The greatest threat the world is facing today may surprise you.

November 1 (King World News) – Greggory Mannarino, writing for the Trends Journal: Today market history is being made, but you would hardly know it when it comes to the stock market.

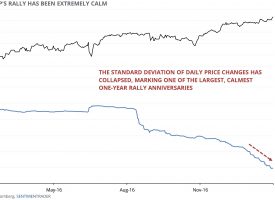

The world right now is experiencing A RAGING BEAR MARKET IN BONDS. In fact, this is THE longest, most vicious bear market in bonds EVER IN HISTORY! Meanwhile, the stock market has held up quite well. How is that?

Right off, the stock market is completely detached from any kind of reality…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Things which should be important, like a company’s PE ratios, forward guidance, cash flow, etc.,no longer matter. The market has gotten so used to easy money and easy credit, that overall, the stock market is somewhere off way beyond LaLa land.

The recent selloff in the debt market has pushed risk in this market to EXTREME levels, and even with that, the stock market has held up reasonably well.

Recent geopolitical events, more specifically rapidly expanding war, and its associated funding/support etc., to the tune of HUNDREDS OF BILLIONS of dollars, soon to be much more, has certainly given a major boost to U.S. GDP. It has also set the stage for much higher inflation.

Expanding war has also, for now, stabilized the selloff in the bond market.

It is certainly no secret that war, along with the expansion and propagation of war, is stock market positive. War fuels the Military Industrial Complex, which is often described as the relationship between a country’s military and the defense industry that supplies it.

But where does all this cash come from?

No other endeavor on Earth generates a greater need for borrowed dollars than war. No developed nation on the planet has a “war chest.”

So again… where does the cash come from to fight wars? ITS CENTRAL BANKS! It is these same central banks, like the Federal Reserve, who are more than willing to lend ANY AMOUNT, and to FUND BOTH SIDES to propagate war.

The more cash any central bank can issue, or is called on to issue, THE STRONGER THEY BECOME. War accelerates the process by which a central bank can gain power.

War is the GOAL OF CENTRAL BANKS. War also gives political leaders a scapegoat. “It’s the War” which is responsible for the failing economy. “It’s the War” which is responsible for inflation… “It’s the War!”

The root cause of why the current global situation is where it is now, WHICH INCLUDES EXPANDING WAR, comes down to a single thing… liquidity is rapidly drying up.

Although the world today is awash in debt, which continues to skyrocket higher every second of every day, it’s not enough.

The current debt-based system, which is run by central banks, who also run the world economy, world markets, and the financial system, demands ever increasing debt IN MULTIPLES.

The current central bank debt-based system operates in a perpetual, ever increasing debt black hole—which can never ever be made whole. Nor is it ever meant to be made whole.

War allows central banks to keep the system liquid. But it will not stop its inevitable end. In fact, war will only serve to exacerbate the current liquidity problem… and then they can “Blame the War” for the collapse of the entire monetary system.

And of course, they will have a solution… one which will serve their interests again, not ours.

ALSO JUST RELEASED: Demand For Gold Is Enormous As Financial Chaos Picks Up Steam CLICK HERE

ALSO JUST RELEASED: Here Is A Stunning Look At The Gold Market CLICK HERE

ALSO JUST RELEASED: Greyerz – Few People Understand That The Next Cycle Of Evil Is About To Hit Them CLICK HERE

ALSO JUST RELEASED: Gold Approaching Historic Upside Breakout CLICK HERE

ALSO JUST RELEASED: Michael Oliver: Gold & Silver Dynamic Trend Change – About To Go Vertical CLICK HERE

JUST RELEASED! A World In Chaos & Skyrocketing Gold

To listen to Alasdair Macleod’s greatest audio interview ever discussing skyrocketing gold and a world in chaos CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.