The “Everything Bubble” Has finally popped and it will get much worse from here. One thing is certain, the trading will get more violent from here.

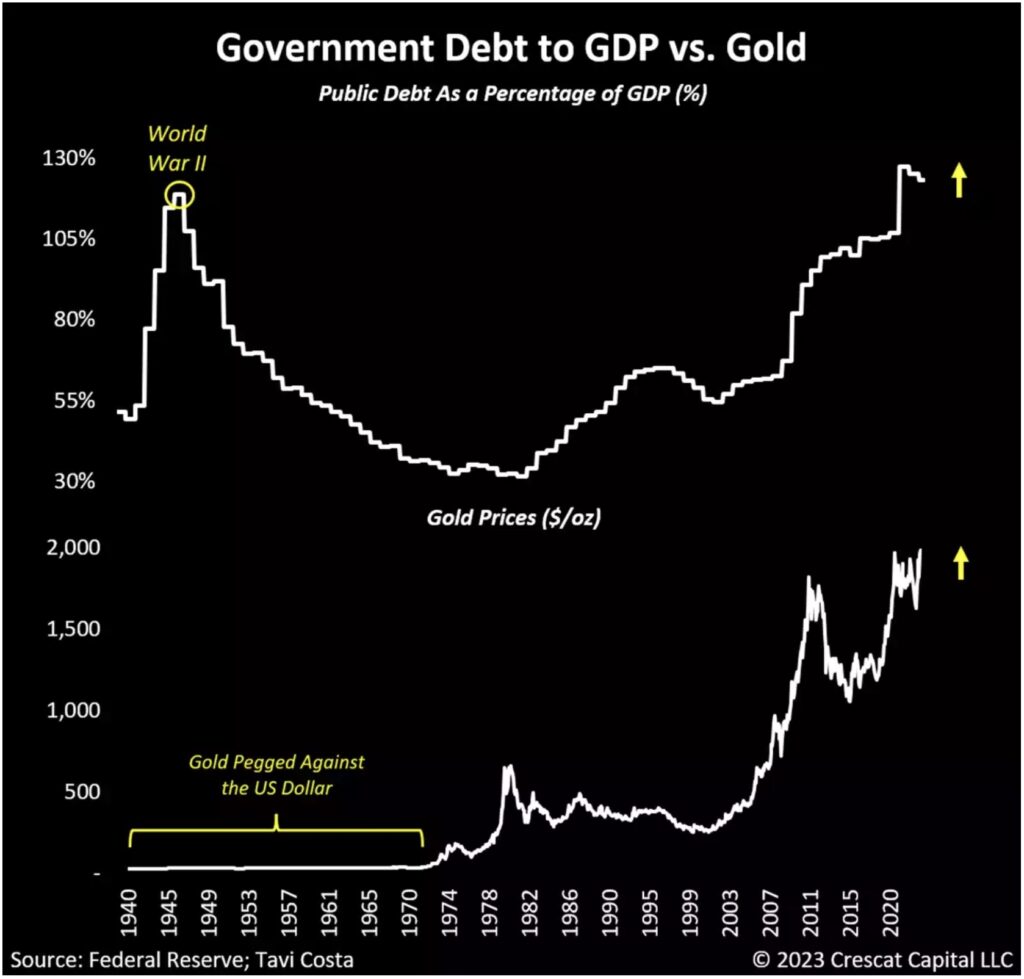

A Growing Debt Problem, But This Time Gold Prices Are Unpegged

June 1 (King World News) – Otavio Costa: While the 1940s serve as an important historical parallel due to the seriousness of the current debt issue, there is a significant distinction: during that period, gold was effectively tied to the US dollar, rendering it an impractical investment alternative. Today, with prices unpegged, it is highly probable that capital will divert from US Treasuries and flow into gold.

Triple Tops Almost Never Work

We note that gold is the only macro asset trading near record prices today. While there are inexorable fundamental drivers to push it much higher, from a technical perspective, the metal has recently encountered historical resistance after re-testing previous highs. More importantly, triple-top formations often prove to be temporary with prices eventually breaking out to the upside in a significant way.

Once the metal decisively achieves record prices, it is likely to spark a new gold cycle. These cycles, characterized by long-term trends, have occurred only twice in the past 50 years: during the 1970s and the 2000s. The current market conditions present an exceptionally strong array of fundamental and macro drivers for precious metals, arguably the most robust in history, which include:

- Central banks compelled to purchase gold to enhance the quality of their foreign exchange reserves;

- The likelihood of global gold production entering another secular decline, akin to the bull markets of the 1970s and 2000s which supports the supply side;

- Failing 60/40 portfolios seeking alternative safe-haven assets;

- Inflation expectations exceeding the historical average for this decade, driving the need for tangible assets;

- Commodities being historically undervalued compared to financial assets;

- A significant number of yield-spread inversions in the US Treasury curve, surpassing the 70% threshold, making a compelling case for owning gold and reducing exposure to overvalued stocks;

- Major mining companies inclined to ultra-conservatism, prioritizing returning capital to shareholders over investing in the current and future production of precious metals;

- Insufficient investments in exploration resulting in a lack of new gold and silver discoveries, compounded by the geological challenges of finding new mineral deposits;

- ESG mandates and government pressure deterring the development of new resource projects;

- Institutional investors pressuring traditional gold-focused companies to pivot to green metals;

- Doubt surrounding precious metals due to the surge of speculative interest in digital assets, totally unwarranted due to the credibility and historical significance of gold as the one enduring and truly scarce monetary asset in contrast to a plethora of easy-to-produce digital assets; and

- The US and other developed economies are currently facing a trifecta of macro imbalances:

-

- The debt problem reminiscent of the 1940s

- A speculative environment like the late 1920s and 1990s

- Inflationary concerns akin to the 1970s

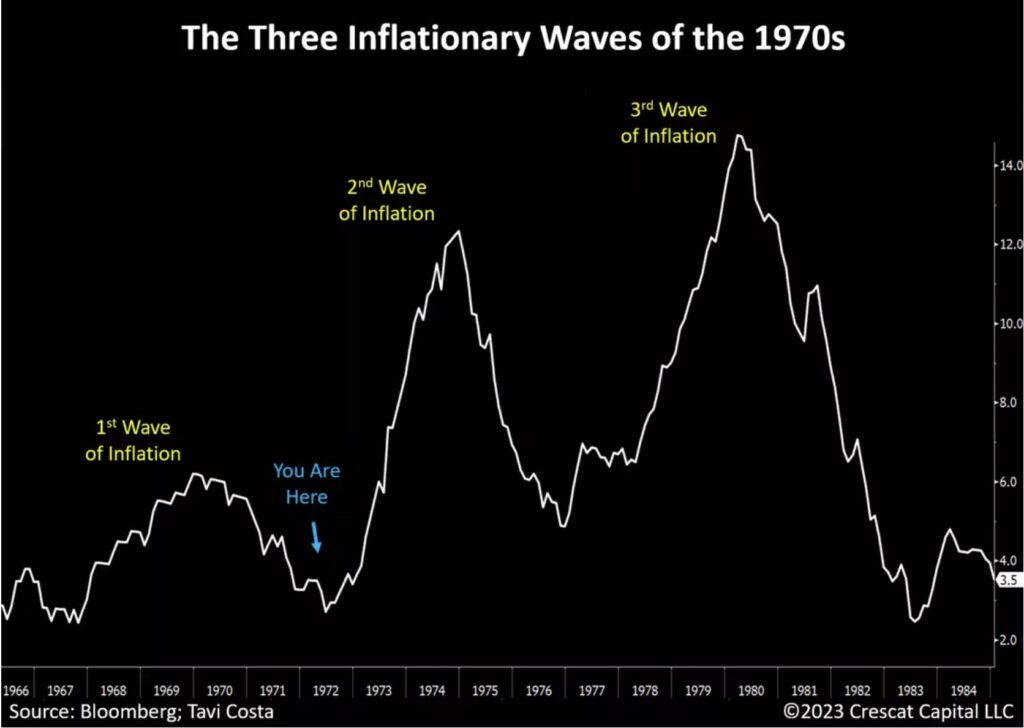

Structural Inflationary Forces Abound

Having benefited greatly from globalization, cheap labor, and abundant natural resources, it appears that we have entered a new economic regime. The pandemic crisis exposed several long-standing macroeconomic forces that are now beginning to permeate the economy. While the growth of consumer prices for goods and services has slowed, it is important to remember that inflationary periods tend to develop in waves.

Given the structural nature of many of today’s drivers, we believe it is only a matter of time before the next wave of inflation ignites.

The percentage of labor costs relative to corporate profits is starting to rise from historically low levels. Although a near-term recession could potentially slow down the pace of wage growth, structurally speaking, considering the persistently high cost of living, it is highly likely that we are witnessing the early stages of a wage-price spiral. This is especially relevant among the bottom 50% of households in developed economies.

Moreover, the availability of cheap labor was largely driven by globalization trends, which have decidedly shifted as geopolitical risks have increased worldwide. Since the souring of US-China relations in 2016, deglobalization trends have escalated in nearly all regions of the world. As a result, countries are prioritizing self-reliance at the expense of higher costs…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Tightening monetary conditions have made it more challenging for commodity businesses to access capital for new resource projects. Although the upward pressure on commodity prices has eased, the underlying issue of constrained resource availability has not been resolved. While policies like the selling of US strategic petroleum reserves may have a short-term downward impact on prices, it has an opposing and potentially more deleterious long-term effect. We believe it is only a matter of time before significant upward pressure on commodity prices resumes.

Furthermore, due to large social programs, investments in the green revolution, infrastructure construction, and defense spending, the US fiscal agenda has become highly extended. In fact, today’s government deficit is the largest in history relative to how low the unemployment rate is. The current situation can be viewed as one of the most conflicting policies in history, as the Federal Reserve is raising interest rates to address inflationary pressures while the government continues to engage in significant levels of expenditure. History has shown us repeatedly that excessive fiscal spending has inflationary consequences.

The recent technological advancements in artificial intelligence (AI) have the potential to be a countervailing and positive deflationary force in the long run, but AI is only in its early disruptive phases. It is an emotional factor driving the current speculation in popular tech stocks, but it not alleviating the structural inflationary pressures from more pressing issues like reckless deficit spending, the transition to a green economy, scarcity of natural resources, and trade deglobalization.

Additionally, the deceleration of inflation from peak levels has been rather slow when compared to other periods in history. To put it into perspective, we just had 10 consecutive monthly declines in CPI year-over-year and the index is still standing at 4.9%. Interestingly, the only other time this happened was during the aftermath of the 1919 Spanish Flu. Back then, CPI had a 12-month streak of declining year-over-year data, marking a bottom at the deeply deflationary rate of -15.8%. The current macro environment suggests that inflation is significantly ingrained in the economy.

The Inflation Will Come In Accelerating Waves, Similar To What Happened In The 1970s

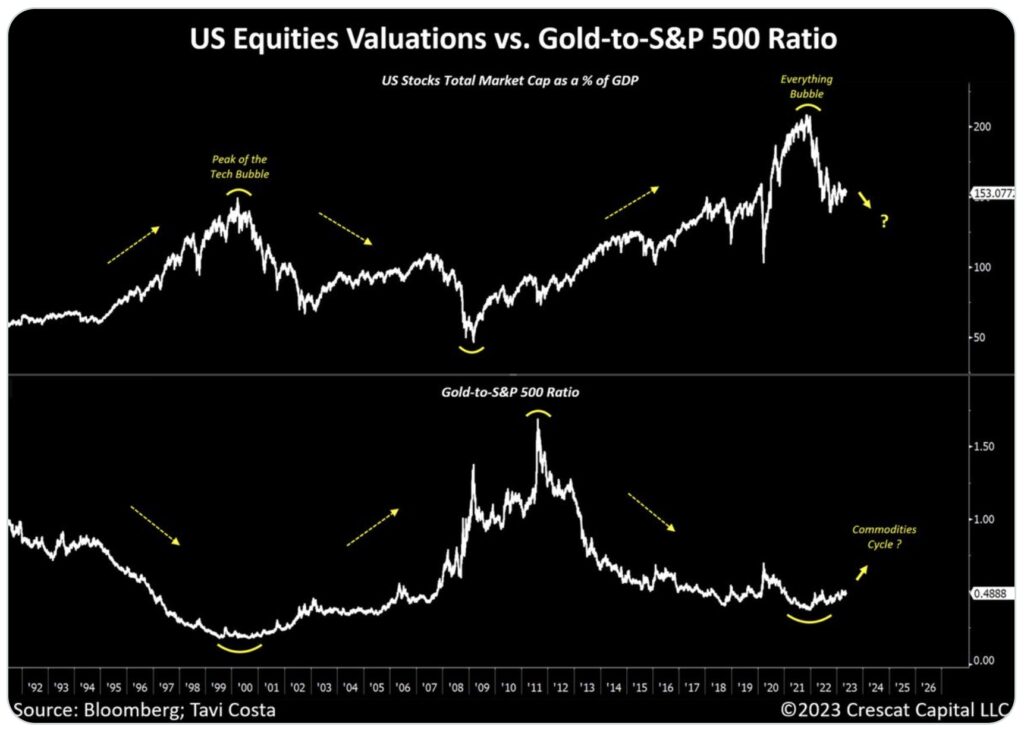

Gold Becomes Attractive When Financial Assets Are Expensive

The valuation cycle of the overall equity market often follows the gold cycle itself, and consequently, commodities are highly interconnected. Using one of the most traditional ways of assessing the state of the market, also Warren Buffet’s favorite indicator, the total market cap of the overall stock market as a percentage of GDP is currently slightly above where it was at the peak of the Technology Bubble in 2000. Historically, such excessive levels in this measurement would suggest that a gold cycle, and a secular bull market in commodities, are both underway.

A major macro shift is now developing. The valuation cycle of the overall equity market often follows the gold cycle itself, and consequently, commodities are highly interconnected. Historically, such excessive levels in the total market cap of overall US stocks as a percentage of GDP would suggest that a gold cycle, and a secular run-up in commodities, are both underway.

The “Everything Bubble” Has Finally Popped And Gold Will Continue To Massively Outperform The Stock Market

ALSO JUST RELEASED: Look At Who Is Buying Gold Right Now And How This Will Impact The Price CLICK HERE.

ALSO JUST RELEASED: PRELUDE TO FULL-BLOWN PANIC: This Type Of Move Into Gold Has Occurred Only Twice In 50 Years CLICK HERE.

ALSO JUST RELEASED: Turk – Debt Ceiling Deal Suspension Similar To Nixon Taking US Off Gold Standard CLICK HERE.

ALSO JUST RELEASED: BUCKLE UP: The “War On Inflation” Is Creating Even More Inflation CLICK HERE.

Nomi Prins just predicted the price of gold will hit $3,500 next year and also said the US is the biggest Ponzi scheme in the world in this powerful audio interview CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.