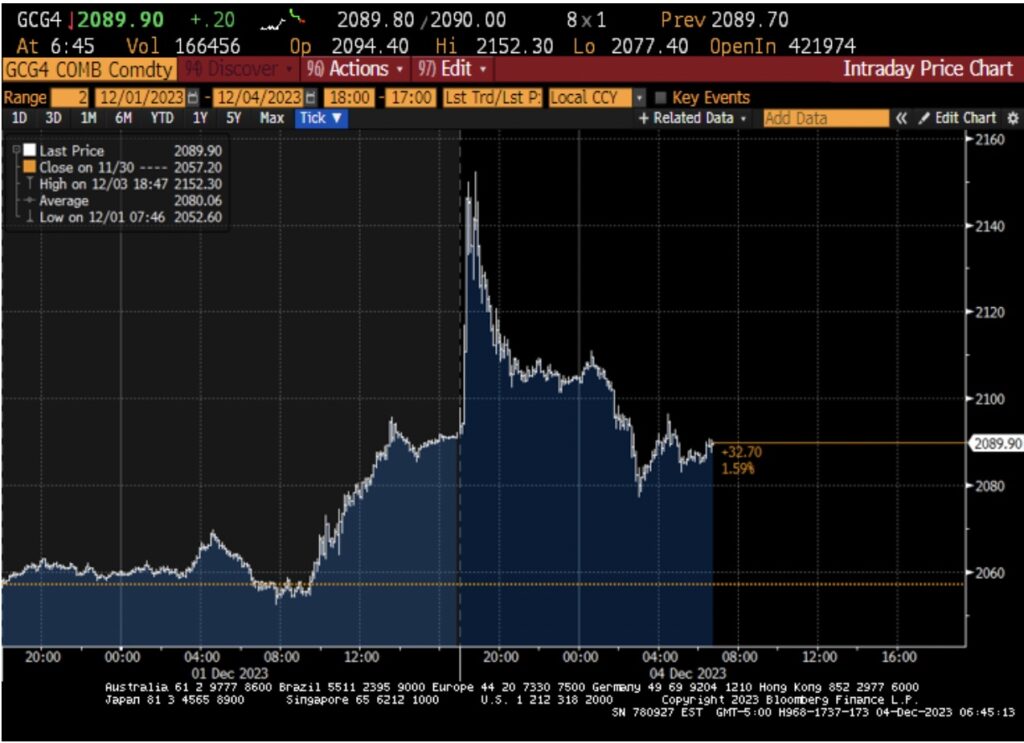

King World News repeatedly reported in recent weeks that the price of gold was headed to a new all-time high. Well, the price of gold soared in overseas trading, hitting $2,152 at one point. The buying was so intense in the gold market and the upside action so violent that it required the Fed’s massive trading room to intervene before the price would back off. The price of gold, however, continues to trade above the previous all-time high. Look at what is happening, but first, a quick note from Michael Oliver.

“We understand AAPL’s value is greater than the entire gold/silver mining sector. Imagine what might happen if AAPL and MSFT actually began to disappoint (see the pages on XLK earlier in this report). And then some asset managers might finally recognize that gold has already been speaking and is now speaking very loudly. Hence it’s time to move a few percent of fund assets into this sector. It could be like many big hands trying to grab a wet bar of soap!” — Michael Oliver, Founder of MSA Research

Gold Market Erupts

December 4 (King World News) – Peter Boockvar: I don’t believe Jay Powell when he woke up Friday morning was expecting or wanting the reaction in the markets we saw to his speech that he gave that day. This is a committee where many members just a month ago talked about the markets further tightening for them when we saw the 10 yr yield go from about 3.75% in July, when they last hiked rates, to a short term peak of 5%. While that 10 yr yield is still 50 bps higher, the 2 yr yield is about 40 bps lower. We are seeing writ large again how the Greenspan incorporation of ‘financial conditions’ into monetary policy can influence and cloud that policy. Who pushes who around? The markets or the Fed? Sometimes it’s the latter but now it seems to be the former.

And what a round trip in financial conditions as measured here by the Goldman Sachs index. The lower it goes, the easier they get and vice versa. As for this writing, when I look at the fed funds futures, by May the market has priced in a 100% chance of a 25 bps cut and a 38% chance of a 2nd one by then. In March, the rate cut odds are at 68%.

Keep in mind here with the ‘odds’ calculation, there are a few different techniques and not just one when figuring it out so would explain why sometimes you hear different answers. I specifically use the fed funds futures market and I use the ‘effective fed funds rate’ which is currently 5.33% when doing the math.

And that move in gold last night was wild, spiking to a record high and then backing off to little changed.

Gold Soars Higher In Overseas Trading Hitting $2,152 Before Backing Off

Now gold is not coming out of nowhere here. Over the last two years it has traded amazingly resilient in the face of the dramatic rise in real rates, about 400 bps in 5 yr TIPS, and the rise in the US dollar. So once we got relief on both, gold was just a coiled spring. And much of that resiliency has been the buying on the part of central banks…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

BIG CENTRAL BANK BUYING: We Remain Bullish

According to the World Gold Council, in Q3 central banks bought 337 tons, almost double the pace of Q2 and that is the 3rd highest quarter on record. The record was in Q4 2022 and almost exceeded in Q1 2023. The acceleration in buying was certainly in part triggered by the US and EU confiscation of about half of Russia’s central bank reserves. Who after all wouldn’t then want more gold in their reserves that they can store themselves? We remain bullish and long gold and silver, I’ll say again for the umpteenth time.

$3,200 Gold?

Just for reference, if you inflation adjust gold for the 1980 peak then of $850, today it would be around $3,200. If you price gold off the dramatic expansion in central bank balance sheets over the past 15 years relative to historical relationships, you get a price much higher.

Bitcoin is of course also seeing another move here higher but central banks are certainly not storing it as a reserve and I still don’t know what Bitcoin wants to be when it grows up.

There was a big rebound of $21.7b of C&I loans outstanding for the week ended 11/22 but because it was Thanksgiving week, and much earlier than usual, it’s likely that this influenced the figure so we’ll wait until next week to see to what extent.

The November auto sales figure seen late Friday totaled 15.32mm at a seasonally adjusted annualized rate (SAAR). That was below the estimate of 15.5mm but up from 14.14mm in November 2022 and that’s because of more inventory on lots that has created more customer options. However, because of the record average price on top of high borrowing costs, it still remains well below the November 2019 pace of 17.09mm.

The Swiss National Bank is likely going to also sit on its hands at their next meeting as the Swiss reported November CPI that was also below expectations at 1.6% vs the estimate of 1.9% and vs 2% in October. The moderation was driven by energy, food and travel related products like hotels. The core rate was higher by 1.4%.

ALSO JUST RELEASED: GOLD HITS ALL-TIME HIGH: Hope Dies, Gold Rises! CLICK HERE

ALSO JUST RELEASED: Price Of Spot Gold Hits All-Time High As Silver Surges Along With Miners CLICK HERE

To listen to Alasdair Macleod discuss the price of gold hitting all-time highs along with silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.