Today legend Art Cashin warned markets are ultra complicated after the attack on Israel.

Markets Ultra Complicated After Attack

October 9 (King World News) – Art Cashin, Head of Floor Operations: The new month will continue to evolve, although the new money for the new month was somewhat obfuscated by the wild swings that we got from the algorithms. We will take another look at some of the technicals and where that may have brought us, particularly regarding the near-term outlook for that ten-year yield, which will remain critically important.

Ordinarily, at this point, we take a look at what is going on in the foreign equity markets, but that is ultra complicated this morning by a convoluted international holiday schedule and at least one major geopolitical event. That being the large Hamas raid out of Gaza into Israel with very large casualties, hostages and other complications.

On the holiday standpoint, Canada is closed for Thanksgiving Day. Japan is closed for Sports Day. South Korea is closed for Hangul Day and Taiwan is closed for Double Ten Day.

The complications continue here in the U.S. where, on Columbus Day, banks and Federal offices are closed, which means that trading in bonds is closed, while equity markets are open. We do see changes in oil prices as the international markets are open in that account.

So, in the pre-dawn hours, U.S. equity markets are lower, but somewhat off their overnight lows. With the bond market closed, we cannot get the benefit of a possible flight to safety that you would see on the international anxiety. We will await to see how that plays out.

Oil prices are higher. I have to assume on the idea that the hostility might spread as far away as Iran, which is a major oil producer. So, that leaves things up in the air. Overall, the holiday market has things confused and geopolitics even more so.

The number of dead, wounded and the number of existing hostages is very large, almost unprecedented and that may have further implications in much of the Middle East as people are shocked that the normally highly efficient Israeli intelligence system seems to have been caught off guard. So, too, did their allies here in the U.S., which appeared to provide no warning either.

With that confusion as backdrop, let’s look at what foreign markets did wind up doing or are doing.

Overnight, global equity markets are trading anxiously, but not in a full panic. Tokyo is closed for the Sports holiday we mentioned. Hong Kong had trading interrupted by threatening weather warnings. Mainland China was down about 160 points in the Dow. India closed off about 240 points in the Dow.

As we go to press, London is up the equivalent of nearly 100 points in the Dow. Paris is down about 80 Dow points and Frankfurt is down about 100 Dow points.

As we said earlier, with U.S. Treasury closed, we cannot see an outright flight to safety, but the next best thing is to assess what bond markets are doing around the globe and they are not showing a full-blown flight to safety. So, it may appear that the markets are taking this geo-political crisis in stride.

It will be important to see how things develop and if the geopolitical problem in the Mid-East spreads and what is or will be the Iran involvement and if that fully develops, what happens in Saudi Arabia. So, it is kind of an open page as we begin.

Given all that is going on the geopolitics, obviously, stay close to the newsticker. Keep your seatbelt fastened. Stay nimble and alert. The yields will not be guidelines because of the closing of the bond market for Columbus Day. Instead, we will be stuck looking at the newsticker probably minute by minute. The old Chinese curse is evident – “May you live in interesting times”. So, stay interested, but also stay safe.

It’s Never Easy

Peter Boockvar: It’s never easy writing after a profound tragedy and tie it into markets and the economy because it sounds insensitive and tone deaf but I’ll try. We’re seeing the exact market reaction that you would expect with commodities giving the largest response because of disruption assumptions, particularly oil with the unknown of how Iran will be dealt with (just as we drained our SPR, originally meant to protect us against supply disruptions, to 40 yr lows).

Also, any hopes of the Saudi’s pumping more oil on a grand deal with Israel and the US is of course now not happening. After three days of losses, the dollar is bouncing but gold is too. Grains are higher as is copper. While the cash market is closed, Treasury bond futures are rallying with the 10 yr up almost a half a point. I think stocks are only down modestly because the economic impact for now of what is happening is so muted that there is no discernible impact to earnings, notwithstanding the human devastation in Israel.

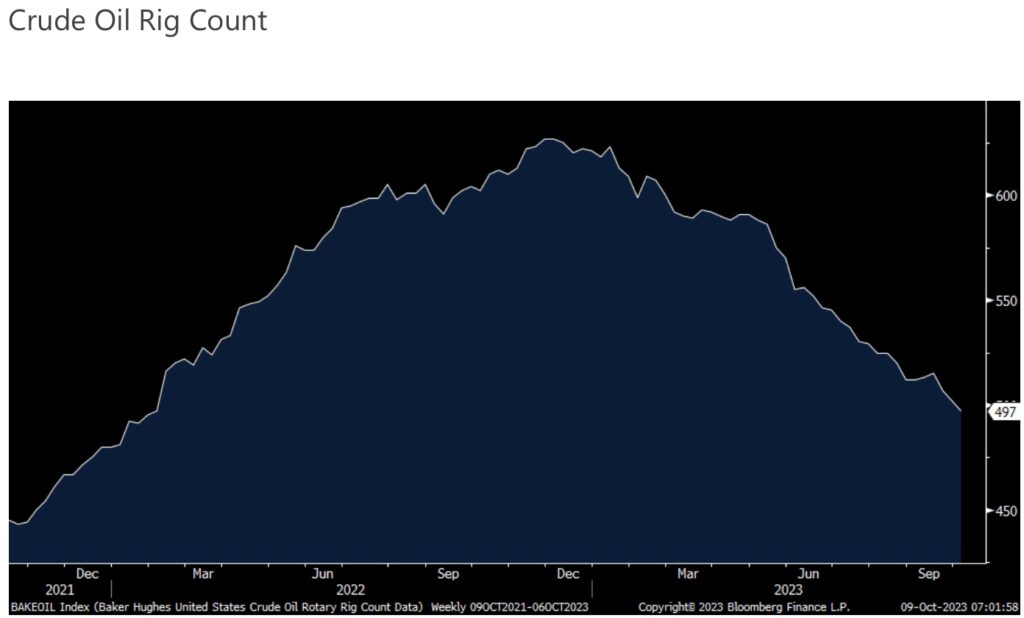

Speaking of oil, the US crude oil rig count fell by another 5 rigs and now is below 500 at 497, the least since February 2022.

Ahead of the inflation stats this week, on Friday we saw the Manheim Used Vehicle Index measuring wholesale prices for September. It rose 1% m/o/m seasonally adjusted but still down 3.9% y/o/y. Cox Automotive, who releases the data, said:

“September auction sales bolstered prices through the channel. While there was a bit of an acceleration from August, we shouldn’t get ahead of ourselves heading into the late fall and winter period. We are at a crossroads for wholesale, mainly from concerns about the UAW strike’s potentially slowing new retail sales and moving buyers into the used market. We don’t see that happening just yet, as it always takes time for changes to work through the market.”

While of course much will depend on the path of the strikes from here and its impact on used car prices, they said:

“we think the market mainly reflects balance at this point, relative to what we have been seeing for much of the last three years. We typically see only slight upward trends in wholesale values in the fourth quarter, which is why are forecasting our Used Vehicle Value Index to finish down 2.2% for the year.”

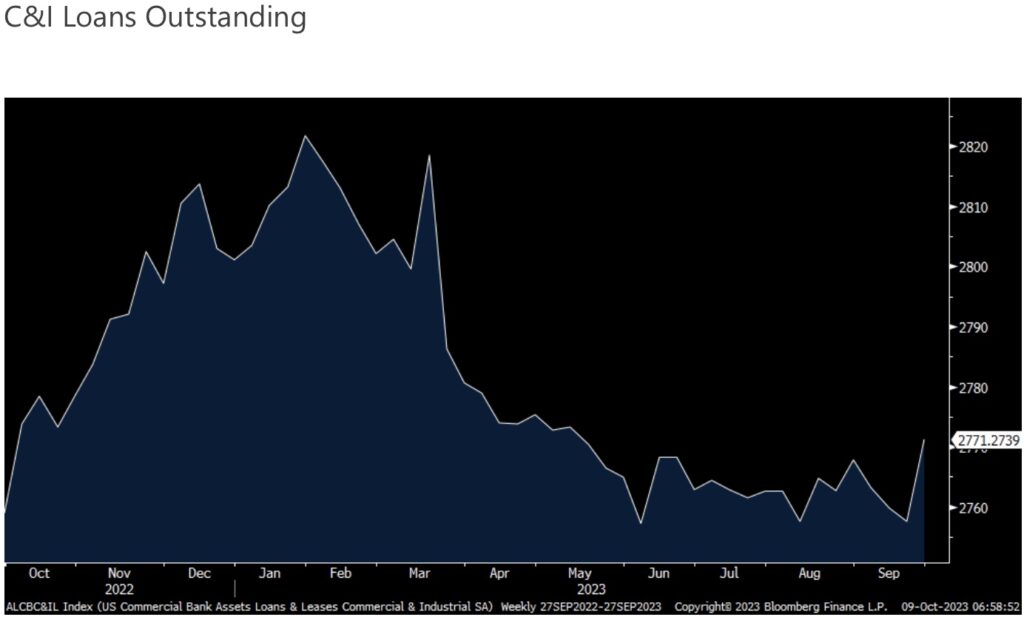

Maybe we’ll find out on Friday when we hear from the large banks, but there was a large $13.7b increase in C&I loans outstanding for the week ended 9/27 taking it to the most since May off the lowest level in a year. I’m guessing maybe some companies decided to tap their revolvers.

Bank deposits also rose by $40b, taking the total amount to the most since March as more banks entice customers to stay via higher interest rates paid.

The economic data is pretty quiet overseas. Sentix released its investor confidence index on the Eurozone economy and it was little changed at -21.9 vs -21.5.

Sentix said “The global economy is still in a difficult situation at the beginning of autumn in the northern hemisphere. In the Eurozone, and especially in Germany, the economic situation remains weak and the recessionary tendencies persist. At least there is a slight ray of hope in the form of rising expectations. However, it would be premature to declare a turnaround. If we look further into other regions, we see a largely unchanged picture. Cooling tendencies dominate. A positive trend reversal is nowhere to be found here either.”

ALSO JUST RELEASED: BUCKLE UP: A World Hurtling Toward The Inflationary End-Game CLICK HERE

ALSO JUST RELEASED: This Crisis Today Is Multiples Worse Than What The World Faced In The 1970s CLICK HERE

To listen to James Turk discuss what to expect from paper assets, gold, silver, stocks and bonds CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.