With the price of gold rallying today along with the US dollar, big concerns are centered around the global economic slowdown.

Gold Surging

June 23 (King World News) – Graddhy out of Sweden: The inverse correlation Gold vs US dollar can be strong shorter term, but longer term it is not an issue, as this ratio chart shows. When this breakout happens, the opportunity will be generational, a rare event that does not come around many times during a lifetime.

GOLD BLASTOFF COMING:

Once In A Generation Opportunity In Gold

Dr. Copper’s Big Bull Market

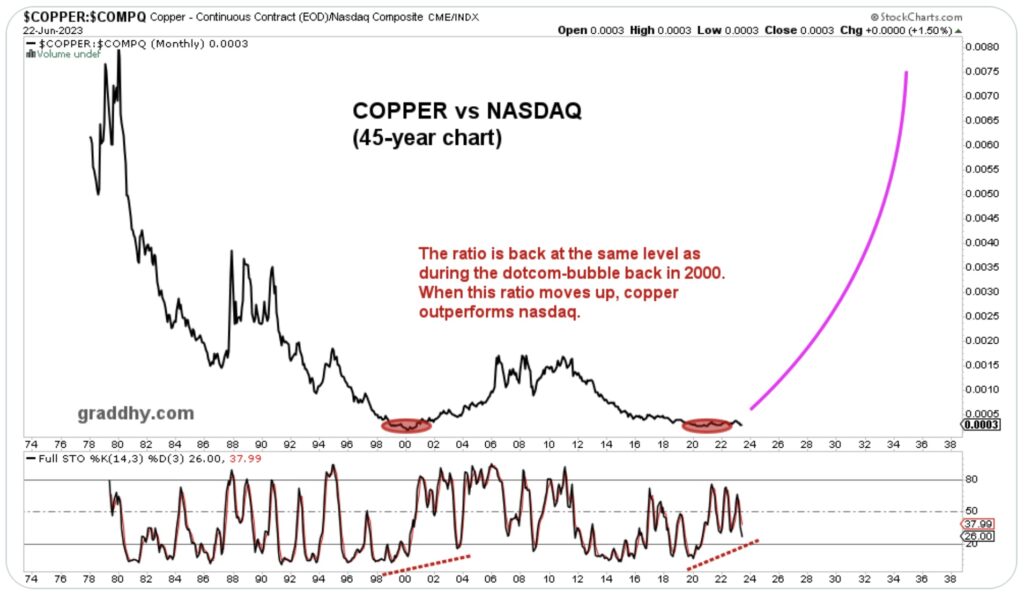

Graddhy out of Sweden: Big, global inflation always starts with, and is driven by, commodities. This chart shows how undervalued copper is (hard asset), and how overvalued Nasdaq is (paper asset). When this chart starts to move, the 2nd inflationary wave starts.

Copper Will Radically Outperform NASDAQ

The Global Economic Slowdown Is Here

Peter Boockvar: Growth concerns are the worry this morning with June PMI’s in Japan, Australia, the Eurozone and in the UK all declining m/o/m. Japan’s manufacturing PMI fell back below 50 at 49.8 and its service sector saw its index down by 1.7 pts m/o/m to 54.2. The composite of 52.3 is a 4 month low and “The softening of growth momentum fed through to reduced optimism around the outlook, with business confidence slipping to a 5 month low.”

Australia’s composite PMI fell to 50.5 from 51.6 with manufacturing at 48.6 vs 48.4 and services dipping to 50.7 from 52.1. Also, “the level of business confidence fell to the weakest since April 2020 amid concerns over interest rates and the economic outlook.”

The June Eurozone PMI fell to just above 50 at 50.3, down from 52.8 in May and under the estimate of 52.5. Manufacturing fell further below 50 at 43.6 from 44.8 and services dropped to 52.4 from 55.1. Services in France did decline below 50, along with its manufacturing sector. Price pressures continued to moderate as a result for both goods and services, though still remains high for the latter. S&P Global said “Eurozone business output growth came close to stalling in June…After Eurozone GDP fell for the 2nd time in a row in the first quarter, the probability has increased somewhat that the GDP change will again carry a negative sign in the current quarter, due in part to weak services activity in France.”

The UK composite PMI fell to 52.8 from 54 and below the forecast of 53.6 with manufacturing down to 46.2 from 47.1 and services lower by 1.5 pts m/o/m to 53.7. S&P Global said “The UK economy has lost momentum again after a brief growth spurt in the spring, and looks set to weaker further in the months ahead. Most notably, consumer spending on services, which was a core growth driver in the spring, is now showing signs of faltering as the reality of higher interest rates, the increased cost of living and gloom about the outlook sets in and overrides the brief boost to spending enjoyed from the pandemic tailwind. The manufacturing sector meanwhile continues to report recessionary conditions.”…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

US Dollar Rallies And A Big Problem For Bank Of Japan

The net result has the yen, Aussie$, euro and pound all lower vs the US dollar. And in Europe, sovereign bond yields are all falling sharply and in turn is helping US Treasuries to rally.

Separately, and a big problem for new BoJ Governor Ueda, core/core CPI in Japan in May rose 4.3% y/o/y, a fresh 42 yr high and up from 4.1% in April and one tenth more than anticipated. Notwithstanding the upside and maybe because the headline print of 3.2% was down from 3.5% in the month before, but as expected, JGB yields were little changed overnight as was the 10 yr breakeven. Ueda is running out of reasons to maintain negative rate policy and YCC.

Meanwhile In The US

Back in the US, yesterday’s jobless claims number wasn’t the only signs seen this week of labor market softness. The Philly non manufacturing activity index for June out a few days ago saw its Full Time Employment component plunge to -14.3 from +14.9. The Part Time Employment component dropped to -8.8 from -1.3. Yesterday in the KC manufacturing index, the employment index fell to -12 from +7 and that’s the weakest since 2016 not including Covid. The labor market is the last leg of the stool holding the US economy up and it’s getting wobbly.

The Fed’s balance sheet shrunk by $26b in the week ended Wednesday to $8.362 trillion and that is just above the $8.342 level it stood at just before SVB went down. The liquidity tide, for other reasons too, is no longer the markets friend.

We know leisure, hospitality, travel, and dining has been the strong part of the US economy. Here are some things Darden, owner of Olive Garden, LongHorn Steakhouse, Yard House, Ruth’s Chris, The Capital Grille and some others, said in its call yesterday:

“the consumer seems pretty strong overall, and within the restaurant industry and based on our internal and external data sources, there appears to be only minimal switching between lower priced occasions at this point, not a whole lot of switching, but some. And overall, we’re not seeing anything concerning.”

“What I will say, as you think about mix, we’ve talked about this before, we’re not seeing material changes in our check trends across our core casual brands…but one area we’re seeing a little bit of check management is with alcohol sales, primarily at our higher end brands.” They did follow this up by thinking that some of this is due to tough comps as “there was probably a little bit of euphoria in check last year.”

With respect to Accenture’s earnings, they specifically cited a slowdown in “small deal sales, especially in Strategy & Consulting, and systems integration” along with “lower than expected results in communications, media, and high tech industry group for the quarter.” Growth was seen in their US federal business, health and utilities. There of course was plenty of AI talk during the call…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Trouble Brewing In Auto Sales And Credit

CarMax is trading up this morning after earnings but they did say in their earnings release today that “We believe vehicle affordability challenges continued to impact our first quarter unit sale performance, as headwinds remained due to widespread inflationary pressures, higher interest rates, tightening lending standards and prolonged low consumer confidence. Total retail used vehicle revenues decreased 14.4% compared with the prior year’s first quarter, driven by the decrease in retail used units sold as well as a decrease in average retail selling price, which declined approximately $1,600 per unit, or 5.5%.”

In terms of credit quality, “As of May 31, 2023, the allowance for loan losses was 3.11% of ending managed receivables, up from 3.02% as of February 28, 2023. The increase in the allowance percentage primarily reflected the effect of unfavorable performance within CarMax Auto Finance’s portfolio as well as the uncertain macroeconomic environment. CAF has continued to tighten its underwriting standards in response to the current environment.”

ALSO JUST RELEASED: $248 Price Target For Silver, Plus The Big Reversal And Something Not Seen In 31 years CLICK HERE.

ALSO JUST RELEASED: Look At What They Are Dumping To Buy Dips In Gold, Plus More Inflation On The Way CLICK HERE.

ALSO JUST RELEASED: Focused On Major Gold & Silver Bottom As Putin Declares “Beginning Of The End” For US Dollar CLICK HERE.

ALSO JUST RELEASED: THE FUTURE: Human Flesh For Fantasy And The Rise Of AI CLICK HERE.

ALSO JUST RELEASED: Crude Oil Will Soar To At Least $250-$350 And The “Perfect Gold Storm Surge” Will Skyrocket To $10,000-$15,000 CLICK HERE.

ALSO JUST RELEASED: Ignore The Gold & Silver Takedown And Look At These Surprises CLICK HERE.

ALSO JUST RELEASED: Peak Cheap Gold And A World In Chaos CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.