As we move through the first half of February, one thing is certain, more Fed rate. hikes are coming. Plus a look at inflation and car prices.

Inflation

February 14 (King World News) – Peter Boockvar: January headline CPI rose .5% m/o/m and .4% core just as expected and follows the revisions done for 2022. The y/o/y gains are 6.4% headline and 5.6% core. We also know that this year the BLS has changed how they calculate CPI and that is using just a one year comparison rather than two. Why they are changing the rules of the game, I’m not sure but PCE will not be altered in its calculation.

Energy prices rebounded by 2% m/o/m and are up 8.7% y/o/y. Food prices continue to be robust, rising by .5% m/o/m and 10.1% y/o/y. I want to highlight here that Fed Governor Waller made a point last week that he’s focused on headline inflation and not core.

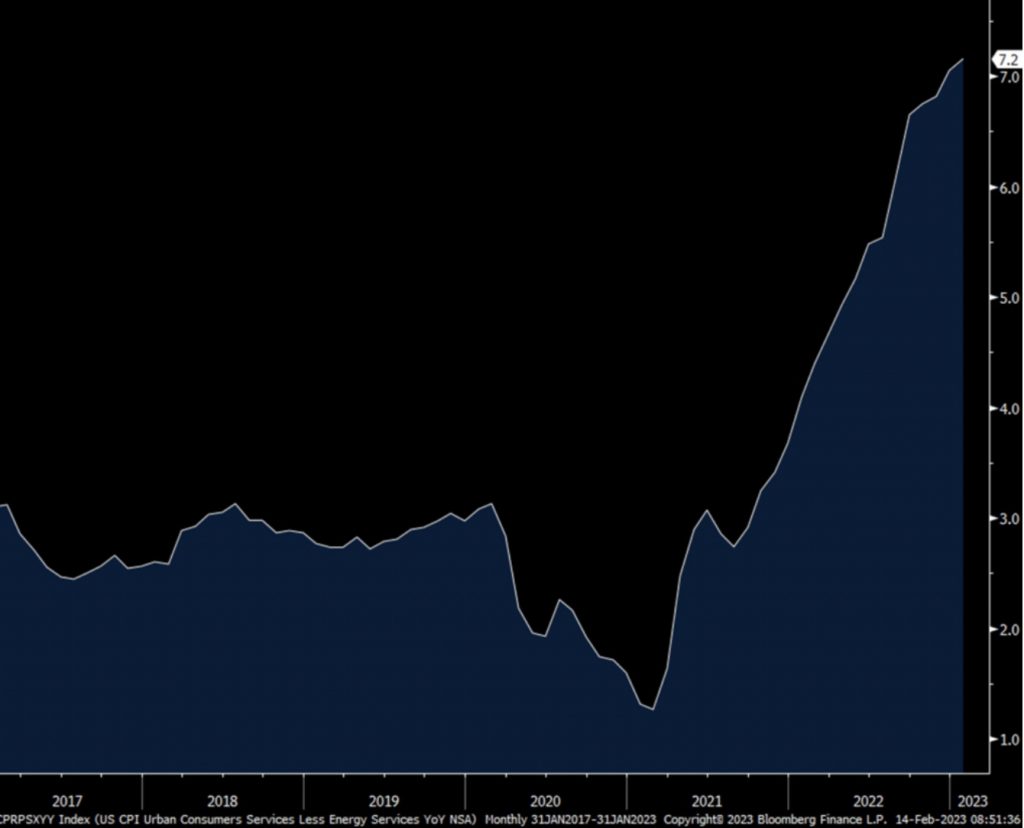

Core services inflation rose .5% m/o/m and 7.2% y/o/y as rents, in a much delayed fashion, continues to accelerate higher (though that should slow notably in the coming quarters as we know).

Services ex Energy Year-Over-Year

OER was up .7% m/o/m and 7.8% y/o/y. Rent of Primary Residence was also up by .7% and by 8.6% y/o/y. Medical care was a drag on the figure as prices fell .4% m/o/m, though up 3.1% y/o/y. Lower health insurance prices, for the quirk calculation stated here months before, was the main drag, falling 3.6% m/o/m. Prices for car insurance jumped by 1.4% m/o/m and almost 15% y/o/y. Fixing one’s car saw a price gain of 1.3% m/o/m and 14.2% y/o/y. Airfares cooled again by 2.1% m/o/m but are still up 25.6% y/o/y. Hotel prices jumped 1.5% m/o/m and by 8.5% y/o/y. Tuition prices rose .3% m/o/m and 3.4% y/o/y.

After a steady string of disinflation, core goods prices rose .1% m/o/m but the y/o/y pace slowed to just 1.4%.

Core Goods Prices Year-Over-Year

Car Prices

Used car prices again saw price declines of 1.9% m/o/m and by 11.6% y/o/y. New car prices though rose again by .2% m/o/m and 5.8% y/o/y. When all is said and done with auto prices, new car prices will remain elevated because the OEM’s are intent on not flooding dealers with inventory anymore. And, three years of limited new car sales means there will be a lot less used car inventory in the few years to come. Apparel prices rose .8% m/o/m and 3.1% y/o/y. While the housing market has obviously slowed with the pace of transactions, the prices of ‘household furnishings and supplies’ continue higher and in January rose .5% m/o/m and 6.4% y/o/y…

ALERT:

This company is about to start drilling what could be one of the largest gold discoveries in history! CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Bottom Line

Bottom line, further acceleration in core services prices offset the continued drop in core goods prices. For the latter, the 1.4% y/o/y gain is the slowest since February 2021. And for perspective, in the 20 years leading into covid this figure averaged ZERO. I’ll argue that when the inflation dust settles, we are NOT going back to zero and something around 1-3% will be the norm. Yes, technology here is a deflationary force but it has been since the beginning of time. Higher labor costs globally and just in case inventory are the main reasons for my prediction in addition to what I said on vehicles.

As for services, rents in real life are slowing down to a pace of 3-4% so the BLS continues to play catch up to what has already happened. But after this deceleration runs its course, the high cost of buying a home will keep rent demand pretty healthy, partly offset by rising supply. In the 20 years leading into covid, core services prices grew by 2.8% per annum and I believe a higher pace in wage growth than pre Covid will likely raise this sticky rate to 4-5% I believe. The net result combining services and goods inflation will result in 3-4% inflation rather than1-2%.

The 2 yr yield just before the print was 4.5% vs 4.53% as of this writing. The 10 yr yield is at 3.69% vs 3.68% just before. The dollar is weaker but little changed since the number release.

More Fed Rates Hikes Coming

As for the Fed, they will do as they’ve said over the past few weeks, hike two more times and then keep the fed funds rate above 5% all year. The terminal rate ticked up 3 bps in response to the data to 5.22%. We are in a higher rate environment for longer and I don’t think many have accepted this new reality and the economic and market implications. Big picture, this is a good thing vs the monetary fantasyland we lived for many years but there is always a withdrawal period that will take time to get through.

ALSO JUST RELEASED: Look At This Inflation, Plus Expect Higher Rates CLICK HERE.

ALSO JUST RELEASED: SPROTT: The Bull Market Nobody Is Watching In Its Early Stages CLICK HERE.

ALSO JUST RELEASED: LOOK AT THIS: The Big Lie About Gold And The US Dollar CLICK HERE.

ALSO JUST RELEASED: Greyerz – There Is A Financial Nuclear Event On The Horizon CLICK HERE.

ALSO RELEASED: THE END OF FIAT CURRENCIES: We Are Going Into A Post-Fiat Currency World CLICK HERE.

ALSO RELEASED: A Monster Rally In Gold And Oil May Be Directly In Front Of Us CLICK HERE.

To listen to James Turk discuss the post-fiat currency world CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the big surprise for the gold and oil markets as well as what other surprises are in front of us CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.