This bull market virtually nobody is watching is in its early stages and fortunes will most likely be made.

A Bull Market In Its Early Stages

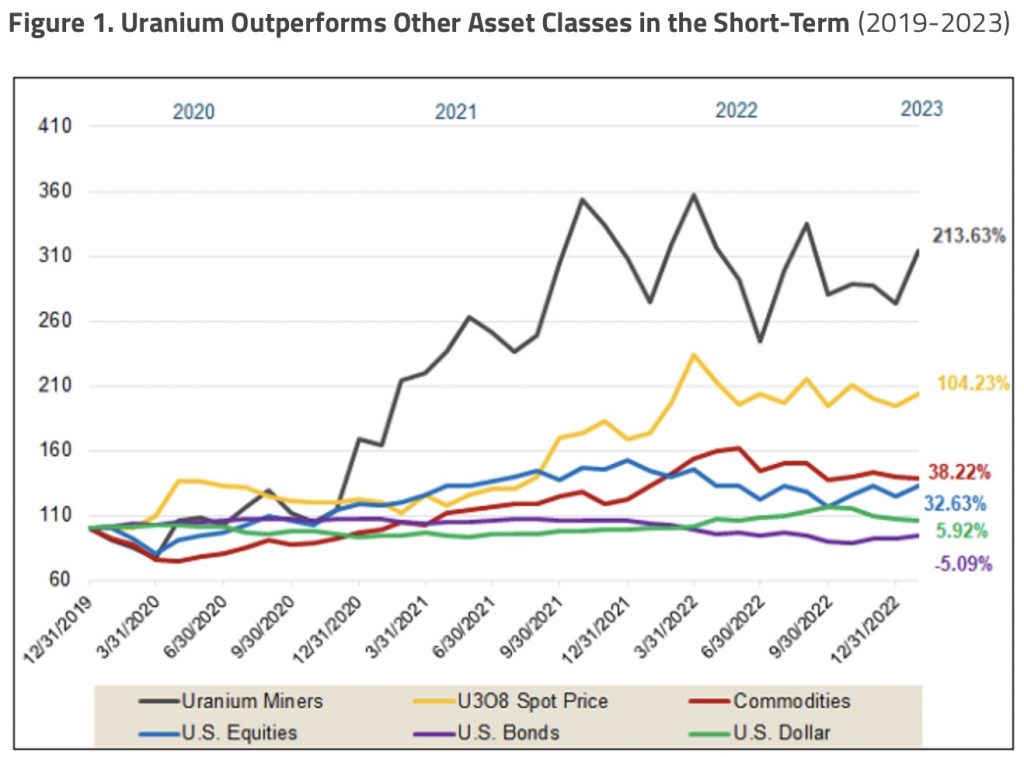

February 13 (King World News) – Jacob White at Sprott Asset Management: January was a strong month for uranium markets, along with the broad equity and bond markets, but a mixed month for the commodity complex overall. The U3O8 uranium spot price rose from $48.31 to $50.75 per pound in January, a 5.05% increase, while uranium mining equities gained 14.65%.

For the U3O8 uranium spot price, this marked a continuation of notable performance, having appreciated 14.74% in 2022 and 104.23% since December 31, 2019. January’s strong performance for uranium mining equities reflects a reversal of their 11.42% decline in 2022. The recent strength of uranium miners represents a return to their pre-2022 notable performance; for the period December 31, 2019, to January 31, 2023, uranium equities have gained 213.63%.

Lifting Headwinds and Stronger Government Support

In 2022, the fundamentals for uranium and nuclear energy significantly strengthened and were bolstered by a continuous flow of endorsements from global governments. Despite this, uranium mining equities were dragged down in 2022 by their systemic risk to the overall markets, not surprising given last year’s bear market in which the S&P 500 Index fell 18.11%.

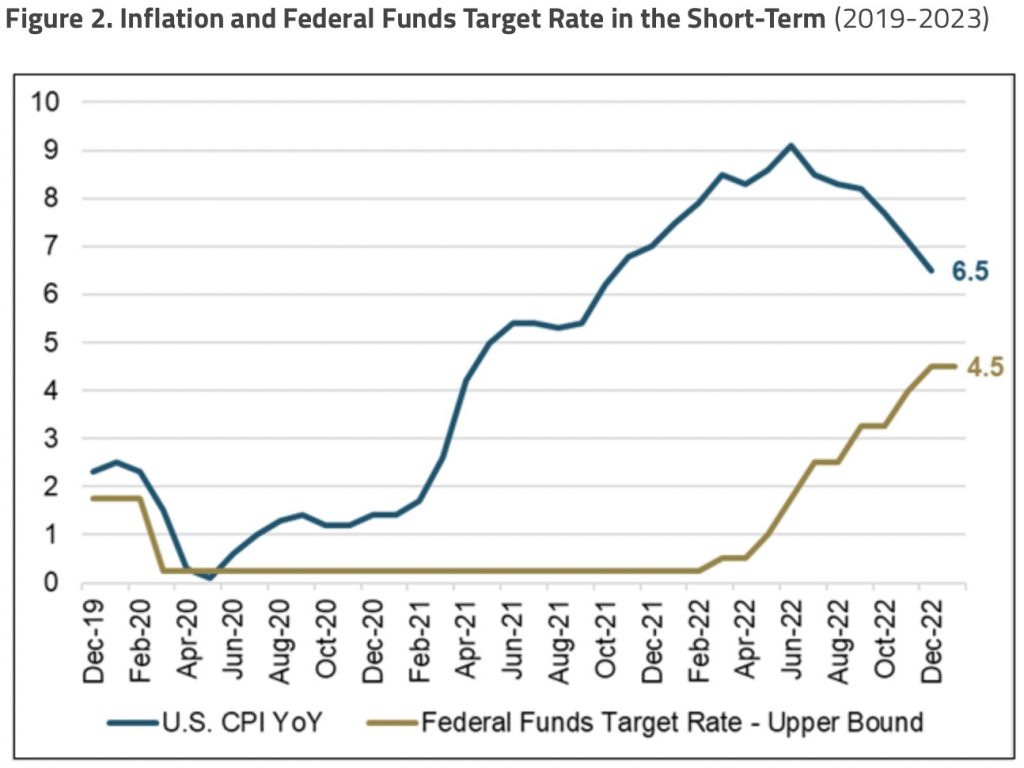

January marked a pivotal month in shifting investor sentiment and diminishing headwinds for equity markets, which supported the surge in uranium mining equities. A combination of the “January Effect”, lessening fears that the U.S. economy is heading toward recession and declining inflation, buoyed markets. Markets began their move higher on January 6 when the December U.S. Jobs Report showed wage growth was below expectations, and indication that inflation pressures may be weakening. This eased concerns that Federal Reserve would continue its aggressive interest rate hikes. Market anxiety over Inflation and rate hikes further quelled on news that the year-over-year U.S. consumer price index fell from 7.1% in November to 6.5% in December.

In January, other market headwinds that dominated 2022 reversed course and helped to boost asset prices. Most notably, Europe’s anticipated energy crisis was mitigated by warmer weather, and China reversed its long-standing zero COVID policy and reopened its economy. The reduction in these headwinds helped uranium mining equities flourish in January. We continue to believe the strong underlying fundamentals of the uranium sector will provide long-term structural support for uranium and uranium miners in the remainder of 2023.

January was also characterized by growing recognition by global governments that nuclear energy plays a vital dual role by supporting the energy transition and enhancing energy security. Belgium continued its U-turn on nuclear energy by extending the life of two nuclear reactors for 10 years — a tremendous policy change given that Belgium had planned for a complete nuclear phase-out by 2025. Sweden announced that it is preparing legislation to remove the rule that caps the number of nuclear reactors and prohibits new reactor construction in new locations, a noteworthy U-turn given the number of Swedish reactor closures over the past years. Finally, South Korea announced that it downgraded its plans for renewable energy in favor of nuclear energy, increasing its nuclear power goals from 24% to 33% of its total energy mix.

Positive Macro Outlook for Uranium and Nuclear Power

Looking beyond January, we believe the uranium bull market still has a long way to run. Over the long term, increased demand in the face of an uncertain uranium supply is likely to support a sustained bull market. For investors, uranium miners have historically exhibited low/moderate correlation to many major asset classes, providing portfolio diversification potential.

Nuclear energy and uranium’s critical role in energy security may likely be paramount going forward. Russia’s invasion of Ukraine sparked a global energy crisis that forced many countries to reimagine their energy supply chains. In past years, Western countries’ energy policies have predominantly favored renewable energy as a way to reduce reliance on fossil fuels. However, renewables often suffer from intermittency and low capacity, and require offsets with base load energy sources, such as coal, natural gas or nuclear power plants. Of these, nuclear power has the highest base load capacity. We believe ongoing supply chain disruptions may likely cause utilities to seek out the base load reliability of nuclear power…

To Find Out Which Uranium Company Is Positioning Itself To Become A Powerhouse In Nevada Click Here Or On The Image Below.

Prices for uranium conversion and enrichment services more than doubled in 2022, a significant outperformance relative to the U3O8 uranium spot price. We believe this upward price pressure will support the uranium spot price. While Russia accounts for a small portion of U3O8 production at 6% of the global total, it controls about 27% of the global uranium conversion capacity and 39% of fuel enrichment. Although there have yet to be sanctions on either Russian uranium or conversion and enrichment services, and legacy contracts are being honored, utilities are not signing any new contracts with Russian entities. In response, Western countries are investing in and supporting the expansion of local conversion and enrichment capacity.

U.S. Restart of ConverDyn in 2023

A key development expected in the first half of 2023 is the restart of the U.S.’s only domestic conversion facility, ConverDyn. This shift to Western conversion and a lack of enrichment capacity is the bottleneck for higher uranium demand. Once new conversion capacity comes online, we anticipate an industry shift from underfeeding to overfeeding (using more UF6 as feedstock to produce more enriched uranium) should significantly increase uranium demand in 2023 and beyond, which is ultimately supportive of uranium miners. Further, “available for sale” uranium inventories have mostly been sold and may likely not act as a significant source of secondary supply as in the past couple of years.

The energy transition movement is structural and we believe that nuclear energy is a crucial solution for decarbonizing the global energy supply. Growing global recognition by governments, catalyzed by the need for greater energy security, is likely to continue to be a dominant theme. In the U.S., the Inflation Reduction Act, Civil Nuclear Credit Program and the U.S. Federal Strategic Uranium Reserve will provide financial support to nuclear power plants, allowing them to compete more effectively with other energy sources. We also expect to see continued progress toward the build-out of new nuclear reactors in China and India (the world’s two largest countries by population).

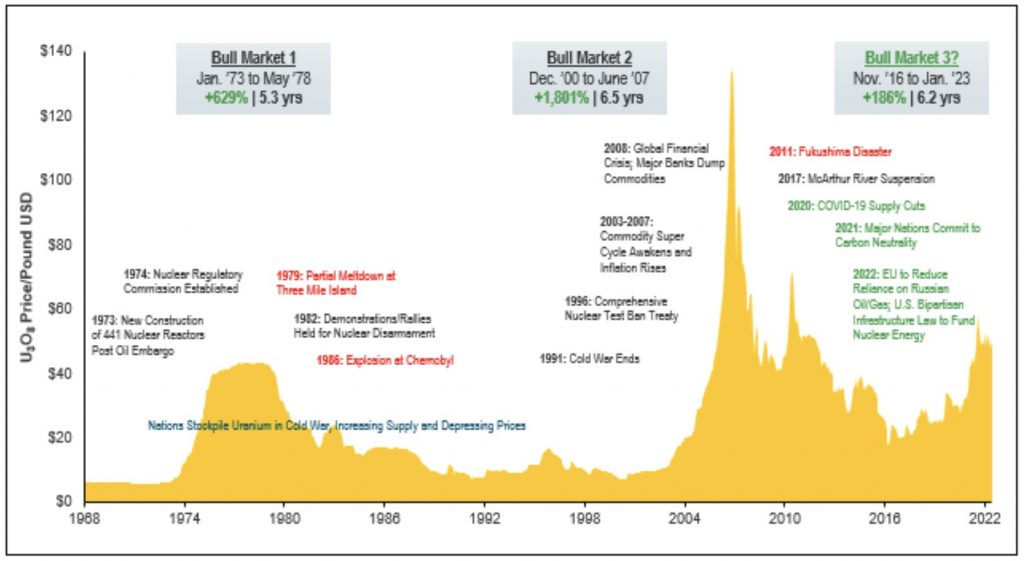

Uranium Bull Market Remains Intact

We believe the uranium bull market remains intact despite the uncertain macroeconomic environment. There has been an unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are likely to create incremental demand for uranium. However, the current uranium price still remains below incentive levels to restart tier 2 production, let alone greenfield development.

Figure 3. Uranium Bull Market Continues (1968-2023)

To listen to James Turk discuss the post-fiat currency world CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the big surprise for the gold and oil markets as well as what other surprises are in front of us CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: LOOK AT THIS: The Big Lie About Gold And The US Dollar CLICK HERE.

ALSO JUST RELEASED: Greyerz – There Is A Financial Nuclear Event On The Horizon CLICK HERE.

ALSO JUST RELEASED: THE END OF FIAT CURRENCIES: We Are Going Into A Post-Fiat Currency World CLICK HERE.

ALSO JUST RELEASED: A Monster Rally In Gold And Oil May Be Directly In Front Of Us CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.