The squeeze in the gold market continues with the price of gold surges near the $2,000 level as fear engulfs global banking system.

Chaos Unleashed

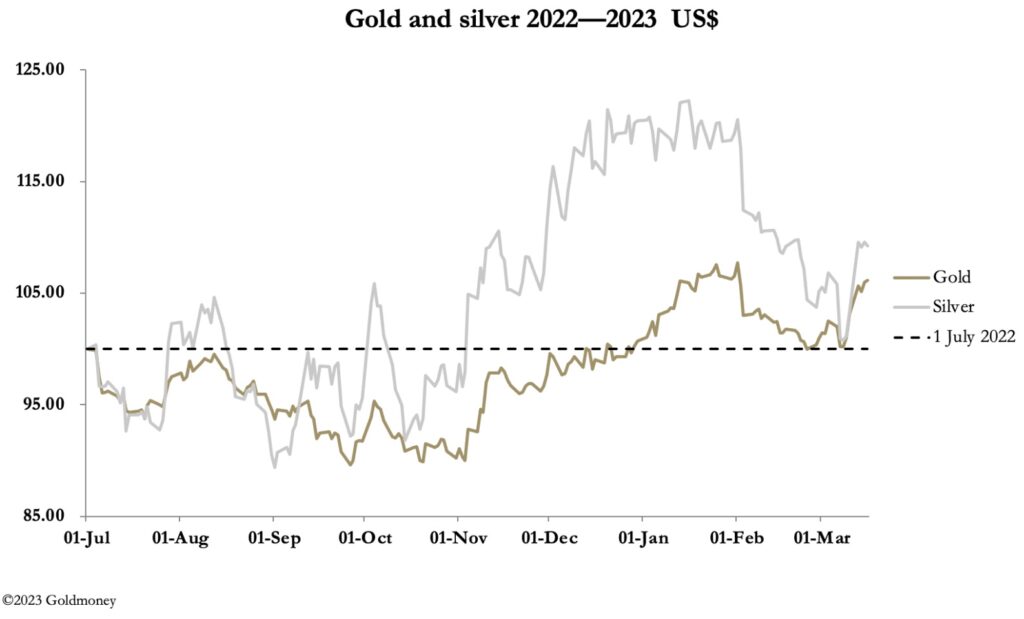

March 17 (King World News) – Alasdair Macleod, head of research at Goldmoney: Last weekend saw the failure of three banks in the US: Silicon Valley, Signature, and Silvergate. Gold rallied to $1931 in European trade this morning, up $68 from last Friday’s close and up $118 in just seven trading sessions. Silver was $21.86, up $1.35 this week, and $1.85 from the previous Wednesday.

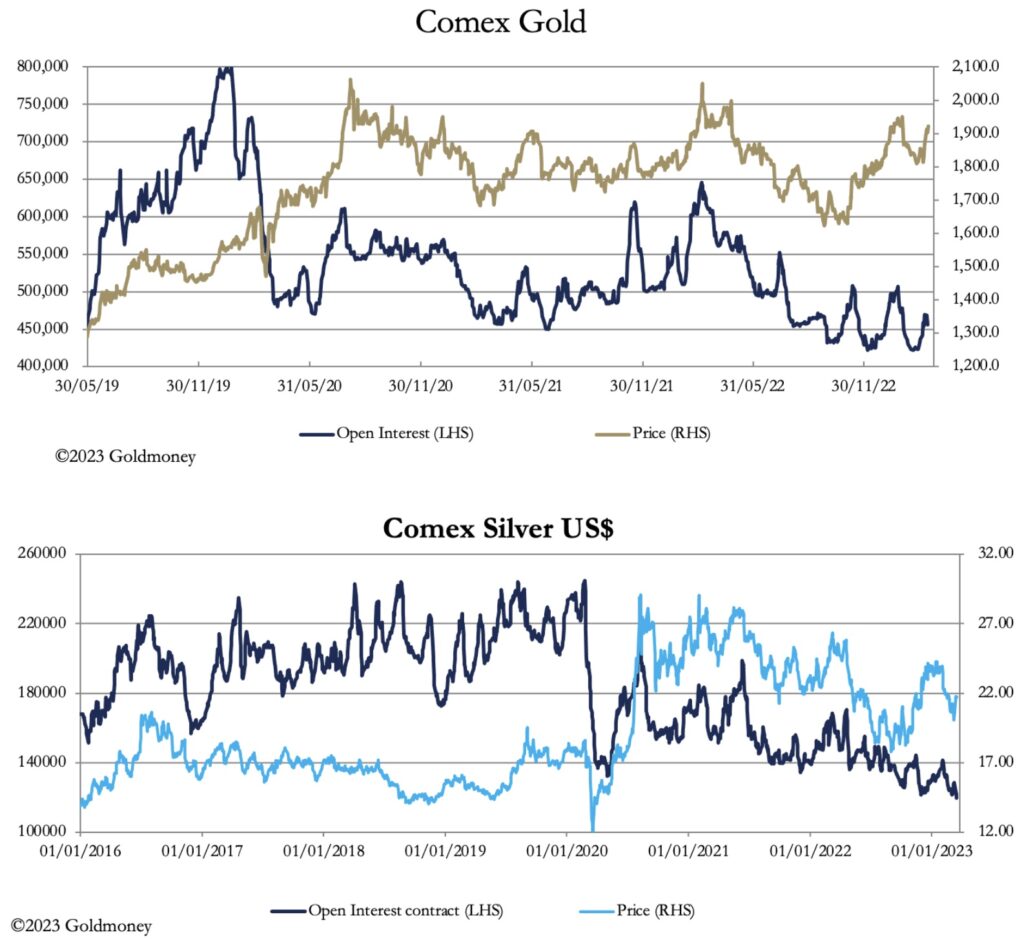

There was a significant element of bear squeeze involved. On Comex, there were days when the gold price rallied, and Open Interest fell indicating that on balance more bears were closing than new bull positions being taken out. Understandably, on Monday trading volumes in both contracts spiked higher after a calamitous weekend. But the subsequent decline in silver volumes took them back to pre-panic levels. And most notably, Open Interest has declined to the lowest levels for many years (the second chart below).

The reason for the change in sentiment is a dawning realisation that the global banking system is in a perilous state. The SVB collapse was brought about by the realisation of hidden losses on its bond portfolio. Worryingly, SVB was investing in long maturity Treasury and Agency debt, something which banks never did in the past…

ALERT:

Billionaire mining legend Pierre Lassonde has been buying large blocks of shares in this gold exploration company and believes the stock is set to soar more than 150% in the next 6 months. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

So why did SVB do this, and is this departure from short-term debt into longer maturities common with other banks? We need to look at the recent history of the yield curve.

When the Fed suppressed interest rates to the zero bound, the yield curve was positive. In March 2021, it stood at 1.53%, which meant that a bank could improve its interest margin by buying a 10-year UST over a 2-year UST by that amount. This was before the inflation monster became apparent, and it is a fair bet that the bank’s inhouse economic advice was that inflation was unlikely to be a problem, given official forecasts. But from then on, the 10—2 spread began to decline as the yield on shorter maturities began to anticipate higher short-term rates, with the 2-year UST yielding 0.75% In January 2022. The effective Fed funds rate then began its fastest rise in recent history, making the cost of funding long positions in long maturities greater than their yield…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

It is worth repeating, that funding long maturities off a short-term book has always been a no-no in banking. But of the $4.5 trillion USTs and $2.7 trillion Agency debt on the banking system’s books, we now know that a considerable portion of that is likely to be in long maturities. This is why the Fed has introduced a Bank Term Funding Program, offering to buy in all bond debt at par on a one-year loan. According to JPMorgan, up to $2 trillion of bonds might be involved, adding to the Fed’s QE, and similarly is likely to be impossible to reverse.

It is hardly surprising that markets appear to be waking up to the inflationary consequences, particularly if other central banks introduce similar facilities. But above all, for precious metals traders, it has proved to be an expensive lesson…to continue listening to Alasdair Macleod’s powerful and timely KWN audio interview where he discusses the ongoing collapse in the banking system as well as what this means for global currencies and other markets as well as why gold is set explode higher CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Banking Solvency Problems Are Everywhere And The Backstop Guarantee Is Worthless CLICK HERE.

ALSO JUST RELEASED: Here Is The Big Picture For Gold After Bank Collapses In Europe And The US CLICK HERE.

ALSO JUST RELEASED: Accidental Banking System Failure? Don’t Believe It CLICK HERE.

ALSO JUST RELEASED: The Terrifying Chart That Caused The Collapse In Bank Stocks And Frightened The Markets CLICK HERE.

ALSO RELEASED: Forget All The Bear Talk And Look At This Major Bull Market Nobody Is Watching CLICK HERE.

ALSO RELEASED: Is It Only Tuesday? A Sigh Of Relief For Markets But Here Is What To Watch CLICK HERE.

ALSO RELEASED: I’ve Seen Many Bank Crises In My 75 Years. Here Is What I Learned CLICK HERE.

ALSO RELEASED: Schiff On The Historic Fed Pivot. Art Cashin Warns: Keep Your Seatbelts Fastened CLICK HERE.

ALSO RELEASED: Here Is A Look At The Ongoing Panic CLICK HERE.

ALSO RELEASED: Bank Runs Set To Accelerate As Fear And Panic Spreads CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.