On the heels of a brutal multi-week smash in the gold and silver markets and with bonds collapsing and interest rates soaring, this is going to rock the world and bring countries to their knees.

As we approach the end of November, in what has been an extremely tough environment in the gold and silver markets, a legend in the business that is connected in China at the highest levels says forget the pullback and predicted that the price of gold will see a staggering 86 percent spike or more than a $1,000 upside surge.

Last year, Richard Russell made one of his last and most shocking predictions ever. Below is what the Godfather of newsletter writers had to say.

On the heels of a continued takedown in the gold and silver markets and chaos in bond markets, today King World News is pleased to present an extremely important update on the war in the gold market from Michael Oliver at MSA. Oliver allowed KWN exclusively to share this key report with our global audience after today’s takedown in the gold market.

Is the 34-year bull market in U.S. bonds over? And how will this impact gold, silver, and the Canadian dollar?

With the Dow hitting new all-time highs along with the Nasdaq, one pro says the stock market is on borrowed time. Also, will India actually ban gold imports?

With continued uncertainty in global markets, are we seeing a turn in the tide? Plus a remarkable look at the Kennedy and Lincoln assassinations.

Look at the stunning levels of extreme action in gold, silver, U.S. dollar and the stock market post-election.

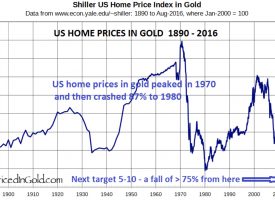

As we kick off the fourth week of trading in November, this is the real reason why the public is broke and the middle class is being destroyed.

With the Thanksgiving Day holiday on Thursday of this week, are you prepared for the unwinding of the biggest bubble in history?

On the heels of another wild week, today the man who has become legendary for his predictions on QE, historic moves in currencies, and major global events, spoke with King World News about how devastating the coming worldwide financial destruction will be.

On the heels of continued chaos in key markets, radical changes are in store for the world and global markets.

For those who are worried about the plunge in the gold and silver markets…

With continued weakness in the precious metals markets, did this major divergence just trigger a bottom in gold and silver?

Look at these markets seeing massive waterfall declines as other hit new highs as chaotic global trading continues.

After the decline in gold and silver, today one of the wealthiest and most street-smart pros in the business spoke with King World News about what they are doing at Sprott Asset Management with their money right now.

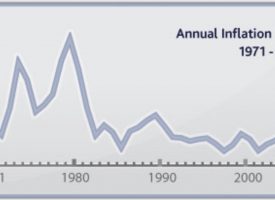

In the aftermath of what has been a wild couple of weeks of trading, today a former associate of George Soros told King World News that the professionals have it completely wrong and that gold and silver are going to skyrocket like the 1970s.

On the heels of the recent post-election market turmoil, is the world going to see a global monetary reset with QE used to purchase gold?

As the monetary madness continues around the globe continues, what is happening is stunning.

With continued uncertainty in global markets, here is a look at the big picture from around the world, including silver.