As we end trading in the 3rd week of October, gold is having its revenge on those playing games in the paper markets.

The King World News audio interview with Michael Oliver discussing gold’s nearly $200 surge has now been released! Also…

Gold Has Its Revenge

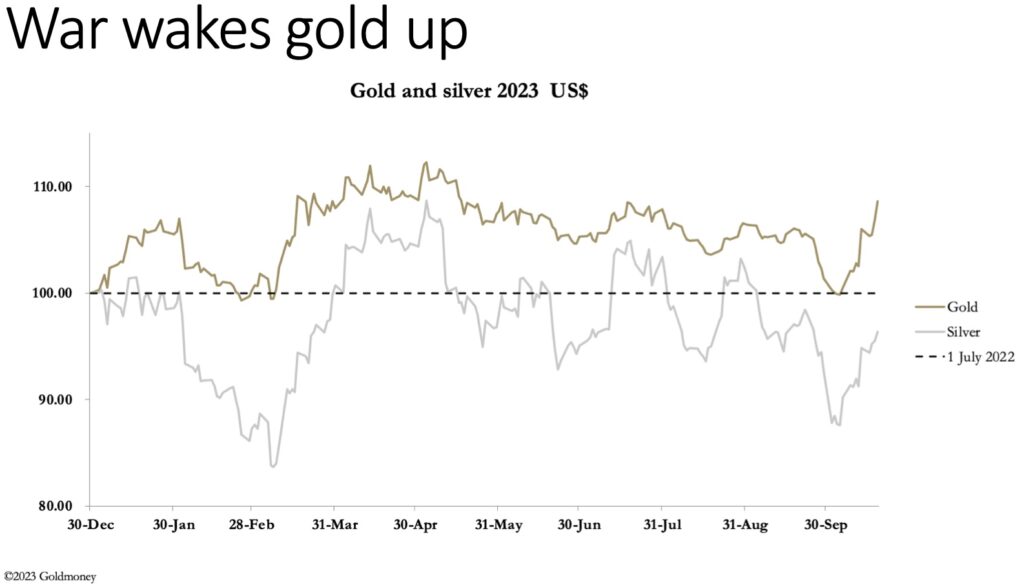

October 20 (King World News) – Alasdair Macleod: This week, a firmer trend in gold continued as markets realised the seriousness of the deteriorating situation in the Middle East. In European trade this morning, gold traded at $1979, up $46 from last Friday’s close and up $160 from the October 6 low. Silver was less responsive at $22.95, up a modest 25 cents from last Friday’s close.

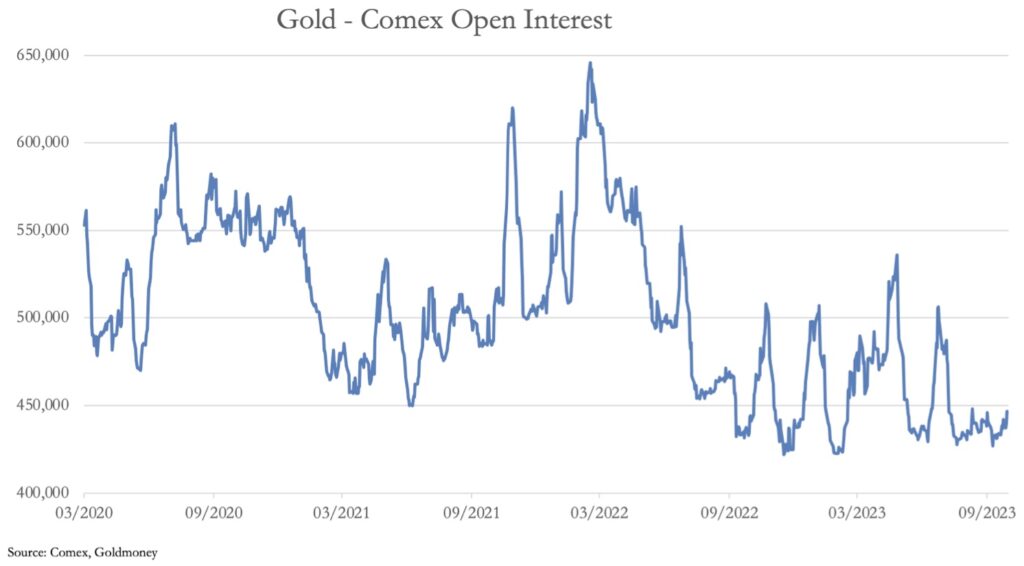

Open interest in gold remains remarkably low, as our next chart shows.

This is possibly the most bullish chart we can show. It illustrates the very low level of speculative and hedging interest in gold, both of which can be expected to increase materially as the conflict in Israel evolves. Central to the problem, of course, is oil. Any attempt by the US and her NATO allies to intervene increases the likelihood of Iran closing off Hormuz at a time when western oil reserves are depleted. And according to StanChart, oil demand now exceeds pre-covid pandemic levels.

Higher oil and distillate prices are also being encouraged by OPEC+, led by Russia, the Saudis, and Iran. The implications for western capital markets and their currencies are that inflation, interest rates, and bond yields will remain higher for longer. And this reality is beginning to drive global bond yields up, with the US 10-year Treasury Note already testing the 5% yield level…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Interestingly, establishment fund managers and speculators now find that higher interest rates and bond yields don’t suppress gold, because the price has been rising at the same time as bond yields. This probably explains the low level of Open Interest on Comex, with speculators being frozen out from taking positions because of this phenomenon. But there is bound to come a time when they re-enter long positions, because of the destabilising effects of higher bond yields and lower asset values on the banking system and government finances.

These conditions are especially pernicious for US Government deficits. The USG will have to fund a widening fiscal deficit at a 5me when China and Japan are selling their US Treasury holdings, and some $7.6 trillion in Treasuries will have to be refinanced next year before a deficit probably exceeding $3 trillion in the current fiscal year will need to be financed. Embedded in this deficit is a likely debt interest figure of about $1.5 trillion, a 60% increase from the fiscal year just ended.

In short, the US Treasury is ensnared in a debt trap which can only result in foreigners spurning US Treasuries and the dollar itself. The only reason the dollar hasn’t declined on the foreign exchanges is the lack of an attractive currency alternative. The euro system is bust with nearly all the national central banks in negative equity and the major commercial banks rated at deep discounts to their book values. Italy is entering its own debt crisis as well, with budget deficits hitting 8% last year and government debt to GDP ratios exceeding 140%. Meanwhile, a seriously bust Bank of Japan is finding it increasingly difficult to suppress bond yields and support the yen.

Problems are global. And gold is the evidence. The chart certainly looks bullish.

Gold Price Will Explode $600 Higher In 60 Days!

To listen to Michael Oliver’s remarkable predictions for the price of gold, silver, mining stocks and other major markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: CONSUMER WORRIES: Things Are Tough All Over CLICK HERE

ALSO JUST RELEASED: Michael Oliver – Here Is The Major Breakout Level For Silver And The Mining Stocks CLICK HERE

ALSO JUST RELEASED: Here Is How The Elite Decided To Deal With A Full-Blown Worldwide Liquidity Crisis CLICK HERE

ALSO JUST RELEASED: Gold & Silver Parabolic Moves Ready For Launch $10,000-$15,000 Gold, But Look At Silver! CLICK HERE

ALSO RELEASED: SPROTT: Gold And The Global Debt Bubble CLICK HERE

ALSO RELEASED: Greyerz – This Global Collapse Will Be One For The History Books CLICK HERE

ALSO RELEASED: Gold’s Big Move, Plus A Look At Housing And Consumer Spending CLICK HERE

ALSO RELEASED: James Turk – Gold Has Major Breakout, Plus Look At Silver’s Explosive Chart CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.