Demand for gold is enormous as financial chaos across the globe picks up steam.

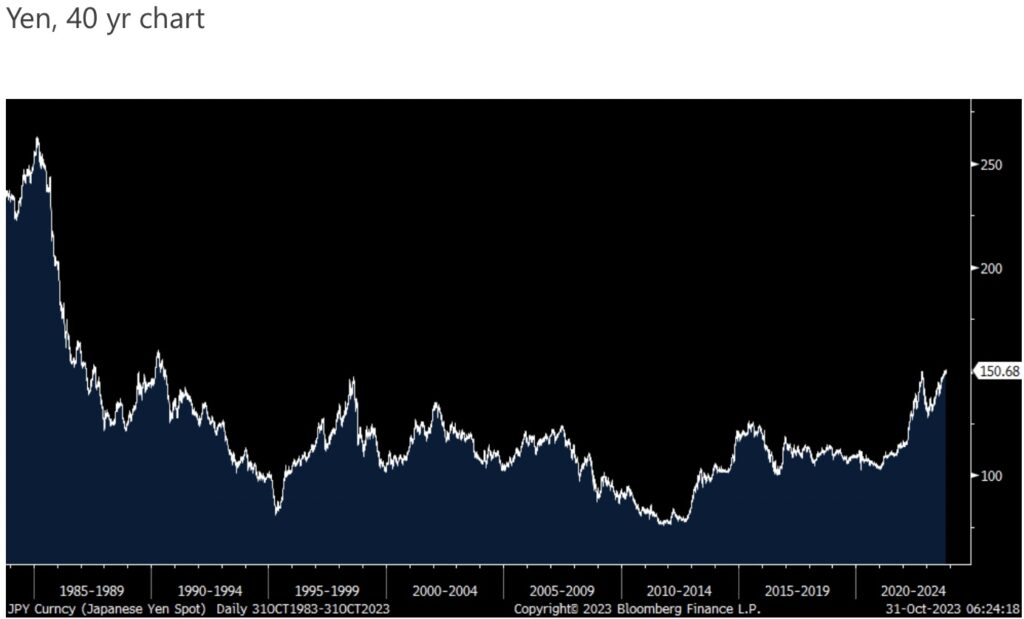

Japan’s Currency In Serious Trouble

October 31 (King World News) – Peter Boockvar: Well, the tweak that was leaked is what we got from the BoJ but certainly nothing more as NIRP lives on and just won’t die. They continue to redefine the word ‘patience’ when it comes to dealing with inflation. In their statement it said “Given extremely high uncertainties over the economy and markets, it’s appropriate to increase flexibility in the conduct of yield curve control.”

Governor Ueda in his press conference said “Uncertainty is extremely high within both overseas and domestic economies and financial markets. We decided that it’s appropriate to increase flexibility so that long term yields can be smoothly shaped, according to different future scenarios.” In other words, if the 10 yr JGB yield gets to 1%, which it is quickly approaching, maybe or maybe not will they buy JGB’s and now will tolerate a yield above 1% without being more specific.

Also, while they raised their inflation forecasts, there was no guidance on when NIRP will be eliminated which is all of 10 bps and the yen is selling off back above 150 and itself further clouds the situation as we know the government doesn’t want further weakness in the yen because it further stokes inflation, particularly with the big need to import energy products. Bottom line, the BoJ still remains afraid of its own shadow and the enormous financing needs of the Japanese government is likely a key reason and who needs low financing costs.

The 10 yr JGB yield was higher by 5.5 bps to .95% which is the highest since 2012.

European and US bonds though are rallying because Eurozone October CPI came in below expectations at the headline level, up 2.9%, 2 tenths less than forecasted and down from 4.3% in September because of an 11% drop in energy prices. The core rate though was as expected, up 4.2% y/o/y vs 4.5% last month as service inflation was higher by 4.6% y/o/y and non energy industrial goods prices grew by 3.5% y/o/y. Maybe because the core rate was as expected, the 5 yr 5 yr euro inflation swap is unchanged at 2.50%.

Q3 GDP in the Eurozone was in line when we include the Q2 revision. Growth was non existent as if was up just .1% y/o/y. In response to both inflation and growth data, yields in the region are down about 4 bps across the board. The euro though is higher vs the US dollar…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

“We Do Not Expect An Easy Start To 2024”

Anecdotally, the CEO of BASF, the large German chemical company said “Looking ahead, we do not expect an easy start to 2024.”

The US Treasury market is also digesting the quarterly funding needs of the US government and we saw that thanks to the extra tax receipts from the citizens of California that Uncle Sam needs a bit less than the Street expected. I will say this on the supply situation, the numbers are so mind boggling the gigantic size of the US debts and deficits but trying to analyze this and draw conclusions on what it means for Treasury yields is not easy as 40 yrs ago people were complaining about the rising debts and deficits and how that would crowd out the private sector and lead to higher rates. That said, this time really feels like it will matter as it comes with a variety of other influences, including less buyers at the table and the global central bank removal of monetary easing, right now mostly QT with short term rate hikes mostly done.

Demand For Gold Is Enormous

Meanwhile, the demand for gold is enormous, coming big time still from central banks. The World Gold Council today released its Q3 report and said “The World Gold Council’s Q3 Gold Demand Trends report reveals that support for the asset continues as central bank buying maintains a historic pace, bringing quarterly gold demand to 1,147 tons, 8% ahead of its 5 yr average.”

No wonder that in the face of a 450 bps rise in 5 yr REAL rates off its lows over the past 2 years, along with a sticky US dollar, gold is up in the face of that. We remain bullish and long.

Bottom line, this data is more reason for the Fed to kick back and relax for now, though QT will continue to tighten financial conditions…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Manufacturing Contracting For 14th Straight Month

The October Chicago manufacturing PMI remained in contraction for the 14th straight month at 44. This joins the NY, Philly, Dallas and KC regional surveys all showing declines. The Richmond survey was the only positive at +3 and my guess is the defense industry was the main reason why as it is a key sector in this region.

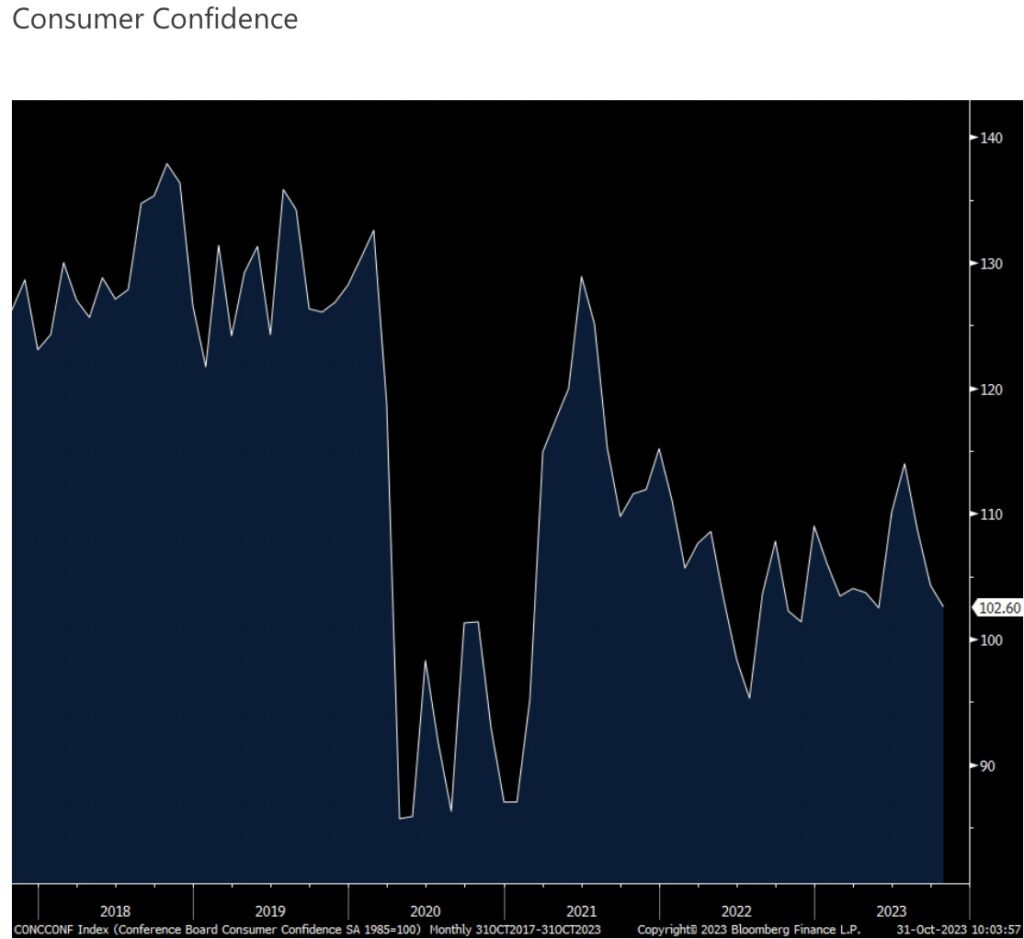

The October Conference Board Consumer Confidence index fell to 102.6 from 104.3, the lowest since May but that was above the estimate of 100.5.

The answers to the labor market questions were mixed as Plentiful jobs fell a touch but also dropped for those Hard to Get. Expectations for ‘more jobs’ was down slightly but to a 4 month low. Disappointingly, those expecting an increase in income fell to the lowest since February.

Consumer Is Weak

Spending intentions weakened. There was a 6 month low for those wanting to buy a vehicle. Plans to buy a home fell to the lowest since September 2022, not surprisingly. There was also a drop in intentions to buy a major appliance. Plans to take a vacation typically jumps in October ahead of the holidays and it did again.

The bottom line from The Conference Board was this, “Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for grocery and gasoline prices in particular. Consumers also expressed concerns about the political situation and higher interest rates. Worries about war/conflicts also rose, amid the recent turmoil in the Middle East. The decline in consumer confidence was evident across householders aged 35 and up, and not limited to any one income group.”

On recession expectations, “More than 2/3rds of consumers still said recession is ‘somewhat’ or ‘very likely’ in October.” Also of note, those making more than $125,000 saw their confidence slip to the weakest since July 2022.

My bottom line: while the consumer held the economy on its shoulders in Q2, almost single handedly, from what I hear from so many that cater to the consumer, I just don’t see it being sustainable.

ALSO JUST RELEASED: Here Is A Stunning Look At The Gold Market CLICK HERE

ALSO JUST RELEASED: Gold Approaching Historic Upside Breakout CLICK HERE

ALSO JUST RELEASED: Michael Oliver: Gold & Silver Dynamic Trend Change – About To Go Vertical CLICK HERE

JUST RELEASED! A World In Chaos & Skyrocketing Gold

To listen to Alasdair Macleod’s greatest audio interview ever discussing skyrocketing gold and a world in chaos CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.