Things are tough all over but now it appears it’s getting really bad out there.

Bond Market Tightening

October 10 (King World News) – Peter Boockvar: The sharp rally in US treasury futures yesterday is being reflected in the cash market today with the 10 yr yield down 12 bps to 4.68% after Fed vice chair Philip Jefferson and Dallas president Lorie Logan joined some of their colleagues in recognizing that the long end of the yield curve has tightened monetary policy further for them. For some reason, Michelle Bowman still believes that more rate hikes are needed in spite of the long rate jump. The 10 yr future is down slightly this morning.

As earnings reports are about to flood in, I’ll say again what I say every quarter, it’s a guarantee that about 75% of companies will exceed earnings estimates which Pepsi did this morning (I didn’t see them break out revenue growth between price and volume).

Desperate Realtors

“If mercy’s a business, I wish it for you” once sang the Grateful Dead in ‘Fire on the Mountain’ and yesterday in a letter, the National Association of Home Builders, the National Association of Realtors and the Mortgage Bankers Association are singing that song in a letter to the ‘Honorable Jerome Powell, Chair.’ They want mercy from the interest rate pain they are all experiencing and now expressing.

They write to “the Board of Governors of the Federal Reserve System (hereinafter ‘the Fed’) to convey profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path is contributing to recent interest rate hikes and volatility. This has exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume. These market challenges occur amidst a historic shortage of attainable housing.”

What Do They Want?

What does this group want? “We strongly urge the Fed to make two clear statements to the market: 1) The Fed does not contemplate further rate hikes; 2) The Fed will not sell off any of its MBS holdings until and unless the housing finance market has stabilized and mortgage-to-Treasury spreads have normalized.” This is quite the lobbying effort…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Hypocrites?

While I fully understand their concerns, I don’t recall these groups during the mid 2000’s calling for the Fed to raise rates as they were stoking that decade’s housing bubble and I don’t believe they were telling the Fed to stop QE, including the massive buying of MBS, in 2020 and 2021 and to raise rates as home prices were leaping by 40% in two years. Here is the link to the letter, https://www.mba.org/docs/default-source/advertising/mba-nar-nahb-fed-rate-path-final-1.pdf?sfvrsn=f3ecbd03_1.

Also, what if the Fed stops raising rates, which I believe they have, and even starts cutting next year, albeit modestly, and long rates continue higher? It would be further evidence that the Fed has lost some control over the long end of the bond market for many reasons discussed here this year.

With regards to housing, yesterday the September Fannie Mae Home Purchase Sentiment index was released and it fell 2.4 pts to 64.5 “as elevated mortgage rates further dampened already pessimistic consumer housing sentiment.” Affordability is of course the biggest challenge as “16% of consumers reported that it’s a good time to buy a home (thus 84% say it’s not), matching the all time survey low set last year. Additionally, 63% said it was a good time to sell a home, down 3 percentage points compared to the prior month.”

Bottom Line

Their bottom line, “Mortgage rates persistently over 7% appear to be deepening the malaise consumers feel about the home purchase market. In fact, high mortgage rates surpassed high home prices as the top reason why consumers think it’s a bad time to buy a home, a survey first.”

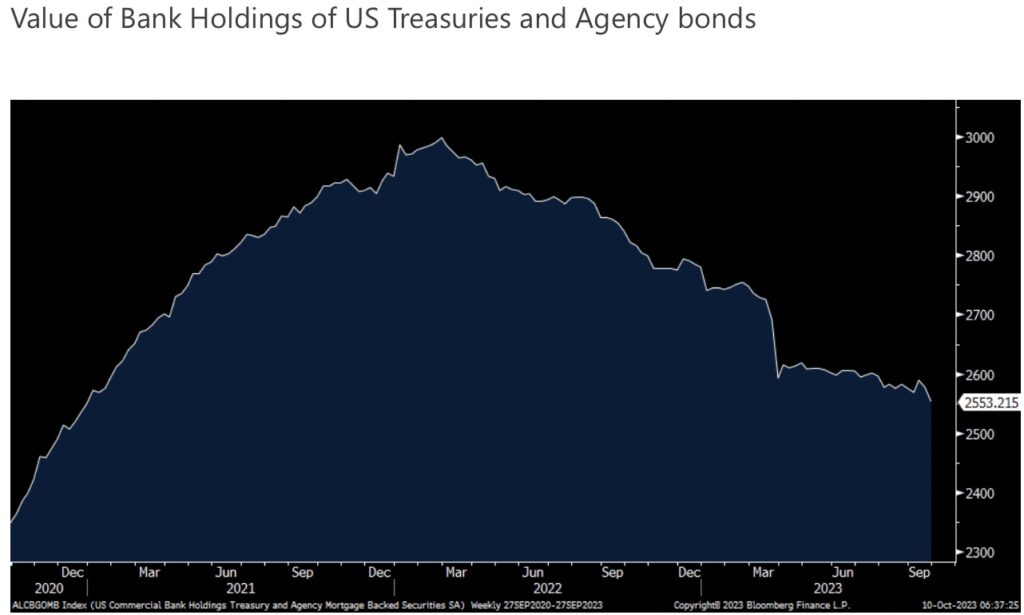

Ahead of the bank earnings reports on Friday, the treasury and agency holdings of the US banking system (seen on Friday) had its biggest drop for the week ended 9/27 since the March banking mess. Whether there was outright selling or just further downward marks in price, the value of the total holdings stand at the lowest level since early January 2021, down $450b from its 2022 peak.

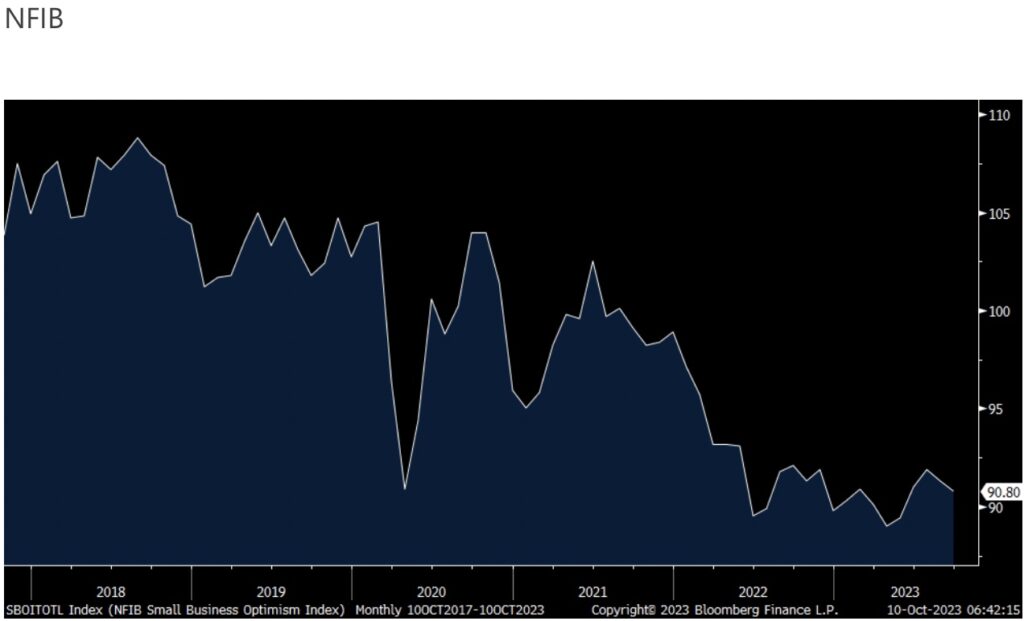

The September NFIB small business optimism index fell .5 pt m/o/m to 90.8, a 4 month low.

The internals were mixed. Plans to Hire rose 1 pt to a 4 month high and job openings were up 3 pts after dropping by 2 pts last month. Current compensation was unchanged but future plans dropped by 3 pts but only after rising by 5 last month. Capital spending plans were unchanged while plans to increase inventory fell 1 pt and is back under 0.

Those that Expect a Better Economy weakened by 6 pts to a 4 month low but those that Expect Higher Sales rose 1 pt, albeit still negative at -4%.

Good Time to Expand weakened by 1 pt to also a 4 month low while ‘earnings trends’ were little changed. Higher Selling Prices rose 2 pts to match a 4 month high.

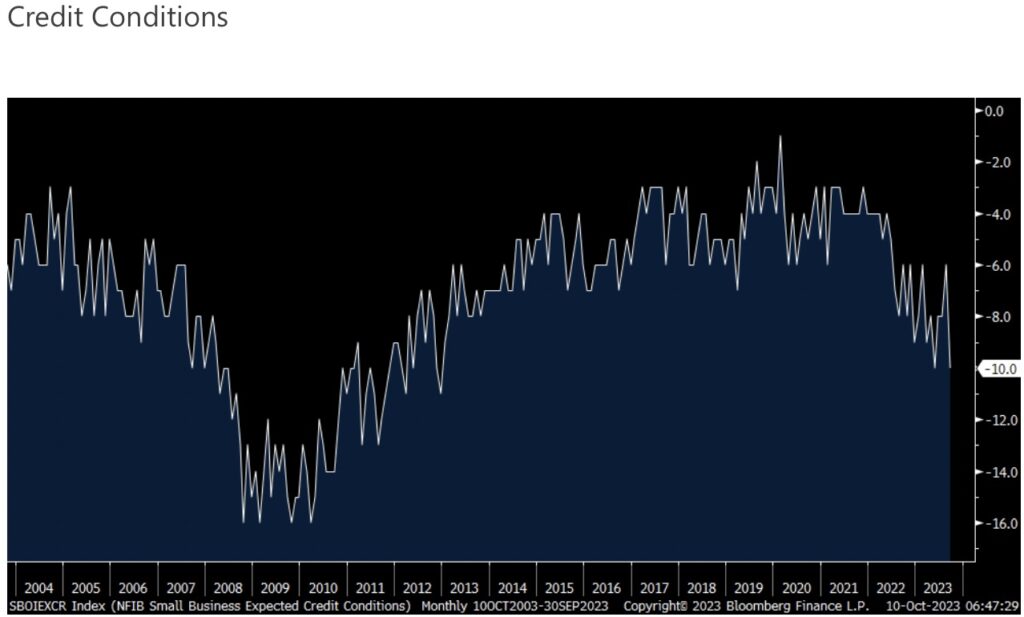

Finally, and I separate this line item out, ‘credit conditions’ weakened by 4 pts to -10%, matching the lowest since 2013.

And here is more on this, “23% reported all credit needs met (down 4 pts) and 65% said they were not interested in a loan (up 6 pts). A net 8% reported their last loan was harder to get than in previous attempts (up 4 pts).” Also, 4% reported that financing was their top business problem (up 2 pts) and 26% said they paid a higher rate on their most recent loan, up 2 pts m/o/m. And what’s that rate they are paying? “The average rate paid on short maturity loans was 9.8%, up .8 of a percentage point above last month.” The one positive, just “Two percent of owners reported that all their borrowing needs were not satisfied”, unchanged from August.

The NFIB’s bottom line was this, “Owners remain pessimistic about future business conditions, which has contributed to the low optimism they have regarding the economy. Sales growth among small businesses have slowed and the bottom line is being squeezed, leaving owners few options beyond raising selling prices for financial relief.” Inflation and labor quality are tied for the top two challenges facing small business.

China Rebound?

Let’s shift to China for a moment after yesterday’s return from Golden Week. The stats I’ve seen saw 826 million domestic trips over the 8 days and while below the 900 million China was hoping for, it’s about line with the amount seen in 2019. I also read from Inside Asian Gaming, that gross gaming revenue in Macau got back to 80% of the 2019 pace and that was better than anticipated.

ALSO JUST RELEASED: At All Costs Remain Focused On The Big Picture CLICK HERE

ALSO JUST RELEASED: Art Cashin – Markets Ultra Complicated After Attack On Israel, Boockvar Also Weighs In CLICK HERE

ALSO JUST RELEASED: BUCKLE UP: A World Hurtling Toward The Inflationary End-Game CLICK HERE

ALSO JUST RELEASED: This Crisis Today Is Multiples Worse Than What The World Faced In The 1970s CLICK HERE

To listen to James Turk discuss what to expect from paper assets, gold, silver, stocks and bonds CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.