payment. So what’s actually driving the decline in used car prices? Auto lenders. Their lending standards have tightened (and requiring), 1) reduced loan to value ratios, 2) larger down payments, 3) bigger fees, etc…”

His bottom line:

“lending supply has declined.”

Not a surprise to the rest of us that sees what has been going on with banks and other lenders but point made.

Credit Card Interest Rates Continue To Skyrocket

New Zealand And Canada

The Reserve Bank of New Zealand finally took a breather with its rate hikes, holding it at 5.50% as expected. Acknowledging that they don’t need to go any higher on rates but still have continued tightening, they said “Interest rates are constraining spending and inflation pressure as anticipated and required. The Committee is confident that with interest rates remaining at a restrictive level for some time, consumer price inflation will return to within its target range.” In response, the 10 yr New Zealand yield fell 10 bps overnight after dropping by 11 bps on Tuesday. The 2 yr yield dropped by 14 bps for a 2nd day.

The Bank of Canada is expected to raise rates by 25 bps today to 5% after the 25 bps hike in June which followed a two meeting pause.

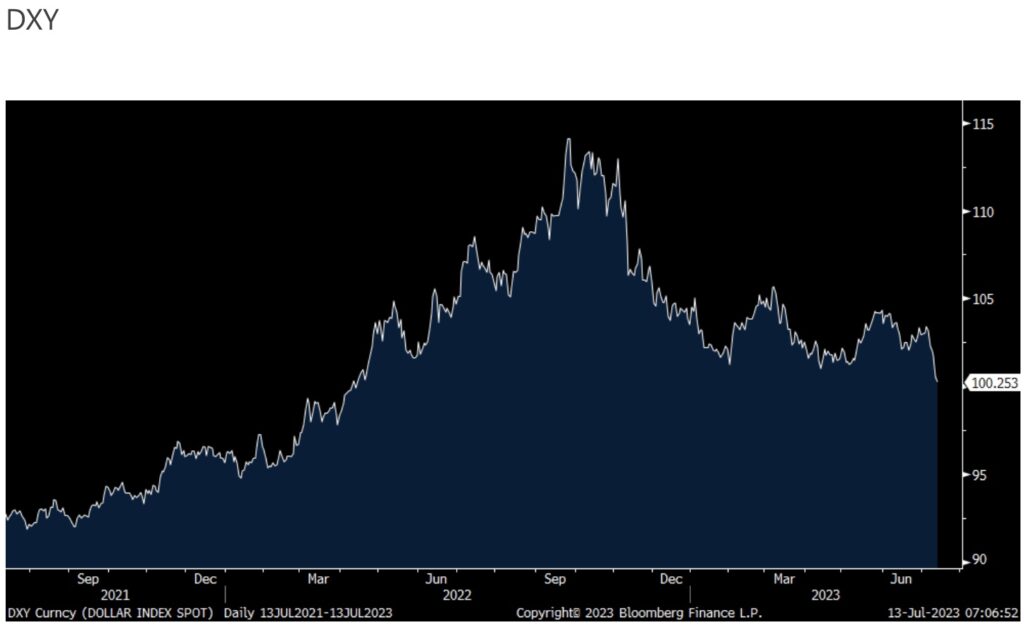

US Dollar Troubles

The DXY has broken down and is now trading at its lowest level since mid April 2022. The dollar rally ended up being solely an aggressive Fed thing, nothing more. The DXY bottomed in June 2021 when Jay Powell said at his presser that they are finally thinking about tapering QE and topped (at the same time the stock market bottomed) in late October/early November 2022 just as the Fed was ending its cadence of 75 bps rate hikes. If this weakness continues, yes it will be positive for exporter earnings but it will raise the prices of imports and could put a floor under inflation. We still are long gold and silver which could finally get its due with this dollar weakness and the Fed just about done hiking rates.

US Dollar Breaking Down

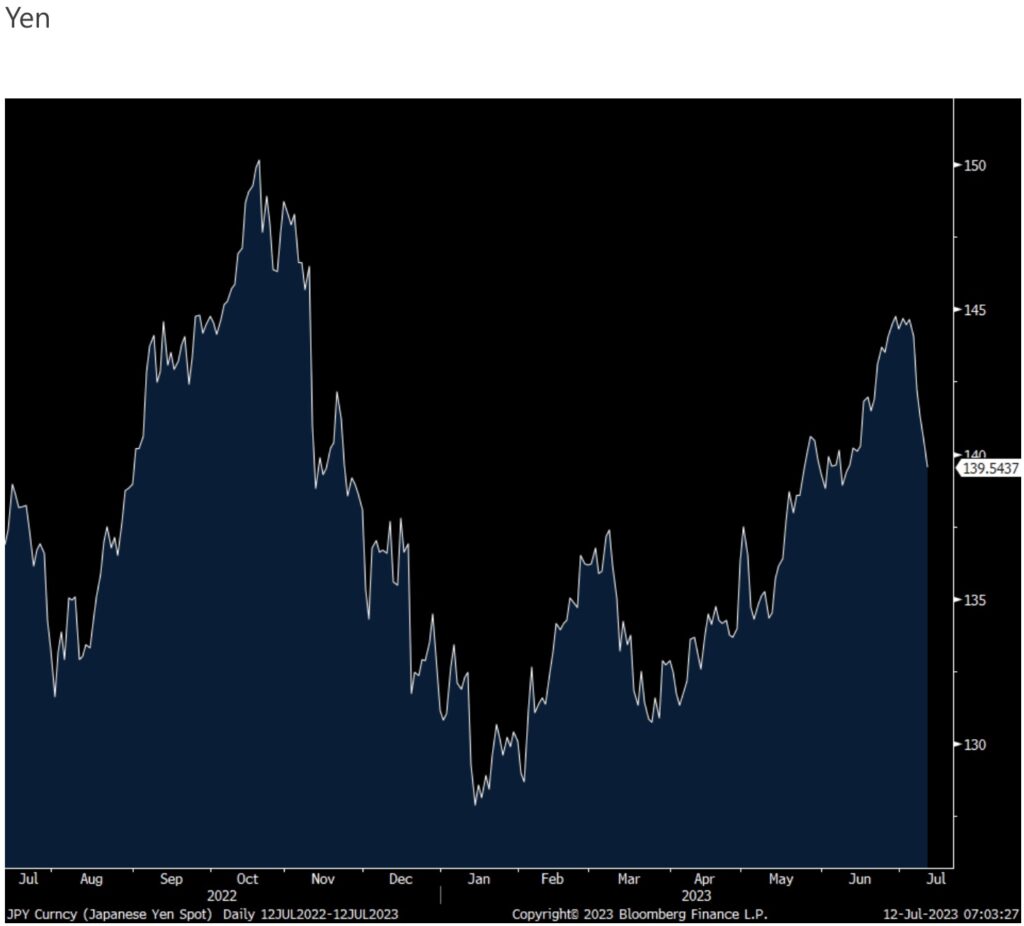

Yen vs US Dollar

The yen is rallying for a 5th straight day and is back under 140 vs the US dollar as we can’t discount the possibility of a YCC move at one of the next two BoJ meetings. There was a story from Nikkei News yesterday that “Speculation is mounting that the Bank of Japan will adjust its ultraloose monetary policy as soon as this month in response to recent economic data, driving the yen to its strongest against the dollar in about a month.” For so many reasons, particularly in FX and bond land, this is a must watch I’ll say again. The 10 yr JGB yield is further approaching the .50%, up 1.5 bps overnight to .474%, the highest since late April.

Japan Jawbones Yen, Strengthens vs US Dollar

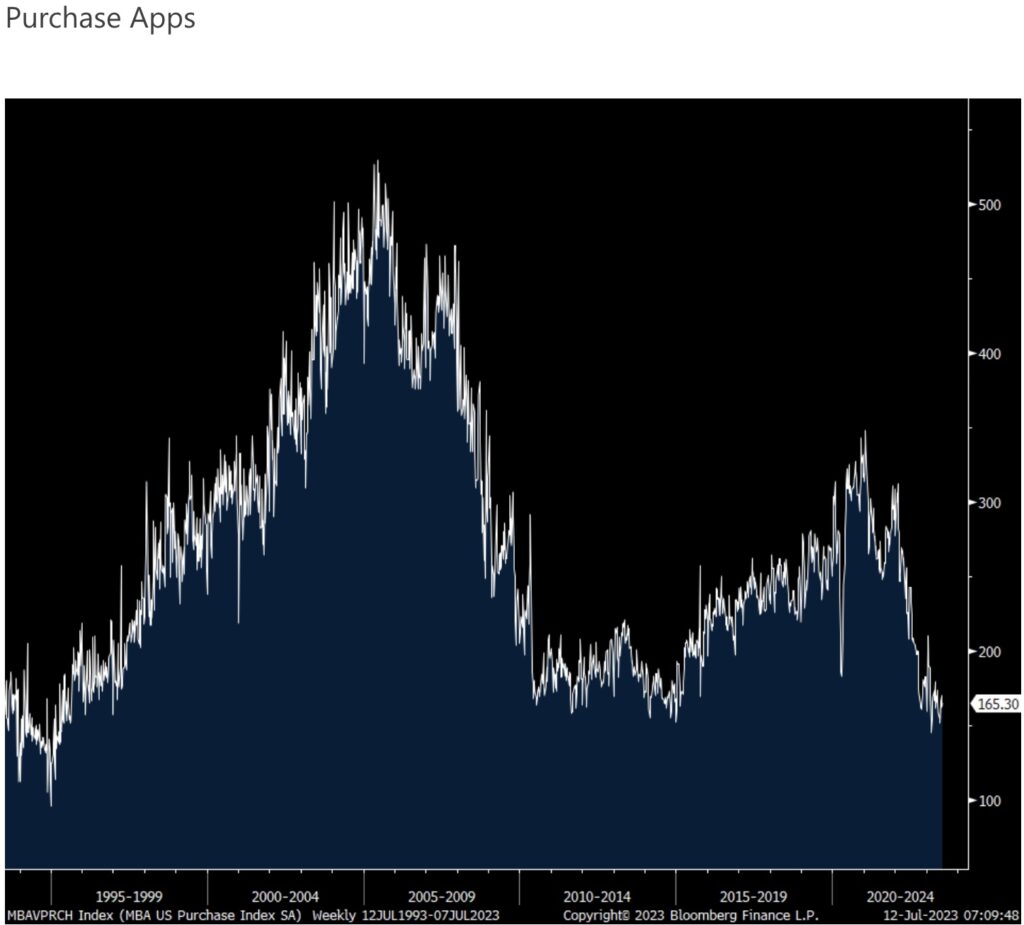

Home Prices And Purchases

With the average 30 yr mortgage rate back above 7%, mortgage apps were mixed. Purchases rose 1.8% w/o/w after falling by 4.6% in the week before but still are down 26% y/o/y. Refi’s fell for the 3rd week in the past 4, down by 1.3% w/o/w and 39% y/o/y. Refi’s right now are almost all cash out refi’s. Bottom line, we have the purchase component near the lowest level since the mid 1990’s at the same time builders are partying like it’s 2005 (not quite I know). Quite the upside down situation but we know the inventory situation helps to explain why. I will say that while the public homebuilders are saying that buyers are more comfortable with the current level of interest rates and are ‘getting used to it’, I’ll push back and say there is no chance they are comfortable with rates where they are, double the rate they once saw a few years ago. Price matters and I question how long this new home strength can last with affordability so much of a growing issue.

Mortgage/Purchase Applications Remain Buried At Multi-Decade Lows Due To House Prices Being Overvalued

Also of importance…

Major Potential Inflection Point at World Class Gold Miner After Blow-out Production Beat

K92 Mining, operating the Kainantu Gold Mine which is one of the highest-grade gold mines globally, delivered a monster Q2 results beat this week. The Company delivered 30,794 oz gold equivalent propelling the stock up 12% on the news on big volume and could have more room to run with John Lewins, CEO and Director messaging a positive second half of the year:

“…the second half of 2023 is expected to be our strongest, driven by stope sequence and operational flexibility significantly increasing through the remainder of the year.”

From expansions, to exploration to execution, Mr Lewins, is very excited about what is in-front of the Company on so many levels:

“For the second half of the year, there is a tremendous amount of sense of anticipation in the Company. On the process plant, now that the Stage 2A Plant Expansion is complete, optimization efforts are underway to thoroughly test its recovery and throughput potential. We believe throughput has the potential to be notably above design nameplate. On mining, we continue to benefit from the arrival of more equipment, with a new jumbo scheduled to arrive this month and multiple long-term infrastructure projects that will drive efficiencies and boost operational flexibility such as the twin incline, also progressing well.

We are also active in exploration, with our underground program currently drilling Kora Deeps and Judd South in addition to Kora and Judd. Surface exploration is drilling Judd, Judd South and Kora South, in addition to the A1 Porphyry. And lastly, the tender process for our major growth capital packages for the Stage 3 and 4 Expansions are well advanced and we look forward to providing an update near-term.”

K92 is in the early construction phase of a major expansion to 300,000 oz gold equivalent per year (Stage 3) followed by an expansion to 500,000 oz gold equivalent (Stage 4) over the medium-term. K92 Mining trades on the TSX under ticker symbol KNT and KNTNF in the US.

GOLD BLASTOFF! To listen to Tavi Costa discuss gold and silver soaring along with mining stocks CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Gold Is Going To $2,700-$3,000 And Some Junior Stocks Will Soar 20-30x Higher CLICK HERE.

ALSO JUST RELEASED: Art Cashin Says Commodities Close To Major Upside Breakout, Plus A Look At 1920s vs Today CLICK HERE.

ALSO JUST RELEASED: This Has Only Happened A Handful Of Times Since 1928 CLICK HERE.

ALSO JUST RELEASED: Calm Markets But Here Is The Big Surprise Of The Day CLICK HERE.

ALSO JUST RELEASED: BRICS Countries Continue Massive Gold Buying Spree CLICK HERE.

ALSO JUST RELEASED: Interview With The Man Who Correctly Predicted Russia & BRICS Would Launch Gold-Backed Currency CLICK HERE.

To listen to the man who correctly predicted the BRICS would launch a gold-backed currency CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.