The war on inflation is creating even more inflation and that is extremely dangerous policy at this moment in history.

May 28 (King World News) – Matthew Piepenburg, partner at Matterhorn Asset Management: It’s true that, “the Devil is in the details.”

Anyone familiar with Wall Street in general, or market math in particular, for example, can wax poetic on acronym jargon, Greek math symbols, sigma moves in bond yields, chart contango or derivative market lingo.

Notwithstanding all those “details,” however, is a more fitting phrase for our times, namely: “Keep it simple, stupid.”

The Simple and the Stupid

The simple facts are clear to almost anyone who wishes to see them.

With US debt, for example, at greater than 120% of its GDP, Uncle Sam has a problem.

That is, he’s broke, and not just debt-ceiling broke, but I mean broke, broke.

It’s just THAT simple.

Consequently, no one wants his IOUs, confirmed by the simple/stupid fact that in 2014, foreign Central Banks stopped buying US Treasuries on net, something not seen in five decades…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

In short, the US, and its sacred bonds, just aren’t what they used to be.

To fill this gap, that creature from Jekyll Island otherwise known as the Federal Reserve, which is neither Federal nor a reserve, has to mouse-click money to pay the deficit spending of short-sighted and opportunistic administrations (left and right) year after year after year.

Uncle Fed, along with its TBTF nephews, have thus become the largest marginal financiers of US deficits for the last 8 years.

In short, the Fed and big banks are literally drinking Uncle Sam’s debt-laced Kool aide.

The Fed’s money printer has thus become central to keeping credit markets alive despite the equal fact (paradox) that its rate hikes are simultaneously gutting bonds, banks and small businesses to fight inflation despite the stubborn fact that such inflation is still here.

The Inflation Narrative: Form Over Substance

My view, of course, is that the Fed’s war on inflation is a headline optic rather than policy fact.

Like all debt-soaked and failing regimes, the Fed secretly wants inflation to outpace rates (i.e., it wants “negative real rates”) in order to inflate away some of that aforementioned and embarrassing debt.

But admitting that is akin to political suicide, and the Fed is political, not “independent.”

Thus, the Fed will seek inflation while simultaneously mis/under-reporting CPI inflation by at least 50%. I’ve described this as “having your cake and eating it too.”

All that said, inflation, which was supposed to be transitory, is clearly sticky (as we warned from the beginning), and even its under-reported 6% range has the experts in a tizzy of comical proportions.

Neel Kashkari, for example, is thinking the US may need to get rates to at least 6% to “beat” inflation. James Bullard is asking for more rate hikes too.

But what these “go higher, longer” folks are failing to mention is that rate hikes make Uncle Sam’s bar tab (i.e., debt) even more expensive, a fact which deepens rather than alleviates the US deficit nightmare.

The War on Inflation is a Policy that Actually Adds to Inflation

Ironically, however, few (including Kashkari, Bullard, Powell or just about any economic midget in the House of Representatives) are recognizing the additional paradox that greater deficits only add to (rather than “combat”) the inflation problem, as deficit spending (an economy on debt respirator) keeps artificial demand (and hence) prices rising rather than falling.

Furthermore, these deficits will ultimately be paid for with more fiat fake money created out of thin air at the Eccles building, a policy which is inherently (and by definition): INFLATIONARY.

In short, and as even Warren B. Mosler recently tweeted, “the Fed is chasing its own tail.”

Inflation, in other words, is not only here to stay, the Fed’s “anti-inflationary” rate hike policies are actually making it worse.

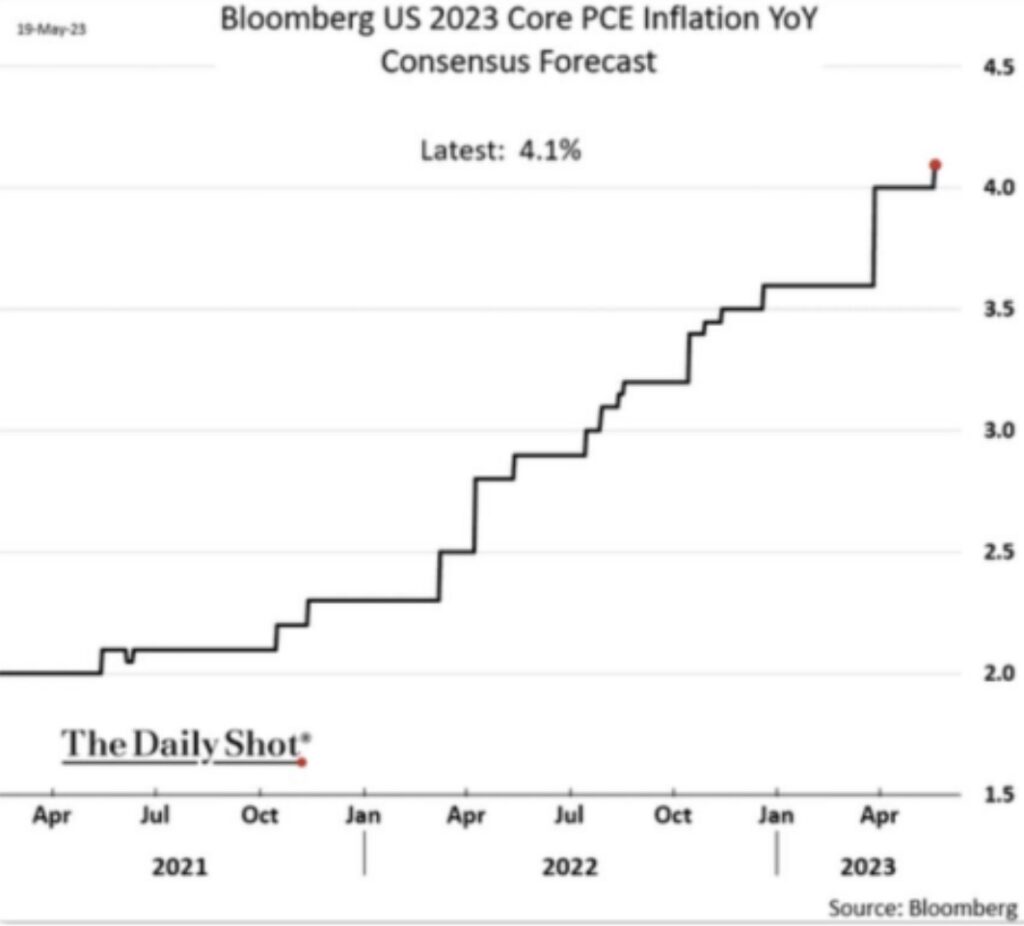

Even party-line economists are forecasting higher core inflation this year:

The Real Solution to Inflation? Scorched Earth.

In fact, the only way to truly dis-inflate the inflation problem is to raise rates high enough to destroy the bond market and the economy.

Afterall, major recessions/depressions do “beat” inflation—along with just about everything and everyone else.

The current Fed’s answer to combatting the inflation problem is in many ways the equivalent of combatting a kitchen rodent problem by placing dynamite in the sink.

Meanwhile, the Rate Hikes Keep Blowing Things Up

Buried beneath the headlines of one failing bank (and tax-payer-funded depositor bailout) after the next, is the equally dark picture of US small businesses, all of which rely on loans to stay afloat.

But according to the U.S. Small Business Association, loan rates for the “little guys” have reached double digit levels.

Needless to say, such debt costs don’t just hurt small enterprises, they destroy them.

This credit crunch is only just beginning, as small enterprises borrow less in the face of rising rates.

Real estate, of course, is just another sector for which the “war on inflation” rate hikes are creating collateral damage.

Homeowners enjoying the fixed low rates of days past are naturally remiss to sell current homes only to face the pain of buying a newer one at much higher mortgage rates.

This means the re-sale inventory for older homes is shrinking, which means the market (as well as price) for new construction homes is spiking—serving as yet another and ironic example of how the Fed’s alleged war on inflation is actually adding to price inflation…

In short, Fed rate hikes can make inflation rise, and equally tragic, is that Fed rate cuts can also make inflation rise, as cheaper money only means greater velocity of the same, which, alas, is inflationary…

See the Paradox?

And that, folks, is the paradox, conundrum, corner or trap in which our central planners have placed us and themselves.

As I’ve warned countless times, we must eventually pick our poison: It’s either a depression or an inflation crisis.

Ultimately, Powell’s rate hikes, having already murdered bonds, stocks and banks, will also murder the economy.

Save the System or the Currency?

At that inevitable moment when the financial and social rubble of a national and then global recession is too impossible to ignore, the central planners will have to take a long and hard look at the glowing red buttons on their money printers and decide which is worthing saving: The “system” or the currency?

The answer is simple. They’ll push the red button while swallowing the blue pill.

Ultimately, and not too far off in our horizon, the central planners will “save” the system (bonds and TBTF banks) by mouse-clicking trillions of more USDs.

This simply means that the deflationary recession ahead will be followed by a hyper-inflationary “solution.”

Again, and worth repeating, history confirms in debt crisis after debt crisis, and failed regime after failed regime, that the last bubble to “pop” is always the currency.

A Long History of Stupid

In my ever-growing data base of things Fed-Chairs have said that turned out to be completely and utterly, well…100% WRONG, one of my favorites was Ben Bernanke’s 2010 assertion that QE would be “temporary” and with “no consequence” to the USD.

According to this false idol, QE was safe because the Fed was merely paying out dollars to purchase Treasuries is an even swap of contractually even values.

What Bernanke failed to foresee or consider, however, is that such an elegant “swap” is anything but elegant when the Fed is marred by an operating loss in which its Treasuries are tanking in value.

That is, the “swap” is now a swindle.

As deficits rise, the TBTF banks will require more mouse-clicked (i.e., inflationary) dollars to meet Uncle Sam’s interest expense promise to the banks (“Interest on Excess Reserves”).

In the early days of standard QE operations, at least the Fed’s printed money was “balanced” by its purchased USTs which the TBTF banks then removed from the market and parked “safely” at the Fed.

But today, given the operating losses in play, the Fed’s raw money printing will be like like raw sewage with nowhere to go but straight into the economy with an inflationary odor.

Bad Options, Fluffy Words

Again, the cornered Fed’s options are simple/stupid: It can continue to hawkishly raise rates higher for longer and send the economy into a depression and the markets into a spiral while declaring victory over inflation, or it can print trillions more fiat dollars to prop the system and neuter/debase the dollar.

And for this wonderful set of options, Bernanke won a Nobel Prize?

The ironies do abound…

But as a famous French moralist once said, the highest offices are rarely, if ever, held by the highest minds.

Gold, of course, is not something the Fed (nor anyone else) can print or mouse-click, and gold’s ultimate role as a currency-insurer is not a matter of debate, but a matter of cycles, history and simple/stupid common sense. (See below).

Markets Are Prepping

In the interim, the markets are slowly catching on to the fact that protecting purchasing power is now more of a priority than looking for safety in grossly and un-naturally inflated “fixed income” or “risk-free-return” bonds.

Why?

Because those bonds are now (thanks to Uncle Fed) empirically and mathematically nothing more than “no-income” and “return-free-risk.”

Meanwhile, hedge funds are building their net short positions in S&P futures at levels not seen since 2007 for the simple reason that they foresee a Powell-induced market implosion off the American bow.

Once that foreseeable implosion occurs, get ready for the Fed’s only pathetic tools left: Lower rates and trillions of instant liquidity—the kind that kills a currency.

In Gold We Trust

The case for gold as insurance against such a backdrop of debt, financial fragility and openly dying currencies is, well: Simple stupid and plain to see.

Few on this round earth see the simple among the complex better than our advisor and friend, Ronni Stoeferle, whose most recent In Gold We Trust Report has just been released.

Co-produced with his Incrementum AG colleague, Mark Valek, this annual report has become the seminal report in the precious metal space.

The 2023 edition is replete with not only the most sobering and clear data points and contextual common sense, but also a litany of entertaining quotations from Churchill and the Austrian School to The Grateful Dead and Anchorman …

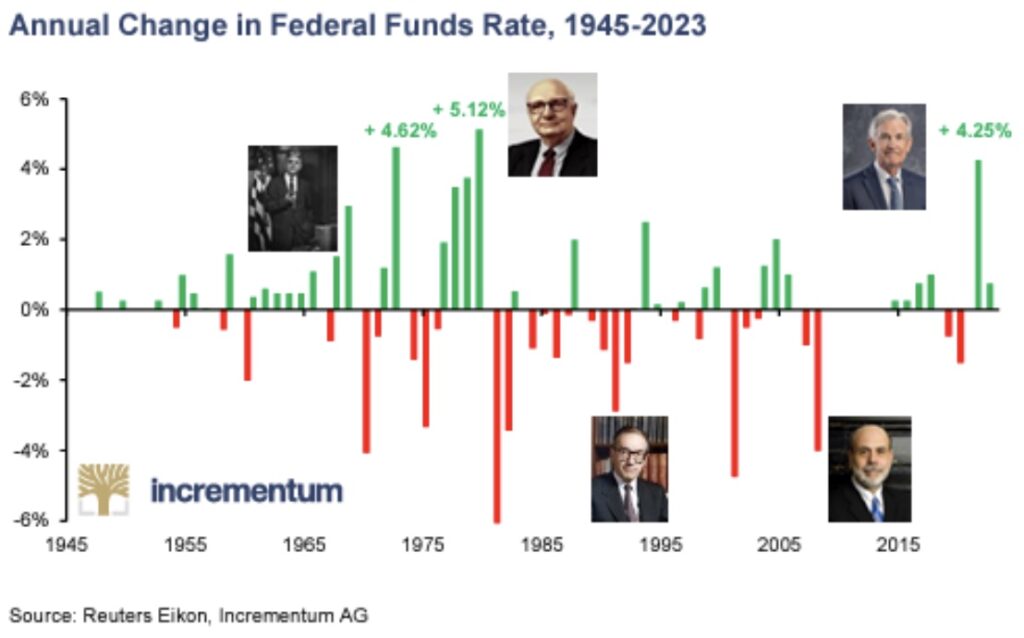

Ronni and Mark unpack the consequences of a Fed that has raised rates too high, too fast and too late, which is, again a fact plain to see:

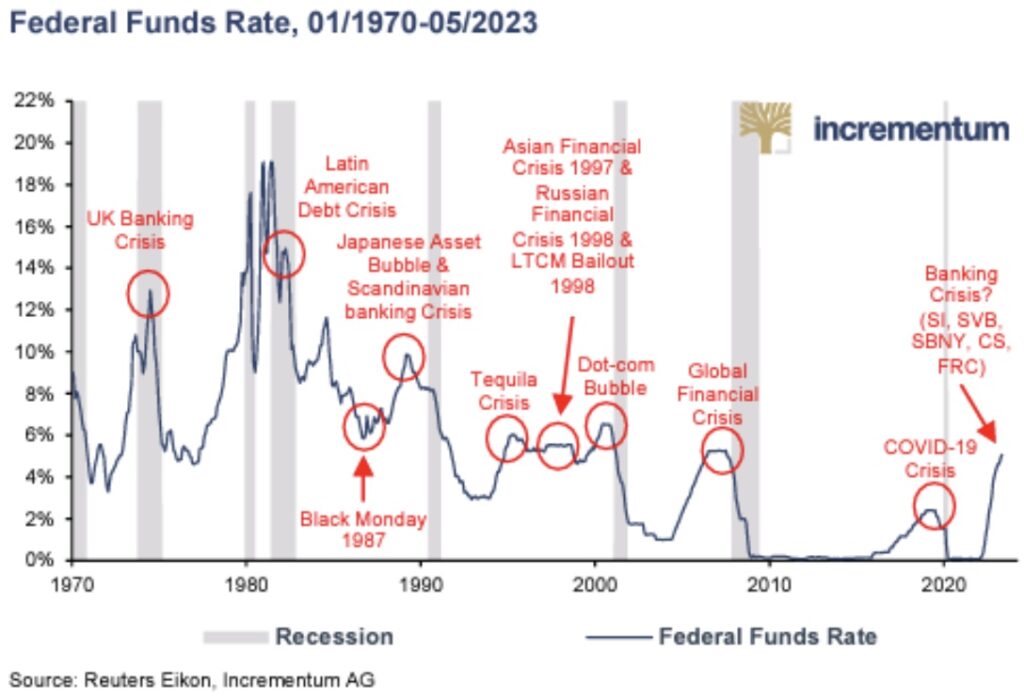

Needless to say, hiking rates into an economic setting already historically “debt fragile” tends to break things (from USTs to regional banks) and portends far more pain ahead, as both history and math also plainly confirm:

In a debt-soaked world fully addicted to years of instant liquidity from a central bank near you, Powell’s sudden (but again too late, too much) hiking policies will not “softly” restrain market exuberance nor contain inflation without unleashing the mother of all recessions.

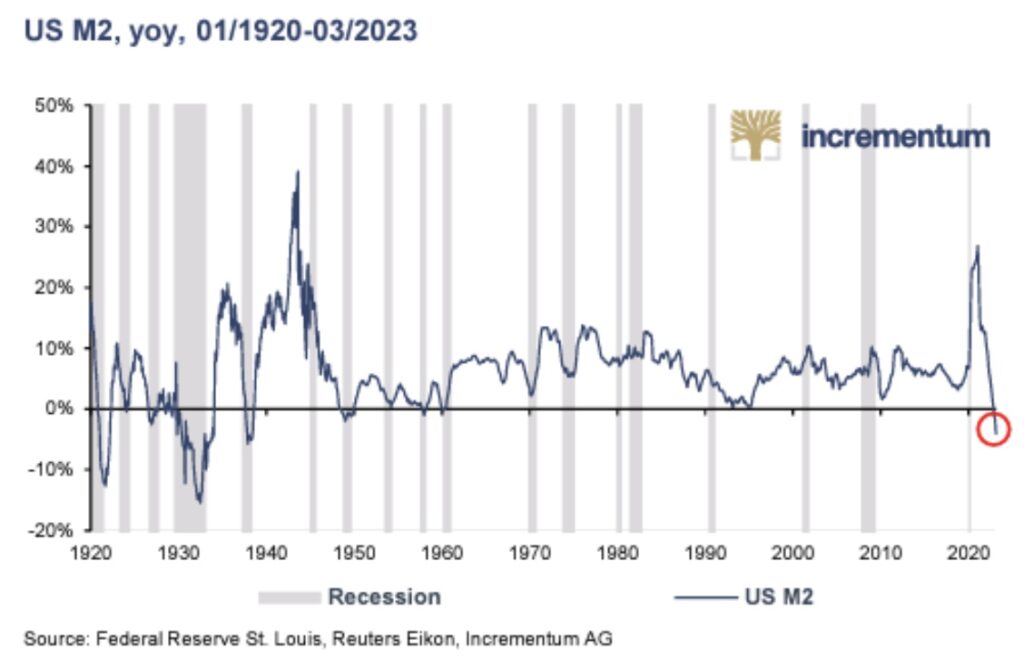

Instead, the subsequent and sudden negative growth of money supply will only hasten a recession as opposed to a “softish” landing:

As the foregoing report warns, the looming approach of this recession is already (and further) confirmed by such basic indicators as the Conference Board of Leading Indicators, an inverted yield curve and the alarming spread between 10Y and 2Y yields.

Self-Inflicted Geopolitical Risks

The report further examines the geopolitical shifts of which we have been warning (and writing) since March of 2022, when Western sanctions against Russia unleashed a watershed trend by the BRICS and other nations to seek settlement payments outside of the weaponized USD.

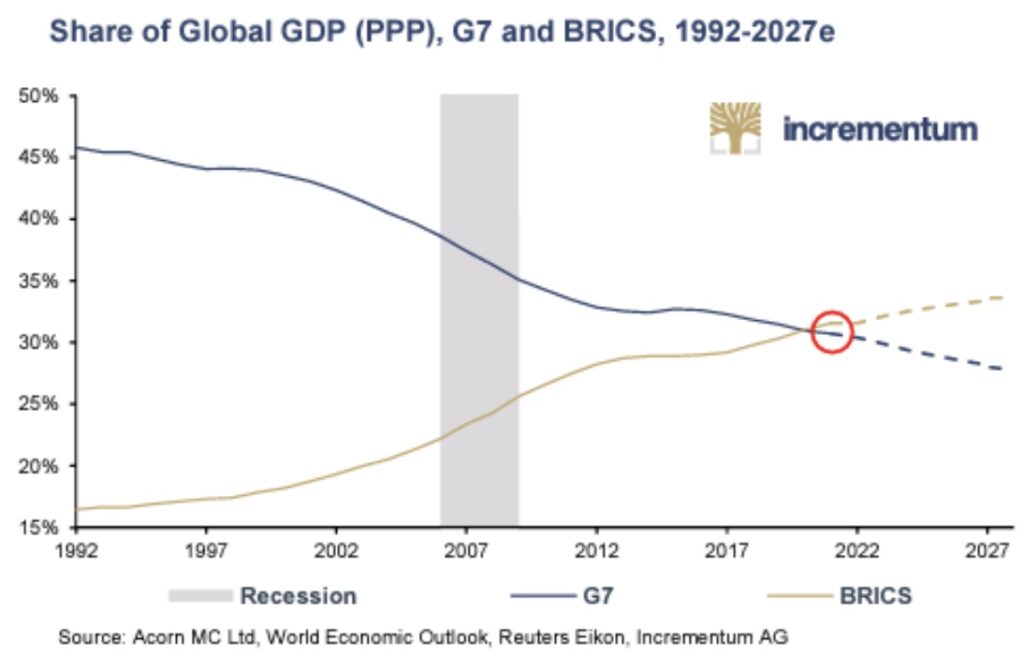

One would be unwise to ignore the significance of this shift or underestimate the growing power of these BRICS (and BRICS “plus”) alliances, as their combined share of global GDP is rising not falling…

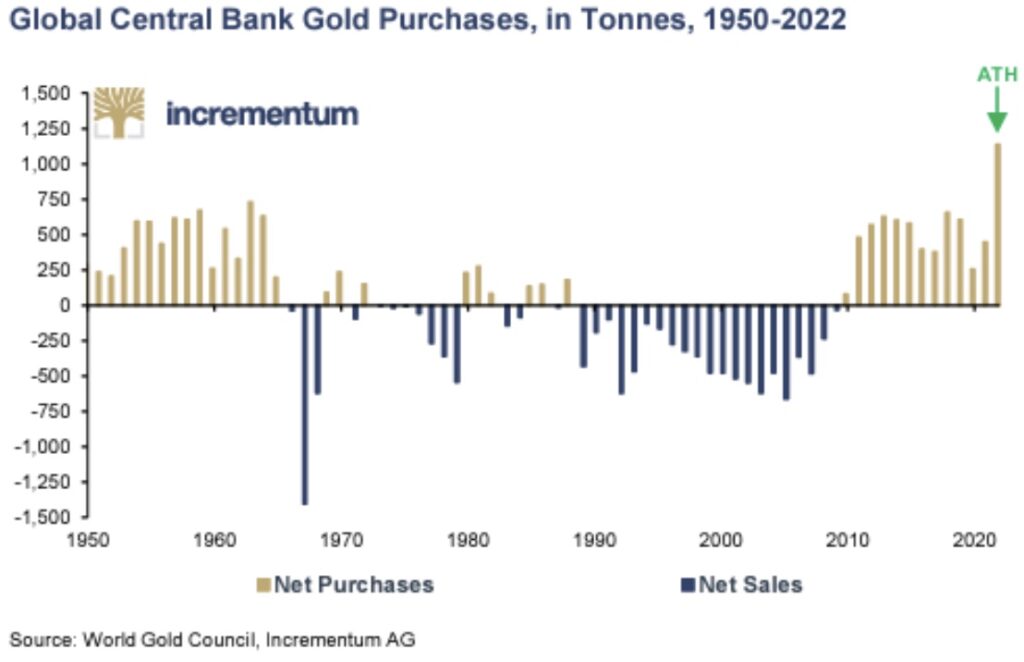

As interest in (and trust for) the now weaponized USD as a payment system declines alongside a weakening faith in Uncle Sam’s IOUs, the world, and its central banks (especially out East) are turning away from USTs and turning toward physical gold.

Again, I give credit to the In Gold We Trust Report:

See a trend?

See why?

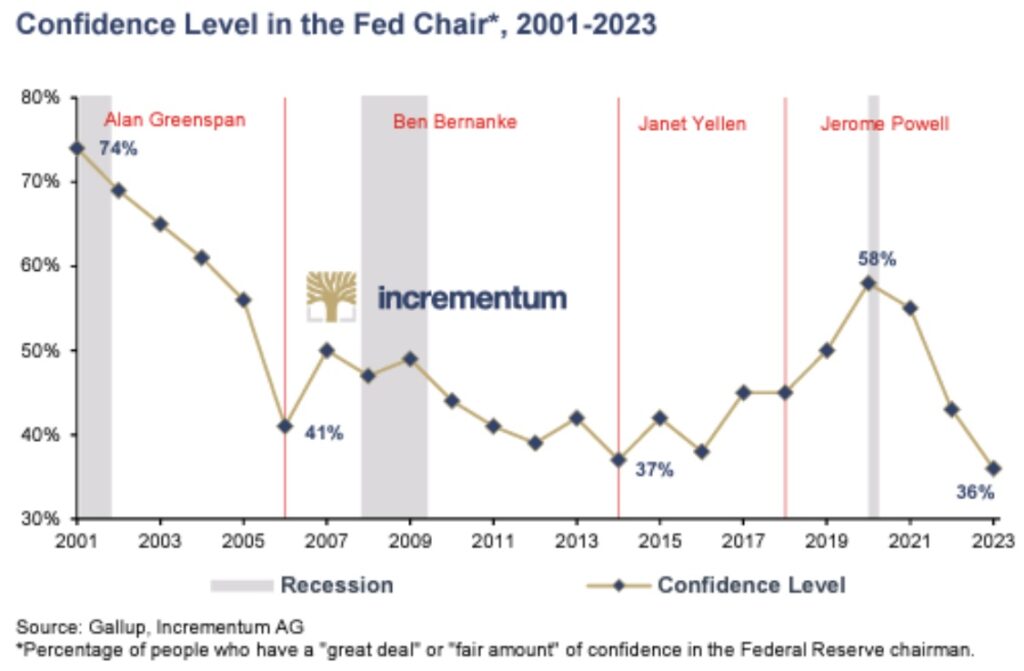

It’s fairly simple, and for this we can thank the fairly stupid policies of the Fed in particular and the declining faith in their prowess in general:

Myths Are Stubborn Things

Many, of course, find it hard to imagine that a Federal Reserve based in DC and within the land of the Great American dream (and world reserve currency) could be anything but wise, efficient and stabilizing, despite an embarrassing Fed track record that is empirically unwise, inefficient and consistently destabilizing…

Myths are hard to break, despite the fact the myth of MMT and QE on demand has been a failed experiment and is sending the US, as well as the global, economy toward a reckoning of historical proportions.

But the messaging of “Keep calm and carry on” from Powell is calming in spirit despite the fact that it hides terrifying math and historically confirmed consequences for the fiat money by which investors still wrongly measure their wealth.

But as Brian Fantana of Anchorman would tell us, trust the central planners.

“They’ve done studies, you know. 60% of the time it works every time.”

As for us, we trust the kind of data Ronni and Mark have gathered and that barbarous relic of gold far more than calming words and debased, fiat currencies.

As history reminds, when currencies die within a backdrop of unsustainable debt, gold in fact does work—and every time. This will link you directly to more fantastic articles from Egon von Greyerz CLICK HERE.

Nomi Prins just predicted the price of gold will hit $3,500 next year and also said the US is the biggest Ponzi scheme in the world in this powerful audio interview CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.