As we come to the end of another trading week, the war in gold, silver and bonds continues.

Rising bond yields

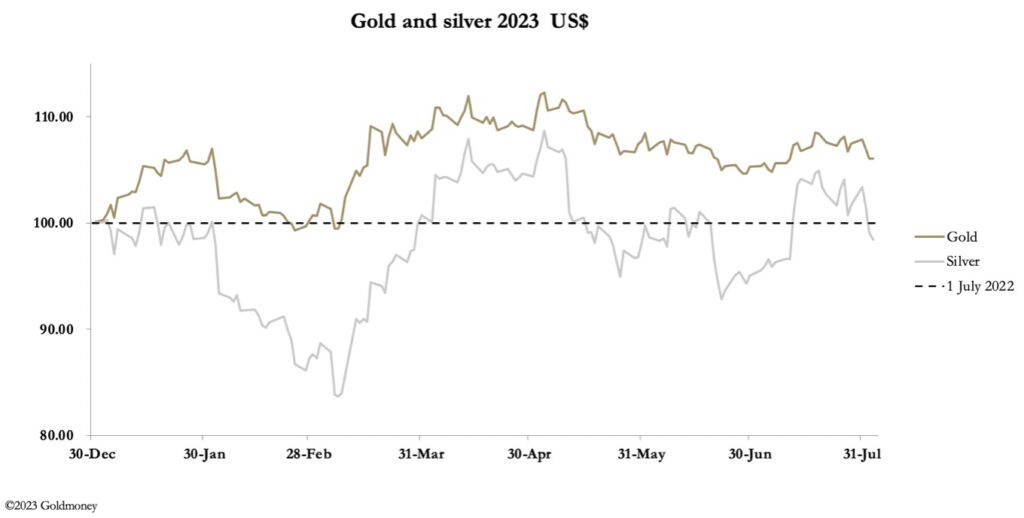

August 4 (King World News) – Alasdair Macleod: This week, gold and silver prices were undermined by rising bond yields, allowing bullion banks to mark prices lower and cover their short positions. In Europe this morning, gold traded at $1934, down $32 from last Friday’s close, and silver at $23.46 was down 83 cents on the week.

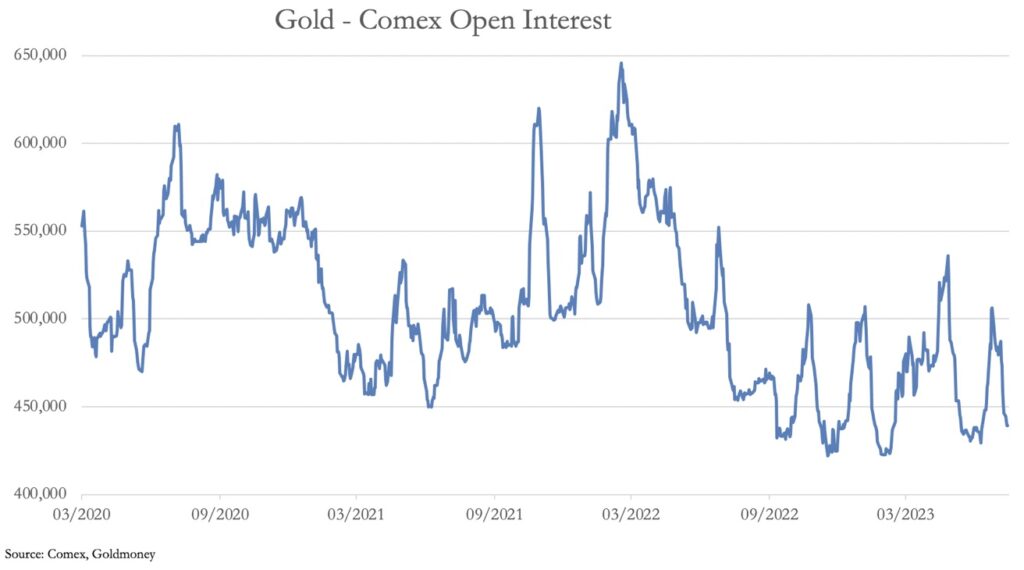

Volume in the gold contract on Comex was exceptionally low, as the screenshot from the CME website illustrates:

And when we look at Open Interest, it confirms that participation in this contract can hardly be lower.

The ability of the Swaps (bullion bank traders) to shake out the longs in the Managed Money and Other Reported categories is becoming strictly limited. The Commitment of Traders Report for 25 July shows the Managed Money category net long 95,287 contracts and the Other Reported 78,352. But since then, Open Interest has contracted by 40,690 contracts so net longs in these two categories are entering oversold territory.

The problem for the longs and to the delight of the shorts is that interest rates and bond yields are still rising. Last week, the Fed raised its funds rate by 0.25% to 5.5%. And this week, the Bank of England raised its bank rate to 5.25%. But worse of all, charts of 10-year government bond yields look terrible.

After consolidating sharp rises from 2019—2020 for roughly a year. These bond yields look like breaking out of flag formations, which project further increases with target levels equal to the previous rise. For US Treasuries, this gives us nearly 8%, for gilts over 8%, and for bunds over 6%. JGB yields are so distorted by the Bank of Japan’s debt monetisation that there’s no knowing how high they will go: they have already leading the way on the upside.

This is the background for precious metal prices. For the last forty years, it is the cost of funding long gold and silver paper positions which has been the major influence on prices. That fact is still at the forefront of hedge fund managers minds when they trade between gold and dollar derivatives. But when uncertainty over the future value of a currency begins to drive values, the interest rate spread argument falls away.

Systemic and currency risks will then begin to influence markets more than paper cost factors such as interest rate spreads. Just image the impact on the US economy from a combination of the cost of the government’s rapidly expanding funding programme, soaring interest costs on overindebted private sector borrowers, the collapse of financial asset values, and foreigners trying to desperately liquidate their long-term dollar financial investments, currently valued at about $24.5 trillion, and to get out of fiat dollars.

And imagine the consequences for Britain, the Eurozone, and Japan, the last of which sports a government debt to GDP ratio of 263%. Welcome to the Time Machine taking us back to the 1970s, when gold rose from $35 to $850.

No doubt, so long as the current relatively stable environment persists, gold is reasonably priced. But for what lies ahead, even without the disruption of a new BRICS gold backed currency, it is an entirely different matter.

ALSO JUST RELEASED: Man Connected In China At Highest Level Says Gold Headed To New All-Time High CLICK HERE.

ALSO JUST RELEASED: Massive Russian And Chinese Gold Hoards Will Be Used To Back A Gold Currency CLICK HERE.

ALSO JUST RELEASED: Michael Oliver – Gold’s Oversold Reading And Why Bears Better Hope There Is No Upturn CLICK HERE.

ALSO JUST RELEASED: JP Morgan Has Become A Gold Bull CLICK HERE.

ALSO RELEASED: Celente – People Are Suffering But This Is When Reality Will Hit CLICK HERE.

ALSO RELEASED: Gold & Silver Volatility Aside, Here Is The Global Backdrop CLICK HERE.

ALSO RELEASED: James Turk – This Is Silver’s Short Term Price Target CLICK HERE.

ALSO RELEASED: The Everything Bubble Is Bursting Now It’s All About Economic Survival CLICK HERE.

ALSO RELEASED: Michael Oliver Says Gold’s Breakout Is Very Real, Despite Volatility CLICK HERE.

To listen to Gerald Celente discuss the gold market as well as the collapse that has already begun CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.