Today legend Art Cashin confirmed we may see another Black Swan in financial markets, plus a look at the current market chaos.

January 6 (King World News) – Art Cashin, Head of Floor Operations at UBS: The group of old fogies that I belong to, will I think, be watching to see if the second- half of that cycle kicks in. Remember there was a short term cycle that indicated a selloff going into yesterday and possibly today. We got the first half of that. Now let’s see if there’s a follow through on the South side. Most of that probably will depend on the data.

Black Swan

And again, next week we’re going to try and get some of this background on the Fed together to see where things are going. We think that the unnoticed part of the Fed action, that is the quantitative tightening, may be kicking into high gear, the money supply growth is falling off a cliff, and if anything else, it’s almost as though the money supply is contracting. And I believe that could have serious Black Swan effect in the financial markets. The problem is which markets, where and when?

So we will be consulting several of our insightful friends and hope to deal with that as the week progresses.

In the meantime, you know the current drill. Stay close to the newsticker. Keep your seat belt fastened. Stay nimble and alert. And most of all, stay safe and have an absolutely wonderful weekend. Happy New year.

Arthur

Economic Worries Continue

Peter Boockvar: Here are some notable quotes from two companies that had earnings conference calls yesterday which coincidentally we happen to own stock in both of them, MSC Industrial Direct and Conagra.

MSM (a great proxy for US manufacturing):

“Turning to the external environment. The picture remains similar to last quarter with sentiment readings declining and IP readings moderating. The majority of our customers are seeing stable order levels, demand and general activity. We are hearing though continued talks of softening among a portion of our customers.

More recently, we experienced a higher prevalence of extended holiday shutdowns along with weather disruptions during the 2nd half of December…this resulted in a strong start to the month, but a slow finish as activity saw a sharper decline than in the last two weeks of prior year.”

“Looking forward, we continue to see new cost increases from our suppliers, although not at the fast and furious pace of last year. As a result, we anticipate taking a small pricing adjustment within the next month…the reality of the situation is that there’s still inflation. And while it is definitely moderating, there’s still inflation and there is still cost increases as evidenced by the fact that, yes, we’re still seeing suppliers coming to us with increases.”

CAG reported a 17% increase in price/mix and an 8.4% decrease in volume:

“Price/mix was driven by the company’s inflation driven pricing actions that were reflected in the marketplace throughout the quarter. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions; however, the elasticity impact was favorable to expectations.”

“inflation has begun to moderate in certain areas, enabling our inflation justified pricing actions to catch up to the rising costs…Of course, inflation remains elevated in many areas, and we continue to closely monitor our cost, just as we have in the past. We will continue to take appropriate inflation justified pricing actions as needed…We expect gross inflation to continue, but moderate through the remainder of the fiscal year, resulting in an inflation rate of approximately 10% for fiscal ’23.”

Eurozone Inflation

In the Eurozone, December headline CPI fell .3% m/o/m, more than the forecast of down .1%. The y/o/y gain slowed to 9.2% from 10.1%, 3 tenths below the estimate. The core rate though accelerated to 5.2% y/o/y vs 5% in November and that was one tenth more than anticipated. While energy prices are definitely falling and helping in the moderation in headline inflation, energy price caps in many European countries are helping to. That said, core inflation continues to rise.

Eurozone Inflation Continues To Surge

QT Starts In A Few Months

The ECB does plan to keep on hiking and QT starts in a few months. Today Mario Centeno, an ECB governing council member, said:

“Interest rates will rise until the moment when we consider that the inflation profile is sufficiently robust to as quickly as possible bring inflation to 2%. We can’t hesitate on the path. In our opinion, inflation is more negative for the economy than this process of normalizing interest rates.”

The persistence in the core rate offset the headline drop in keeping the 5 yr 5 yr euro inflation swap unchanged today in response at 2.35%. Sovereign bond yields are down 1-2 bps while the euro is lower and the Euro STOXX 600 is up a hair but has started the year off nicely. Parts of Europe, particularly Germany, will be a big beneficiary of China’s reopening…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Until that full reopening though, Germany said November factory orders dropped by 5.3% m/o/m, well worse than the estimate of down .5%. The Economy Ministry said that “industry is going through a difficult winter, even though companies’ business expectations have improved recently.” Retail sales in Germany slightly missed the forecast.

For all of the Eurozone, the December Economic Confidence index rose to 95.8 from 94 and that was 1 pt better than expected. All 5 of the internal confidence components rose m/o/m, that being manufacturing, services, consumer, retail and construction.

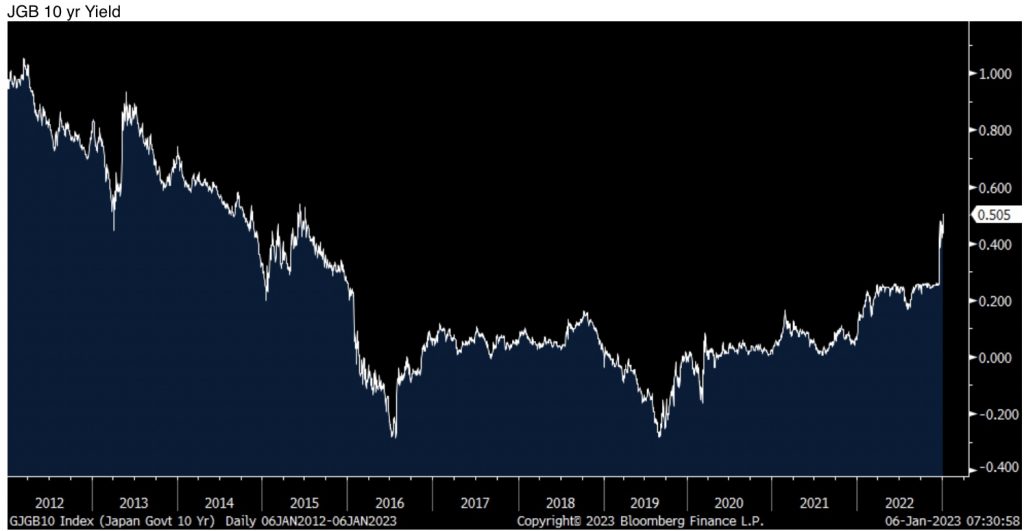

With respect to the BoJ who claimed that they widened yield curve control because they wanted to improve market functioning even though they ramped up QE which further damages market functioning, Bloomberg is reporting that “Bank of Japan officials see little need to rush to make another big move to improve bond market functioning, and the BoJ should assess the impact of last month’s yield adjustments for now, according to people familiar with the matter.” The yen is falling in response. The 10 yr JGB yield closed right at .50% for the first time since July 2015, up a large 7 bps, as the market continues to test the BoJ’s policy stance. The Japanese bond market is going to be a big story this year I believe with major ramifications for other bond markets.

BoJ Has Been Losing Control Over Their Bond Market

Japan also reported modest wage gains in November at the same time inflation continues to rise, further lowering REAL earnings to -3.8%. Thankfully BoJ governor Kuroda is leaving in April but it remains to be seen whether policy will change thereafter.

ALSO JUST RELEASED: GOLD & FIAT MONEY: The Achilles Heel Of The West Is The East’s Strength CLICK HERE.

ALSO JUST RELEASED: Art Cashin – Another Black Swan May Be On The Horizon CLICK HERE.

ALSO JUST RELEASED: Historic 2022 Panic And How It Will Impact 2023 As Investors Move Into Gold & Silver CLICK HERE.

ALSO RELEASED: Celente’s Shocking Global Predictions For 2023 CLICK HERE.

ALSO RELEASED: Here Is Why 2023 Will Be A Big Deal For Gold, Silver And The US Dollar CLICK HERE.

ALSO RELEASED: BUCKLE UP: The Terrifying Global Reset Is About To Begin CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.