What is unfolding right now generally marks a major turning point for gold and silver.

Gold

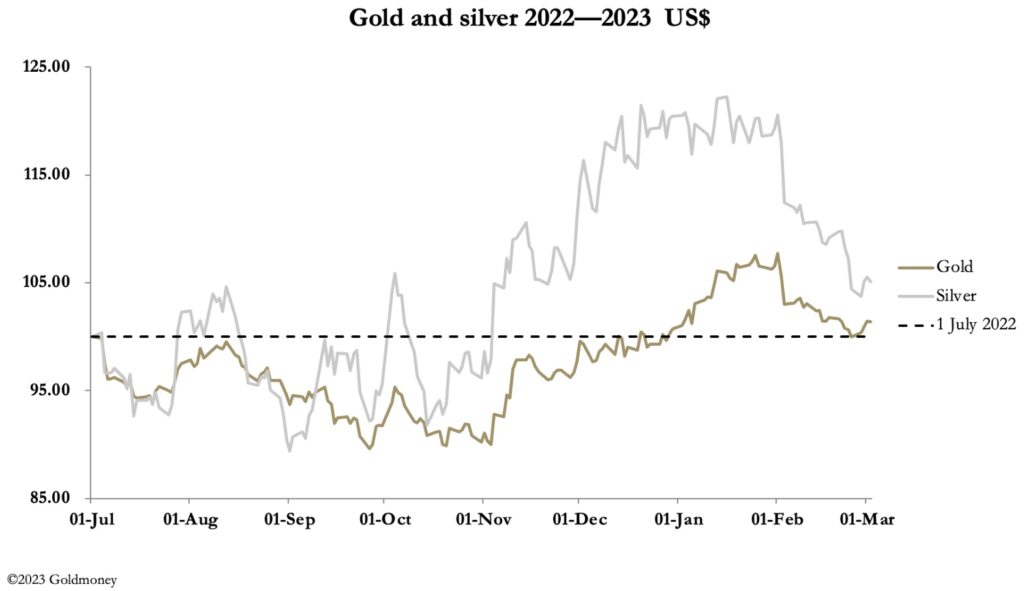

March 10 (King World News) – Alasdair Macleod, head of research at Goldmoney: Gold and silver traded lower this week, with gold down a net $21 at $1834 in European trade this morning, having dipped as low as $1810 on Wednesday. Silver was hit even harder, down $1.18 at $20.06, having traded as low as $19.90.

This week, Jay Powell gave his two-day testimony to the Senate and Congress, which sparked fears of yet further tightening. But yesterday, US Treasury yields along the curve eased, indicating that the hawks were closing their bear positions. That derivative markets are heavily short of US Treasuries (betting that yields will rise) has attracted some comment. And when everyone has sold, and there is no one left to sell, then the only way is up.

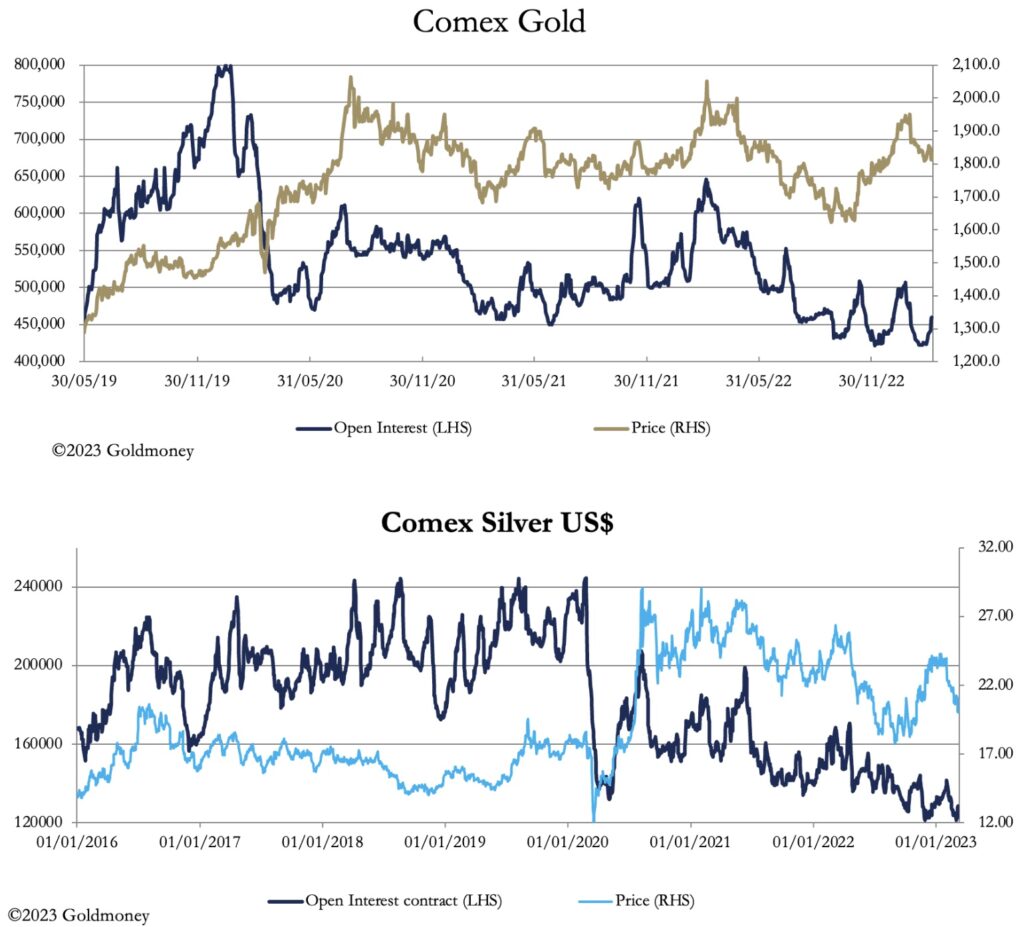

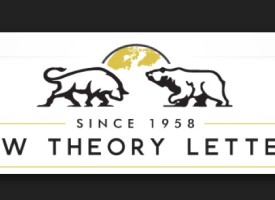

The same applies to precious metals. The traders who are short of US Treasury futures, will also be short of gold and silver on Comex. And an examination of changes in Open Interest relative to price moves confirms this analysis. This is the subject of our next two charts.

This Generally Marks A Major Turning Point For Gold & Silver

Both gold and silver’s Open Interest increased on recent price declines. This indicates that the Managed Money category, which is normally net long is now net short. As a counterpart of that position bullion banks will have closed their short positions on a net basis and will be marginally long. It is a condition which usually marks major turning points for gold and silver.

We should not just rely on well-founded guesswork, but it also behoves us to look at the physical situation. With respect to Comex, a further 1.8 tonnes of gold has been stood for delivery so far this week, making a total of 77.75 tonnes so far this year. And in silver, a further 40.29 tonnes have been stood for delivery this week, totalling 1,433.24 tonnes for the year…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

According to the World Gold Council, central banks in Asia are continuing to add to their gold reserves, with Turkey (22.5 tonnes in February) Singapore (44.6 tonnes in January), China (24.9 tonnes in February) and Uzbekistan (8.1 tonnes in February). The interesting one is Singapore. We can be sure that her senior officials have their fingers on China’s pulse and would not have increased their gold reserves by nearly 30% without good reason.

The WGC also reports that ETF holdings worldwide fell by 34.47 tonnes in February, which fits in with investor sentiment declining — something we expect to see in oversold conditions.

In geopolitics, America appears to be racking up tensions against both Russia and China, while applying pressure on nations elsewhere to disassociate themselves from the Asian axis. In the coming weeks, there is likely to be a growing feeling of irreversible tensions, increasing the possibility of a new hot war. And on the global financial scene, it should be noted that Credit Suisse, which is one of the global systemically important banks, has seen its shares hit new lows. The rescue package masterminded by the Swiss National Bank does not appear to be going too well.

ALSO JUST RELEASED: Michael Oliver – One Of The Most Important Gold Updates MSA Has Ever Issued CLICK HERE.

ALSO JUST RELEASED: The Crumbling World Financial System Desperately Needs A Gold Anchor CLICK HERE.

ALSO JUST RELEASED: Celente – Major Businesses Are Now Fleeing U.S. Cities CLICK HERE.

ALSO JUST RELEASED: What’s Next After First Gold Price Dip Since Central Bank Gold Buying Spree Began CLICK HERE.

ALSO RELEASED: Systemic Breakdown Is Accelerating And It Is Deliberate CLICK HERE.

ALSO RELEASED: Here’s Why The Dow Plunged 500 Today And Gold Is Down $35 CLICK HERE.

ALSO RELEASED: LOOK AT THIS: Now That Is One Hell Of A Collapse CLICK HERE.

ALSO RELEASED: Silver About To Radically Outperform Gold, Plus The Bear Market Is Over? Not Likely CLICK HERE.

ALSO RELEASED: CALIFORNIA DREAM OR A NIGHTMARE: This Is How Bad It Has Gotten In The United States CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.