Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News that today gold registered an oversold reading and also discussed why bears better hope there is no upturn from current levels.

Gold in Layers

August 2 (King World News) – Michael Oliver, Founder of MSA Research: We are currently using the front trading contract month, the August future.

FYI, the trading contracts for COMEX gold are: February, April, June, August, October, and December. For silver they are: March, May, July, September, and December. Contracts between those months are used for delivery purposes. MSA references the front-month “trading” contract. When volume diminishes on that contract, especially once we get into the expiration month, we adjust its daily range to reflect the trading range of the more active future…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

For example, right now the overwhelming volume is in December gold. We therefore take the August contract’s settlement and subtract it from the higher price settlement of the December futures. That difference is then used to calculate the high and low for the illiquid August future and to reflect the reality of trading that day.

Gold’s Oversold Reading

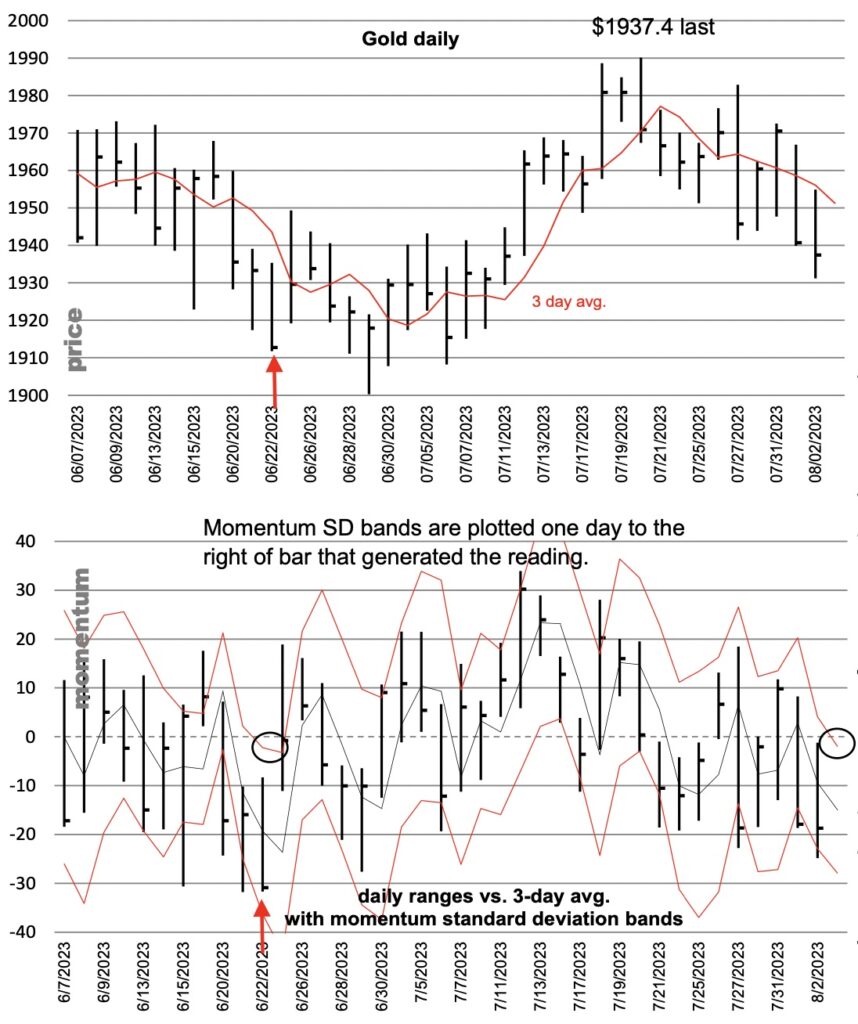

Today’s action by gold generated an oversold reading due to the upper SD band dropping below the zero line on this daily momentum chart. The last time that occurred is noted via the up arrow on price and momentum, as of the June 22nd close.

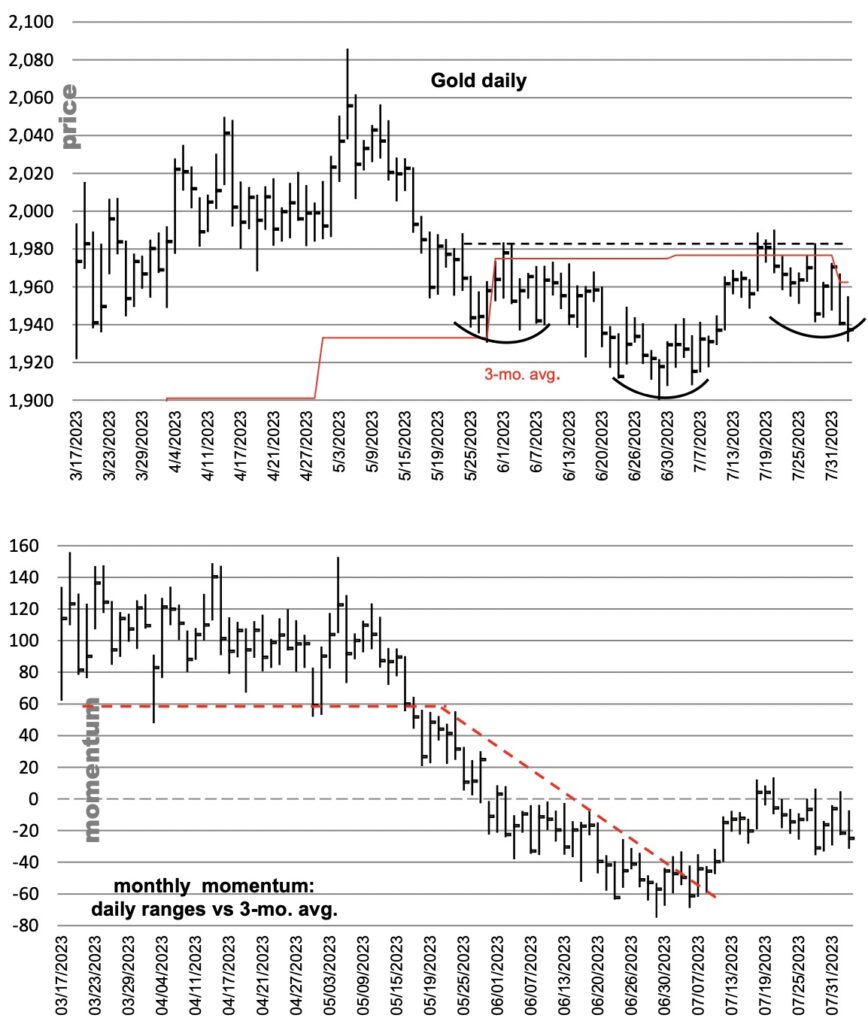

We’ve shown weekly momentum in recent reports and noted that it shifted back to the upside in mid-July. There was similar behavior by monthly momentum (price vs. the 3-mo. avg.). Structures for monthly momentum are noted via the red trend lines. The zero line isn’t always a balance point or structurally important. Often trend shifts occur above or below that mean. That has been the case for gold in the two most recent turns.

Gold Bears Better Hope There Is No Upturn

Price has set dual highs at the $1980 level, with the intervening low just above $1900. Is this a head-and-shoulder pattern bottom? Maybe. It’s too soon to say. But the bears better hope there’s no upturn from current levels back towards those dual highs.

To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by so many serious investors and professionals all over the world CLICK HERE.

ALSO JUST RELEASED: JP Morgan Has Become A Gold Bull CLICK HERE.

ALSO JUST RELEASED: Celente – People Are Suffering But This Is When Reality Will Hit CLICK HERE.

ALSO JUST RELEASED: Gold & Silver Volatility Aside, Here Is The Global Backdrop CLICK HERE.

ALSO JUST RELEASED: James Turk – This Is Silver’s Short Term Price Target CLICK HERE.

ALSO RELEASED: The Everything Bubble Is Bursting Now It’s All About Economic Survival CLICK HERE.

ALSO RELEASED: Michael Oliver Says Gold’s Breakout Is Very Real, Despite Volatility CLICK HERE.

To listen to Gerald Celente discuss the gold market as well as the collapse that has already begun CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.