Here is a look at the Great Unwind as the economy tanks…

Stay Alert

November 8 (King World News) – Art Cashin, Head of Floor Operations at UBS: The Equity Bulls’ early attempt to extend their string of plus days is running into a bit more serious trouble than most had assumed. If you recall in the late morning update, we talked about the potential heavy resistance at 4400, while we didn’t actually reach that, we got to within about 8 points.

A couple of members of the Friends of Fermentation checked in to say that some of their cocktail napkin chartwork hinted that there were two technical cycles that were about to overlap. And it might call for an intermediate top somewhere between here and the end of the week. They said it was of note because the intermediate top would be followed by a more than noticeable pullback.

So far that’s only on a cocktail napkin, but it will make watching today’s action all the more important where the Bulls try to regroup and come back on again, but we may see further weakness. If you see the S&P dip below the 4355 level, put on the “check engine” light, could make for a bit of a sticky afternoon.

But for now the Bulls are on the defensive, the yield on the 10-year has dipped below the 4.55, we were concerned about if it were to break below 4.50 that could cause some real damage.

Also of note, Crude has broken below its 200 day moving average.

So for now, keep the slide rule handy, we might be doing some important testing, as we had mentioned in the late morning update. So stay alert and try to stay safe.

Arthur

Things Are Tightening All Over

Peter Boockvar: So when looking at the Senior Loan Officer survey that comes out every quarter, as the latest one was published Monday, after a notable move in one direction in any particular quarter in terms of standards and demand, it’s important to follow that by looking at the ‘basically unchanged’ category. This is because after a string of tightening lending standards over the past year, Q3 saw a 63% figure that was ‘basically unchanged’ vs 49% in Q2 meaning that while they haven’t tightened much further, the cumulative tightening in standards remains. In other words, the credit crunch continues on if you need to rely on a bank for a loan.

The Fed said “Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for C&I loans to firms of all sizes over the 3rd quarter. Furthermore, banks reported tighter standards and weaker demand for all CRE loan categories.”

“For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government residential mortgages, for which standards remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance.”

About The Banks

There was a special question of note that “inquired about banks’ reasons for changing standards for all loan categories in the third quarter of 2023.” And the response back was, “Banks most frequently cited a less favorable or more uncertain economic outlook; reduced tolerance for risk; deterioration in the credit quality of loans and collateral values; and concerns about funding costs as important reasons for tightening lending standards over the third quarter.”

Shifting gears to the transportation sector, pun intended, times remain challenging but just maybe there are some lights of hope out there as the inventory destocking runs its course. I’ll highlight here the earnings comments from Expeditors International, the global freight broker talk about the situation and the signs of hope expressed, along with the October Logistics Managers Index which came out yesterday and saw m/o/m improvement…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

The Great Unwind

From Expediters

As expected, the deceleration in demand that we have seen since the 2nd half of 2022 continued in the comparable third quarter of 2023. Additionally, rates generally remained soft while capacity exceeded demand in most lanes. The shipping industry has been undergoing a great unwinding of so many of the drivers that led up to the massive mismatch of supply and demand that occurred during the pandemic. As a result, air and ocean capacity is now mostly plentiful and at rates that remain well below the pandemic period. We have also experienced declines in the number of customs brokerage transactions we handled, even as we benefited from lower costs resulting from the gradual clearing of pandemic related port congestion.”

“We have seen shippers generally move smaller volumes in a marketplace that is defined by inflation, high energy costs, an increasingly tentative consumer, and now significant and growing geopolitical uncertainty.”

The bright side after an initial caveat, “While not all markets are soft and rates have even increased in certain lanes, we have yet to see signs of a widespread improvement in rates. Nevertheless, we are encouraged by indications that tonnage and volumes are perhaps flattening or improving…As the market recalibrates, we are encouraged that both tonnage and volumes increased from the June quarter, marking the first sequential quarterly growth in both tons and volumes since the third quarter of 2022.”

The October Logistics Manager’s Index rose 4.1 pts m/o/m to 56.5 and is up now for a 3rd straight month. The LMI said, “We had wondered whether last month’s shift from contraction to expansion was a one-time aberration or the start of a new trend. This 2nd consecutive month of expansion provides some evidence for the latter.” Transportation prices are still slowing but “doing so at the slowest rate since September 2022.” Of note here, “These upward movements are catalyzed by inventory levels moving back to expansion after 5 consecutive months of contraction. Whether increased inventories are temporary bursts of seasonal expansion or the sign of a larger move back towards stronger economic growth remains to be seen. What we can say however is that October’s inventory and overall index scores are a marked step forward for the logistics industry.”

I will say this, any sustainability to an inventory rebuild will be determined by end demand and that is where at least for discretionary goods items remains pretty fragile right now.

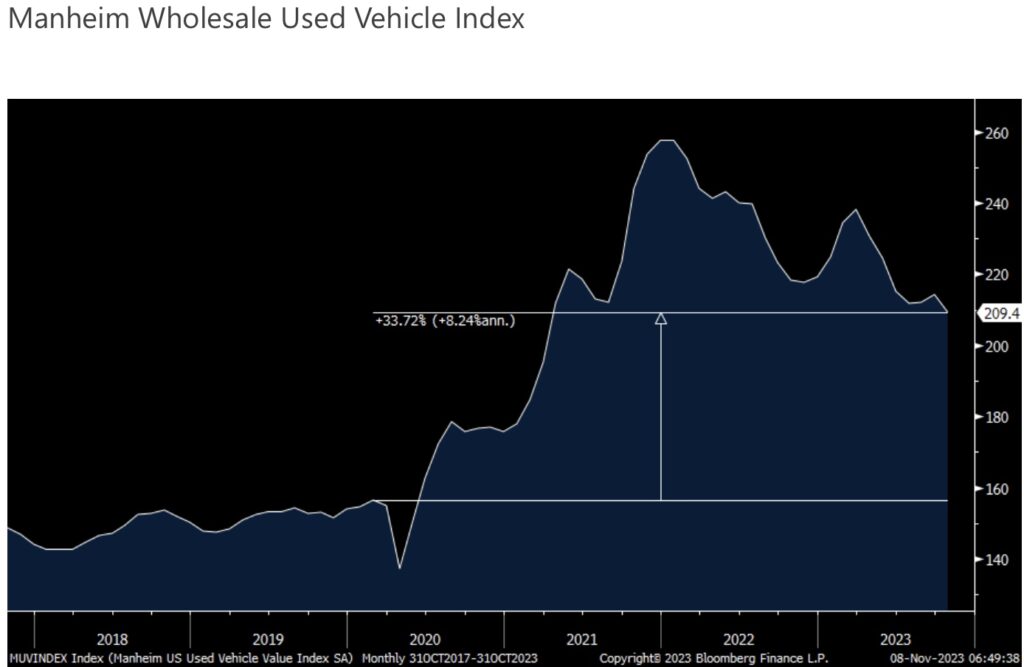

Used Car Prices Retreating

Manheim yesterday said wholesale used car prices fell 2.3% in October from September and are lower by 4% y/o/y. This reverses the gains seen in the two prior months and Manheim said this trend was similar to that seen in October 2022. As for the next few months of the year, “Wholesale vehicle values typically experience some modest increases during the holiday season, and with two months remaining, we could see some upward price movements.”

If Used Car Prices Break Support, It’s A Long Way Down For Prices

While Wall Street and our central bankers live on rate of change, even with the recent pullback the average wholesale price of a used car is up 34% from early 2020.

Ebay Weighs In On Economic Woes

On the US consumer, here is what we heard from EBAY last night:

“Inflationary pressures, and rising interest rates continue to weigh on consumer confidence, and pressure demand for discretionary goods…we’ve observed softening consumer trends to date in Q4, and particular challenges in Europe, suggesting we may see a more muted, seasonal uptick over the holidays.”

“US consumers are increasingly seeking value…Our international markets continue to experience more severe macroeconomic pressure than the US, but the UK is seeing consistently negative e-commerce growth since early 2022, while Germany has now faced multiple quarters of economic contraction.” The UK and Germany by the way are their 2nd and 3rd largest markets.”

As for how Q3 ended and Q4 started, “we did observe softening consumer demand in September, that carried through October” and was most pronounced in Europe as stated above. But also, “We have also seen tapering demand in the US market quarter to date.”

Travel & Leisure

Travel and leisure still is what consumers are mostly spending on as said and seen by TripAdvisor. In their call yesterday, “we continue to see resilient and durable travel intent in our data, driven by the enduring trend of consumers prioritizing travel and experiences over other discretionary spend.”

The drop in mortgage rates coincident with the rally in Treasuries drove a 3% w/o/w rise in purchase applications according to the MBA and follows 3 weeks of declines that took this index to the lowest since 1995. Refi’s were up by 1.6% w/o/w after falling by 3.5% last week…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Housing

On housing and as to how home builders are dealing with a 7 handle on mortgage rates, DR Horton said this yesterday in their earnings call:

“To adjust to changing conditions and higher mortgage rates, we have increased our use of incentives and are reducing the size of our homes where possible to provide better affordability for our homebuyers. We expect to continue utilizing higher levels of incentives in fiscal 2024, particularly rate buydowns in the current interest rate environment.”

You’ve heard me rant many times this year on how the first time home buyer is getting completely screwed by the housing market in terms of affordability. In CNBC’s “Youth & Money in the USA survey of 18-34 yr olds (they asked about 1,000 of them), only 14% own a home and “more than half (55%) say it is much harder to purchase a home now compared to when their parents started out in the job market and 51% say mortgage and interest rates impact their decision to buy a home.” We know it’s all about the monthly payment for many, especially when compared to the monthly rental price of an apartment.

ALSO JUST RELEASED: GREATEST WEALTH TRANSFER: Global Hyper Bubble In Debt Set To Soar Exponentially CLICK HERE

ALSO JUST RELEASED: PARTY ON: Shocking Look At The Great Distortion CLICK HERE

ALSO JUST RELEASED: More Pain Is On The Way As Economic Deterioration Is Accelerating CLICK HERE

ALSO JUST RELEASED: GET READY: Gold & Silver Big Picture Shows Imminent Upside Explosion CLICK HERE

ALSO JUST RELEASED: This Is Going To Send Shockwaves Through Global Markets CLICK HERE

ALSO JUST RELEASED: The United States Is Being Destroyed And Other Countries Are Taking Notice CLICK HERE

JUST RELEASED!

To listen to Alasdair Macleod’s just released audio interview discussing major surprises happening around the world that are set to ignite gold and silver prices higher and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.