Here is why the gold anchor just hit $2,060.

The Gold Anchor

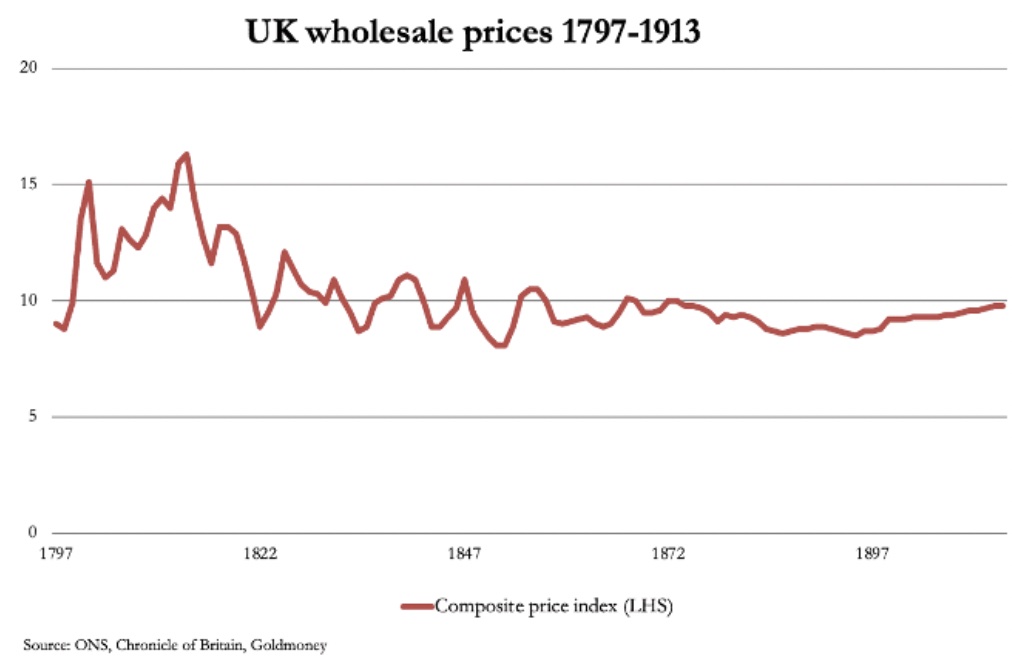

May 4 (King World News) – Alasdair Macleod: Credit needs an anchor in value. As demonstrated by the legal heritage of gold in all significant jurisdictions with law derived from Europe, if credit is anchored to gold then its value becomes stabilised both internationally and domestically. The link must be credible and for durability’s sake should be accessible to all. This was the thinking behind the introduction of the British gold sovereign coin in 1817, an arrangement that secured sterling’s purchasing power until the outbreak of war in 1914. The chart below shows how wholesale prices stabilised, after the suspension of specie convertibility in 1797.

The early years of the nineteenth century commenced with the suspension of specie payments, following the Bank Restriction Act of 1797. The Act was enabled to protect the Bank of England’s dwindling bullion reserves of gold and silver coins following a succession of poor grain harvests and preparations for war against an increasingly belligerent France. The suspension lasted through the Napoleonic wars until the introduction of the sovereign in 1817.

Following war-time inflation and the remedial actions taken, the general level of wholesale prices declined until the early 1820s, when despite a series of banking crises, price fluctuations tended to diminish over time. The reason prices stabilised was due to evolutionary improvements in the commercial banking system. The London banks had established a joint clearing system in 1775, and in 1854 joint stock banks (banks with outside shareholders) joined the system. This was followed by the Bank of England becoming a member in 1864.

Between 1844 (the time of the Bank Charter Act) and 1900, the wholesale index in the chart above was unchanged, having dipped slightly after 1875. It was also remarkably stable. But between 1844 and 1900, the sum of Bank of England banknotes in circulation and commercial bank deposit obligations increased eleven times, and there was a material increase in the quantity of short-term, commercial bills funding foreign trade as well. Monetarist theory would suggest that the expansion of credit on such a scale would undermine the purchasing power of the currency, but plainly it did not…

To Find Out Which Uranium Company Is Positioning Itself To Become A Powerhouse In Nevada Click Here Or On The Image Below.

The evidence is that so long as credit is tied firmly to gold, it will continue to take its value from it. And it will continue to do so until gold stocks in bullion or coin are drained from the note issuing bank to the point where the link is threatened.

It also explains why dollar prices were stable during the Bretton Woods Agreement, even though the connection was tenuous. The point is that given US official gold reserves were substantial, credit markets trusted the arrangement and derived their value from it.

Furthermore, the loss of the tie between gold and the dollar following the Bretton Woods Agreement’s suspension confirms the importance of firmly linking the value of all forms of credit to gold.

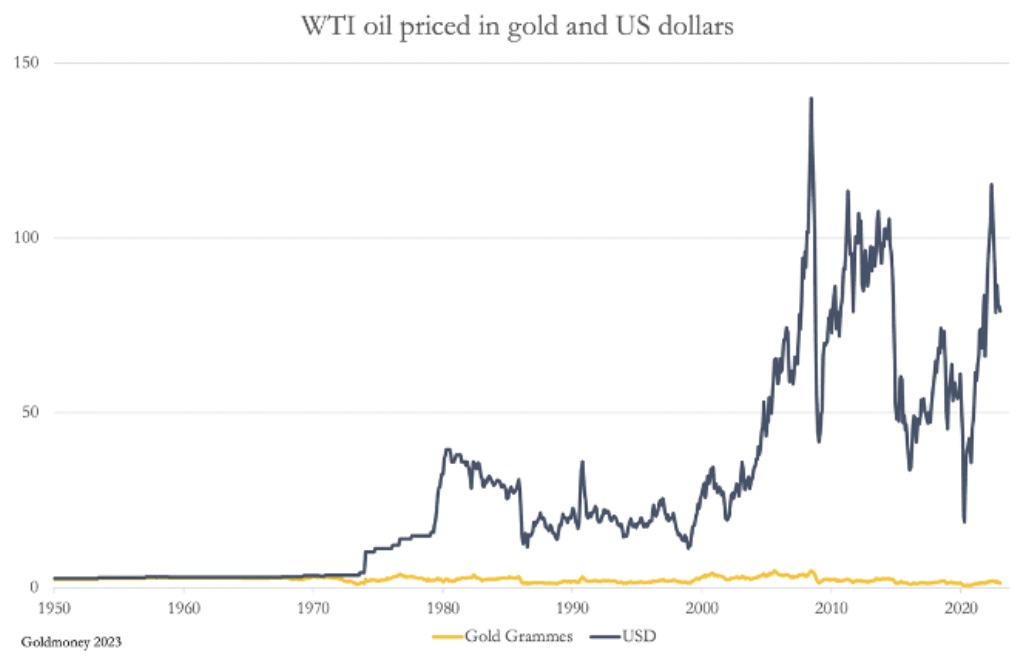

The next chart illustrates the point with respect to that most important commodity without which human progress would collapse — in this case the price of WTI oil in both dollars and gold, which is the marker for energy values.

The dollar price of oil was remarkably stable before the early seventies and priced in gold has remained so ever since. But shortly after the end of the Bretton Woods regime, priced in dollars the oil price exploded upwards, and became extremely volatile. Some of that volatility affected the price of oil measured in gold. In January 1974, priced in dollars oil more than doubled, while priced in gold it fell by 21%.

Price analysis misses this vital point, with economists, financiers, and businesses alike believing that the dollar is stable, and it is the oil price which is volatile. While there is some volatility in the oil price, it is actually the dollar which is unstable. The dollar is entirely credit, unanchored to legal money which is gold. This finding is confirmed in the pricing of a wide range of commodities in gold, which is our next chart.

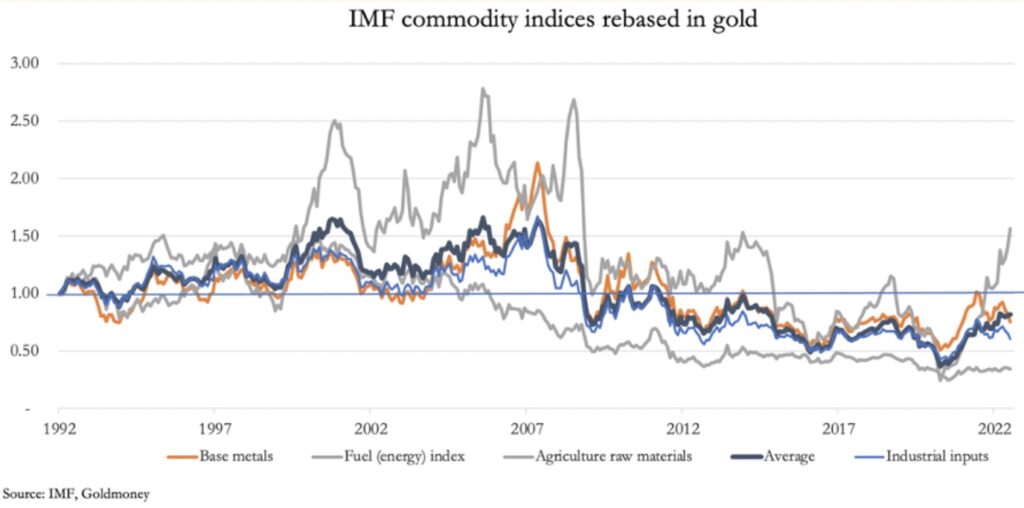

While individual sectors have fluctuated in value over the last three decades, priced in gold they have been considerably less volatile than in fiat currencies. And their average value (the black line) has been remarkably constant. The low point was in early-2020 when futures speculation drove the dollar price of oil briefly into negative territory. But by mid-2022, the average value of these commodity baskets had declined by only 18% from January 1992, when the IMF’s data series began.

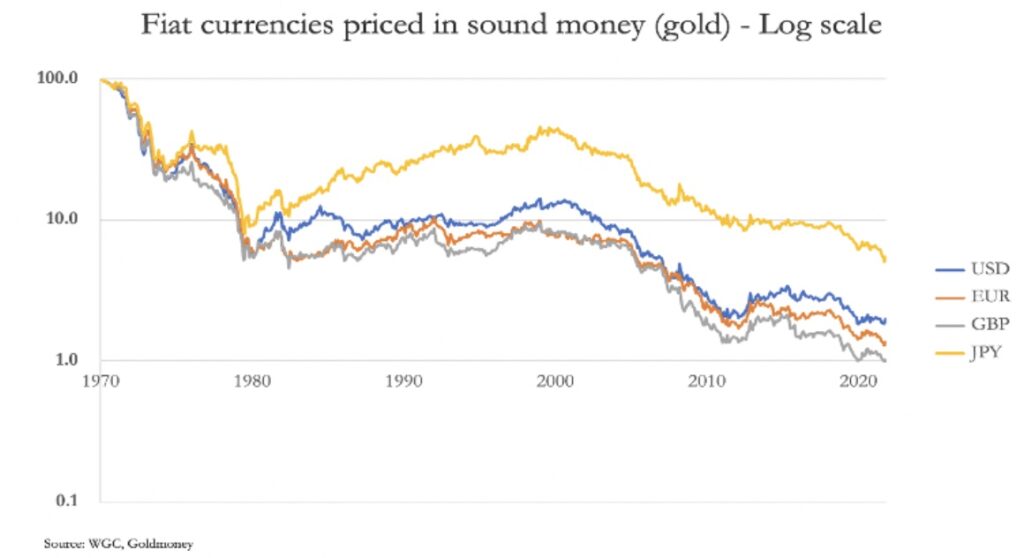

It is a fact that major currencies have become completely detached from legal money. The British gold sovereign was exchangeable for a one-pound note before the First World War: today the value of a pound note has reduced to one quarter of one per cent of one sovereign — put conventionally, a sovereign now costs £400.

The next chart shows how the four major currencies have declined relative to gold since the abandonment of Bretton Woods.

Even the mighty yen has lost over 95% of its value. The euro, based on the basket of currencies that contributed to its creation in 2000, has lost 98.7%, and the dollar 98.3%.

The banking crisis and credit contraction

There is a long-established cycle of bank behaviour, whereby bankers progressively become more confident in their lending until they become over-leveraged. They are then extremely vulnerable to a change in lending sentiment from greed for profit to fear of losses. Since the early nineteenth century this cycle of credit expansion and contraction has averaged about ten years. It is worth noting that since the last banking crisis in 2009, fourteen years have elapsed, making this cycle unusually extended.

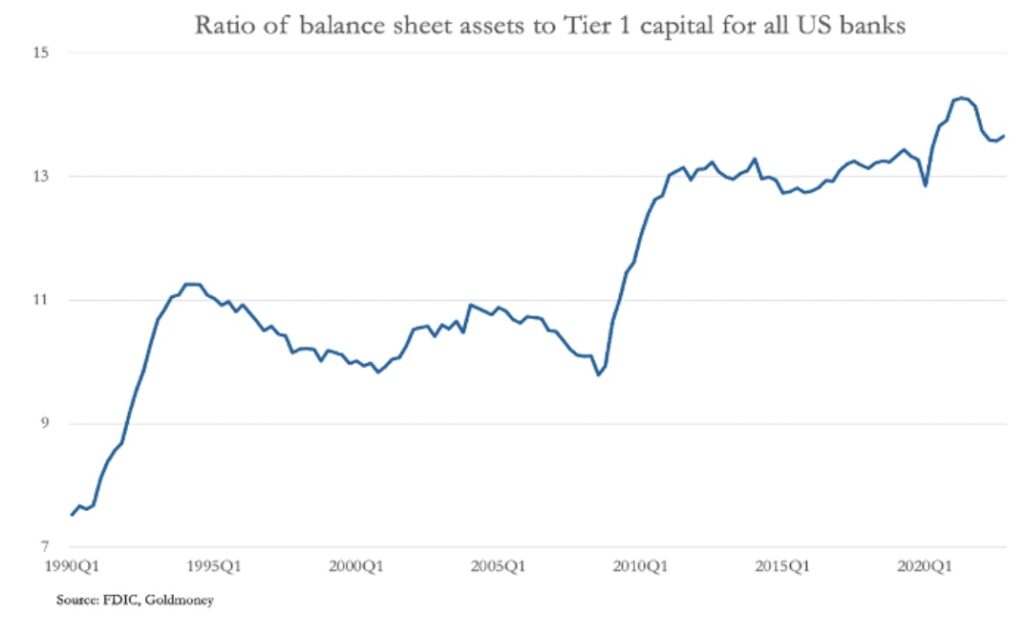

The next chart indicates how bank balance sheet leverage in the US’s commercial banking system has evolved over the last thirty years.

It is against this background of record balance sheet leverage that US commercial bank credit is now contracting. The increasing financialisation of the US and other western economies coupled with the suppression of interest rates by central banks inflated a financial bubble, which came to an end last year when consumer price inflation forced a change on interest rate policies.

Unusually, the world’s most senior commercial banker, Jamie Dimon of JPMorgan Chase, at a banking conference in New York in June last year warned of an economic hurricane approaching. The implication was that his bank would become more cautious over lending and risk exposure generally. He was signalling his pivot from maximising the bank’s profits through balance sheet leverage to risk containment. And as the chart above shows, the relationship between balance sheet size and Tier 1 equity for the entire US banking industry topped out at that time.

Dimon’s warning would have been echoed in the lending policies of the other major banks. Together, bankers act as a cohort, and his hurricane comment would not have fallen on deaf ears.

Since then, some significant banks have failed in America, and Credit Suisse in Switzerland as well. That has only increased bankers’ fears of risk over the entire international banking system — excepting China and Russia where economic and financial prospects are markedly better and isolated from the western banking system. So far, this new environment of lending caution has led to the withdrawal of credit principally from financial activities. It will soon become evident in the non-financial economy as well. And the recognition of systemic risk has spread to depositors shifting their deposits from smaller, regional banks where deposit protection is limited, to the larger banks deemed too-big-to-fail.

Much has been written about the on-balance sheet losses arising from investments in bonds, due to rising interest rates, bond yields, and yield curve inversions. Investors hope that the gathering crisis will mean an end to interest rate rises and a prospect that they will soon fall due to the somewhat patchy evidence of declining consumer demand. But this misunderstands the consequences of contracting bank credit.

Participants in both financial and non-financial activities depend on the ready availability of bank credit. But banks can refuse to novate outstanding loans and demand their repayment as they come due, and they can reduce their revolving credit facilities, sometimes with little notice in accordance with their terms. Demand for credit in the financial sector tends to continue or even increase for a while because investors are generally unaware of changing credit conditions. And industrial borrowers experience cash flow difficulties in an economic slowdown, requiring credit facilities to be sustained or even increased.

Consequently, a contraction in bank credit can increase demand for it, and there can only be one outcome: for the fewer borrowers who succeed in persuading their bankers to extend loan facilities, it will be at increased interest rates. Furthermore, the history of banking confirms this analysis is correct.

It is a myth, therefore, that a central bank can retain control over interest rates when the increase in commercial bank lending slows or even reverses. Hopes that banks in trouble and a deteriorating economic outlook will lead to lower interest rates are misplaced. But the tendency for interest rates to rise even further, driven by the withdrawal of credit irrespective of the inflation outlook undermines financial asset values even further with dire consequences for an economy, financial asset values, the funding of government finances, and for the commercial banks themselves.

It is at this stage that the folly of divorcing the value of credit from legal money will rapidly become apparent. With all the risks, with all the foreign ownership of dollars in particular, and with the prospect of a central bank prioritising the protection of financial asset values and underwriting the entire financial system, the value of credit is bound to face its most serious challenge.

The only remedy is unlikely to be adopted — reintroduce a firm link between credit and gold. A central bank would then have to ignore the consequences and severely limit the expansion of its own obligations, prioritising the maintenance of the currency’s value or face a run on its gold reserves. Given entrenched Keynesianism and central bankers’ group-thinking, it can be ruled out.

The future for credit

It would appear that the current dollar dominated fiat currency regime is drawing to a close. We can cite the following as evidence of its impending demise:

- The last fifty-two years since the end of the Bretton Woods Agreement culminated in a global financial bubble on a scale never seen before. It ended with negative interest rates in Europe and Japan (where they still persist).

- The unshackling of credit values from gold has fuelled credit expansion for financial speculation. The increasing financialisation of US, UK, and most European economies has chased production of goods abroad, hollowing out their economies, and increasing domestic dependence on ephemeral services.

- In the main, these conditions have not been supported by genuine savings. Instead, consumers rely on increasing levels of debt to maintain unaffordable lifestyles. This is in stark contrast with the principles behind the division of labour, whereby production is turned into consumption, with some of that consumption deferred to become capital available for driving economic progress.

- Bubble conditions have left massive amounts of unproductive debt, which cannot be repaid when due, and now the banks have neither the desire nor the balance sheet capacity to extend them. Properly accounted for, the entire banking system is so overleveraged that even losses in this early stage of credit contraction are estimated to wipe out bank equity in the US, Europe, and Japan.

- Having taken on massive quantities of government debt at the highest possible prices through quantitative easing, the major central banks themselves are in negative equity. They are in no condition to absorb the costs of assuming the liabilities of failing commercial banks without debauching their currencies.

The combination of a deflating financial bubble and a collapsing fiat currency resulted in the collapse of John Law’s Mississippi bubble. We see similar conditions today, justified in large measure by Keynesian macroeconomics, which pursue similar economic policies to those propounded by Law. It was the livre which became valueless then, so we can expect the existence of dollars, euros, yen, and pounds to be similarly threatened.

The moral of this sorry tale is that expanding credit is a good thing, creating wealth as incorporeal value subject to two conditions. Its value must be soundly tied to legal money, which is physical gold. And credit must only be created in anticipation that the debtor uses it wisely and that it will be eventually settled.

The rise and rise of Asia

While the major western currencies and their credit systems are descending into crisis, China in partnership with Russia is planning an industrial revolution for all of Asia. So far, they have been careful not to disrupt the international monetary system beyond expressing a desire to do away with dollars in their Asian backyard.

This changed with the invasion of Ukraine and the sanctions imposed on Russia. Russia’s currency reserves in dollars and euros were rendered worthless, and Russia is no longer selling her gold output into western markets, though she is selling some through Dubai and Hong Kong. Apart from these sales, the indications are that Russia is securing her currency by accumulating gold reserves and making gold in the Gokhran —the State Fund for Precious Metals — available for monetary purposes in addition to the Central Bank of Russia’s reserves. It cannot be confirmed, but it is thought that this secret fund holds an estimated 10,000 tonnes, so it will be possible for Russia to declare and demonstrate reserves considerably in excess of those held by the US Treasury.

China has undoubtedly accumulated substantial quantities of gold since 1983, when the Peoples Bank was appointed to manage China’s gold and silver reserves. Investment in gold mining and refining was stepped up, and China rapidly became the largest nation by gold mine output. Other than small amounts permitted for Hong Kong jewellery fabrication, no gold leaves China. And over 21,000 tonnes have been delivered into public hands from the Shanghai Gold Exchange since the public was first permitted to buy gold in 2002.

Given that the Peoples Bank began accumulating gold in 1983, between then and 2002 at contemporary prices China’s state-owned gold accumulation will have been substantial. It is likely to amount to some 20,000—25,000 tonnes, when capital flows and state policies towards mining and refining are considered. That amount has almost certainly increased since.

Whatever the figures, it is clear that both Russia and China anticipated a western currency crisis and have deliberately taken steps to protect themselves against it.

They understand what we have forgotten: the distinction between money and credit.

***To listen to Michael Oliver discuss the looming stock market collapse as well as what this will mean for major markets including gold CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Gold Truly Shining Brightly Near All-Time High, Plus Look At These Two Collapses CLICK HERE.

ALSO JUST RELEASED: Fed Raises Rates But Will They Reverse Course? Plus Silver Ready To Soar CLICK HERE.

ALSO JUST RELEASED: Michael Oliver Just Warned This Global Collapse Is Going To Be Far Worse Than 2008-’09 CLICK HERE.

ALSO JUST RELEASED: Gold Surges To $2,025 As Fears Of Bank Failures Accelerates But Here’s The Big Surprise CLICK HERE.

ALSO RELEASED: Gold & Silver Close To Major Upside Breakouts But Take A Look At This… CLICK HERE.

ALSO RELEASED: Mikhailovich – Expect A Long And Brutal Collapse CLICK HERE.

ALSO RELEASED: Greyerz – The Everything Bubble Is Now Turning Into The Everything Collapse CLICK HERE.

***To listen to Alasdair Macleod discuss the key for the next major move in the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.