This bank crisis has already pushed gold to near record levels but the crisis is just getting started.

Bank crisis pushes gold to near record

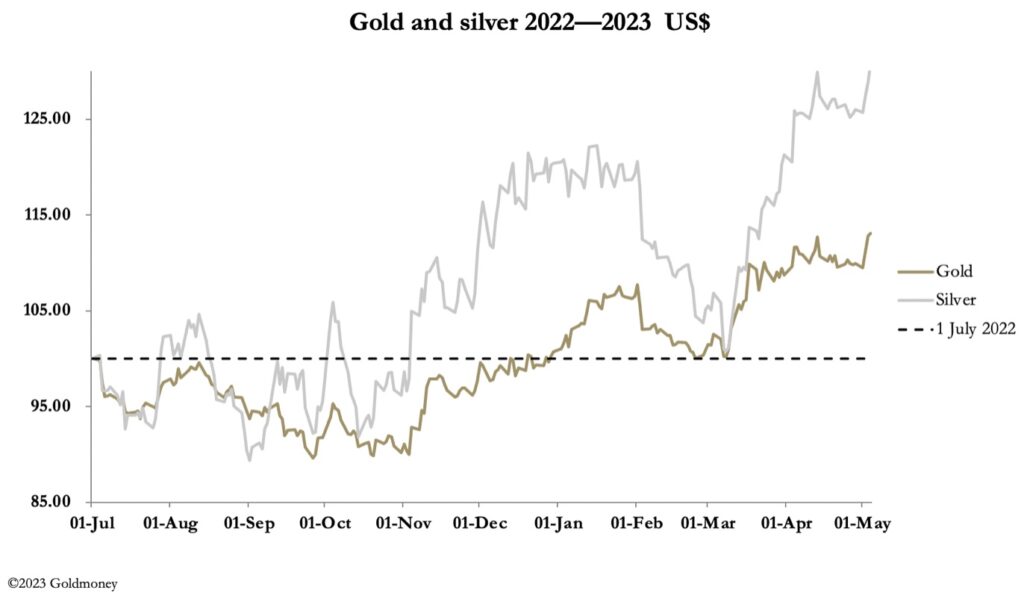

May 5 (King World News) – Alasdair Macleod: On the back of worrying developments in US regional banks, gold and silver performed well this week. This morning in European trade, gold was at $2039 up $53 from last Friday’s close after briefly testing new high ground, and silver was at $25.88, up 90 cents.

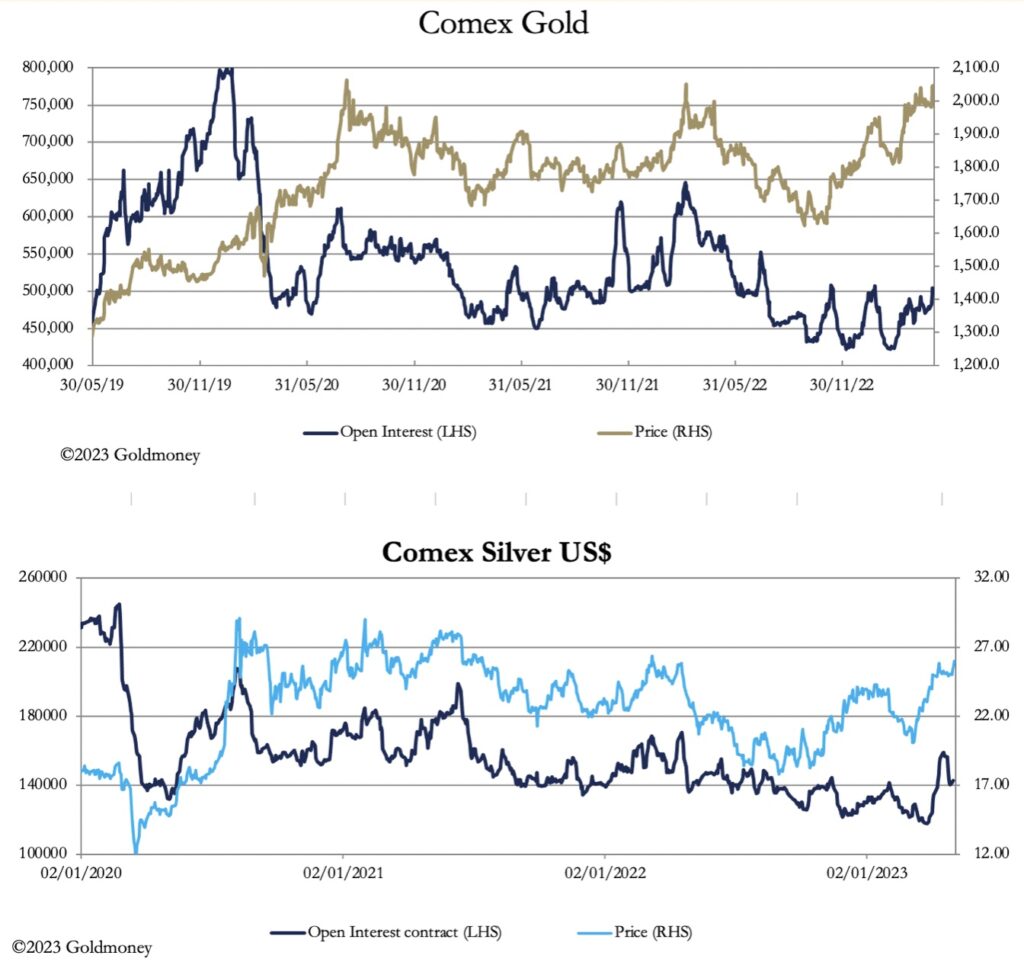

Volumes on Comex picked up with the rise, and gold’s Open Interest is moving into neutral territory rather than being overbought, but silver is still marginally oversold. This is illustrated in our next two charts below:

Recent history has seen even higher levels of open interest, evidenced in these charts. But it is always difficult for technical traders to adjust trading history for the facts. For the facts are that we have a totally different situation today from anything we have seen since the 1970s. On balance, with the prospects of an end to the Fed’s interest rate hiking cycle, or the alternative of or even an accompanying banking crisis there is room for even more buying of Comex futures…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

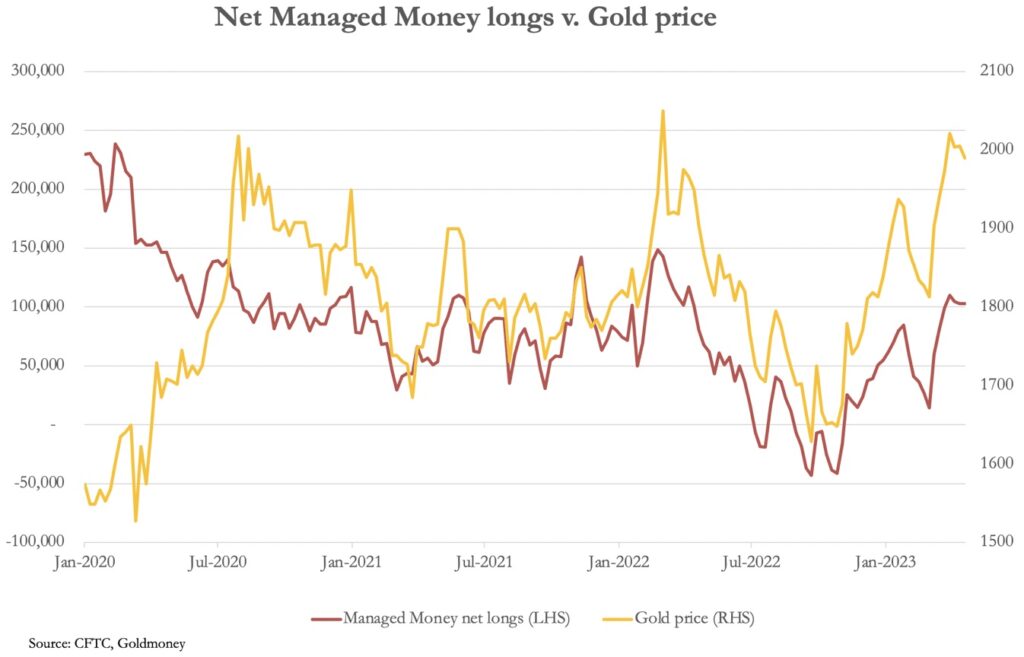

More particularly, the next chart is of Managed Money net positions (hedge funds), clearly showing how the skew is in favour of a rising gold price, and that the average net longs in this category is neutral from an overbought/oversold perspective.

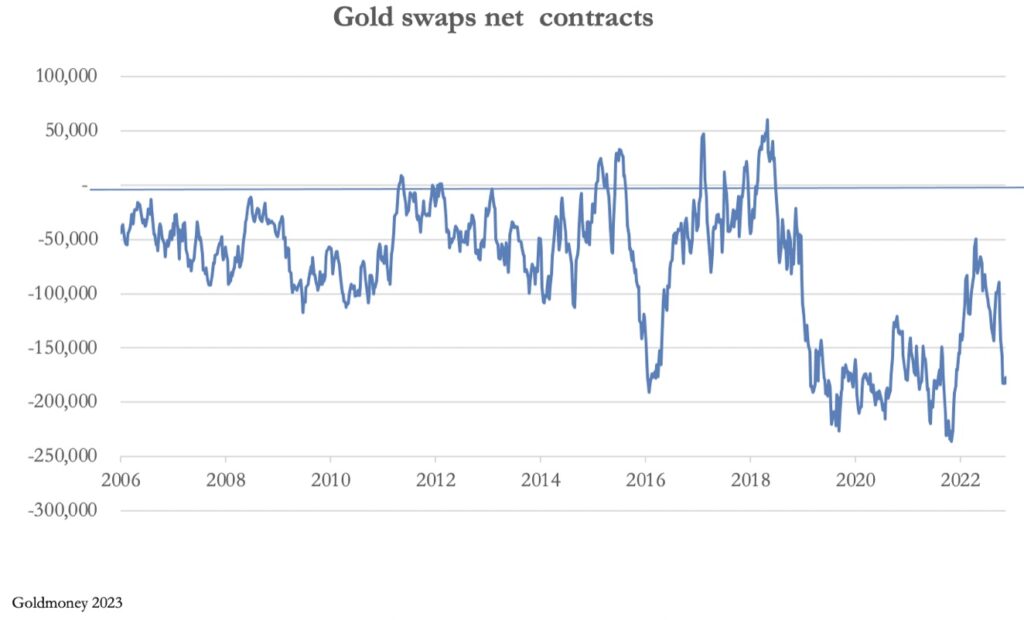

But the Swaps are already seeing their net contract position moving towards record shorts. This is next.

The pressure on the bullion bank trader short positions, who make up the majority of this category, appears to be greater than on the large speculators. Both parties will be watching the technical position very closely. This is up next.

From a technical point of view, the gold price’s bullish chart is almost perfect. The only question is how long the price will consolidate at or above the previous highs at $2070. Once that is dealt with, price targets above $2500 become mere debating points.

Driving it all is growing evidence of a banking crisis in America which is likely to worsen. And no one yet seems to be talking about problems in other banks in other jurisdictions. Particularly in the Eurozone, commercial banks have the same problems with a tightening cycle that started later than that of the US…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

All this means heightened counterparty risk. The response by banks is sure to be to tighten their lending standards further, and to contract total credit. What almost no one seems to realise is that contracting credit leads to higher interest rates reflecting credit shortages.

This throws the burden of credit creation increasingly onto central banks. They have lost control over interest rates, and they need to make a choice: do they act to save their financial systems and stop an economic slump, or do they save their currencies? they cannot do both.

Meanwhile, the only banking systems seeing rising share prices are the Chinese. For the rest, there is increasing uncertainty and fear of failures. There is no room for central bankers and treasury ministries to exercise judgement over moral hazard.

ALSO JUST RELEASED: Gold, Oil & Global Currencies Entering A Watershed Moment CLICK HERE.

ALSO JUST RELEASED: Here Is Why The Gold Anchor Just Hit CLICK HERE.

ALSO JUST RELEASED: Gold Truly Shining Brightly Near All-Time High, Plus Look At These Two Collapses CLICK HERE.

ALSO JUST RELEASED: Fed Raises Rates But Will They Reverse Course? Plus Silver Ready To Soar CLICK HERE.

ALSO RELEASED: Michael Oliver Just Warned This Global Collapse Is Going To Be Far Worse Than 2008-’09 CLICK HERE.

ALSO RELEASED: Gold Surges To $2,025 As Fears Of Bank Failures Accelerates But Here’s The Big Surprise CLICK HERE.

ALSO RELEASED: Gold & Silver Close To Major Upside Breakouts But Take A Look At This… CLICK HERE.

ALSO RELEASED: Mikhailovich – Expect A Long And Brutal Collapse CLICK HERE.

ALSO RELEASED: Greyerz – The Everything Bubble Is Now Turning Into The Everything Collapse CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.