The King World News publication schedule will be back to normal now that people have returned from traveling. Here is the latest note on gold, silver and the bank crisis.

April 12 (King World News) – James Turk: People are starting to talk about a credit crunch, Eric. That could happen eventually, but we’re not there yet.

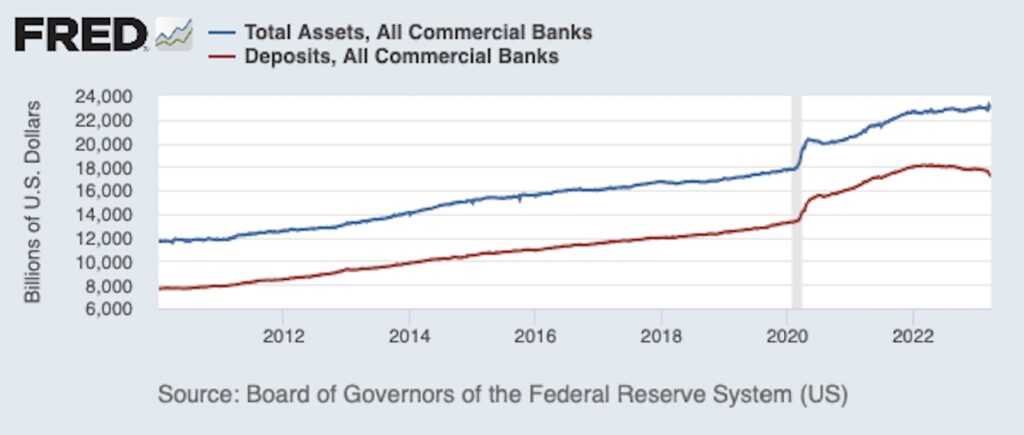

So far banks have slowed down their lending. That makes it feel like there’s a credit crunch. But a credit crunch will only begin if banks reduce their assets. Banks aren’t doing that, as we can see in the following chart.

It is customer deposits that are falling. The Federal Reserve is reducing M2, the quantity of dollars in circulation. Nearly all of these dollars are held in deposit accounts of bank customers. These dollars circulate in commerce through bank balance sheets, by checks, plastic cards, wire transfers and online. Paper currency is not a big factor these days.

The Federal Reserve is in a pickle. Demand for the dollar is diminishing. Globally, countries are increasingly relying on bi-lateral trade deals in their own currency. Another factor is a flight out of dollars to safety, which explains the strong uptrends in gold and silver. Even alternative currencies like bitcoin are benefitting as people escape the dollar.

To stop this flight out of the dollar, the Fed needs to slow down the debasement of the dollar. Inflation got out of hand because the Fed conjured up ‘out of thin air’ trillions of new dollars after the economy was shut down during the pandemic. It’s an ‘inflate-or-die’ monetary system, and the Fed never wants the bubble to pop…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

The Fed has raised interest rates hoping that would do the trick. Inflation has fallen somewhat as the customer deposits added to the system during the pandemic are now being removed, as the chart shows. But the Fed can’t raise interest rates much further because of the huge debt load overhanging the economy. The economy cannot create enough to new wealth to repay the debt. In other words, the Fed cannot do what Paul Volcker did to stop the 1970’s inflation and save the dollar with sky-high interest rates. So the Fed is taking a different tack.

Hoping it brings down inflation, the Fed has squeezed customer deposits at banks, and M2 has declined $520 billion from last July’s peak. Inflation has dropped a little, but not enough.

This squeeze by the Fed is hurting people, not the banks. Bank assets are not falling, so it’s not a credit crunch, which can be easily explained with some basic accounting.

M2 measures the quantity of dollars on deposit in banks, and these deposits are a liability on bank balance sheets. Further, the deposits fund loans that banks make to their customers who borrow. So as M2 has declined, banks need to reduce their assets – their loans to customers – to match the reduction in their liabilities to keep their balance sheets in balance…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Banks do that by stop making loans and start calling in loans – demanding immediate repayment. However, that is not too easy to do. Loan agreements these days often contractually bind the bank to make the loan once it is agreed. Nor is it easy to call in a loan. It could force companies to default, which would then require the bank to increase its loan loss provision causing a hit to earnings and reducing the bonuses of bank CEOs. So what do banks do?

The easy alternative is to borrow from the Fed – the so-called lender of last resort. The banks have borrowed about $317 billion, but this new debt does not tell the whole story.

Banks also borrow from the so-called next-to-last lender of last resort, the Federal Home Loan Bank, from whom they are borrowing $247 billion. These two sources added together explain why bank assets have not declined with the drop in M2.

So there is no credit crunch – but there is less currency in circulation – the currency in people’s bank accounts. So far the Fed is only squeezing people by taking currency out of the system, not the banks. I think the Fed is being careful to avoid a repeat of the last credit crunch, which was in 1974.

We’ll see whether the Fed continues to squeeze and how far, and whether it goes far enough to cause a credit crunch. The 1974 credit crunch led to bank failures globally and the collapse of Franklin National Bank in New York City, at that time the largest bank failure in US history.

King World News note: The price of crude oil is continuing to surge, now above $84 a barrel. This will feed into inflation everywhere. So the fundamentals for the bull markets in gold and silver are accelerating, regardless of how the US dollar trades. And if Turk is correct that there will be no credit crunch, then inflation will be off to the races once again at a galloping speed. If however there is a credit crunch, gold will still be the primary beneficiary as people continue to panic out of banks and into the Metal of Kings.

ALSO JUST RELEASED: Look At Who Just Issued A $48,000 Price Target For Gold CLICK HERE.

ALSO JUST RELEASED: There Is A Reason Why Gold Is Surging CLICK HERE.

ALSO JUST RELEASED: Way Too Soon To Say The Bank Crisis Has Ended CLICK HERE.

ALSO JUST RELEASED: A Terrifying Global Reset Is Being Orchestrated And Here Is Your Ticket Out Of The Collapse CLICK HERE.

ALSO RELEASED: Leeb Just Warned This Global Collapse Will Be Much Worse Than 2008 CLICK HERE.

ALSO RELEASED: Gold’s Rise And How The World Is Changing Before Our Eyes CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.