As we move through trading in the month of August, we are now seeing some serious deflation.

Real State Of The Economy

August 9 (King World News) – Peter Boockvar: For always an important tell on the US labor market, and one of my go to sources, ZipRecruiter reported earnings last night and this is what was said on the earnings call from CEO Ian Siegel:

“Employers continue to respond to the enduring macroeconomic uncertainty with caution. The number of job openings and employers’ willingness to pay for those job openings has been declining significantly from the peaks of 2021 and 2022. This trend is consistent among both SMB and enterprise customers alike, across multiple industries and geographies. We see this as a macroeconomically driven reality impacting companies across the recruiting space. This results in the continuation of an atypical hiring pattern.”

Their y/o/y revenue decline of 29%…

“is primarily reflective of a continued and accelerating softening in the hiring market. Quarterly paid employers were 102,000 representing a 35% decrease vs Q2 ’22 and a 4% decrease vs Q1 ’23. This is primarily reflective of weakness among small and medium sized businesses which make up the vast majority of our paid employers.”

Of particular importance,

“The speed of this deceleration is particularly noteworthy with July’s revenue being down approximately 31% y/o/y” and “it really accelerated towards the back end of July.”

And, ZIP is making it clear that this slowdown in hiring is not just a ZIP thing and not something specific to them.

“So, it seems very clear to us that this trend that we’re observing is something that is an external force as opposed to an internal problem.”

To further prove Siegel’s point that this is macro related,

“Our marketplace is rated number one by both job seekers and employers alike. And we have 80% aided brand awareness on both sides of that marketplace.”…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Bottom Line

Bottom line, the words expressed by Zip is the reality of their current business and the marketplace and it is really important to differentiate what is going on in the labor market. “The labor market is strong” that we hear echoed from many needs to be sliced and diced. The modest pace of firing’s and the desire of employers to hold on tight to many of their employees that they fought hard to get over the past few years is apparent. BUT, the pace of hiring’s is clearly slowing and this is now the 3rd quarter in a row that ZipRecruiter has warned of this. I would bet that the BLS payroll numbers when finally said done with all its revisions will reflect this more so than what has been reported so far, with a lot of that taking away all the birth/death model jobs that were magically added by the BLS.

With the business of UPS in the US disrupted by the strikes, this is what they said about their international businesses,

“macro conditions remained sluggish in the 2nd quarter. In Europe, persistent high inflation and tight financial conditions weighed on the consumer; and in Asia, the slow recovery we experienced in the first quarter stalled in the 2nd quarter.”

Specifically with the China to US corridor,

“Exports volume on the China to US lane was down 7% y/o/y, which was an improvement from the first quarter.”

Sealed Air is a major packaging company whose products you likely see every week and don’t even know it. They said this in their earnings call yesterday,

“Our guidance at the beginning of the year anticipated a V recovery in the 2nd half of 2023. Based on continued end market demand weakness compounded by destocking, we expect an L shape recovery through 2023 and then into 2024, reflecting a post Covid lower growth environment.”

As all economists have their forecasts for the economy and how it will progress next year too, Celanese, a large chemicals company whose products go into a lot of things, they have no idea. The CEO said in their earnings call,

“we really have no visibility into 2024 at this time. So, we don’t really know what demand is going to look like in 2024, if I had to guess, I’d say it’s going to be better than 2023, but we don’t know.”

As for the current situation

“we continue to navigate a persistently soft demand environment and volatile competitive backdrop.”

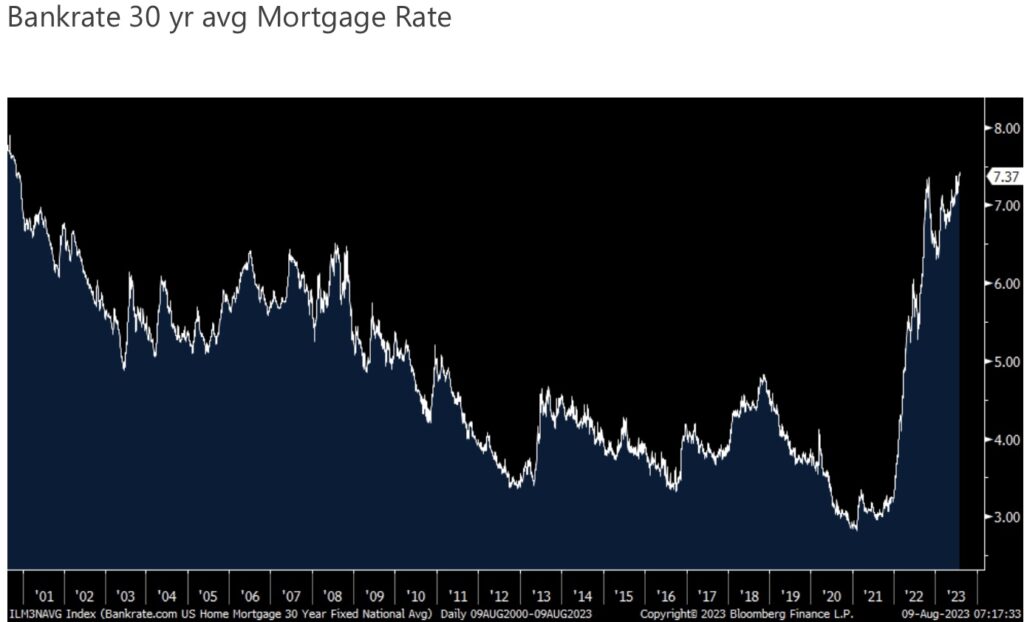

30 Year Mortgage Rates At Highest Level In 23 Years!

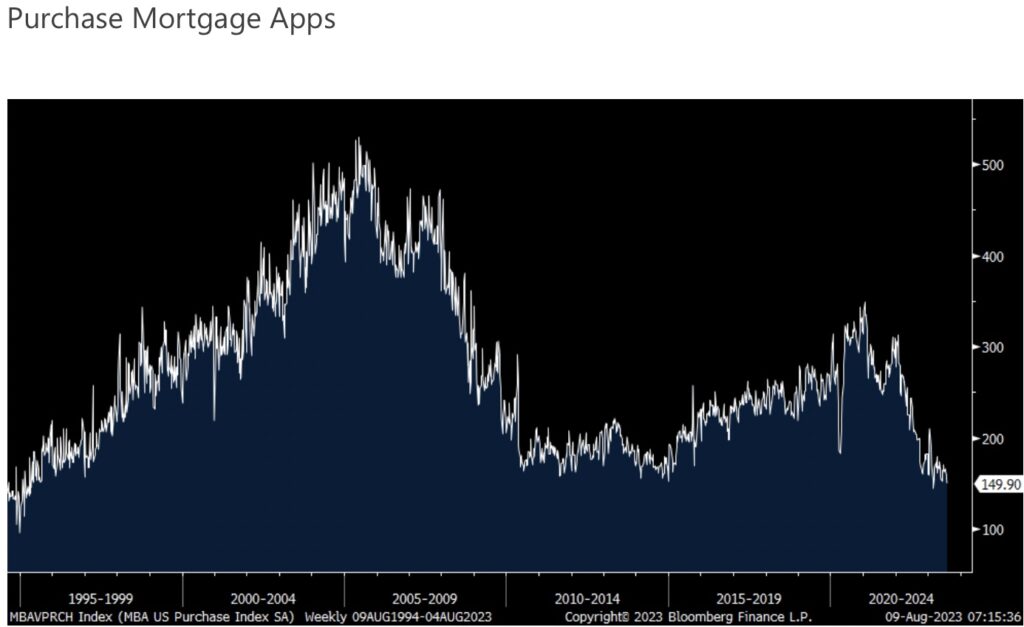

With the average 30 yr mortgage rate continuing higher to the highest level in 23 years with the move up in the US 10 yr yield, mortgage applications fell for the 4th straight week, by 2.7% w/o/w and down by 27% y/o/y. This is index is just 4 pts from the lowest level since 1995. Yes, 1995. The new and existing home market are like night and day right now.

Mortgage Applications To Purchase A New Home At Lowest Level In 28 Years (Since 1995)

Refi’s fell 4% w/o/w and by 37% y/o/y.

Deflation Is Good

‘China is in deflation’ is all I’m hearing this morning, like it’s a bad thing. I have a few things to say about this bogeyman. With respect to consumer prices, the per capita income in China is about $13,000 and thus ‘deflation’ is a tax cut for many in China that could use it. Should we root that they pay higher prices for things instead? Food prices fell 1.7% y/o/y and was the main reason for the .3% y/o/y headline CPI drop. Should we root that the Chinese pay higher food prices? Ex food and energy, consumer prices rose .8% y/o/y which happens to be a 6 month high in China.

As for PPI which fell 4.4% y/o/y, more than the estimate of down 4% but less than the down 5.4% seen in June, it is a symptom of the manufacturing recession in China, which is being experienced globally and the fact that many commodity prices are well off their highs. Once inventory restocking starts to take place and when, not if, commodity prices rise again, PPI will as well.

And the Chinese themselves don’t understand that at least for consumer price deflation it helps to RAISE real wages and is the equivalent of a tax cut, because they don’t want financial analysts using the word deflation. Over the last few years haven’t we learned the lessons of the evils of inflation? Deflation is NOT a boogeyman. It is ONLY for those that have too much debt but too much debt was going to suffocate them anyway at some point. In China, it is real estate developers and local governments that are the main entities that have too much debt. Deflation is not good for them.

We’re seeing a bounce in Italian banks after the government decided to cap the tax to a .1% of assets. The idea is still terrible but not as bad as initially feared. Unicredit and BPER are up about 4% and Intesa by 3%.

ALSO JUST RELEASED: Celente – This Is Why The Gold Market Is Seeing Volatility CLICK HERE.

ALSO JUST RELEASED: Michael Oliver – Here Is The Setup In The Gold Market CLICK HERE.

ALSO JUST RELEASED: Art Cashin – Bulls Need To Get Their Act Together Plus A Look At Inflation CLICK HERE.

ALSO JUST RELEASED: What Is Happening With Wells Fargo Customer Bank Deposits Disappearing CLICK HERE.

ALSO JUST RELEASED: The Fed Is Going To Pivot From Dis-Infllationary QT To Mega-Inflationary QE CLICK HERE.

To listen to James Turk discuss the short term and long term predictions for the US dollar, gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

To listening to Alasdair Macleod discuss what to expect from gold, silver and bonds CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.