As we kickoff a new trading week, big money will be made in silver, plus a commodity boom is coming.

Silver

June 26 (King World News) – Graddhy out of Sweden: Silver miners have hugely underperformed both metals and gold miners lately. End of the rainbow, get-out-of-rat-race-stuff, if played right. … Life-changing money will be made.

Big Money Will Be Made In Silver (Miners)

This Is Madness

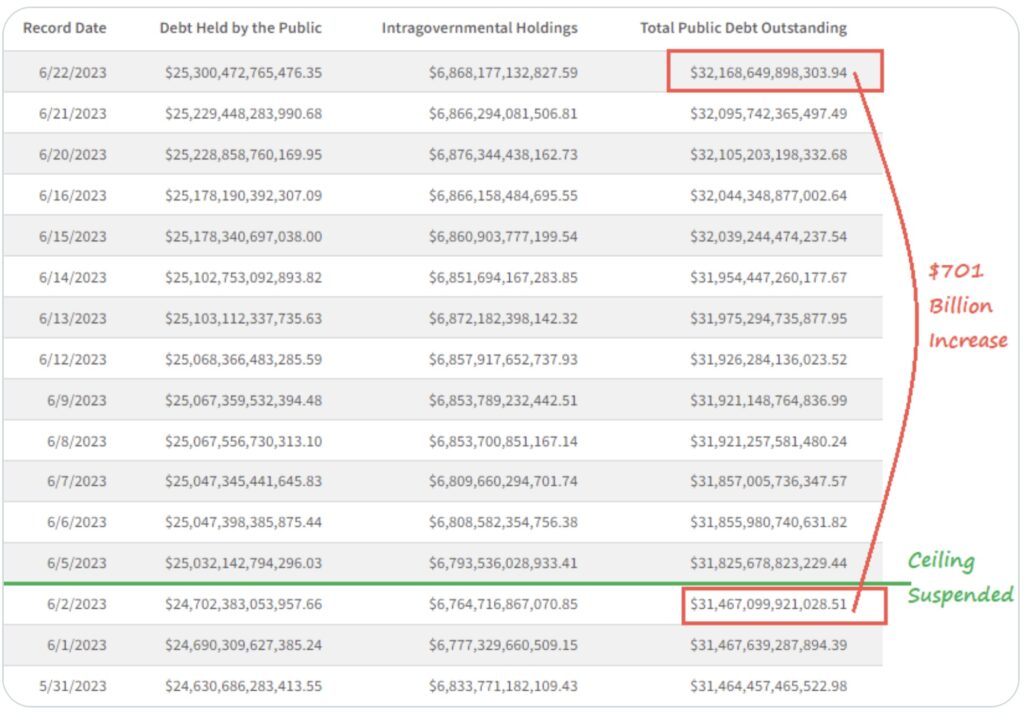

Charlie Bilello: $700 billion increase in US National Debt since the debt ceiling was suspended 3 weeks ago under the “Fiscal Responsibility Act of 2023.” Only the government could get away with naming a plan to borrow and spend trillions of dollars “fiscally responsible.”

US Debt Skyrocketing

Commodity Boom Coming

Peter Boockvar: I’m not going to even pretend to game out what happens from here with the war in Ukraine and its impact other than to say if the war ends, there will be an enormous rise in demand for everything commodities, electrification and infrastructure as the world helps Ukraine rebuild (steel, cement, copper, electrical wiring, aluminum, paint, HVAC, telecom equipment, plumbing, glass, lumber to name a few needs). Also, lets do a perspective check on key commodity prices that were pushed around when the war started to see where they are now.

Let’s use February 15th, 2022 (about a week before the invasion) for comparison:

1) Dutch TTF natural gas 67.6 euros/mwh then vs 36 euros/mwh today.

2) Wheat $7.80 per bushel then vs $7.55 today.

3) Soybeans $15.50 per bushel then vs $15.01 today.

4) Brent crude $79.34 then vs $74.27 today.

So if the war ended today, we might not get any notably immediate benefit commodity price wise as prices have already adjusted dramatically after the initial war shock. And as stated, I believe the demand for the Ukrainian rebuild will be massive…

UPDATE: This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

In the bank loan data released late Friday, after falling to the lowest since last September and down by $82b from its mid March peak, commercial and industrial loans outstanding rebounded by $11b. Bank deposits rose by $17.6b after dropping by $78b in the week before. We know now that via mostly CD’s, banks are doing what they can to recapture/retain deposits and they are all still tight with their lending standards.

I mentioned the falling oil rig count last week and as of Friday, it dropped by another 6 to 546, the lowest since last April. For natural gas, it’s at the smallest since last March. We’re still bullish on energy, particularly natural gas, not just the E&P companies but also the pipelines.

Global Recession

In Asia, and pointing to the global recession in manufacturing, Singapore said its industrial production in May fell 3.9% m/o/m, well worse than the estimate of up 2.6%. The production of electronics is what they make the most of and that component fell 23% y/o/y. Chemicals, that go into just about everything, fell by 9.5% y/o/y. Overall, IP was down 10.8% y/o/y. Taiwan’s May IP was down by 15.7% y/o/y but not as bad as the 20% drop that was expected. The production of electronics out of Taiwan was down by 24% y/o/y. The TAIEX was down .8% overnight with weakness again seen in China but the Singapore Straits was little changed. We remain bullish on Singapore stocks with its market trading at 10.6x 2023 earnings and with a dividend yield of 5.1%.

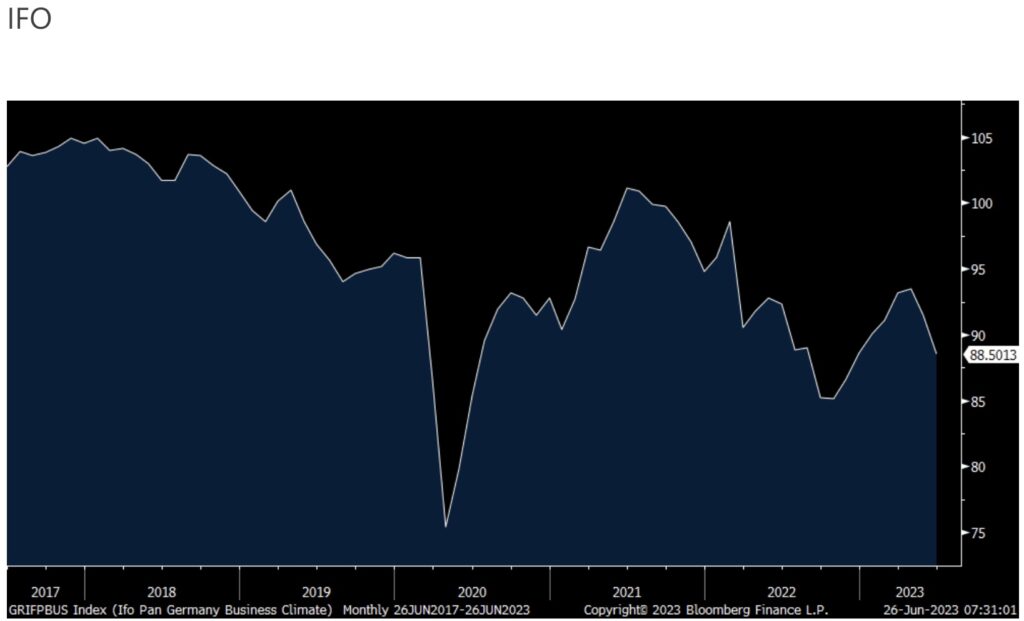

In Germany, who is hugely impacted by this manufacturing downturn, saw its June IFO business confidence index falling to 88.5 from 91.5. The estimate was 90.7. That’s the weakest since last November.

Both the Current Situation and Expectation components were down m/o/m. The IFO said “Above all, the weakness in the manufacturing sector is steering the German economy into turbulent waters.” Specifically, “In manufacturing, the business climate deteriorated substantially.” And it’s spilling over into services as “Transport and logistics in particular are suffering from the negative development in manufacturing.”

The softness in this number is helping sovereign bonds rally again in Germany and the rest of Europe. The euro though is higher as the dollar is down across the board, particularly against the yen.

Japanese Yen In Trouble…Again

With respect to the yen, Japanese finance ministry officials are talking tough against the rapid weakness with an official saying “Underlying moves are rapid and one-sided. Therefore we are watching carefully with a strong sense of urgency, and will respond appropriately to excessive moves…We have all options available and we are not ruling out any options.” That said, “I won’t comment on what to do now.” I assume 145-150 is the trigger point for some intervention even though the only real intervention that would work has to come from the BOJ and a change in its policy.

ALSO JUST RELEASED: Waiting For The Fed Pivot As More Things Break And US China Financial War Heats Up CLICK HERE.

***To listen to James Turk discuss the three key levels that need to be broken on the upside as well as what to expect in the back half of the year CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss why gold is bottoming and what to expect from silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.