As we move through another wild trading week, here is a look at why gold is on target for $1,800, leverage 2008 vs today, bonds, oil, and what would be very bad news for the world.

Greenspan & Gold

September 5 (King World News) – Peter Schiff: “Today gold closed above $1,550 and silver closed above $19.50. Yet despite the steady rise, and the fact that both metals remain cheap relative to the outlook for global money supply growth and negative interest rates, retail investors largely remain absent. This rally has legs!”…

IMPORTANT:

To learn which junior explorer may be about to report some of the best drill holes in the world CLICK HERE OR ON THE IMAGE BELOW

Sponsored

Sponsored

Leverage 2008 vs Today

Lawrence McDonald, Former Head of Macro Strategy Society Generale: “Got Leverage?

2008

Lehman 44-1

Bear Stearns 47-1

Fannie and Freddie 64-1

2019

PBOC China 99-1

Federal Reserve 79-1

China Banks 49-1

Hard To Believe

Sven Henrich: “Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this”.

Greenspan Lies…Again

Peter Schiff: “On CNBC Alan Greenspan just claimed that over his long lifetime the bureaucrats who work at the Fed have called the movements of the U.S. stock market better than anyone else in the world. If this is true, why haven’t they all quit to become billionaire hedge fund managers?”

Leverage 2008 vs Today

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab & Co.: “The United States now has the only interest rate in the developed world that’s north of 2% (see below).

US Is Now The Only Developed Country In The World With Interest Rate North Of 2%

What Will This Mean For The Rest Of The World?

Here are 3 important charts from top Citi analyst Tom Fitzpatrick:

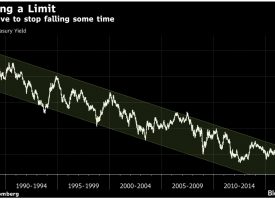

WARNING: US 10-Year Treasury Yields May Go Negative Soon And 30-Year Yields May Tumble Close To Zero

If Crude Oil Breaks $50, Look Out Below

Gold Bullish Targeting $1,800 While Copper Struggles

And finally…

$1,550 Gold

Eric King: “John, although K92 has had a pullback after a huge run, the underlying cash flow for the company has to be exploding with the price of gold near $1,550.”

$100 Million Of Profit, All-In Sustaining Costs Below $700

John Lewins, CEO: “The PEA shows that our all-in sustaining costs will be below $700 an ounce. And so when you are sitting with over $1,500 an ounce as the gold price, K92s margins are pretty substantial at well over $800 an ounce. And going forward, with the ramp up in production and the decrease in the all-in sustaining cost to produce, at these metals prices our long term shareholders understand that we will be generating a lot of cash. With production for 2020 slated to be 120,000 ounces of gold, at $1,500 gold we are talking about roughly $100 million of net profit.

Mining Friendly Country

And, Eric, we are talking about a very mining friendly country that is already working with Barrick Gold and others to renew their mining licenses. This is a country that is saying very categorically that they want mining development, they want companies coming in and creating jobs and opportunities for economic growth. Our license isn’t even up for renewal until 2024, so the recent reaction in our share price over this issue was ridiculous.

Rapidly Expanding High-Grade Gold Production

We also have 6 drill rigs operating and results pending, and this year every single hole has been hitting the vein system, which demonstrates how robust this high-grade gold system really is. This large scale drill program has us in a position to shortly announce a new resource estimate, which will lead to an updated PEA that will be the catalyst for us to expand production beyond the 120,00 ounce production target that is already underway. So the current pullback in the share price represents a huge buying opportunity for those looking to take advantage of what we anticipate will be temporary weakness in the stock before the share price heads to new all-time highs.” K92, symbol KNT in Canada and KNTNF in the US.

$1,000 Silver, China’s 50-1 Leveraged Banks, Plus Highest In 40 Years

READ THIS NEXT! $1,000 Silver, China’s Banking System Leveraged Nearly 50-1, Plus Look At What Just Hit The Highest Level In 40 Years CLICK HERE TO READ

More articles to follow…

In the meantime, other important releases…

“Poison” For The Entire Global Financial System Is Spreading CLICK HERE TO READ

$2,764 Gold, What A Summer For Silver, A Crazy World, Plus Chart Of The Day CLICK HERE TO READ

Silver Surges 5% And Gold Rallies Near $1,550 As Stocks Tumble But Here Are The Big Surprises CLICK HERE TO READ

We Are Now Reaching The Monetary Policy Endgame CLICK HERE TO READ

© 2019 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged