It’s hard to believe it’s only Tuesday as investors and traders breathe a sigh of relief with markets rallying but here is what to watch.

The Sharp Rally In Stocks

March 14 (King World News) – Art Cashin, Head of Floor Operations at UBS: This morning’s sharp rebound rally is very much a function of the severely oversold condition in the market that I noted in the pre-opening Comments. Aiding that rebound also, is the relative calm in the regional banking area with no sign of deposits hemorrhaging out of any institution visible.

The rebound so far seems to be respecting the near-term technicals. So far, the S&P has not heavily challenged the resistance at 3925/3950. The market will also focus on the next step in the attempt to re-auction the SVB and whether it looks like it will be impossible to do as an entity and that it needs to be broken up.

As I say, so far, there is a sigh of relief, but a welcome one after that many days of selling, particularly of selling of that intensity.

Watch the auction and the yields are bouncing back so, keep an eye on them moving up another 25% from here. All will grab the attention and possibly put some pressure on the equity markets.

Stay safe.

Arthur

Is it only Tuesday?

Peter Boockvar: While it’s highly uncertain as to what is protected and what’s not, hopefully in the short term depositors can take a deep breath and we can shift back to the economic data and measure the business consequences of everything that has happened over the past week rather than worry about more bank runs (I believe the challenge of most banks is with profits from here and not balance sheet, although I get the mark to market issues that many have). Unfortunately the economic data over the coming month won’t reflect that yet.

Further Tightening Of Lending Standards

How will bank loan officers tighten lending standards further? We have to assume they will. To what extent will bank deposit rates lift from here? Not sure but they’ll be going up. What loan spread will banks be comfortable with and will borrowers want to pay it? Well, high yield is trading at about 500 bps over Treasuries and the CCC component is a bit over 1000 bps. Thus, assume deposit rates go to 2-3% from here, many small and medium sized businesses are going to be paying double digit interest rates for bank loans. All in, we have to assume that bank lending will slow from here as will the demand for loans…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Small Businesses Remain Worried

The NFIB said:

“Small business owners remain doubtful that business conditions will get better in the coming months. They continue to struggle with historic inflation and labor shortages that are holding back growth. Despite their economic challenges, owners are working hard to create new jobs to strengthen the economy and their firms.”

Those that Expect a Better Economy weakened by 2 pts to -47% and that is near the record low.

Businesses Expecting A Better Economy Near Record Low At -47%

US Treasuries continue to trade like meme stocks and the sense of calm today has the 2 yr yield jumping by 24 bps after plunging by 109 bps in the 3 prior days. The LSTA leveraged loan index yesterday had its worst percentage day loss since June 2022 as both credit worries and the drop in interest rates lessen the appeal of owning them as they include low quality credits and are floating rate.

LSTA Leveraged Loan Index

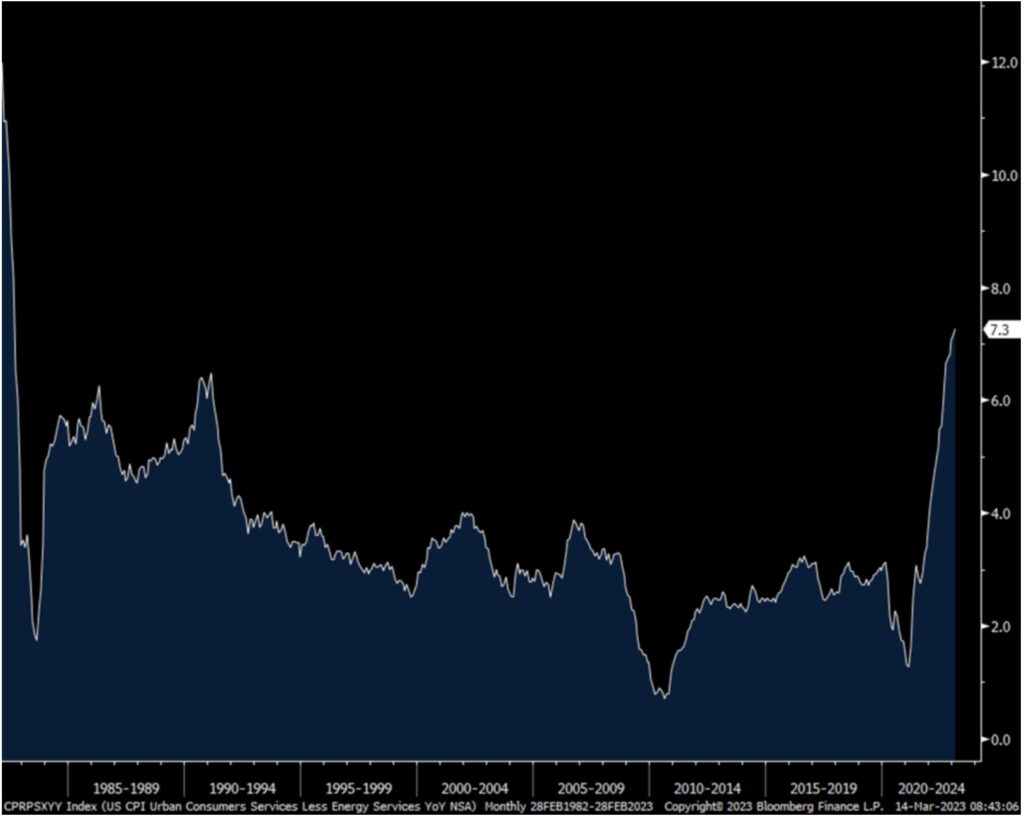

Inflation

…we have again a further acceleration in service prices that is offsetting the continued moderation in goods prices.

Services Inflation Ex Energy

That said, we know rental growth is being way overstated but should still growth 3-4% sustainably after the current supply increase gets absorbed as the demand is still very solid. Goods prices on the other hand have likely bottomed on the downside of the spike. The combination is still going to lead to slower but sustainable inflation and why the Fed is going to hike rates by 25 bps next week but likely pause thereafter. The call for a rate cut next week by a particular bank makes no sense to me as the Fed would look so weak in doing so and would make all the vocal hawks look silly.

Don’t Count On The Fed Put

I want to also say this, this will be the first rate hiking cycle in 40 yrs where the Fed’s ability to pivot aggressively with rate cuts thereafter in reacting to an economic downturn is going to be extremely limited as long as inflation remains so much above its 2% target. Those looking for the Fed to save them in the coming recession will have to temper their expectations I believe.

In response to the persistent inflation report, the 5 yr inflation breakeven is getting back what it lost yesterday and rising by 8 bps to 2.42%, though still down from the near 2.80% it saw two weeks ago before some banks blew up. The 2 yr yield was up about where it was right before the report. The odds of a 25 bps rate hike next week is 84%.

A Little Bit Of Fear

The CNN Fear/Greed index yesterday closed at just 19 vs 46 one week ago and 72 one month ago. That is now in the ‘Extreme Fear’ category and from a contrarian standpoint it’s good to see in looking for a bounce in the very short term.

ALSO JUST RELEASED: I’ve Seen Many Bank Crises In My 75 Years. Here Is What I Learned CLICK HERE.

ALSO JUST RELEASED: Schiff On The Historic Fed Pivot. Art Cashin Warns: Keep Your Seatbelts Fastened CLICK HERE.

ALSO JUST RELEASED: Here Is A Look At The Ongoing Panic CLICK HERE.

ALSO JUST RELEASED: Bank Runs Set To Accelerate As Fear And Panic Spreads CLICK HERE.

***To listen to Matthew Piepenburg’s powerful KWN audio interview which has just been released CLICKING HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the bank collapse, contagion and crisis as well as what this will mean for the gold market CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.