On the heels of the price of December gold futures trading down $30 to $2,016, here is the setup.

KWN has fixed the technical issue the network was experiencing, so audio interviews and articles will resume uninterrupted next week. Now for something about gold’s rise above $2,000…

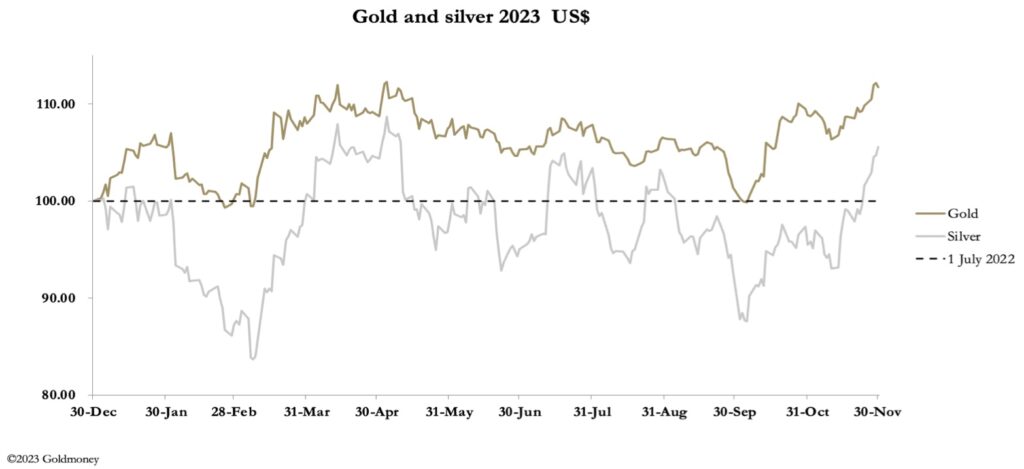

December 8 (King World News) – Alasdair Macleod: Gold and silver continued to rise this week, with gold bursting through the $2000 level, and silver $25. In European trade this morning, gold was $2042, up $42 from last Friday’s close, and silver was $25.20, up 93 cents.

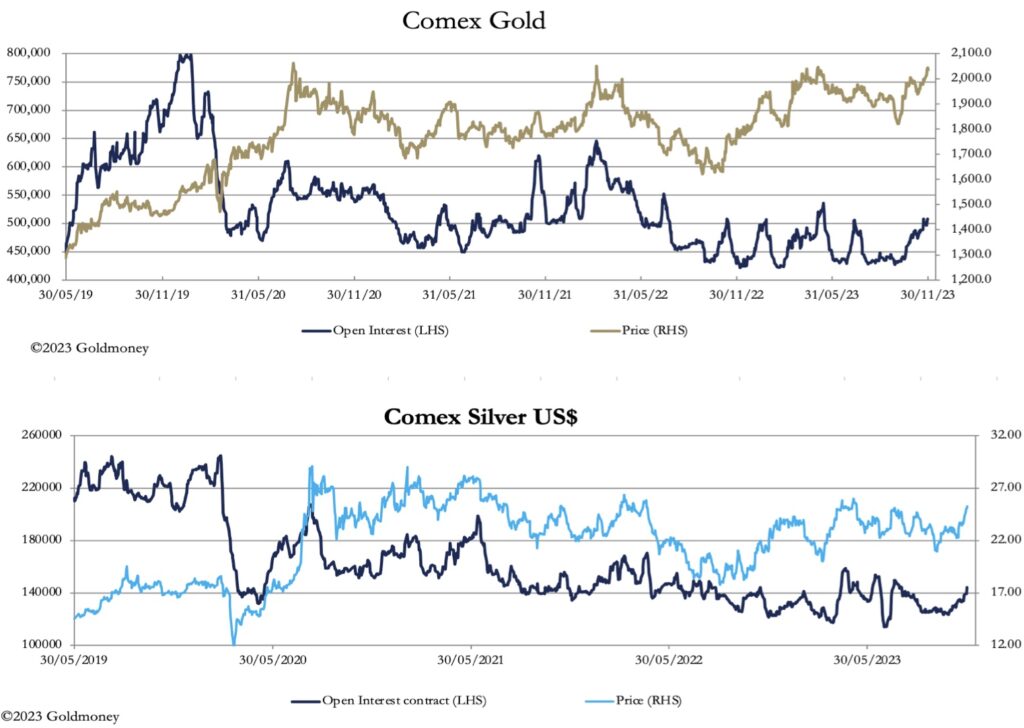

After a busy Monday, Comex volumes in both contracts declined over the week.

Being the month end, usually the bullion establishment likes to shake out weak holders, so that call options are abandoned, and their mark-to-market values are window-dressed favourably. There has been little sign of it. If anything, standing for delivery has been the feature, with 28,184 gold contracts (87.7 tonnes) and 1,554 silver contracts (241.7 tonnes) in the last five trading sessions…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

In both contracts, Open Interest on Comex has been rising, but are not yet in overbought territory, as the next two charts show.

The bullish gold chart has worked like a charm, up next.

Having broken convincingly above $2000, on technical grounds some consolidation is likely before the old highs at $2070 can be challenged successfully. And after the last few weeks of rising prices, it is quite likely that prices for both metals will succumb to some profit-taking later today, ahead of the weekend.

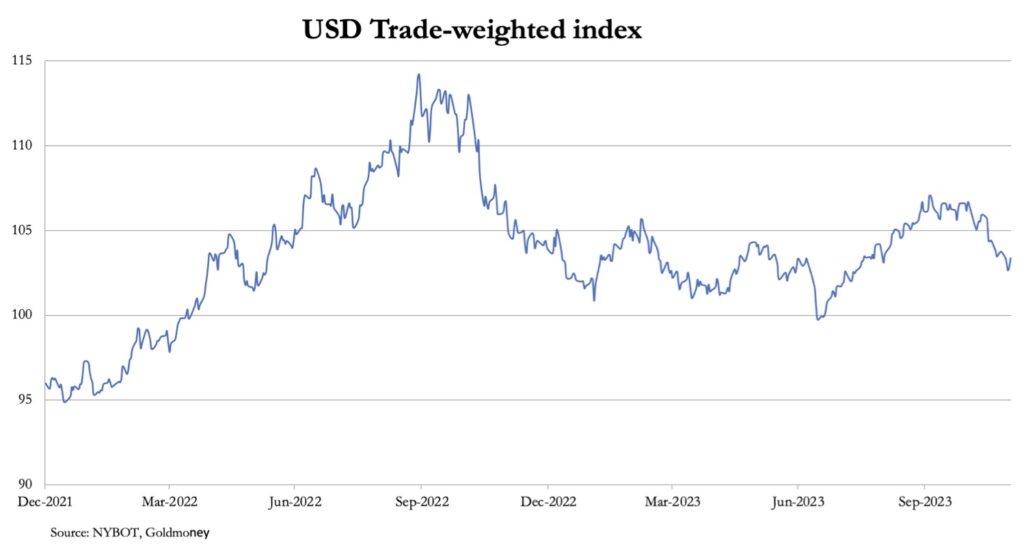

There is no doubt that gold and silver are being driven higher by a weakening dollar. The next chart is of the dollar’s trade weighted index, which will be worrying foreign holders of dollars.

And in US Treasuries, a substantial bear squeeze is driving yields lower. The next chart is of the 10-year US Treasury Note.

Foreign holders will be assessing the outlook for the dollar and Treasuries. They will note that with the US entering recession and a profligate administration in charge, plus $7.6 trillion of maturing debt to be rolled over next year that there are enormous funding hurdles for the US Government ahead. Furthermore, the recession is global, which is not only driving government deficits higher in the US but in the whole G7 as well. International trade will contract, meaning that fewer dollars need to be held in reserve. Inevitably, this will result in selling pressure as the dollar debt trap unfolds. The question to be answered is that after this technical bear squeeze in bonds is over, how high will yields then rise (and prices fall)?

Increasingly, foreigners holding dollars are looking at an opportunity to sell, and they are likely to conclude that the dollar and US Treasuries no longer represent safety. It’s not for nothing that the rating agencies are cutting US Treasury ratings.

This is why far from gold and silver rising, which is the conventional market view, it is the dollar declining, noticeably against other currencies initially. A large part of the dollar’s bull position has been because the Fed took the lead in driving interest rates and bond yields higher, leading to selling of low-yielding yen and euros. That is now reversing, driving the dollar’s TWI lower, a process which has not ended and should see gold go higher.

ALSO RELEASED: Turk – Gold Trades Above $2,000 For 10th Straight Day. Here Is Why That Is So Important CLICK HERE

ALSO RELEASED: Michael Oliver – Emotional 24 Hours Of Gold Trading Ushers In $100 Trading Range CLICK HERE

ALSO RELEASED: GOLD SOARS HIGHER IN OVERSEAS TRADING: $3,200 Could Be A Target CLICK HERE

ALSO RELEASED: GOLD HITS ALL-TIME HIGH: Hope Dies, Gold Rises! CLICK HERE

ALSO RELEASED: Price Of Spot Gold Hits All-Time High As Silver Surges Along With Miners CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.