Today James Turk spoke with King World News about why it is so important that the price of gold has traded above the $2,000 level for 10 straight days.

Due to some technical difficulties King World News was unable to publish for a short period, but that issue has now been resolved. Thank you for your patience.

$2,000+ Gold

December 8 (King World News) – James Turk: Gold has now been trading above $2000 for 10 days, Eric. Each day that passes makes it increasingly likely that we will never again see gold below $2000.

Let’s look back at what happened the last time gold crossed a millennium.

Gold first hurdled above $1000 in Mar 2008, and then settled back. Then up to September 2009, there were several more failed attempts to again hurdle $1000. During these months, buyers of physical gold kept chewing away to absorb all the selling at that level, much like gold today has been absorbing the selling at $2000 since first crossing above that level in August 2020.

Anyway, in October 2009 gold again hurdled above $1000, but this time it finally stayed there. By December, gold was over $1200 and has never again traded below $1000…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

So the key question I’ve been wondering is whether we will ever see gold below $2000 again?

It is important to keep in mind that markets can do anything, and these days market intervention by governments is always a threat. So there is no way to predict the future, but we individuals have two things that tip the balance in our favour – trends and valuations.

Looking first at trends, it has pretty much been a one-way street for gold since the Federal Reserve was formed in 1913. Back then gold was $20.67 per ounce, which was the same it was when the Constitution was written and the dollar was formalized by the Mint Act of 1792 that was signed into law by George Washington.

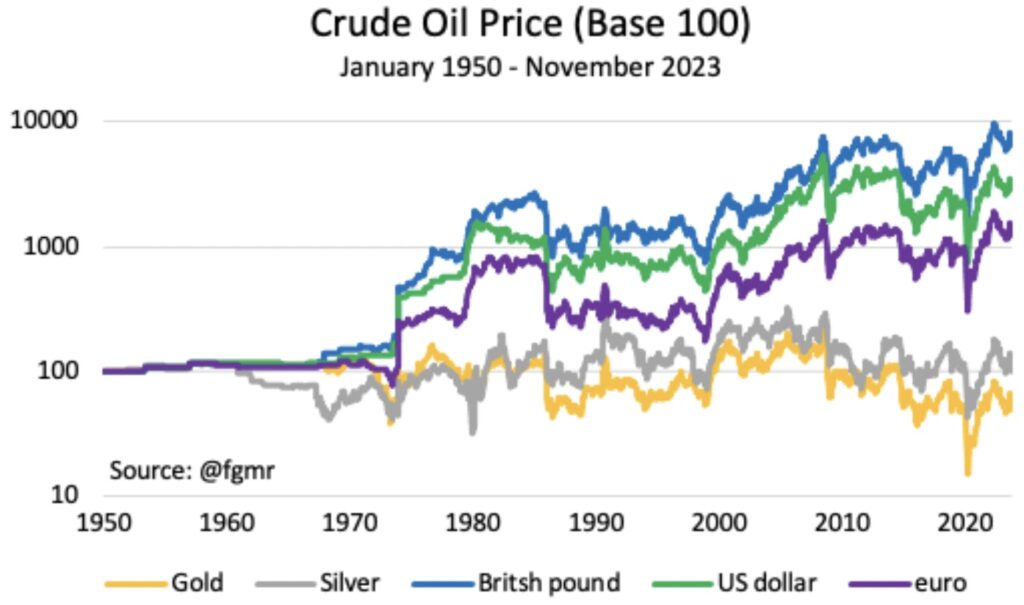

Of course there have been ups and downs in gold along the way – including the usurpation of private property when gold was confiscated in 1933 by President Roosevelt’s decree. But throughout that and two world wars, physical gold does today what it has always done – preserve purchasing power. So does silver, as is clear from this chart of WTI crude oil prices based to 100.

When measured in gold and silver, which is the money of the Constitution, crude oil prices are essentially the same as they were 73 years ago.

We need to remember that gold and silver are natural money. They are only mined when it is profitable to do so, in contrast to the dollar and other fiat currencies, which are produced by bookkeeping. If the politicians want to spend more dollars, the banking system inevitably creates them, laying bare the fiction that central banks are ‘independent’. As a result, the supply of dollars grows more rapidly than the supply of physical gold, and this difference in relative supply debases the dollar.

Without getting into the details, the oil price chart is a result of bank accounting. Over time more more fiat currency is booked by banks than gold or silver are mined. Consequently, the dollar is debased; its purchasing power erodes, while gold’s purchasing power is preserved, which is one of the key functions of money.

Next, let’s consider relative value. Gold and silver can fall out of favour just like any other asset class, as both have been for awhile. Despite gold’s recent record high, surprisingly it remains out of favour.

For example, where are the headlines in the mainstream media announcing what gold has achieved with this new record? It’s not like other tops I have seen in my career.

So in my view, $2000 is not a top; it’s just another milestone in 110 years of dollar abuse by the Federal Reserve, the big banks controlling this fiat currency system, and the politicians who allow it to happen.

This realisation will sink in as gold inches higher in the weeks and months ahead. When it does, gold’s climb to ever higher records will accelerate as the flight from the dollar accelerates, which I expect it will given that the Fed has stopped raising interest rates to fight the dollar debasement called inflation.

ALSO RELEASED: Sprott Says Central Banks Are Buying Gold At A Torrid Pace CLICK HERE

ALSO RELEASED: Michael Oliver – Emotional 24 Hours Of Gold Trading Ushers In $100 Trading Range CLICK HERE

ALSO RELEASED: GOLD SOARS HIGHER IN OVERSEAS TRADING: $3,200 Could Be A Target CLICK HERE

ALSO RELEASED: GOLD HITS ALL-TIME HIGH: Hope Dies, Gold Rises! CLICK HERE

ALSO RELEASED: Price Of Spot Gold Hits All-Time High As Silver Surges Along With Miners CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.