Look at this important gold chart, plus a big inflation warning.

Gold

January 19 (King World News) – Graddhy out of Sweden: This chart showing a breakout for gold in Yuan after the 3 year consolidation, is very bullish for gold in US dollar.

And gold in Yuan having a solid parabolic move in the making, should not be taken lightly.

Gold Priced In Chinese Yuan Has Broken Out And Successfully Backtested. Very Bullish For Gold Priced In US Dollars

Commodities are at the core of very, very big change…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Retail Stocks Getting Pummeled

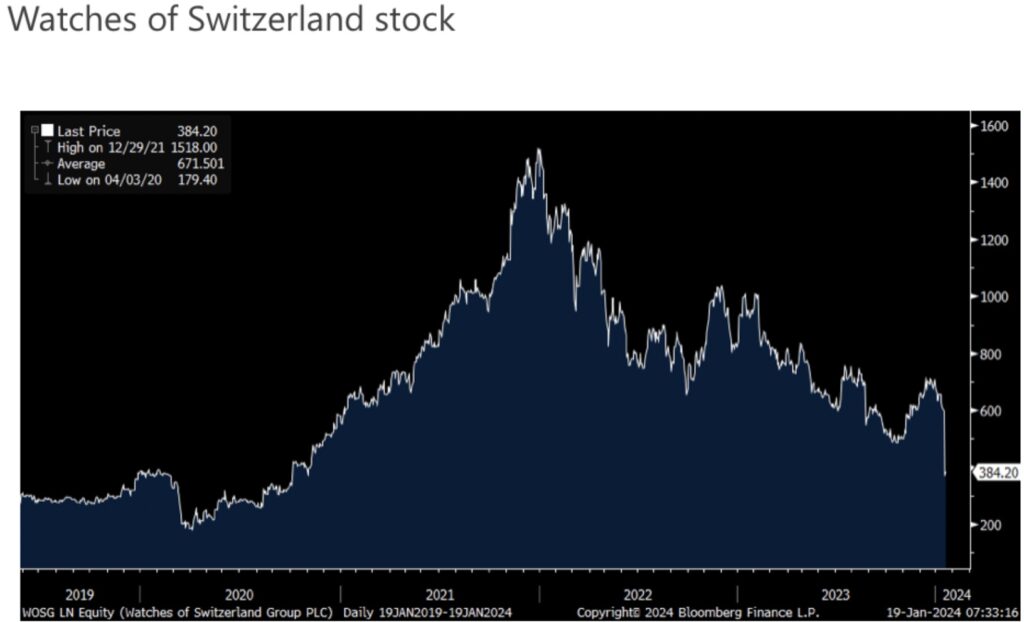

Peter Boockvar: We got lower guidance from Burberry last week and heard a few weeks ago from the CEO of Neiman Marcus talk a bit cautiously about the higher end customer. In case you didn’t see yesterday the stock of Watches of Switzerland crashed by 37%.

In their earnings call the CEO said “As widely reported across retail and luxury sectors, Christmas trading was very difficult to predict and ultimately below projections. This trend continued into January, and we believe the trend will continue for the remainder of the fiscal year…The global watch market continues to normalize, following two years of exceptional growth.”

Stagflation In The UK And Everywhere Else

Maybe this watch weakness was reflected too in the UK retail sales data seen today. They were very weak in December, falling 3.3% m/o/m ex auto fuel and that was well worse than the estimate of down .7%. The ONS said “Food stores performed very poorly, with their steepest fall since May 2021 as early Christmas shopping led to slow December sales. Department stores, clothing shops and household goods retailers reported sluggish sales too as consumers spent less on Christmas gifts.” The UK economy remains mired in a stagflationary backdrop. Gilt yields have had a wild few days, jumping 19 bps on Wednesday and falling by 10 bps over the past 2 days.

BIG INFLATION WARNING: Massive Insurance Inflation In Trucking

JB Hunt reported earnings last night after the close and always gives good insight on the freight economy. Interestingly they started the call with an area that continues to see huge inflation, that being insurance costs. The CEO said “our insurance rates continued to increase as the industry experiences higher verdicts, and as a result, higher litigation settlements. During verdicts in trucking cases where the verdicts exceed $1mm, have seen an 867% increase in the average size of verdicts from 2010 to 2018. This is according to the US Chamber of Commerce Institute for Legal Reform. Given that the majority of motor carriers in the industry carry only $1mm in coverage, just above the legal minimum of $750,000 in coverage, it’s the largest carriers who bear the brunt or disproportionate share of the escalating insurance and claims costs and ultimately these inflationary costs get passed on to customers and consumers.”

And insurance isn’t the only cost pressured they talked about. “I mean, just inflationary cost pressures from wages for our drivers are higher, rates with our railroads are higher. Certainly, just all employment costs, maintaining the equipment itself cost more. Just across the board, we have cost pressures and that inflationary cost lives across our enterprise.” To some, stop spiking the ball on this cyclical downturn in inflation. Just because it has fallen, which happens in a manufacturing recession on the goods side, doesn’t mean it stays down.

Good Riddance To 2023

“On the freight environment, we have turned the page on 2023. Goodbye and good riddance. As you are aware, 2023 presented many challenges…While the New Year has begun and the calendar has flipped another page, not much has changed in regard to the freight environment…the freight environment remains in a challenged state…but we continue to see some signs of improvement, especially related to intermodal volumes. Having said that, I think it’s important to reiterate that volume is historically a leading indicator while price is typically a lagging indicator with uncertainty around the timing of any potential inflection…the impact of pricing during the last bid season will be with us through at least the first half of this year.”

Fastenal is also an important company to listen to with regards to the manufacturing sector. “Now, if you remove warehousing, our sales results continue to reflect sluggish demand. For example, our manufacturing end-market continues to grow, but at moderating rates, while our fastener product line experienced contraction in MRO (maintenance and repair) and for the first time this cycle, OEM products. Trends in these markets and product categories tend to be more reflective of cyclical trends and are being impacted by PMI readings that remain sub 50 and soft industrial production, particularly for key components such as fabricated metals and machinery. This setting is matched by muted feedback from regional leadership, but if conditions didn’t get better in the fourth quarter of ’23, they didn’t get worse either.”

On the disinflation in goods prices, “I’m not hearing anything to suggest that the environment is moving back to an inflationary one, with possibly one exception. I think that there’s been a lot of global conflict around the Suez Canal. I hear a lot about very little water in the Panama Canal and we are beginning to see shipping costs start to tick up again. I don’t know how durable that’ll be, I don’t know how far that will go. It’s not creating any actions today, but that is something that we’re watching fairly closely.”

Germany

Germany said its December PPI fell 1.2% m/o/m and 8.6% y/o/y, more than estimated. A drop of 3.7% in energy prices helped out with other categories like basic goods, capital goods, and durable and non-durable goods seeing little price change vs November. We know the German economy is currently seeing its challenges and today its Finance Minister speaking in Davos said “After a very successful period since 2012 and these years of crisis, Germany is a tired man after a short night. Now we have a good cup of coffee, which means structural reforms, and then we will be continuing to succeed economically.”

Japan

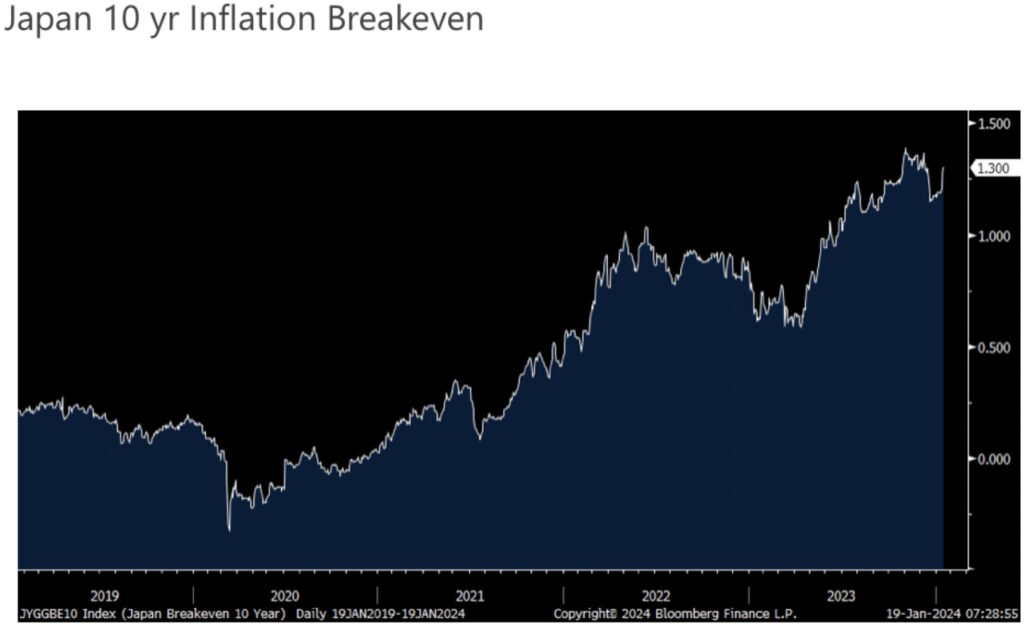

Japan reported its December CPI stats and they were about as expected. Ex food and energy saw prices higher by 3.7% y/o/y, in line and vs 3.8% in November. Service prices were higher by 2.3%, matching the fastest pace in 30 years not including VAT increases. The BoJ is running out reason to keep short rates below zero. The 10 yr inflation breakeven rose for a 5th straight day, by 1.7 bps to 1.30%, nearing the highest level since TIPS were first introduced there about 20 yrs ago.

The 10 yr JGB sold off for a 4th day with the yield at the highest level in a month at .67%, though off the last November peak of .96% just before bonds everywhere rallied.

ALSO JUST RELEASED: SPROTT: 2024 Silver Will Soar! Gold, Copper & Uranium Will Also See Big Moves CLICK HERE

ALSO JUST RELEASED: John Hathaway – Gold Is Headed Much Higher But Take A Look At This… CLICK HERE

ALSO JUST RELEASED: 2024 WILL BE DANGEROUS: Expect Extreme Market Distortions To Worsen CLICK HERE

ALSO JUST RELEASED: BUCKLE UP: We Are About To Witness The Greatest Bull Market Ever Seen CLICK HERE

ALSO RELEASED: Michael Oliver Says The Price Of Gold Is About To Soar 35% CLICK HERE

ALSO RELEASED: Quote Of The Day, Plus Gold & Silver About To See Some Major Moves CLICK HERE

ALSO RELEASED: Eric Pomboy – What Is Happening In The Gold Market Is Stunning CLICK HERE

ALSO RELEASED: Greyerz – Get Into Physical Gold Now Or Risk Losing Your Entire Fortune CLICK HERE

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.