As we kickoff another trading week, this article takes you down the rabbit hole of what is going to send shockwaves through global markets.

November 6 (King World News) – King World News has been publishing Graddhy’s charts and commentary stating bonds have bottomed and yields have topped. This will have big implications for the gold and silver markets and world currency markets.

Another Gold Bull Catalyst

Graddhy out of Sweden: US bonds have bottomed and yields topped.

Here is further chart evidence.

Bond Yields Have Broken Down As Bonds Have Seen An Upside Breakout

Bonds reversing means rates reversing, that in turn should mean lower US dollar pushing many sectors up, i.e. HUGE implications.

King World News note: A lower US dollar will push the price of gold to new all-time highs, simultaneously creating a massive upside breakout in the silver market that will take the price to all-time highs. This will also cement the final bottom for the gold mining indexes (HUI, XAU, GDX, etc.) The mining stocks will begin a historic upside move that will eventually end in a mania.

King World News note: This ties into the extremely important commentary (below) about where things stand for the United States. This is an incredibly bullish setup for the gold market.

The Great Gold Catalyst

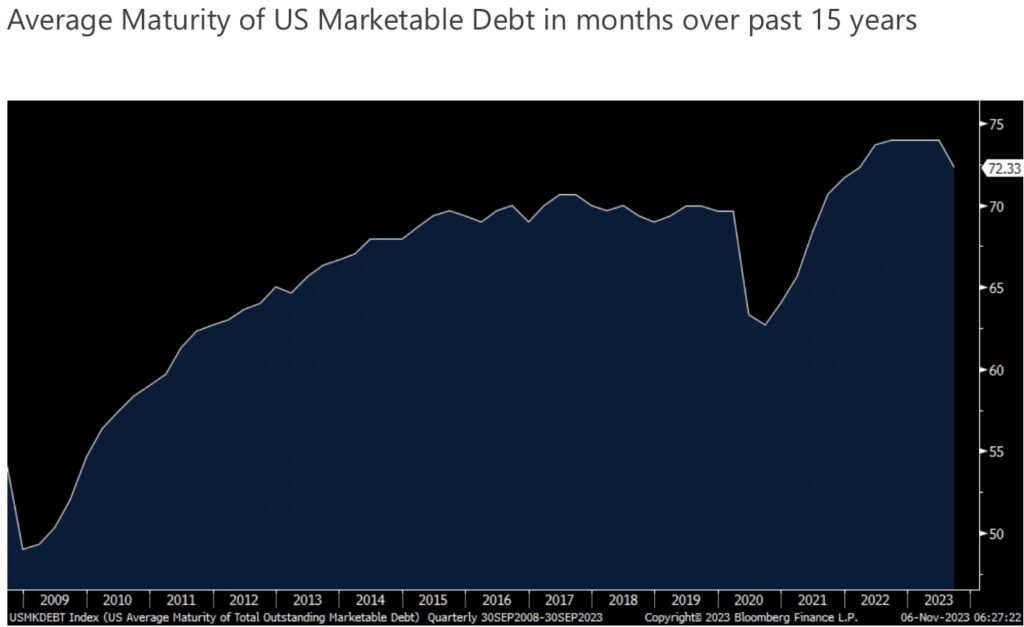

Peter Boockvar: Yes, the US Treasury should have sold many billions/trillions more in longer term debt in 2020 and 2021 than they did relative to short term debt as Stan Druckenmiller used to rightly criticize Janet Yellen as more could have been done. That said however, it’s not as clean a story as it seems however logical it sounds. Let’s back up first. Steve Mnuchin was Treasury Secretary for a chunk of time when the 10 yr yield was below 2% from July 2019 until he left in January 2021 and he seemed committed to taking advantage of low rates to term out debt but didn’t much, outside of reintroducing the 20 yr bond again which was at least something.

Back in 2016, just a few weeks after the election and Mnuchin was appointed, in an interview on CNBC he said “I think interest rates are going to stay relatively low for the next couple of years…We’ll look at potentially extending the maturity of the debt because eventually we are going to have higher interest rates and that is something this country is going to need to deal with.” Of course, now is that time. https://www.cnbc.com/2016/11/30/cnbc-transcript-steven-mnuchin-and-wilbur-ross-speak-with-cnbcs-squawk-box-today.html.

In August 2019, Mnuchin told Bloomberg News, “If the conditions are right, then I would anticipate we’ll take advantage of long term borrowing and execute on that.” In May 2020, Mnuchin was on CNBC and they headlined an online story after an appearance of his, “Mnuchin says he’s comfortable spending $3 trillion because Treasury can lock in very low rates.” He said in the interview, “We’re going to take advantage of refinancing all of our debt…”Between 10 years, 20 years, and 30 years, we’re borrowing an awful lot of money long term so that we can lock in this $3 trillion for a very, very long period of time.” https://www.cnbc.com/2020/05/11/mnuchin-says-hes-comfortable-spending-3-trillion-because-treasury-can-lock-in-very-low-rates.html

About 6 months later, according to Reuters, “US Treasury studying ultra long bonds, demand queried.” https://www.reuters.com/article/us-usa-debt-refunding/u-s-treasury-studying-ultra-long-bonds-demand-queried-idUSKBN17Z1CV.

The Treasury Borrowing Advisory Committee said in May 2017 when that story right above hit basically sums up why more long term debt than should have been sold, wasn’t sold. “While an ultra-long is mostly to be demanded by those with longer-dated liabilities, the committee does not see evidence of strong or sustainable demand for maturities beyond 30 years.”…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

In September 2019, another Reuters headline, “Mnuchin says 100 yr Treasury bond possible.” He said the US will issue 50 yr bonds if there is “proper demand,” a move aimed at “derisking” the government’s $22 trillion of debt and locking in low interest rates, said the article. https://www.reuters.com/article/us-usa-economy-mnuchin/mnuchin-says-100-year-treasury-bond-possible-idUSKCN1VX2SO. They didn’t see the 50 yr debt, let alone 100, because there was little demand for it.

All this talk, all the studying and not much was done. But something was as the US Treasury in May 2020 issued its first 20 yr Treasury bond since 1986. From the NY Fed in July 2020 analyzing the reintroduction, “In introducing the 20-year bond, Treasury cited the expected strong demand, which would ‘increase Treasury’s financing capacity over the long term,’ while meeting its objective ‘to finance the government at the least possible cost to taxpayers over time.’ Market participants suggested that the bond could be attractive to liability-driven investors, such as corporate pensions and insurance companies.” Demand really hasn’t come from anywhere else since.

Fast Forward

Fast forward to Janet Yellen, here is a story in an S&P Global article where at her confirmation hearings she said “There is an advantage to funding the debt, especially when interest rate are very low, by issuing long term debt.” https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/yellen-faces-major-hurdles-to-issue-of-50-year-bond-that-mnuchin-passed-over-62228383. Of course, no 50 yr bonds were offered.

The point of all of this is to say that while it would have been really nice to lock in low long term interest rates for the US Treasury, there was a big time lack of investor demand for long term bonds and still is the case. My friend Luke Gromen who writes the weekly brilliant The Forest for the Trees highlighted in his Friday piece why this was the case and why it is now too, “The long end of the UST market is far less liquid than advertised, and certainly far less liquid relative to supplies of USTs the US needs to sell given deficits of 8% of GDP in a relatively strong economy.” Especially so with the Fed and banks selling and foreigners barely buying. Also, while US ‘households’ have been big buyers, that category includes hedge funds that have been putting on huge basis trades (buying long term Treasuries and shorting futures).

When you see the huge damage done to the long end of the US Treasury market over the past two years where TLT (the 20 yr+ maturity Treasury ETF) fell 50% peak to trough, as bad as many stock bear markets, can you just imagine the further carnage on the part of holders if there was even more long term Treasuries sold.

Here was Luke’s bottom line, “The two Treasury Borrowing Advisory Committee documents released this week STRONGLY suggest that the explanation for why Mnuchin and Yellen did not term out the US debt is because they could not do so without severe dysfunction in the long end of the UST curve, which as the policy rate of the real US economy, would have touched off even worse banking strains and even bigger Treasury receipt declines than occurred.”

Here is what TBAC said themselves, UST demand “has shifted toward more price sensitive investors over the past two years” and recently recommended “tilting issuance toward tenors less impacted by the rise in term premium and those that benefit from greater liquidity premium.” https://home.treasury.gov/news/press-releases/jy1865 King World News note: Again, this nightmare is going to add upside fuel to the price of gold as it heads thousands of dollars higher than what is being quoted today.

JUST RELEASED!

To listen to Alasdair Macleod’s just released audio interview discussing major surprises happening around the world that are set to ignite gold and silver prices higher and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: The United States Is Being Destroyed And Other Countries Are Taking Notice CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.