On a day where the global markets are relatively calm, here is the big surprise of the day.

This Will Move Markets Today

July 10 (King World News) – Art Cashin, Head of Floor Operations at UBS: After a bit of a slow start, the Dow kicked into high gear, thanks to a handful of stocks.

Also, the regional banks are perking up and may be starting to break out to the upside (Hat tip: Katie Stockton).

The S&P is seeing the bulls nibbling a bit, but even though they got it back on the right side of 4400, they don’t look like they are about to make a threatening run at the 4450 resistance.

So, we will continue to watch the Fed speakers as they parade across the newsticker.

Stay alert and stay safe.

Arthur

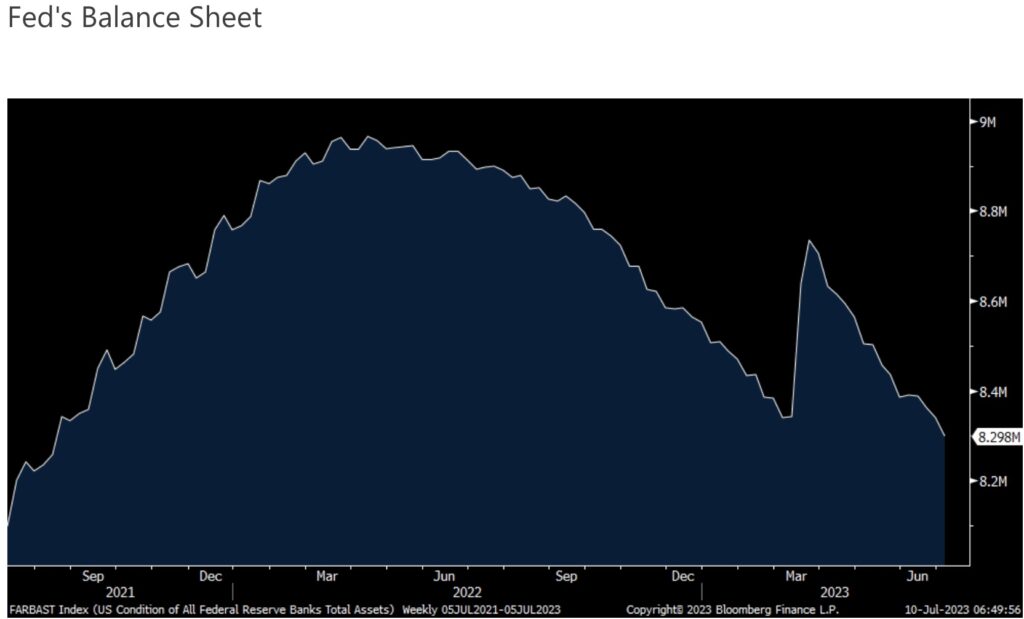

Fed’s Balance Sheet Back To Where It Started

Peter Boockvar: Seen late Thursday, the Fed’s balance sheet is now below where it stood right before the SVB bankruptcy, falling $42b on the week. After the Fed is done hiking rates, this will be their relied upon tool to further tighten policy and drain money away. Combine this with higher rates for longer and monetary policy will continue to tighten even after the last rate hike.

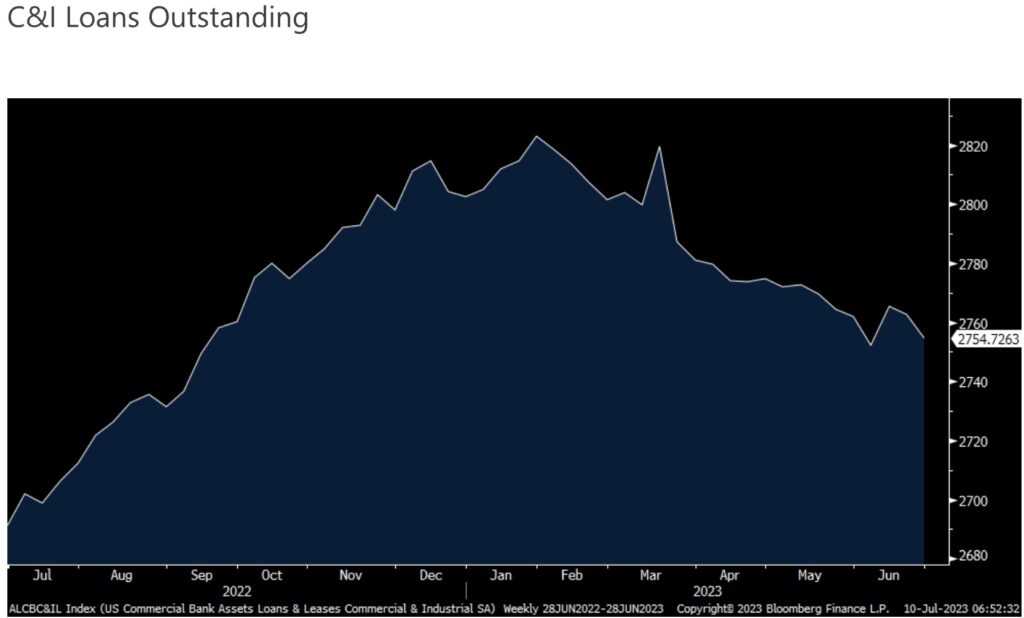

For the week ended 6/28, C&I loans outstanding is just above the lowest since last September and this should continue to be a big focus. Bank deposits were little changed and the rise in short term rates is just making it that much more challenging and costly for banks to retain and recapture lost deposits.

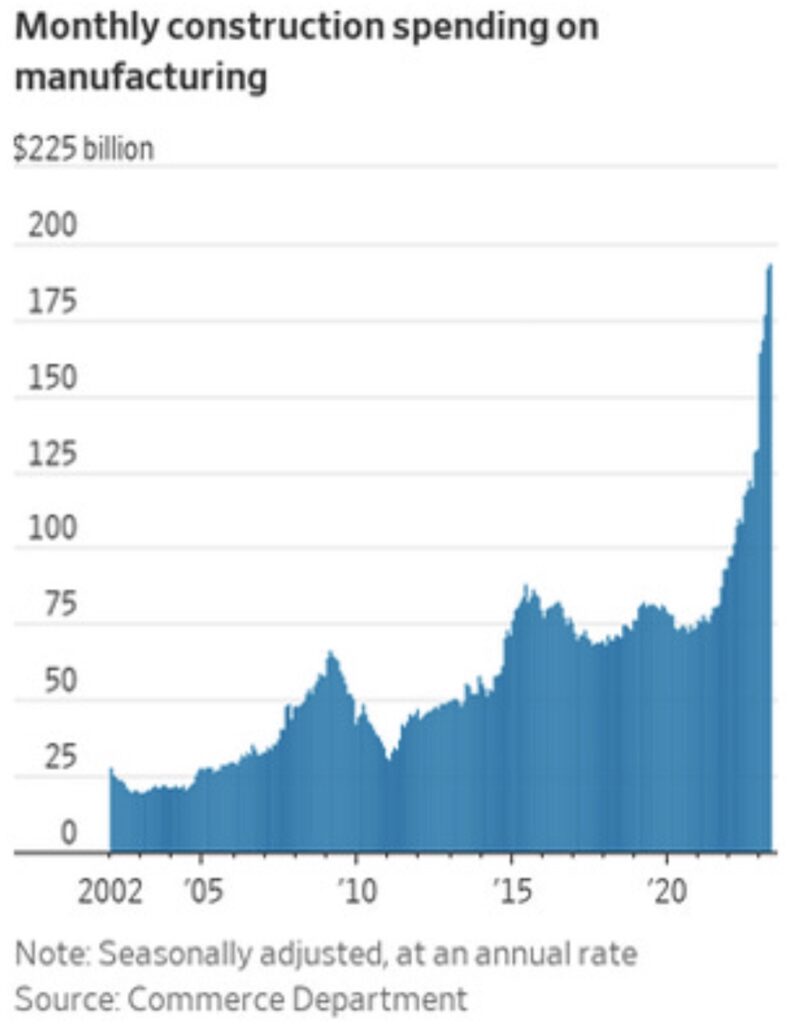

SURPRISE: Money Being Spent To Increase US Manufacturing

A friend last week opened my eyes to the extent government spending via ARPA and the tax incentives to build chip plants and anything green, particularly battery factories, is flowing into the US economy. My friend John Mauldin included this chart in his weekend piece and the visual says it all on this:

China Is In Trouble

China’s PPI in June fell 5.4% y/o/y, a bit more than the estimate of down 5% and it was all lower commodity prices that drove it but we also know China’s manufacturing is experiencing the same recession as the rest of us. Residential real estate of course has deep problems as well. On the consumer side, prices were unchanged y/o/y vs the estimate of up .2%. Ex food and energy saw prices up .4% y/o/y. Bottom line, the deflation bogeyman is now being thrown out by many but if there should be one lesson from the inflation we’ve seen around the world over the past 18 months, it should be that stable to lower prices should not be feared. Yes, PPI is highly correlated to industrial behavior but with the Chinese consumer worried about the economy and youth unemployment high, no change in one’s cost of living is a GOOD thing for them…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Chinese stocks traded higher but all on the hopes of fiscal and/or monetary stimulus but I’m not sure they are going to get much of it. The offshore yuan is weaker after last week’s rally which saw the US dollar broadly soft even in the face of the sharp rise in interest rates.

Meanwhile In Europe

The EU July Sentix Investor Confidence figure weakened to -22.5 from -17. The estimate was -17.9. That’s the lowest since last November and Sentix said “Concerns about the further development of the global economy have probably not diminished with the latest values of the sentix business cycle indices.”

They were most worried about Germany, “The values for Germany, the most important economy in the Eurozone, can only be described as ‘dramatically bad.'” This is not a market moving number but concerns about Germany’s economy is now widely held. Yields are modestly higher in Europe after last week’s jump while the euro is down and stocks there continue to trade well.

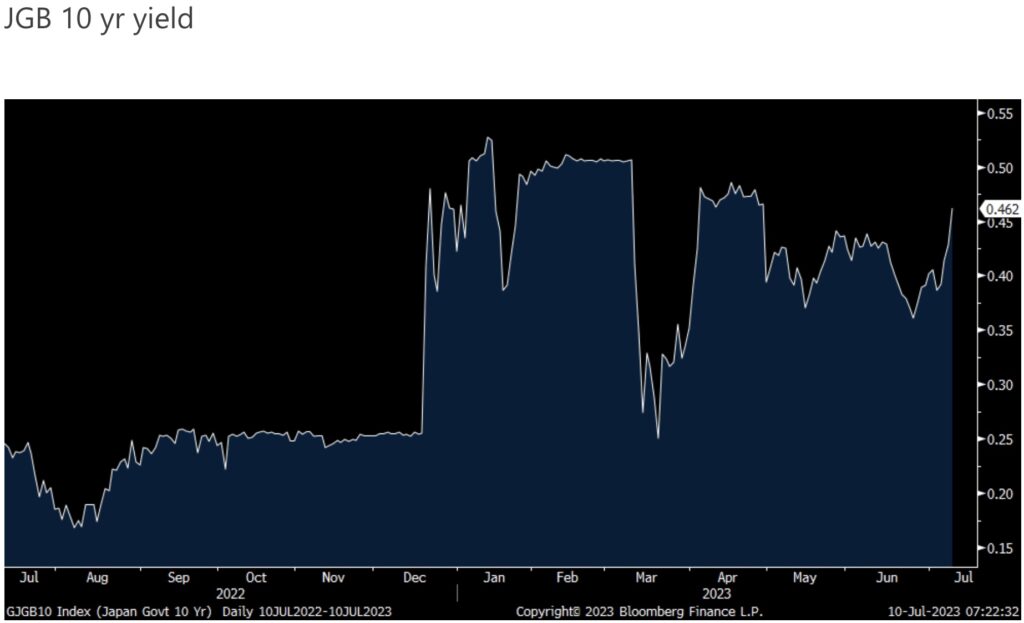

Japanese Yields Continue To Rise

Keep your eye on the JGB market, again, as their 10 yr yield jumped another 3.4 bps overnight to .46% and again getting closer to the .50% YCC defended level. Last week’s wage data could be the catalyst for another chance in YCC at one of the coming BoJ meetings.

ALSO JUST RELEASED: BRICS Countries Continue Massive Gold Buying Spree CLICK HERE.

ALSO JUST RELEASED: Interview With The Man Who Correctly Predicted Russia & BRICS Would Launch Gold-Backed Currency CLICK HERE.

To listen to the man who correctly predicted the BRICS would launch a gold-backed currency CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.