Jim Grant of Grant’s Interest Rate Observer just issued this warning about business and credit conditions in the US.

Gold Is The Strongest Currency In The World

June 27 (King World News) – Graddhy out of Sweden: If you think gold & silver are slow at the moment, consider this XAU/TRY (Gold in Turkish Lira) chart. Gold rose 21x vs Turkish Lira last 10 years. 20% THIS month alone. It will happen to your currency. Have to play this commodities bull right, your future depends on it.

Gold’s Parabolic 21x Surge vs Turkish Lira

Again, Gold Is The Strongest Currency In The World

Graddhy out of Sweden: Gold has risen 500% vs GBP last 16 years. This 4th most traded currency globally is in a losing parabolic move vs gold, a horrible chart. Meet many who are against precious metals. Telling them to get their head straight.

Gold’s 500% Parabolic Surge vs British Pound

Expect More Rate Hikes

Peter Boockvar: Speaking in Sintra today for the central bank get together, ECB president Christine Lagarde continues to be firm in her mission to quell inflation.

“It is unlikely that in the near future the central bank will be able to state with full confidence that the peak rates have been reached. Barring a material change to the outlook, we will continue to increase rates in July.”

She seems also committed for higher for longer.

“Faced with a more persistent inflation process, we need a more persistent policy – one that not only produces sufficient tightening today, but also maintains restrictive conditions until we can be confident that this second phase of the inflation process has been resolved.”

That second phase by the way is the employee desire for higher wages in order to recapture the loss in real wages over the past few years.

The euro is rallying in response but sovereign bond yields in the region aren’t doing much. The German 2 yr yield is up 2 bps but after falling by 2 bps yesterday. Stocks in Europe are little changed…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

The banker I’m most interested in hearing from is the new BoJ Governor Ueda as pressure grows on him to make a move. With the 10 yr JGB yield at .37%, and thus well below .50%, the market is giving him room to widen YCC. He should also take note that the 10 yr inflation breakeven is just one bp from the highest since 2015, up 3.5 bps overnight to 1.05%. The yen is trading at the weakest since last November vs the dollar and another reason why Ueda should step up.

Jim Grant Weighs In

Yesterday I highlighted the Dallas Fed’s Banking Survey which reflected the squeeze going on with respect to bank credit and also the slackening demand for it. It’s not just from the banks. In my friend Jim Grant’s Almost Daily yesterday he mentioned something of note from PitchBook data from last week:

“Nearly two-thirds of this year’s junk bond supply has been backed by specific collateral. That’s far and away the highest proportion since at least 2005, surpassing the 37% share seen in 2009 following the acute phase of the financial crisis.”

In the floating rate space:

“Issuance of syndicated leveraged loans registered at just $1.3 billion from January through May, marking the weakest primary activity since 2009, when the loan market stood at less than half of its current $1.4 trillion size.”

Here’s more:

“Underscoring the changing market dynamics: only a solitary single B-minus rated loan backing a leveraged buyout has priced in 2023, compared to 14 such issues in the same period last year. That comes as the share of single B-minus issues within the Morningstar LSTA Leveraged Loan Index has ballooned to nearly 30% from 14% on the eve of the pandemic. Meanwhile, borrowers looking to refinance are paying a pretty penny to do so, with the market wide 9.68% average effective yield representing the highest since Y2K.”

I will say again, our economy for the last few decades have rolled through multiple credit cycles that ebb and flow with the cost of capital. This time is no different and why economic activity, not influenced by the massive amount of government spending in parts of the economy, will continue to slow as the cost of capital gets more expensive for more and more borrowers. This is not an event, it is an ongoing process and higher for longer is the continued form of monetary tightening that will induce this…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

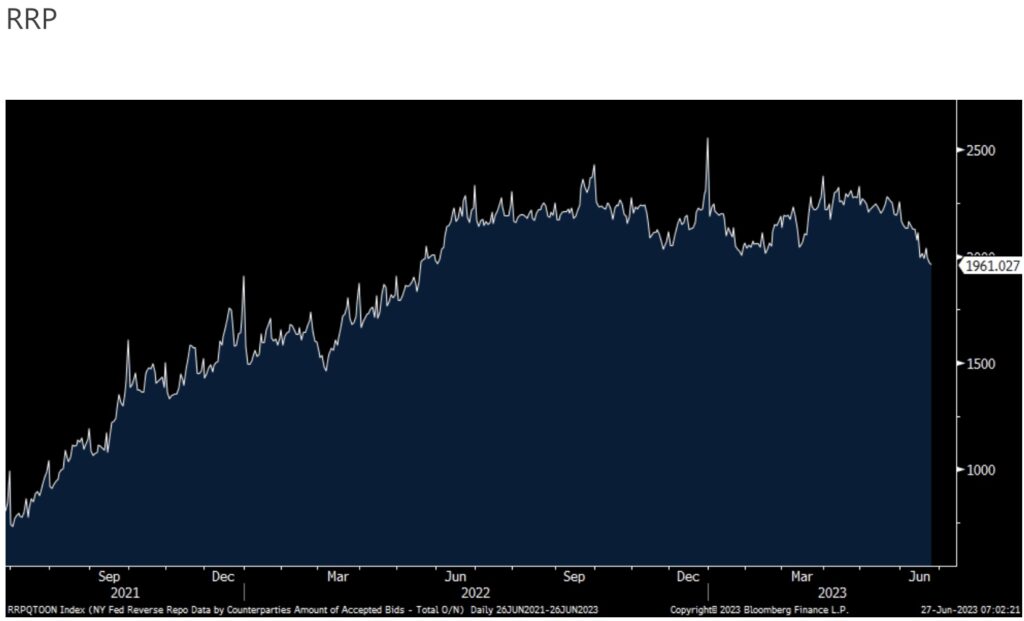

So far, so good with regards to the absorption of the large amount of bills the US Treasury has been selling post debt ceiling deal. As of yesterday the amount of money parked at the Fed’s reverse repo facility fell to the lowest level since last May at $1.96 trillion. We assume that money market funds are now willing to take some duration risk (by a few months) and are buying some of the newly issued paper.

Yesterday the Dallas Fed’s manufacturing index for June was -23.1, the 14th straight month below zero. The 6 month outlook was also in contraction for the 14th month in a row. Here were some notable comments:

When Will The High-Income Consumer Break?

Finally, in Delta’s investor presentation, and to the comment from this textile company highlighting the spending from the high income consumer, Delta said “High-income travelers accounted for 75% of spending on air travel.” And, “Leisure travel is the highest priority purchase for high-income households.” They define ‘purchase priority’ as “big ticket item purchase intent over next four months” and ‘high-income’ is defined as someone who makes more than $100k.

What could eventually impact this ‘high-income’ consumer? Further white collar job cuts and a drop in the stock market.

ALSO JUST RELEASED: STORM ON THE HORIZON: 3 Macro Events Poised To Unfold In Rapid Successions As Credit Crunch Intensifies CLICK HERE.

ALSO JUST RELEASED: Big Money Will Be Made In Silver, Plus A Commodity Boom Is Coming CLICK HERE.

ALSO JUST RELEASED: Waiting For The Fed Pivot As More Things Break And US China Financial War Heats Up CLICK HERE.

***To listen to James Turk discuss the three key levels that need to be broken on the upside as well as what to expect in the back half of the year CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss why gold is bottoming and what to expect from silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.