On the heels of the US dollar surging and gold and silver continuing to consolidate recent gains, here is a look at what else you need to watch.

Bulls & Bears

July 27 (King World News) – Art Cashin, Head of Floor Operations at UBS: The bulls begin the morning with a little carryover inertia and watching the energy in the techs, spurred on by the impressive results from Meta. That appears to be flattening out as we approach midday.

The economic numbers this morning have not provided much motivation for the market itself. It is all on the inertia from this winning streak that has gone on for 13-days in the Dow and is approaching a 14th day, which would be the first time since 1897 that we had such a streak.

We will touch more on that later. For now, the bulls happily were able to poke above 4600 in the S&P and that may become a bit of an area for testing as the day wears on.

Keep an eye on yields. They are starting to inch up and I am a little anxious that the VIX dipped back below 13. The sentiment indicators are on the verge of going parabolic to the over-enthusiastic side.

For now, the market will keep measuring its own internals and keep watching the newsticker for any surprises.

In the meantime, stay safe.

Arthur

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Home Sales

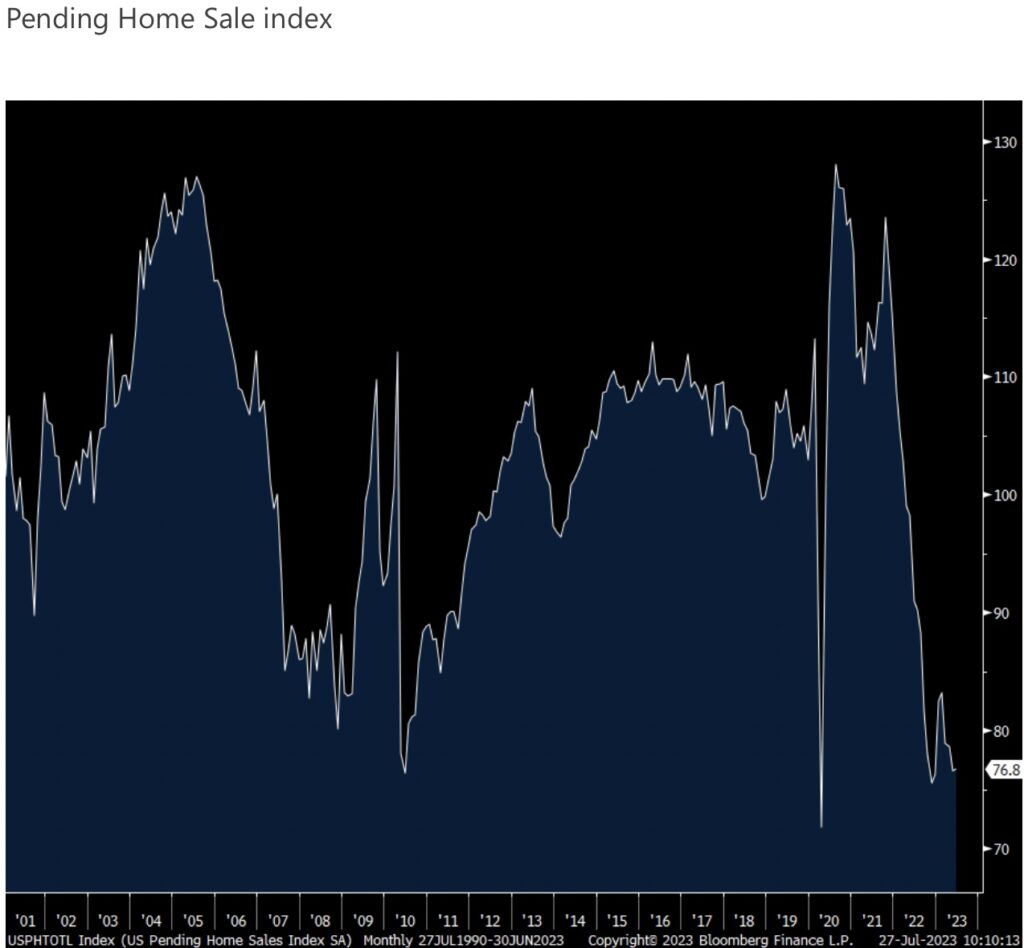

Peter Boockvar: Contract signings for existing homes remains muted for reasons we all know.

Pending home sales were up .3% m/o/m in June after three straight months of declines, particularly a 2.5% drop in May. That was better than another expected drop of .5% m/o/m. The rebound was mostly led by a 4.3% increase in the Midwest (just so happens to be where a lot of the government encouraged green energy subsidized projects are getting started).

Nothing new here from the NAR as its chief economist said: “The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply. Homebuilders are ramping up production and hiring workers.”

While “The recovery (in existing home sales) has not taken place”, the NAR is calling “the housing recession is over.” We’ll see because the affordability challenge hasn’t magically been solved for the first time homebuyer. The pending home sale index itself is just off the lowest level since 2010 not including Covid.

ALSO JUST RELEASED: MAJOR GOLD BULL CATALYST: US Dollar In Danger Of Breaking Down CLICK HERE.

ALSO JUST RELEASED: Gold Moves Higher After Fed Decision And Post Hike Powell Interview CLICK HERE.

ALSO JUST RELEASED: What’s Next After Big Banks Turn Bearish On US Dollar CLICK HERE.

ALSO JUST RELEASED: Ahead Of Fed Decision CRB Is Breaking Out On The Upside CLICK HERE.

ALSO JUST RELEASED: CAUTION: The Public Has Now Gambled All In On Stocks CLICK HERE.

ALSO JUST RELEASED: What To Expect As BRICS Gold-Backed Currency Launch Approaches CLICK HERE.

To listen to Alasdair Macleod discuss where gold and silver prices are set to spike higher and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.