Another gold catalyst is happening in the background and that is going to be seen in the form of a wave of massive commodity inflation that has already started. Also, when it comes to the volatility we have been seeing in the gold market, always step back and stay focused on the big picture.

Focus On Gold’s Big Picture During Volatility

September 6 (King World News) – Graddhy out of Sweden: Big picture, gold is still holding blue support line.

Ignore Volatility, Gold Is Holding Blue Support Line

Just Like 2016 & 2018

Graddhy out of Sweden: The Dow Jones (US stock market) vs gold ratio is topping big picture. Have yellow triangle breakdown and now backtesting. The drop to blue head & shoulders neckline will mean gold outperforming the stock market, just like back in 2016 and 2018.

Dow Jones/Gold Ratio Topping, Gold Preparing To Dominate

The Idiots Never Refilled Our Strategic Oil Reserve

Peter Boockvar: Well, I guess the Department of Energy missed again its chance to refill the SPR when crude oil got to $70. It seems that if the intent is to eventually rebuild it, they will have to get off the $70 goal and raise its buying price.

POLITICAL MADNESS:

US Has Lost More Than Half Its Crude Oil Reserves For Political Reasons. The Reserve Is There For A Reason. Now Oil Is Near The $90 Level. This Is Madness.

Auto Sales Have Collapsed: Pricing Coming Down

I forgot to mention Friday’s August auto sales number where the SAAR was 15.04mm, well below the estimate of 15.4mm and compares with just below 17mm in August 2019. With inventories normalizing, I can only guess that high vehicle prices and high financing costs dissuaded buyers. The auto sector has been the last group standing in the industrial space as dealer lots got filled up again and a particular strong point for the semi companies that sold into this market.

The August Logistics Managers’ Index rose to 51.2, the first time above 50 in four months. LMI said inventories are “still contracting but at a much slower rate” and this led to a rise in inventory costs and warehousing prices. As to what the headline figure means, “It is not yet clear whether this move back towards expansion is a one-off deviation from the contraction we had been seeing or represents a pivot back towards expansion remains to be seen. However, it does appear that the increase in activity we observed in the 2nd half of July has spilled over into August. When taken together with other anecdotal evidence and metrics…, it seems that a move back towards continued expansion is quite possible.” The key will be the desire to rebuild inventories…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

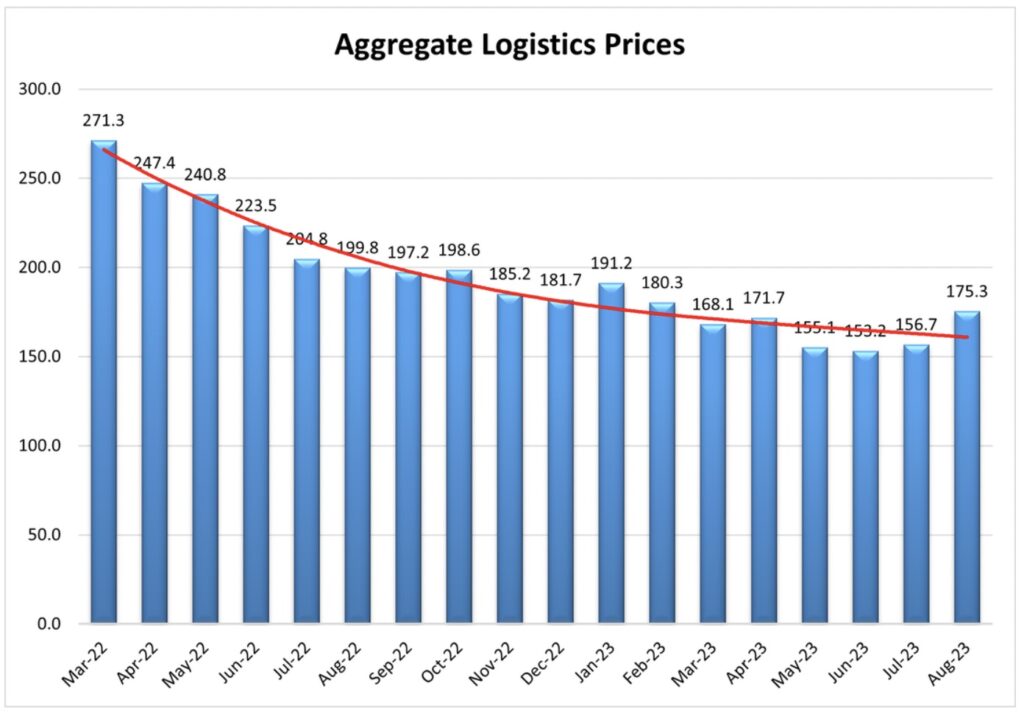

INFLATION ALERT: Logistics Costs Are Soaring!

Something to watch is the rise in total transportation costs as the “Aggregate Logistics Costs jumped up 18.6 pts to a reading of 175.3 in August. This is a marked change from the trends we have been observing over the last 18 months.” To put this figure into context:

“If Aggregate Logistics Prices stay in a reasonable range (e.g. somewhere around 200), then our chances of an improvement in both the freight market and overall economy are good. If however, the increase continues and we see Aggregate Logistics Prices over 250 again it may be a sign that we are moving back towards inflation.”

Higher inventory costs were the main contributor in August. The shipping price of freight index is still below 50 but did rise 7.3 pts in August to the highest reading since September 2022.

High Crude Oil Prices Are Already Beginning To Feed Through The System Ramping Up Inflation. This Will Only Get Worse Over Time.

China Rebound? If True, Prepare For Serious Commodity Inflation

A US inventory build will benefit China’s manufacturers and I’ll highlight data from China again today to reflect while they have major challenges and secular slower growth, their economy is still moving forward. In the China Beige Book’s August flash data, “factory activity surprised to the upside…as output expanded and order growth improved both at home and abroad. Export orders aren’t looking good to the US or Europe, but in terms of Asia and elsewhere they are ramping up solidly.”

In Trip.com’s earnings report, a stock we own, they said China’s domestic demand for hotels and air travel is well above the pre Covid trend seen in 2019 and international travel in Q2 was at 60% of 2019 levels vs 40% in Q1.

I want to emphasize that I keep talking about China because it’s obviously the 2nd biggest economy, thus hugely important to the globe and in order to be more detailed and factual when we hear dire talk about its economic situation.

Also, the real estate downturn is a global thing. If you didn’t see the Weekend FT, the front page had an article titled “Germany’s construction industry calls for help as more developers go bust.” The article said “Builders are facing a perfect storm of rising interest rates, more expensive construction materials, a dire shortage of skilled workers and slowing demand for new developments, leading to financing problems across the industry.”

The End Of A 10 to 15 Year Property Boom

The article quoted the head of the Kiel Institute for the World Economy in Germany who said “We are at the end of a 10 to 15 yr property boom. The financial cycle is now such that every day another property developer is going bust…The old funding models are no longer sustainable.” The head of the IFO Institute said “Demand in residential housing has just collapsed.”

This is Germany, not China.

Germany also said that in July, it’s factory orders figure plunged by 11.7% m/o/m, well worse than the estimate of down 4.3%. It’s the swings in aerospace orders that was the main reason as orders were up 7.6% in June.

In the US, with the average 30 yr mortgage rate around 7.5% according to Bankrate, purchase applications fell 2.1% w/o/w and is back to a 28 yr low, down by 28% y/o/y. Refi’s were down by almost 5% w/o/w and lower by 30% y/o/y. Nothing new here but if you’re not in the home building business, you are having a really tough time in the housing industry.

Ahead of the final US manufacturing and services PMI and after seeing all the international ones, Singapore today was the last to report and its PMI rose to 53.6 from 51.3. It was better domestic business than via exports that drove the improvement. Also of note, “Business confidence also improved to the strongest in 10 months.” The weakness seen was in new export orders which remain “well in contraction territory.” We’re still positive on the Singapore story and are long stocks there.

ALSO JUST RELEASED: UP IN SMOKE: On The Brink Of Default CLICK HERE.

ALSO JUST RELEASED: Gold & Silver Markets Near Historic Upside Explosion CLICK HERE.

ALSO JUST RELEASED: Financial Assets Are Now Set To Seriously Deflate CLICK HERE.

Alasdair Macleod discusses why gold, silver, and mining share investors should ignore the US dollar and all other fiat currencies as well as what other surprises took place this week in the metals markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged