On the heels of volatility in the gold and silver markets, it appears Open Interest has collapsed in the gold market…again.

Gold drifting lower to test late-June support

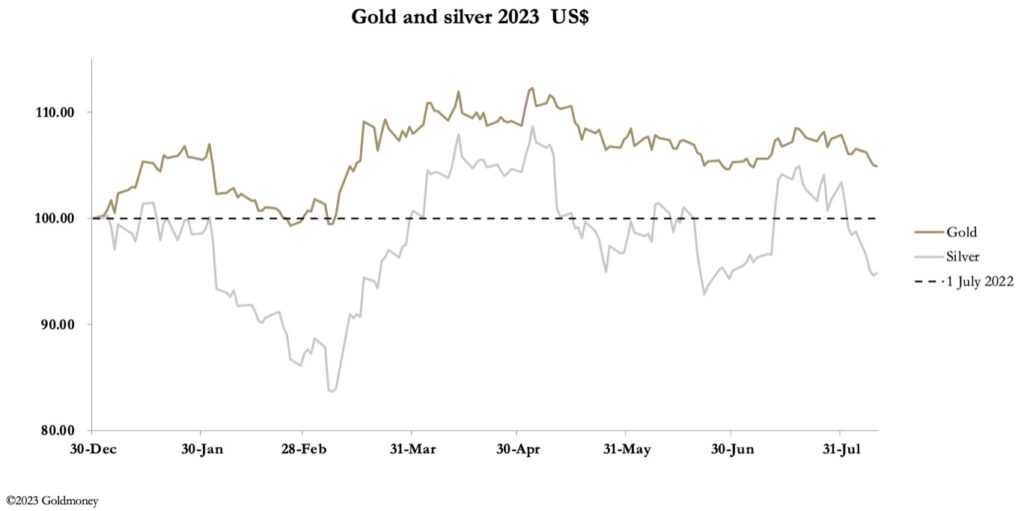

August 11 (King World News) – Alasdair Macleod: Gold and silver drifted lower this week towards a test of the late-June lows. In European trade this morning, gold traded at $1918, down $24 from last Friday’s close, and silver traded at $22.7, down 89 cents.

On Comex, turnover in gold was light, but in silver it was high. Comex deliveries in gold continued at pace, with a further 11.9 tonnes standing for delivery in the last five business days, amounting to 32.9 tonnes in the last two weeks. Deliveries in silver totalled 22.1 tonnes in the last five business days, and 141 tonnes in the last fortnight.

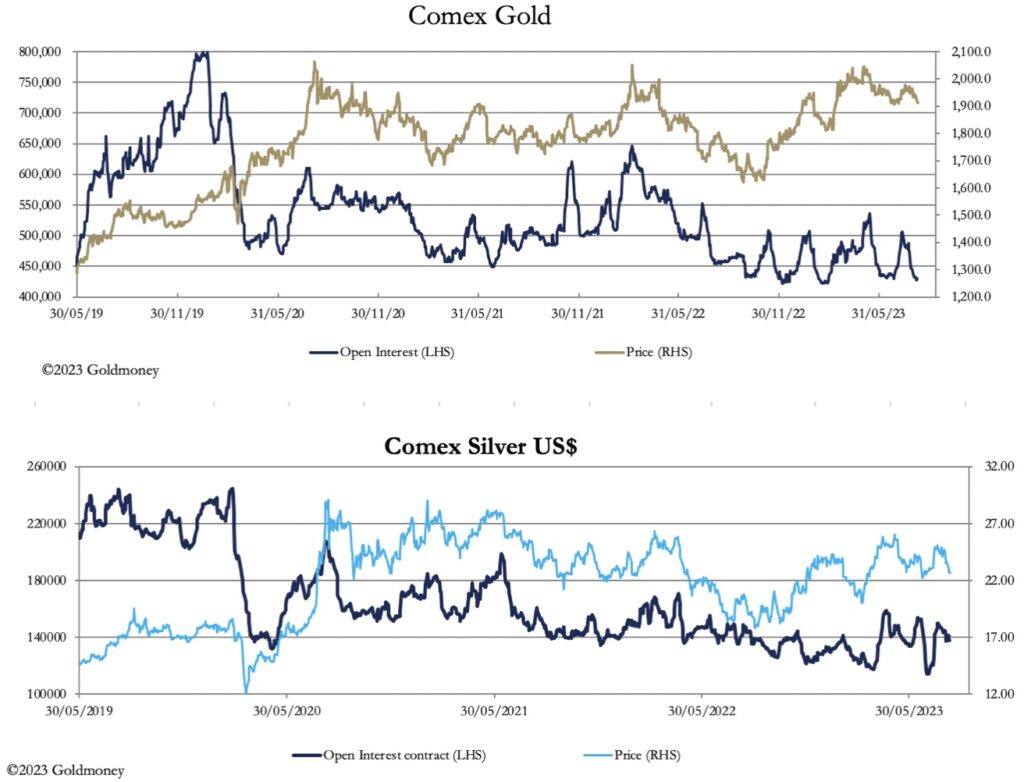

Open Interest on Comex for gold and silver contracts is shown in the two charts below.

Open interest in silver has recovered, and while the price appears to be driven by the gold relationship, this is evidence of strong support.

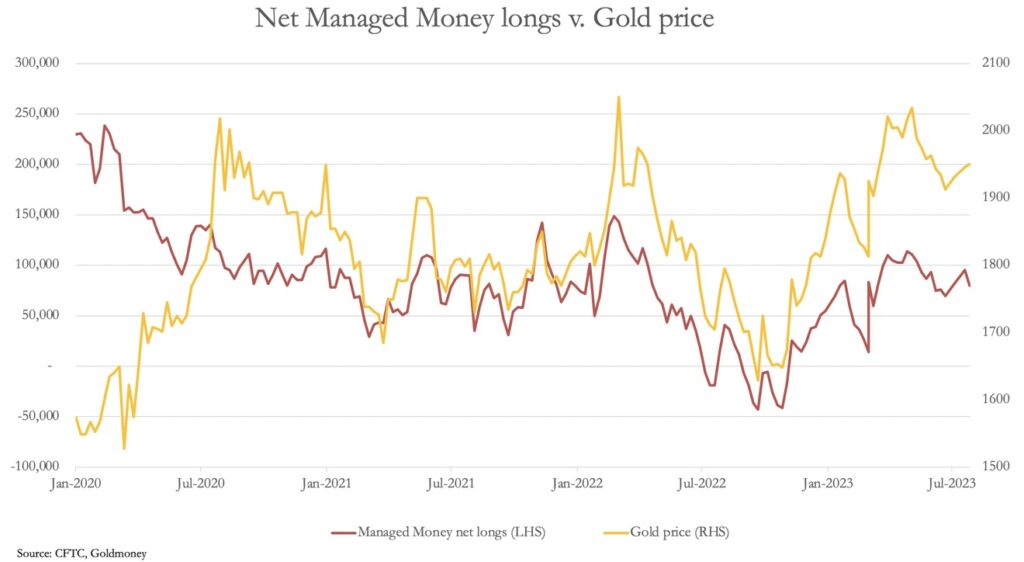

Open Interest in gold is close to four-year lows, yet the divergence with the gold price since 2020 is notable. In other words, attempts by the swaps, which are mainly bullion banks with continually short positions, to drive prices lower have failed. Another way of looking at this divergence is in the relationship between the net longs in the Managed Money category and the price, which is next.

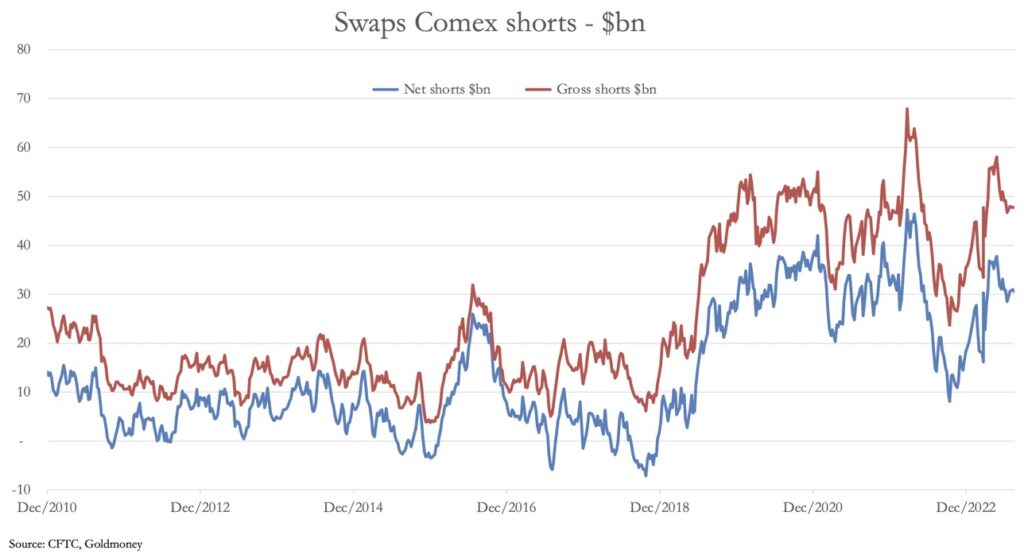

Since 2020, gold has been in a rising trend, while the MM net longs have declined and then moved sideways. This is also reflected in the gross and net values of the swaps’ shorts, which remain stubbornly high. This is next.

The Swaps’ incentive to drive prices lower is correspondingly great. It is in their interests to perpetuate the myth that the only thing that matters for the gold price is the yield differential between gold and dollars. And now we see energy prices beginning to rise strongly, undermining the gold price, supporting the dollar, and promising that high interest rates will persist.

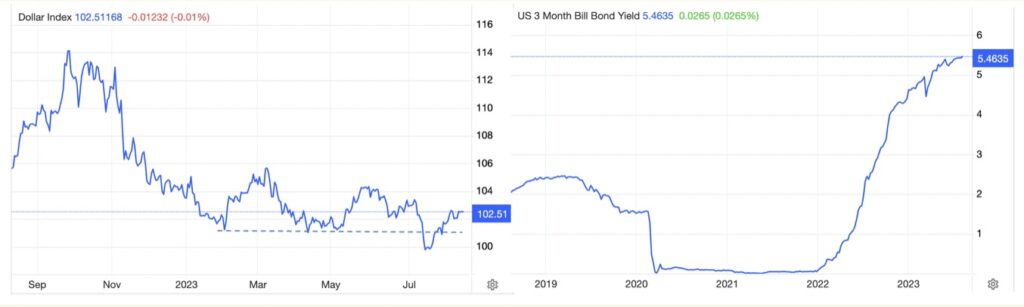

The next two charts illustrate the position.

The error made by central banks and the investment establishment is to not understand that interest rates are compensation for parting with money, currency, or the right to instant access to credit. Interest rates represent the market assessment of the future discounted value of a medium of exchange, to which foreigners are particularly sensitive.

Since gold retains its purchasing power over time, its discounted future value only reflects time preference and counterparty risk. The discounted future value for fiat currencies includes their anticipated loss of purchasing power, which is not only more material today than it was two years ago but increasingly so. There is, therefore, no connection in monetary or economic theory between the yield on gold and a fiat currency.

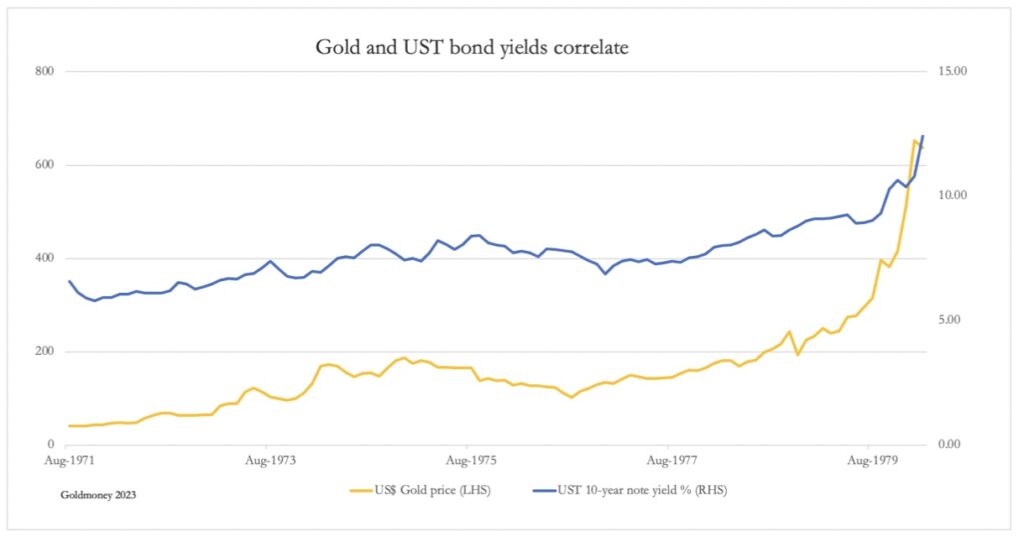

When inflation is persistent, both interest rates and gold rise at the same time, as the evidence from the 1970s clearly demonstrates.

Either way, the Swaps will eventually lose. If inflation falls as most expect, then there will be buyers on the basis of falling interest rates. But if inflation persists, gold will begin to discount the fall in the dollar’s purchasing power.

ALSO JUST RELEASED: Beware The Great Unwind And Full-Blown Collapse That Is Coming CLICK HERE.

ALSO JUST RELEASED: We Are Now Seeing Some Serious Deflation Indicating Collapse CLICK HERE.

ALSO JUST RELEASED: Celente – This Is Why The Gold Market Is Seeing Volatility CLICK HERE.

ALSO JUST RELEASED: Michael Oliver – Here Is The Setup In The Gold Market CLICK HERE.

ALSO RELEASED: Art Cashin – Bulls Need To Get Their Act Together Plus A Look At Inflation CLICK HERE.

ALSO RELEASED: What Is Happening With Wells Fargo Customer Bank Deposits Disappearing CLICK HERE.

ALSO RELEASED: The Fed Is Going To Pivot From Dis-Infllationary QT To Mega-Inflationary QE CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.