There has been a lot of speculation about a potential Airbnb bust, but not yet. Plus a look at interest rates and real estate.

Rates Continue Higher

February 15 (King World News) – Peter Boockvar: On the day before the January payroll report a few weeks ago, the 2 yr yield closed at 4.11% and has tightened by 50 bps since. The 10 yr yield is up by 34 bps over the same time frame. The S&P 500 was at 4180 that day and has fallen just 1% since in the face of that. And it’s not just a rate vs stock look. Since that day too the earnings picture continues to soften. I was sarcastic last month saying that I ‘guarantee’ that about 70-75% of companies would beat the earnings estimates. I was wrong as just under 70% are exceeding those expectations and with very mixed guidance. Either the stock market at current levels believes that this rate move higher won’t last or it’s delusional in thinking it’s ok at the same time an earnings recession has begun.

The visual of the 6 month T-bill which we know is at 5%, and is just following the expectations for the fed funds rate, could very well be a chart of someone’s bipolar personality. Maybe after achieving some level of price stability, the Federal Reserve can find a way to reach some extended period of interest rate stability.

6-Month T-Bill Continues To Surge

Airbnb Bust…Not Yet

As for travel, which certainly has been an economic bright spot, here is what Airbnb said:

First, guest demand on Airbnb remains strong. Nights and Experiences Booked increased 20% in Q4. We had our highest number of active bookers ever in Q4, demonstrating guests’ excitement to travel on Airbnb despite evolving macroeconomic uncertainties. During the quarter, we also continued to see guests booking trips further in advance, supporting a strong backlog for Q1. Second, guests are increasingly returning to cities and crossing border…Third, guests continue to book longer stays on Airbnb.”…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

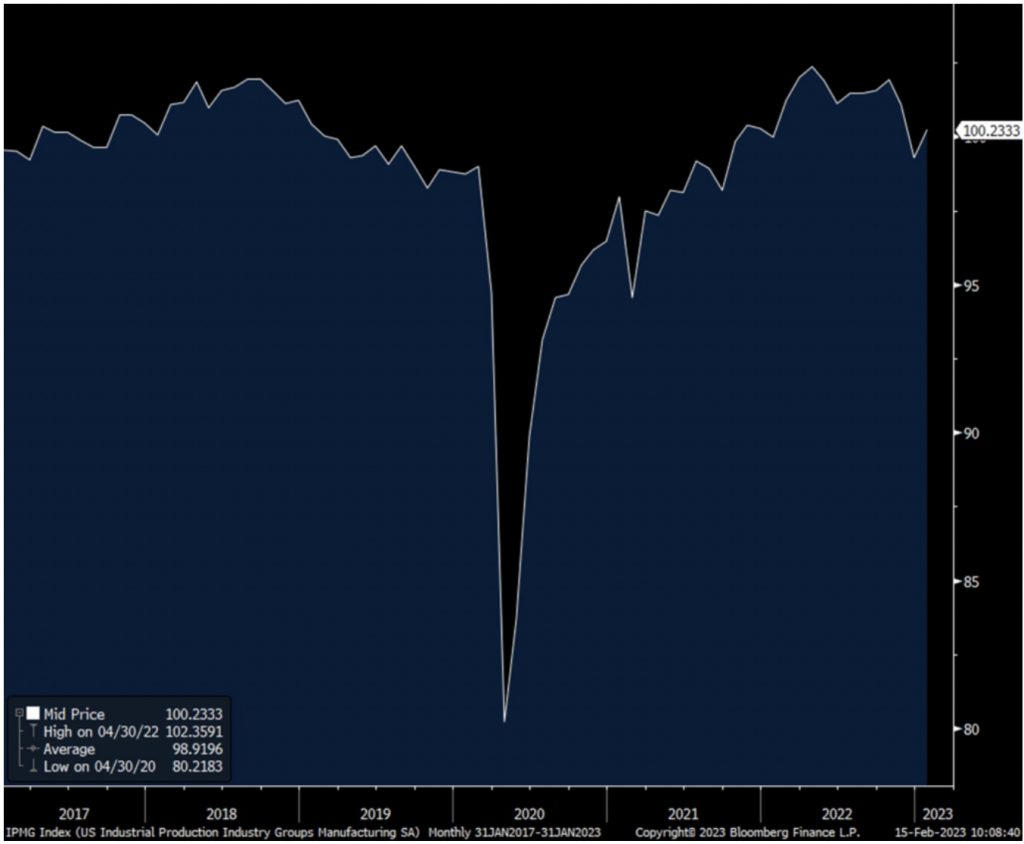

Industrial Production Weaker

Industrial production in January was weaker than expected, seeing no change from the 1% drop in December (revised down by 3 tenths). The estimate was for a bounce of .5% off that initial print in December. The main drag was the 10% drop in utility output which I’m guessing has a lot to do with the mild winter so far. Manufacturing was light relative to expectations if we include the December downward revision.

Manufacturing Production

Motor vehicle production rose .5% m/o/m after dropping in the two prior months. Machinery production and for computers/electronics both rose after dropping in the prior months. Mining production bounced after 2 months of declines.

Capacity utilization slipped one tenth m/o/m to 78.3% and that is the lowest since September 2021, highlighting the manufacturing recession we’re in. Not including one month last April, the manufacturing component of this index is still below where it was right before the 2018 manufacturing recession that took place, triggered by the China tariffs which disappointingly still exist and that US companies pay for.

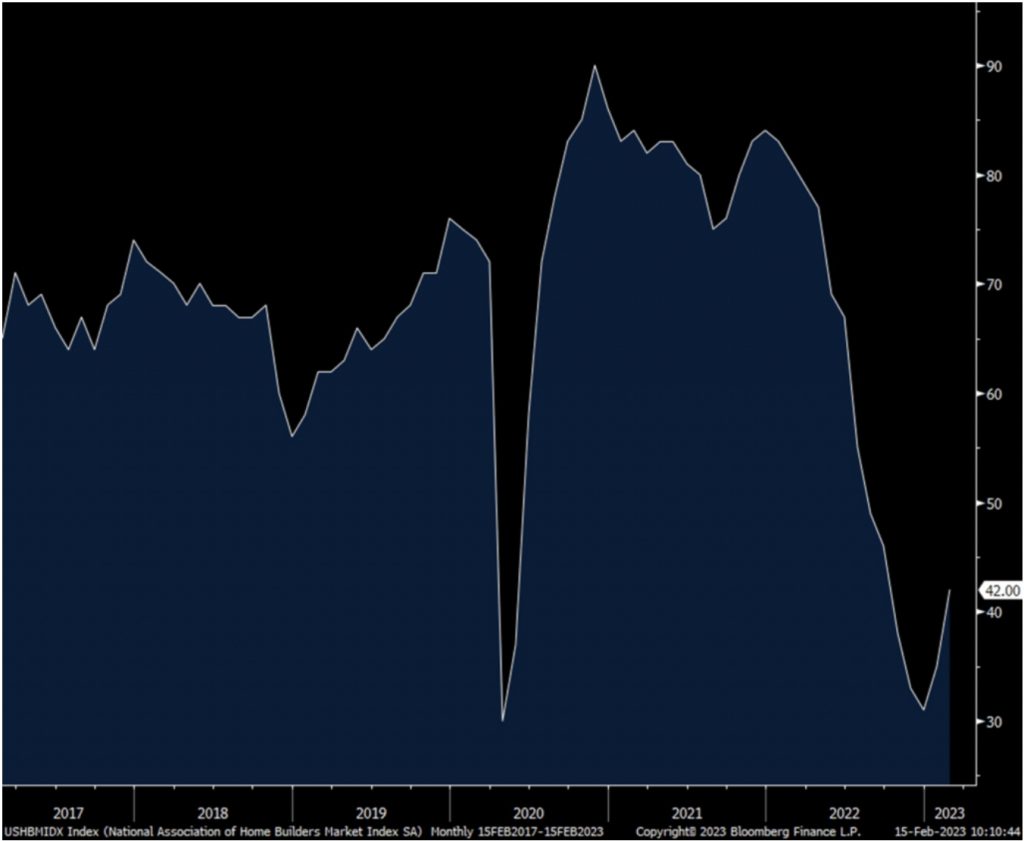

Homebuilder Sentiment

The February NAHB home builder sentiment survey rose 7 pts m/o/m to 42. That was 5 pts better than expected but still is below 50.

NAHB Remains Weak Below 50

The Present Situation rose 6 pts m/o/m to 46 and the Future Outlook was higher by 11 to just under 50 at 48. The Prospective Buyers Traffic component was higher by 6 pts but is still well under 50 at 29.

Buyers Traffic

Interest Rate Drop Has Helped

Bottom line, the drop in mortgage rates off its highs helped to lift builder sentiment. Also helping has been incentives that builders have employed such as rate buy downs that have brought in buyers. The NAHB did say though that those incentives eased in February as 31% of builders dropped price vs 35% in December. They said the average price decline was 6% vs 8% in December. Also, 57% of builders offered some kind of incentive in February vs 62% in December.

The bigger problem still remains for entry level homes and the delivery of them that first time buyers can afford, especially with a 6%+ mortgage rate. That is something that won’t be easily addressed anytime soon with elevated costs of labor, lots and materials.

ALSO JUST RELEASED: Celente – What Is Happening With Gold Demand In Russia And China Is Astounding CLICK HERE.

ALSO JUST RELEASED: More Fed Rate Hikes Coming, Plus Here Is A Look At Inflation And Car Prices CLICK HERE.

ALSO JUST RELEASED: Look At This Inflation, Plus Expect Higher Rates CLICK HERE.

ALSO JUST RELEASED: SPROTT: The Bull Market Nobody Is Watching In Its Early Stages CLICK HERE.

ALSO RELEASED: LOOK AT THIS: The Big Lie About Gold And The US Dollar CLICK HERE.

ALSO RELEASED: Greyerz – There Is A Financial Nuclear Event On The Horizon CLICK HERE.

ALSO RELEASED: THE END OF FIAT CURRENCIES: We Are Going Into A Post-Fiat Currency World CLICK HERE.

ALSO RELEASED: A Monster Rally In Gold And Oil May Be Directly In Front Of Us CLICK HERE.

To listen to James Turk discuss the post-fiat currency world CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the big surprise for the gold and oil markets as well as what other surprises are in front of us CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.