With the price of gold trading over $2,000 an ounce, an inflationary depression is being unleashed.

Expect An Inflationary Depression

April 26 (King World News) – Gregory Mannarino writing for the Trends Journal: Let’s cut right to the chase.

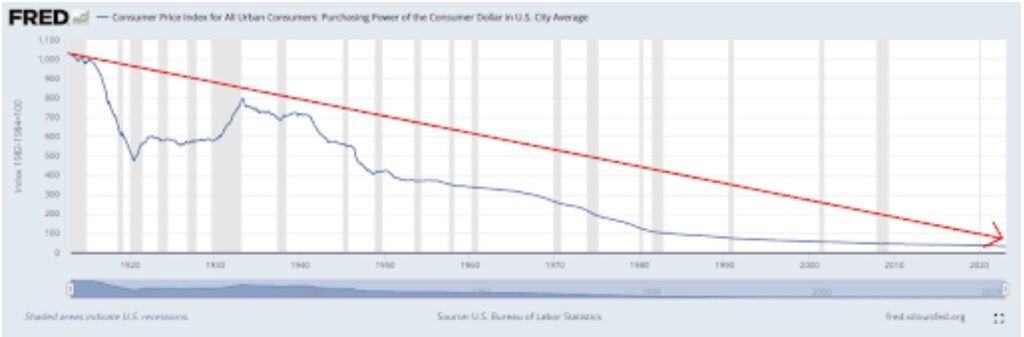

This chart below is from the Federal Reserve’s own website.

What this chart demonstrates is that ever since the inception of the Federal Reserve system in 1913, far left side of the chart, the purchasing power of the dollar has been in a steady, dramatic decline.

What this chart also demonstrates is that there is no end in sight.

Collectively world central banks have been working in concert for many decades to devalue their respective currencies-FASTER. Moreover, this process of devaluation is going to accelerate. Not only are central banks going to exponentially INCREASE global debt, which requires exponentially more currency creation to buy the debt which they issue, but there is a lag effect.

Let’s look at “lag effect.”

This lag effect regarding inflation is the product of past currency/debt creation which then takes time to work its way through the system…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Many people believe that the present inflationary environment is being created by the current economic environment, this is simply not true. The current inflationary situation is the result of previously created debt and monetary policy which really kicked off during the financial meltdown of 2008—the lag effect.

There are many people who believe or are hoping for a “deflationary” event to occur. Many of these same people point to a rapidly slowing economy, and theoretically dramatically falling demand to drive prices lower.

Let us look at the CONvid global economic shutdown for a moment.

During the worldwide CONvid economic shutdown of the world economy, did prices fall?

No, they didn’t.

During the worldwide CONvid shutdown of the world economy did stock markets fall as most people expected that they would?

No, they didn’t…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Truth be told, I may have been one of the only stock market analysts who said publicly that on the back of CONvid, stock markets would move higher… and they did.

What people can count on is central banks NOT ALLOWING a major deflationary event to occur.

Central banks FEAR deflation more than they fear inflation. PERIOD… and this is, among other things, why central banks go out of their way to create inflation.

There will be, and already are, parts of the market which are experiencing falling prices. Real estate for example, which is being offset with food inflation rising at its fastest pace in over four decades.

Then again, we have more “lag effect.”

The truth is this. We have yet to see the full effect of massive debt and currency creation which stemmed from the last financial meltdown, and no amount of central bank rate hikes can do a thing to stop it.

Another MAJOR factor in all this is world de-dollarization. The fact is that the world is becoming less dependent on the dollar, and this lowers demand for the dollar. Lower dollar demand will further devalue the dollar which will in turn lead to higher inflation.

ALSO JUST RELEASED: Miners To Have A Golden Wave This Earnings Season But Look At What Is Plunging CLICK HERE.

ALSO JUST RELEASED: Art Cashin Just Warned About VIX But Look At What Is Already Collapsing CLICK HERE.

ALSO JUST RELEASED: The 1930s Great Depression: Is History Set To Repeat? CLICK HERE.

ALSO JUST RELEASED: Silver On Cusp Of Major Upside Breakout As Gold Approaches $2,000 Level Again CLICK HERE.

ALSO RELEASED: There Are So Many Signs Of Financial Disaster Across The World CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.