As we kickoff trading, market legend Art Cashin says commodities are close to a major upside breakout, plus a look at 1920s vs today.

Commodities Close To Major Upside Breakout

July 11 (King World News) – Art Cashin, Head of Floor Operations at UBS: Overnight, global equity markets are leaning to the upside, but not universally so. Tokyo closed basically flat. Hong Kong, however, closed up the equivalent of 350 points in the Dow and Mainland China was up about 150 points in the Dow. India was not far behind, closing up the equivalent of about 110 points in theDow. London is down the equivalent of about 100 points and Paris is up about the equivalent of about 200 points in the Dow, while Frankfurt is up the equivalent of about 80 points.

Today’s economic calendar is pretty light. This morning, early on, we will get the Small Business Optimism Index then, at late morning, there will be a one-year Treasury auction. At 1:00 p.m., a three-yearTreasury auction and, of course, it is Amazon “Prime Day”. I do not have any Fed speakers scheduled and the details of the rebalancing is due on BastilleDay.

So, we will wait and see if anything comes out of the NATO Summit and any other things that could be a factor in the market.

The rally on Monday was unexceptional, but it was just what the bulls had to do after the choppy trading last week and so, they have regained control of the ball. Let’s see if they make any effort to push it further. Obviously, in any real rally, we will watch the resistance up at 4450 and see if it becomes a factor.

Traders are bothered by an apparent dichotomy. Oil, copper and other commodities looked like they are getting ready to break out to the upside but yields on the ten-year Treasury look like they may be heading lower after a possible double top at the4.08/4.10 levels.

You know the drill. Stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert and most of all try to stay safe.

1920s vs Today

Peter Boockvar: I’ll say what I said a few quarters ago, we have death, taxes and about 75% of companies that will beat earnings expectations. That should happen again but the net result should still be a y/o/y decline in trend and maybe most importantly big picture, a continued degradation in profit margins. According to FactSet, for the S&P 500 we are expected to see a net profit margin of 11.4%, down a touch from Q1 and off the record high of 13% in 2021. We need to be reminded that over the past 15 years, artificially low interest expense and the profit pie going to labor the lowest since WWII were the two main drivers of higher margins, outside of the one time base effect of the sharp cut in the corporate tax rate. Those of course have reversed notably.

We can also throw in huge stock buybacks. Now there is a partial offset on the interest expense side and that is higher interest income with higher rates but that is concentrated at many of the big tech stocks that hold most of the corporate cash. But even that is not a savior for all. Take Apple for example. According to their last quarter’s balance sheet, they have about $167b of cash ($56b considered short term with the balance having more than one yr maturity) but $110b of debt.

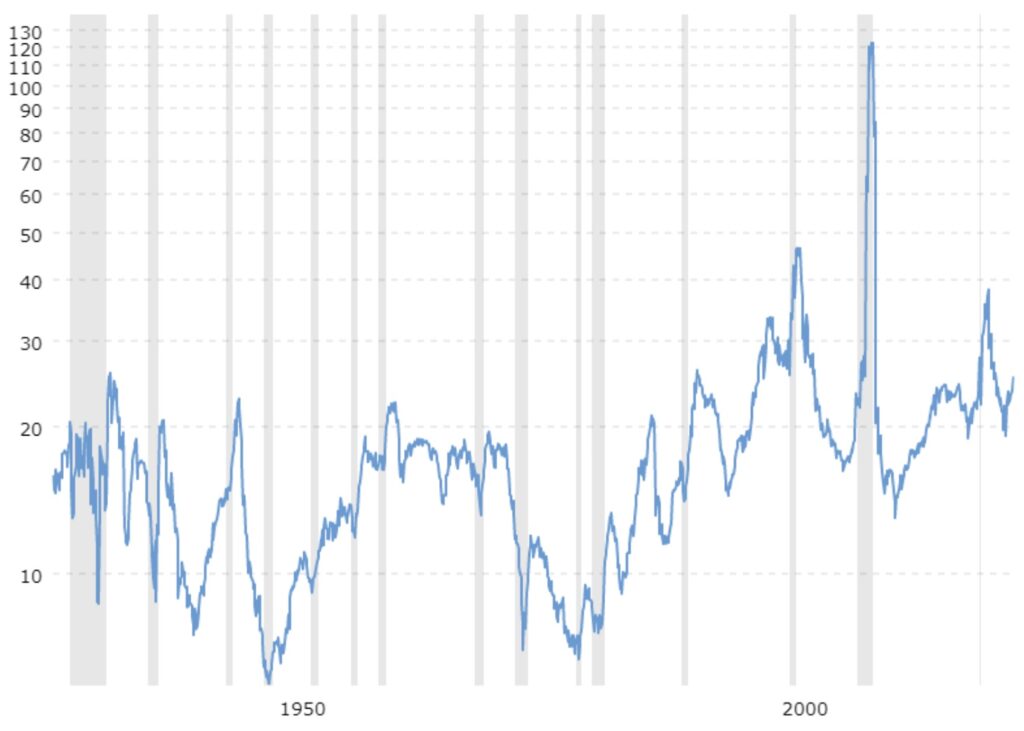

One of the hardest things to do in the investment business is trying to figure out what the right P/E multiple should be for a security or the broader market. It’s all art of course and we can throw in a variety of variables into the mix. Either way, here is a chart from MacroTrends that goes back to the 1920’s and we can see the current multiple has only been seen a few times over the past 100 years. Multiples mean nothing for market performance in the short term so I’m not using this at all as a market call, just market perspective as we digest much higher interest rates and are about to review Q2 earnings.

S&P 500 P/E Multiple 1920s-Today

Things Are Still Tough All Over

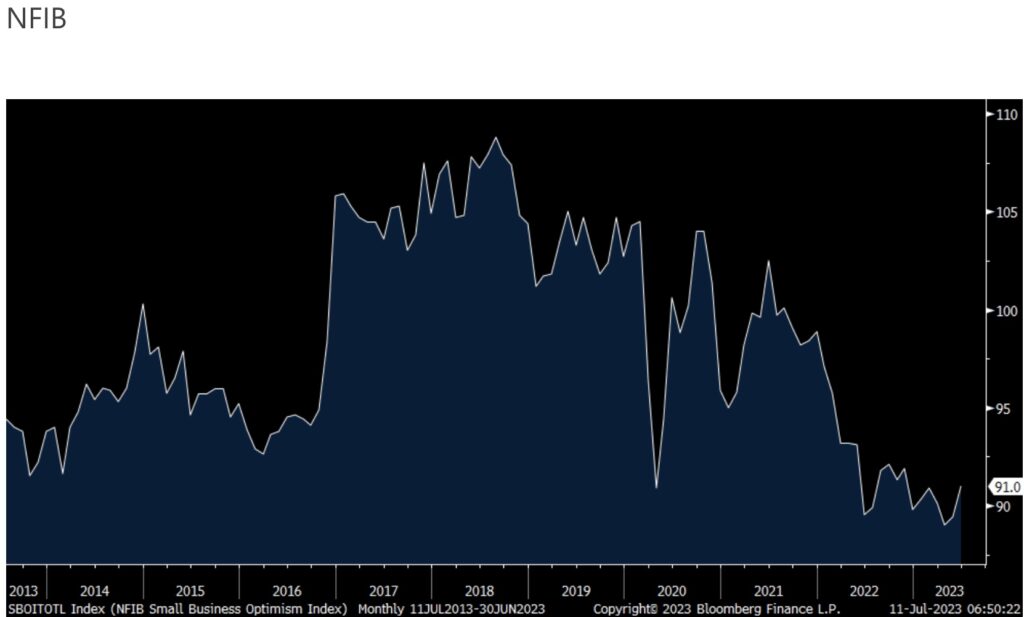

The June NFIB Small Business Optimism index rose to 91 from 89.4 and that is the highest since November but we’re sort of bouncing along the bottom as it compares with 104.5 in February 2020.

Of note, Plans to Hire fell 4 pts to match the lowest since October 2016 not including Covid. There was also a 2 pt drop in job openings to the lowest of the year. The current compensation component was down by 5 pts to the lowest since May 2021 while future comp plans were unchanged m/o/m. Capital spending plans held steady and Plans to Increase Inventory remained negative.

Those that Expect a Better Economy did improve by 10 pts off one of the lowest reads since the 1970’s. Also, those that Expect Higher Sales were up 7 pts but still negative at -14. Those that said it’s a Good Time to Expand was up 3 pts to a 4 month high. Credit conditions were still well below zero but 2 pts less so at -8 and after falling by 3 pts in May, the earnings trends rose 2 pts. Finally, there was another 3 pt drop in Higher Selling Prices to the lowest since March 2021, though NFIB said it is “still a very inflationary level but trending down.”

More on the credit side, only 2% of business owners “reported that all their borrowing needs were not satisfied (up 1 pt)” but “The average rate paid on short maturity loans was 9.2%, 1.4 percentage points above May’s reading. This was highest since June 2007.” That has a hefty cost of capital I say and a high hurdle rate for its usage…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Bottom Line

Bottom line, while seeing a modest lift in June, the NFIB chief economist said “Halfway through the year, small business owners remain very pessimistic about future business conditions and their sales prospects. Inflation and labor shortages continue to be great challenges for small businesses. Owners are still raising selling prices at an inflationary level to try to pass on higher inventory, labor, and energy costs.” With government subsidies notable in manufacturing and construction, NFIB said “The difficulty in filling open positions is particularly acute in the manufacturing, construction, and transportation sectors where compensation gains are more frequently reported.”

Auto Prices Declining

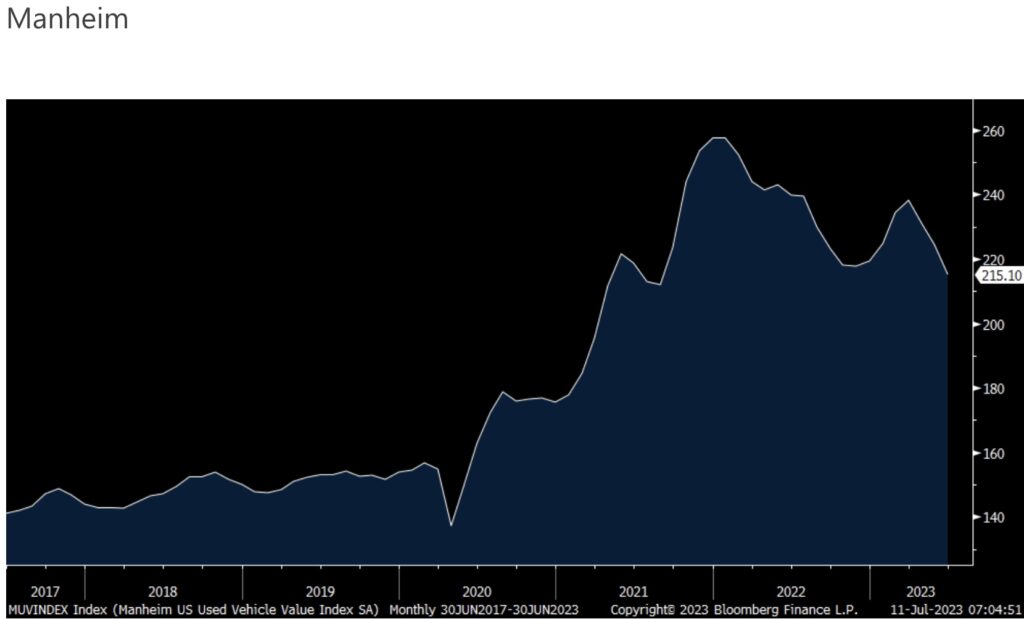

We saw the Manheim used vehicle price index yesterday which fell 4.2% m/o/m seasonally adjusted and by 10.3% y/o/y. The index itself is at the lowest since August 2021 but still up by 37% since February 2020. We should also be getting some relief on the new car side as inventories continue to normalize. Manheim said “Buyers at auction look to have taken an early summer break, and while used retail inventory has been improving over the last several weeks, we are expecting less volatility in wholesale price movements through year end.”

Used Car Prices Coming Back Down To Earth

Out yesterday too, the NY Fed’s June Consumer Expectations survey said one yr inflation expectations fell to 3.8% from 4.1%, the lowest print since April 2021 and “The decline is broad based across demographic groups.” Lower gasoline prices were a key reason. In contrast, the 3 yr expectation for inflation was unchanged at 3% and rose 3 tenths for 5 yrs out to 3%, the highest since March 2022. Expectations for higher prices for homes, college, medical care and rent all were higher. Unfortunately those happen to be the biggest ticket items for consumers.

The labor market component was mixed as there was a drop in those expecting higher unemployment but “The mean perceived probability of losing one’s job in the next 12 months increased by 2 percentage points to 12.9%, the highest reading since November 2021.” The median expected growth in household income fell a touch. On consumer spending, “Median household spending growth expectations declined from 5.6% in May to 5.2% in June, well below its 12 month trailing average of 6.4%, and the lowest reading since September 2021.“ I bolded it.

Interestingly, and not what I was expecting, “Perceptions of credit access compared to a year ago improved somewhat in June, with a slightly higher share of households reporting that it is easier to obtain credit now than a year ago. Similarly, respondents’ views about future credit availability improved slightly.”

US Dollar Weakens…Again

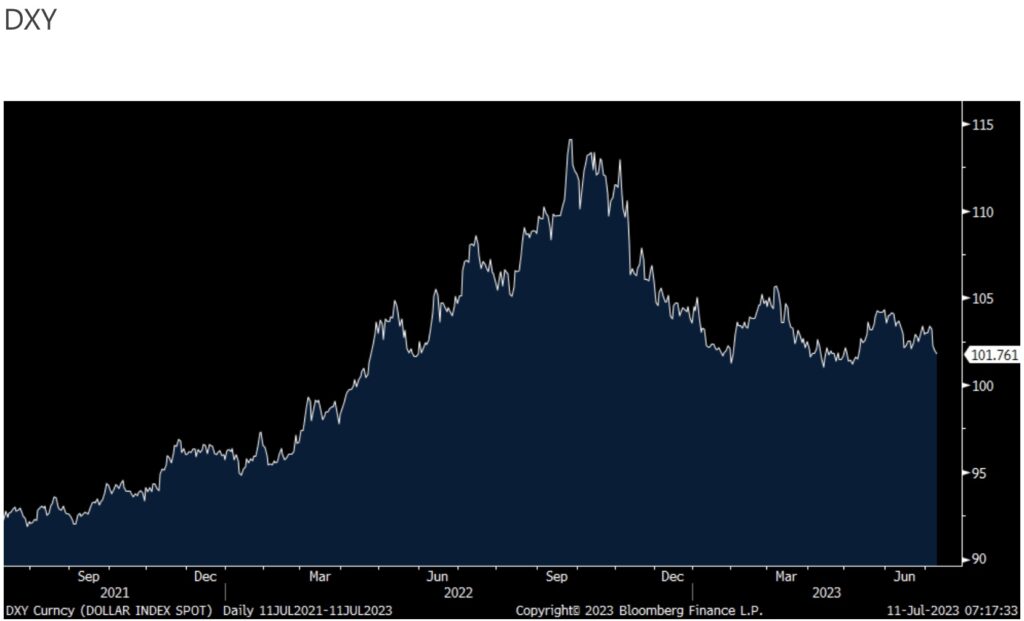

I’m going to mention the US dollar again as the euro/yen heavy DXY today is falling to the lowest level in 2 months. Something is not right with the US dollar, especially when looking at its fiat currency competition.

“Something is not right with the US dollar”

China

Helped by the modest cut in interest rates, aggregate financing in China in June totaled 4.22 trillion yuan, 1.1 trillion more than expected with bank loans making up about 700b yuan of the upside. Money supply growth slowed but at 11.3% still beat expectations by a tenth. Ramping up borrowing is just not going to cut it in terms of driving faster economic growth but what the Chinese are intent on doing is extending out loan maturities in order to buy time. They are also easing home buying restrictions so as to absorb the still high inventories. This data came out after their market closed in which stocks traded higher. The Chinese economy needs faster wage growth and more consumer spending, not more borrowing and infrastructure spend. Their manufacturing sector could also use faster global demand.

Shifting To Europe

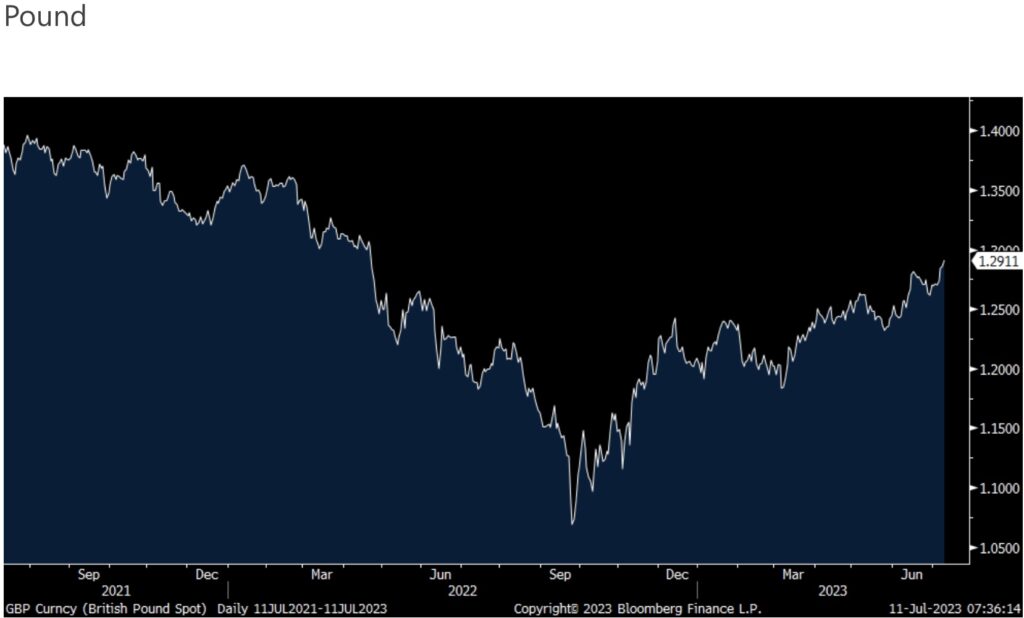

Shifting to Europe, jobless claims in the UK in June jumped by 25.7k and that marks 3 months in the past 4 and reflecting cracks in their labor market. Thru May though, wage growth was strong, rising 7.3% y/o/y ex bonus and trying to catch up to the rising cost of living. It does give the BoE more of a headache however. While employment for the 3 months ended May did exceed expectations, their unemployment rate rose to 4% from 3.8% and the participation rate fell. Yields are not moving much in response after the recent 16 yr jump but the pound continues to power higher, and to my point that there is something seriously wrong with the US dollar. The pound is at the strongest level vs the US dollar since April 2021. UK stocks are some of the cheapest in the world and we remain bullish on some of them.

British Pound Making A Comeback

Lastly

Lastly, the German July ZEW fell to -14.7 from -8.5 and that was worse than the estimate of -10.6. Current conditions softened by 3 pts m/o/m. Bottom line, this is the lowest print of the year and ZEW said “Industrial sectors are likely to bear the brunt of the anticipated economic downturn, with profit expectations for these export oriented industries experiencing a substantial decline once again.” If there is a country that is going to feel the pain from a manufacturing recession and the slowdown in China, it is Germany.

ALSO JUST RELEASED: This Has Only Happened A Handful Of Times Since 1928 CLICK HERE.

ALSO JUST RELEASED: Calm Markets But Here Is The Big Surprise Of The Day CLICK HERE.

ALSO JUST RELEASED: BRICS Countries Continue Massive Gold Buying Spree CLICK HERE.

ALSO JUST RELEASED: Interview With The Man Who Correctly Predicted Russia & BRICS Would Launch Gold-Backed Currency CLICK HERE.

To listen to the man who correctly predicted the BRICS would launch a gold-backed currency CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.