On the heels of gold surging to all-time highs hitting $2,138 at one point, it appears that hope everything is okay with the global economy and banking system is beginning to die. But the rise to the upside for the gold market is just beginning.

Hope Dies, Gold Rises

December 3 (King World News) – Matthew Piepenburg, partner at Matterhorn Asset Management: The primary stages of grief include: Denial, anger, bargaining, depression and finally, acceptance.

When it comes to grieving over the slow demise of the American economy, sovereign IOU/USD and the absolute failure of our “re-election-only-focused” policy makers, these stages of grief are easy to see yet easier to ignore.

But false hope won’t help us.

Denying a Recession

With the vast majority of sectors that make up the U.S. economy evidencing three months of negative GDP growth while a laundry list of leading homebuilder indicators (housing starts and prospective buyers) drops into recessionary red, I keep wondering when the recession debate will finally end.

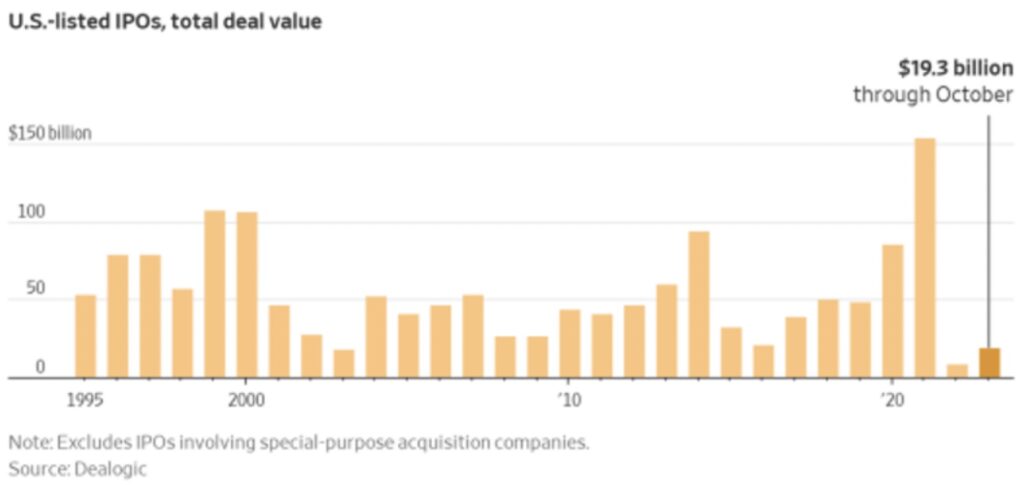

Walmart is worrying, Jamie Dimon is worrying, commercial real estate delinquencies are rising and IPO markets are all but dead on arrival.

But that’s just the latest hard data.

One can cite everything from the Conference Board of Leading Indicators, negative M2 growth, yield curve movements and a drying repo market to make it empirically clear that the US is not heading for recession but has already been in one for nearly a year.

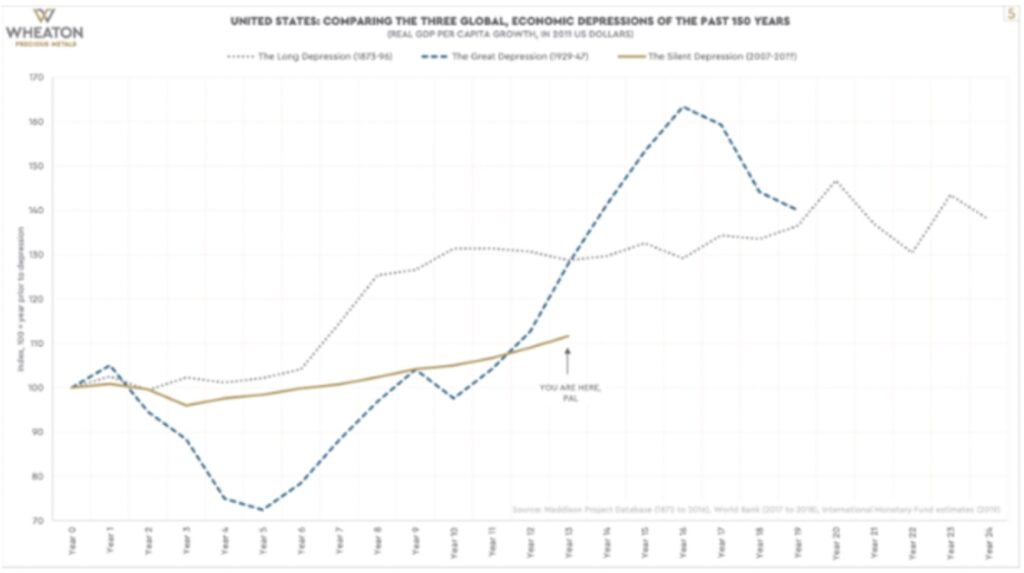

In fact, if we were to define a Depression by growth rates of inflation-adjusted GDP per capita, then factually speaking, we have also been in a quantifiable depression for the last 16 years.

Such data, of course, is depressing, but are we all still hoping for kinder facts or a political and monetary Santa Claus to cure our denial?

I for one favor preparation over denial.

Then Comes the Anger

Citizens storming the Capital, or grabbing guitars and singing “I’m taxed to no end and my dollar aint $#!T” are just the first signs of the anger stage.

Even if the average (and indeed heroic) member of a grotesquely ravaged middle class can’t fully articulate every nasty detail of Wall Street lingo behind a Rigged to Fail market economy, they are catching on to a system which has turned capitalism into feudalism–making them veritable serfs while C-Suite hucksters, from Sam Bankman Fried to Adam Neumann fashion themselves as lords of the manor.

(Now Barron Larry Summers has joined the Marquis de Sam Altman at OpenAI, the perfect combo of perfect [insider] little devils.)

The backbone of America may not fully know the statistics which confirm that 90% of the wealth created by a Fed-driven market bubble circa 2009 was enjoyed by only the top 10%, but they certainly can “feel” it.

Meanwhile, the politicos and central bankers will keep inventing platitudes to mask honest math as market pundits debate soft and hard landings while US voters prepare for an election between a dark-state sleep-walker and an arrested-state swamp-cleaner as soldiers and money are ear-marked toward no-win wars…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Next, the Bargaining and the Depression

Despite obvious evidence of an angry, post-lockdown/mandate society and economy in open decline, some folks still want to believe (bargain) in the iconic America and intuitively turn toward the public “experts” for a miracle solution.

But as I’ve warned with facts rather than invective: Please don’t trust the experts.

The squawking and headlines from our mental midgets in DC are clever diversions from current truths, but as my colleague, Egon von Greyerz, recently made factually clear, truth is as fatal to policy makers as garlic is to vampires.

This, again, IS depressing. And according to the current Zeitgeist (and clinical depression/anxiety data from big pharma), depressed is exactly where America sits today.

Finally: Stone Cold Acceptance

Now that we pass from denial, anger, bargaining and depression, it’s time to accept the recession which our leaders refuse to acknowledge.

Acceptance, at the very least, allows us to think and then act even in the worst of settings.

So then: What can we ACCEPT, EXPECT, and hence DO while our policy makers fight for votes like donkeys scurrying for hay?

Deflation, Inflation and a Neutered Dollar Ahead

The short answer is this: Brace yourselves for a deflation to inflation roller coaster followed by bond volatility and a currency-killing wave of fake money.

Why?

Because math and history still matter.

Whether admitted or hidden, recessions tend to clip the wings of tax receipts. But what does that have to do with markets, currencies and, well… each of us?

In fact, a heck of a lot.

Falling Tax Receipts + Rising Deficits = “Super QE”

In a recession, we can reasonably assume a potential tax receipt decline of 10% in 2024. This will come at the same time that Entitlement spending is rising by 10%.

That’s a double-whammy.

And if one were to then include (as Luke Gromen has done) an average 4% interest rate for 2024, then all of these recessionary percentage numbers add up to a stark piece of easy math but hard days ahead.

That is, we are looking down the barrel of a probable (rather than sensational) True Interest Expense on Uncle Sam’s public debt equal to 120% of US tax receipts.

Think about that.

This percentage is higher than what we saw during the COVID crash of 2020, which was followed by unthinkable trillions of fake money from our equally fake, but all too human, Federal Reserve.

Having thus done the math, Gromen foresees “Super QE” ahead, and I agree.

Relative Strength Is Still No Strength: Brace for Inflationary End-Game

For me at least, this means all the debating about the USD’s relative strength, is still missing the point of its ever-debasing (and hence declining) inherent strength in the face of an impending deluge of “easy money” to keep Uncle Sam on his clay feet.

In other words, get ready for lots and lots of inflationary and currency-debasing fake money in the months ahead once a deflationary recession and potential market massacre are followed by an inflationary fire hose of “accommodative” liquidity (and rate cuts).

No Good Options Left

If not, Uncle Sam’s only other option is to remain higher-for longer, whereby the USD spikes on the tailwind of higher rates as the rest of the world, beaten down by an expensive USD, falls flat on its face ala Japan.

But even in such a scenario, the end-game, which has been true for every debt-cornered nation, empire, kingdom or democracy in history (from ancient Rome to today) will be the same: Save a broken system by killing its currency.

This recession-based prognosis on the longer-term direction of the Fed, rates and the USD is no surprise to the bond jocks either.

Accepting Bond Market Reality

Having argued that history and math matter, let me repeat that bonds matter even more.

What are they telling us?

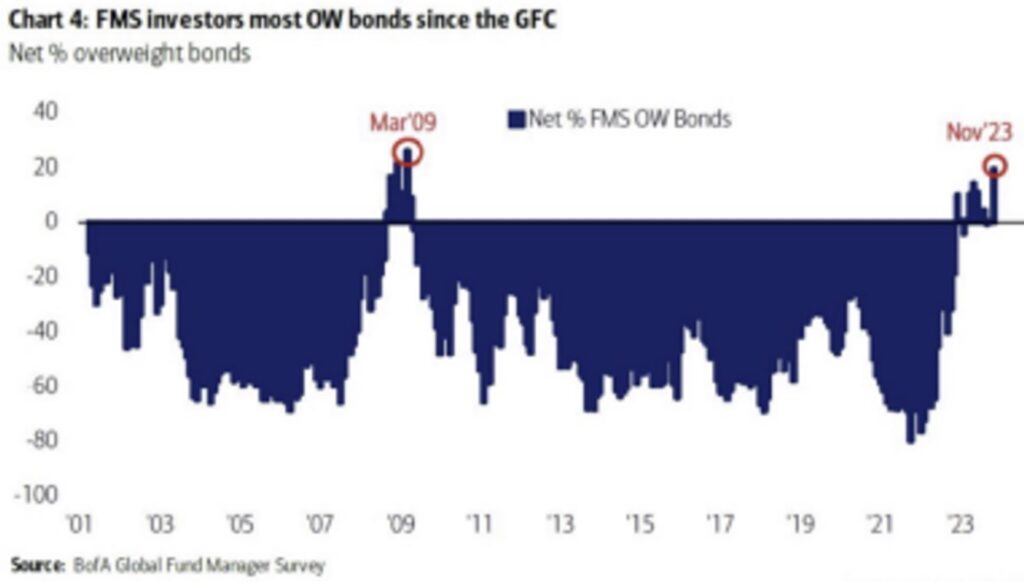

In recent weeks, investors have been dumping dollars and leaping into longer-duration bonds in anticipation of a recessionary “safe-haven.” This explains recent falls in UST yields.

In fact, investors are overweight bonds at levels not seen since 2009.

For retail investors, this flow toward bonds is based on the belief that inflation and yields will drop in 2024 thanks to Powell’s brilliant war on inflation having been won.

Eh-Hmmm.

But portfolio managers are jumping into bonds because they see a recession ahead and are positioning themselves to be early buyers of a rising (i.e., Fed-rescued) bond price.

Smart Money & Dumb Money: Both Wrong

What’s ironic, however, is that both the so-called “smart” and the “dumb” money may be wrong for totally different reasons, as they are each missing the longer-term forces at play—namely an over-supply flood of more USTs ahead.

This means falling bonds and rising yields—longer term.

Why do I take this view? Well, because recessions are not only easy to see, but easy to pattern.

Missing the Importance of UST Over-Supply

Recessions, for example, typically mean growing deficits, and growing deficits mean more USTs spitting out of Uncle Sam’s IOU box.

This looming rise in UST supply eventually means more downward rather than upward pressure on UST pricing longer term.

Thus, even if the USD spikes near term into 2024, foreigners pegged to that expensive Dollar will dump even more of their $7.6T worth of USTs to “milk-shake-suck” more needed USDs, adding even further downward pressure on UST pricing.

By natural math, and simple history, this decline in UST pricing due to massive UST over-supply will spur even higher yields, which in turn means higher rates, which in turn means Uncle Sam won’t be able to afford/pay his higher-rate IOUs without a lot of help from the inflationary money printers at the Eccles Building.

Short of a default or Bretton Woods 2.0, such mouse-clicked money is all Uncle Sam will have left to pay for his own and ever-increasing debt.

This is How Currencies Die

Again, this end-game is nothing new. In fact, it’s always the same choice: Save the bonds or kill the currency.

And you know where my bet (and history’s lesson) lies.

In the interim, be ready for a bumpy ride and more debating pundits splitting hairs on the Dollar, the UST, interest rates, M2 data, CPI correlations and FOMC tea leaves.

Toward this end, yes, the USD can rise, as can UST demand and price. And yes, deflation can, and will come as well—prior to much higher inflation.

This is because the longer play is as easy to see as the destiny of any debt-soaked nation: More and more IOUs paid for with a weaker and weaker currency.

Or stated more contemporaneously, get ready for rising and then falling USTs and falling and then rising yields “saved” by more fake Dollars to “accommodate” an already and inevitably over-supplied UST from an objectively broke America.

Milk-Shake Straws & Sponges Won’t Save the Dollar

To those who follow the milk-shake theory, there is the defensible view that enough national and global demand for USDs will act as a powerful sponge to soak up all the printed Dollars to come, keeping the DXY value of the USD forever (and relatively) safe, strong and victorious.

Hmmm…

But I lean on the view that even a super sponge (or global “straw”) of such magnitude will be unable to absorb the fire hose of milk-shake liquidity about to come pouring through it in the years ahead to “keep America on a respirator again.”

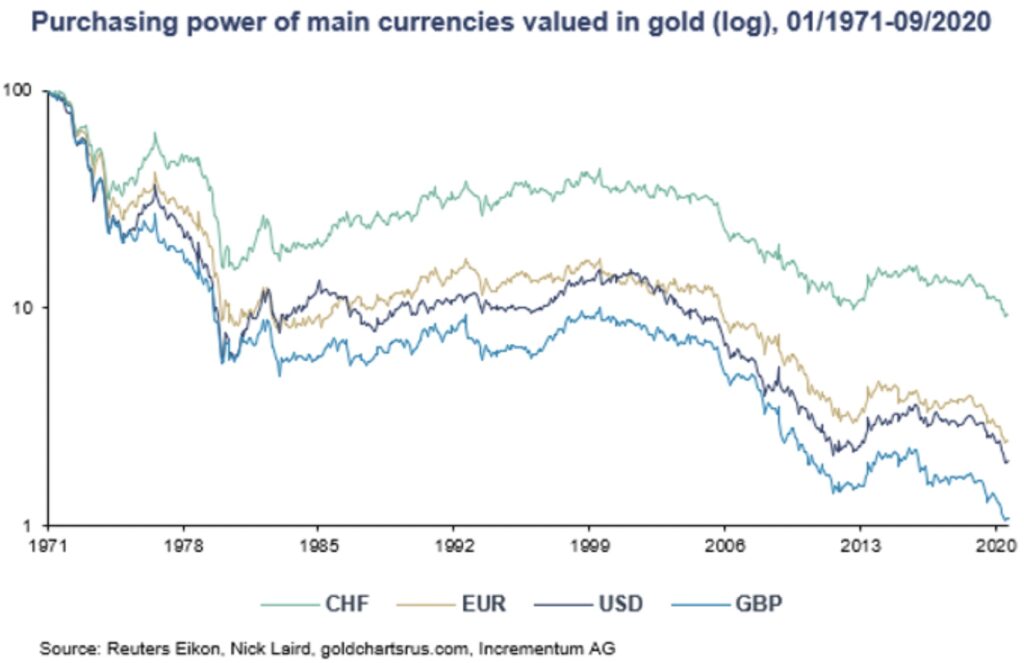

More importantly, and as alluded above, even if the USD’s relative strength survives on the power of that magical sponge (or straw) of eternal Dollar demand, when measured in real terms—i.e., in terms of constant purchasing power –that Dollar’s inherent purchasing power will get weaker and weaker as inevitable synthetic/fake liquidity rises higher and higher.

And this is why anyone who measures their wealth in this paper currency is …well: Screwed.

Your Dollar simply buys less and less, and though it may be relatively stronger than other fiat currencies, is it really any consolation to be betting on the best patient in the ICU, when all the patients are in fact fatally ill?

What very few pundits and even fewer investors wish to fully accept is that once debt levels for a nation go from absurd to flat-out inconceivable (i.e., a debt/GDP ratio of 120%+), the only real option ahead is to inflate away that debt with debased money.

This means Powell’s “war on inflation” is a public ruse.

As I’ve argued, he NEEDS inflation, but has the added luxury of being able to openly lie about the current CPI scale, which grossly under-reports actual inflation.

Too Late for Austerity

As for the more sober approach of simply confessing to America’s debt nightmare and accepting the need for austerity, the FED, which was created by (and lives only for) Wall Street, knows that any such attempt at austerity sends the sovereign bond market into a liquidity crisis.

In the second quarter of 2022 and the 4rd quarter of 2023, brief attempts at governmental “austerity” resulted in immediate dysfunction in the UST market.

In short, it’s too late for austerity. Sovereign bonds can’t stomache the volatility which follows and which we are now seeing in real time.

America’s current debt/GDP ratio is too high for an austerity option as it would cripple credit markets, drive down GDP, further weaken tax receipts and hence make Uncle Sam’s IOUs even harder to pay.

Again, few investors wish to fully accept that America has “no way out.” The nation is too far in debt to “GDP its way” forward, which means it’s left with “inflating/printing its way backward.”

Gold Investors See What Few Are Willing to Accept

Or stated more simply: Your currency is about to lose even more of its already diluted purchasing power.

Gold investors, whether on Main Street, Wall Street or among a BRICS+ nations, of course, are not afraid to see (and ACCEPT) this.

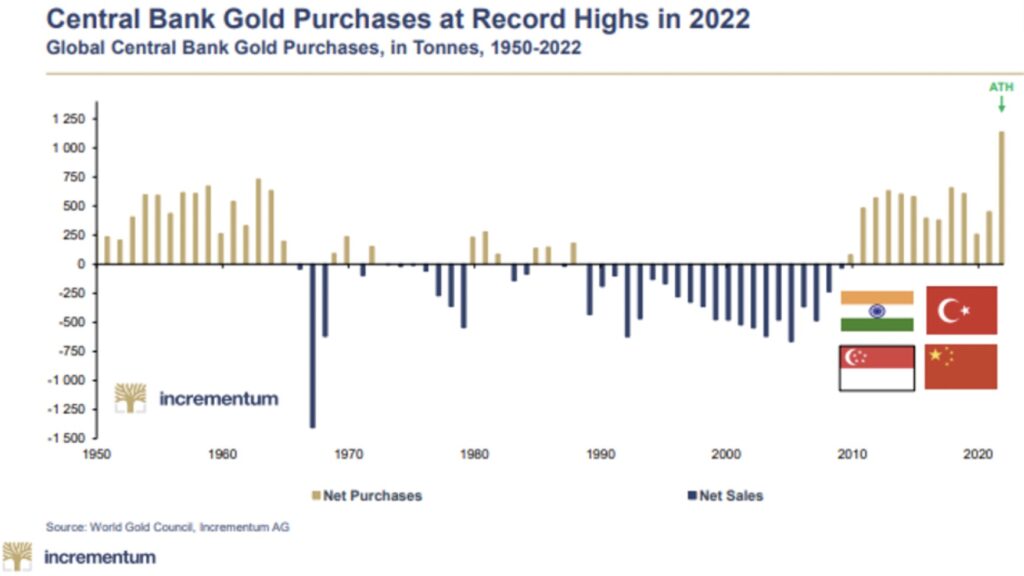

Even Central Banks see this: They are net seller’s of USTs and buying physical gold at record levels.

In short, many have already replaced false hope and paper money with cold facts and real money to preserve their wealth. To read more fantastic articles from Egon von Greyerz and Matthew Piepenburg CLICK HERE.

To listen to Alasdair Macleod discuss the price of gold hitting all-time highs along with silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.