Here is the latest as the war in the gold and silver markets continues to rage.

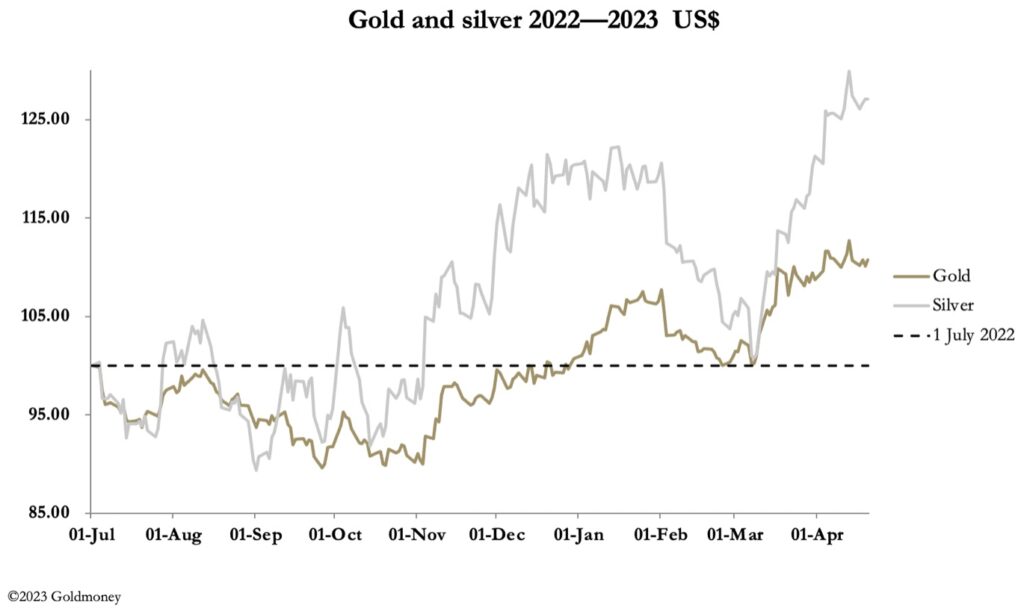

April 21 (King World News) – Alasdair Macleod, head of research at Goldmoney: Gold and silver continued their consolidation this week, with gold down $17 from last Friday’s close at $1986 in European trading this morning. And over the same timescale, silver was down 24 cents at $25.07.

On Comex, turnover in the gold contract was low, with 95,300 ounces (2.96 tonnes) stood for delivery in the first four days, while turnover in silver was healthier.

This week, the Silver Institute released its annual World Silver Survey. It headed its introduction by stating, “Once again, 2022 was a year of sharp contrast between silver’s fundamentals and institutional investor attitudes towards the metal; while the silver market saw what may have been the largest deficit on record, professional investors were indifferent or bearish for much of the year.”

On the Silver Institute’s figures, in 2022 demand exceeded supply by 237.7 million ounces (mo), only partially offset by ETF liquidation, leaving a net deficiency of 111.9mo. That certainly confirms our market perspective…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

The swing factor is net investment. For the current year, the Institute forecasts net investment demand falling 30mo, which given current tightness of the market seems out of date. An increase in both mine output and industrial demand of 20mo is expected. Though they don’t say so, the authors expect American and European demand to be moderated by poor economic performance, based on little or no reduction in interest rates and weak financial markets. This leads them to forecast a year-end silver price of $18.

There are two potential flaws in this argument:

- They assume ETF demand will fall with equity markets, taking little or no account of defensive portfolio switching into precious metals by investors.

- The demand outlook takes no account of prospects for China’s economy and for the entire Asian continent, including India, where bank credit is already expanding.

As usual, reports of this nature are written by industry analysts who in their price forecasts assume the purchasing power of the dollar is constant. This flies in the face of the evidence and is the reason ordinary people hedge out of credit into precious metals.

Turning to markets, this week saw the dollar’s trade weighted index steady having found support at the 100.5 level shown by the dotted line in the chart below:

While moves in the index have been small, prices for gold have moved consistently in the opposite direction. But given that foreigners are increasingly trading in other currencies, it is only a matter of time before the TWI breaks below current support levels. When that happens, we can expect precious metals to move up strongly.

But there is one fallacy to overcome: rising interest rates are bad for the gold price. This was disproved in the 1970s when gold rose from $35 to $850, during which time the Fed funds rate more than doubled.

Contracting bank credit will almost certainly keep interest rates high, leading to more bank failures. Under these circumstances, it will be investors fleeing systemic risk which will drive precious metal prices.

ALSO JUST RELEASED: Ignore Volatility As Silver Is Preparing To Explode Higher CLICK HERE.

ALSO JUST RELEASED: A Gold Revaluation Is Now Playing Out On The World Stage CLICK HERE.

ALSO JUST RELEASED: Celente – We’ve On The Eve Of The Death Of The US dollar CLICK HERE.

ALSO JUST RELEASED: The Gold Trade Is Far From Crowded As Fed Poised To Raise Interest Rate CLICK HERE.

ALSO RELEASED: BUCKLE UP: Fed To Raise Interest Rates In 2 Weeks CLICK HERE.

ALSO RELEASED: No Way Gold Has Topped, Plus One Of The Most Speculative Moments In History CLICK HERE.

ALSO RELEASED: Bull Market #3 In This Key Asset Is Alive And Well And It Will Be A Game-Changer CLICK HERE.

ALSO RELEASED: Greyerz – This Everything Global Collapse Will Be Unlike Anything Seen In History CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.