Just when you thought it would be quiet on the last trading day before Christmas, the price of gold has erupted toward the $2,100 level, surging $30 as silver advances toward the $25 level.

Later today two audio interviews will be released. Until then…

December 22 (King World News) – Alasdair Macleod: Gold and silver drifted higher in tight liquidity. In European trade this morning, gold was $2053 up $34 from last Friday’s close, and silver $24.47, up 63 cents over the same timescale.

King World News note: Since this report was issued, the quiet holiday trading erupted into gold surging $30 to $2,080, and silver advancing toward the $25 level (additional King World News note about gold, silver, and miners at the bottom).

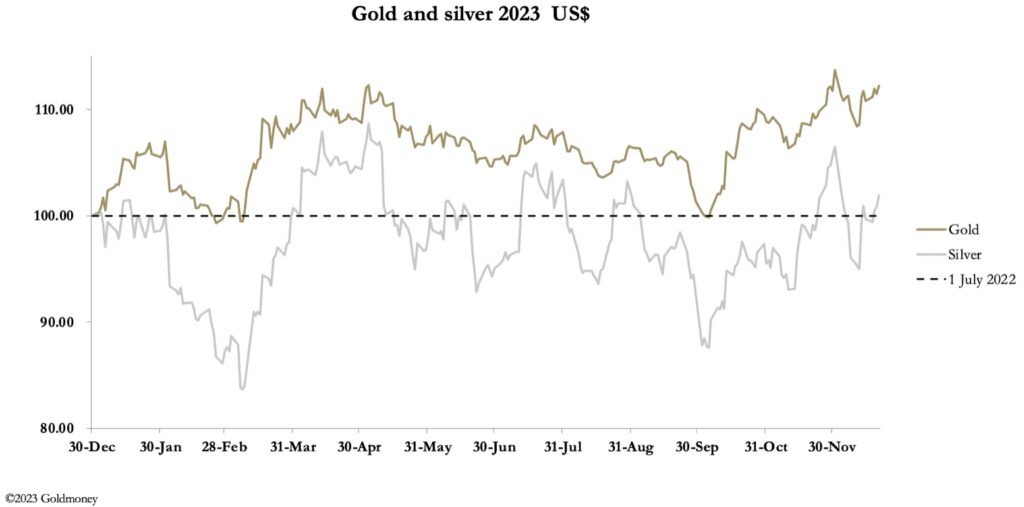

With only four trading sessions left this year, gold is up 12.6% and silver 2.2% from last December’s close. Gold has performed better than its long-term average but has been overshadowed perhaps by equities and bitcoin. Consequently, other than diehard gold bugs who are always a vociferous minority we see gold near to all-time highs with a remarkable lack of investor interest. But then, the investment establishment has increasingly turned its back on gold and physical metals for the last forty years.

Instead of investor demand, it has been central banks adding over 800 tonnes of gold to their reserves this year which has dominated physical markets. Much of it has been supplied by the mines and refiners directly, only referencing market prices. And the addition to reserves does not include buying by sovereign wealth funds, which if known would probably show global statist demand to exceed 1,000 tonnes.

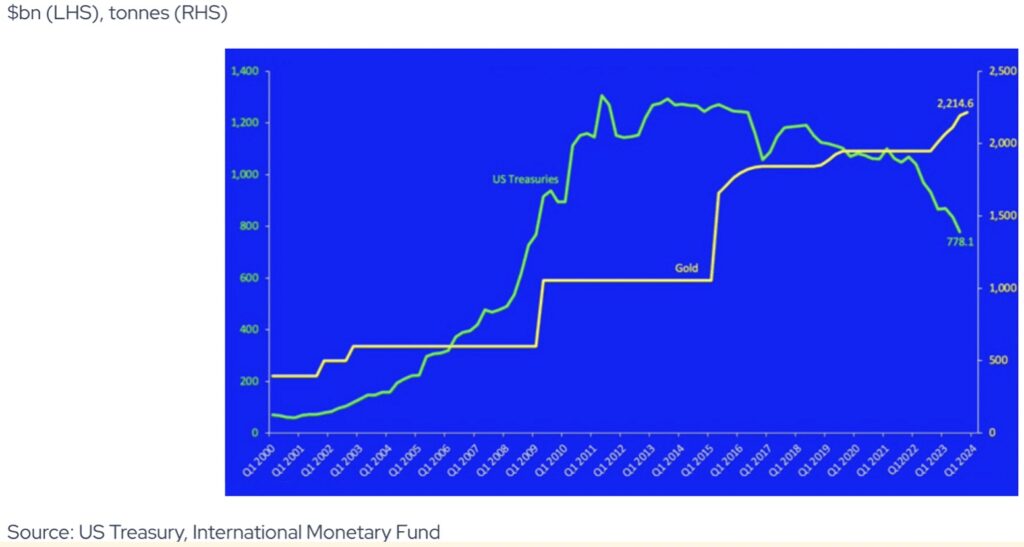

The chart below of China’s central bank dealings illustrates how it is dumping dollars and US Treasuries for gold.

The chart is from an article by OMFIF and reveals the dealing strategy of the People’s Bank. And with the US entering a debt trap, China will not be the only nation doing this trade.

If this trend continues into next year, the squeeze will be increasingly on the western bullion bank establishment. Its worst fear must be of a dawning public realisation that it is not gold going up, but the dollar and other currencies, naked in their value other than increasingly fragile faith in them, losing purchasing power.

This year on Comex, 132,269 gold contracts have been stood for delivery. That’s 13,226,900 ounces, or over 411 tonnes. The figure for silver is 135,510,000 ounces, or 4,215 tonnes.

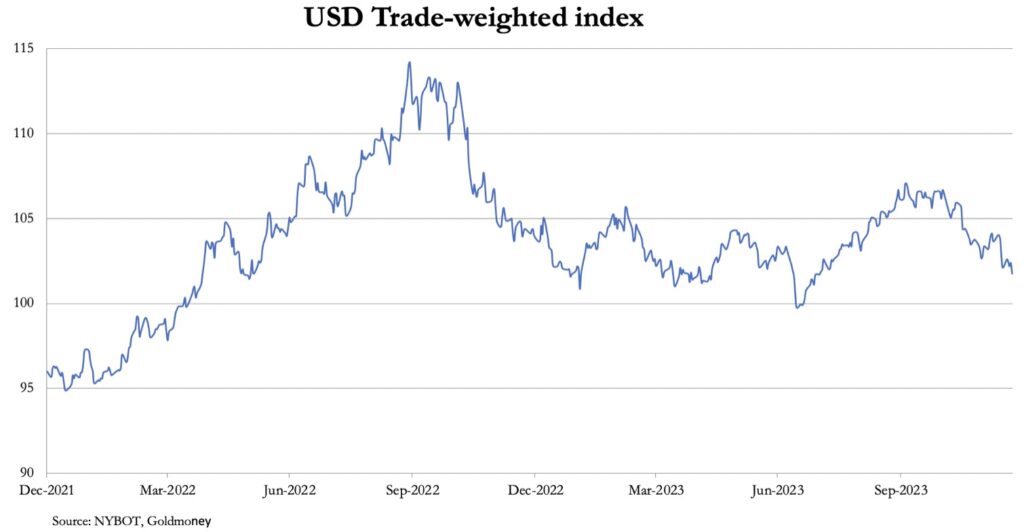

Recently, the Fed’s soft pivot has triggered a relief rally in bonds world-wide but raised fears of a falling dollar. The dollar’s trade weighted index is next.

The widely expected policy pivot has been reflected in a falling dollar since 1 November, since when it has fallen nearly 5%. This is a serious loss for the carry trade selling yen or euros to invest in US T-bills for the yield pickup, which has also narrowed. It could lead to further dollar selling by Japanese and Eurozone institutions which have sought higher yields than offered in their own currencies.

Therefore, the outlook is likely to be for further dollar selling, because of the large bull positions accumulated from earlier this year. But next week, paper markets could see year end window dressing as bullion bank dealers seek lower gold and silver prices for the benefit of their trading books and their year-end bonuses.

King World News note: Surging gold and silver prices will continue to push the HUI Mining Index higher, which already closed yesterday above the key 245 level. The wind is now at the back of the entire sector. The HUI & XAU Mining Stock Indexes will now begin their journey to all-time highs. We should also begin to see the price of silver begin its advance to $50 on the way over $100 an ounce. If you are accumulating physical silver, use any weakness to add to your positions as you keep stacking.

In case you missed this interview…

Ultra High-Grade Gold Discovery Near Fosterville!!

Eric King: “You’ve been very excited about these projects you have in Victoria, near the Fosterville Mine, and you also picked up that asset adjacent to K92’s mine. So you have this company positioned right next door to the historic Fosterville Mine in Victoria and K92’s mine in Papua New Guinea. Everybody is excited about this drilling in Papua new Guinea that is going to unfold, but Rex Motton sinks a hole, out of the blue, in Victoria, next door to Fosterville, and comes up with this ultra high-grade discovery. How soon can you sink additional drill holes into this new discovery? Also, I spoke with K92 CEO, John Lewins, who is also a Director of Great Pacific Gold, about this ultra high-grade discovery, and he is optimistic that more high-grade intercepts will be hit with additional drilling.”

Bryan Slusarchuk: “Well, it’s an amazing discovery that Rex and his team made, Eric. As you noted, we’ve been busy over the last few months getting ready for 2024 Q1 drilling in Papua New Guinea. We have amazing projects there, a 2,100 square kilometer land package, including 130 square kilometers contiguous with (bordering) K92’s mine. So we are very excited to get started there.

In the meantime, we have had these Victorian assets for some time and have been advancing them methodically on the ground. Our COO, one of the founders of the company, Rex Motton, has spent decades in Victoria, and he knows the geology of Victoria as well or better than anybody. And, Rex, based on all of this work that had been done, had a strong conviction that we had to test a project called the Comet Prospect at a precise juncture.

Based on his knowledge of that world famous Fosterville deposit, he believed that X marked that spot for the precise point that if we were going to find another Fosterville, that was where it would be located. So he sinks this drill, the final one of 2023, and on that hole it intersected an incredibly high-grade cut of gold mineralization. It looks remarkably similar to what the Fosterville discoveries looked like several years ago. So we could not be more excited. This is one of the better discovery holes that has been drilled anywhere in the world this year.”

Almost Identical To World Famous Fosterville Discovery

Eric King: “I’m looking at this old press release from the Fosterville discovery, and it’s seven meters of 159 grams per tonne of gold. You guys just hit 5 meters of 166 grams per tonne of gold, a little bit higher than Fosterville’s drill hole. So when you say there is a similarity, it’s almost identical.”

Bryan Slusarchuk: “There are so many similarities to this discovery both geologically and structurally. Rex Motton pounded the table that this was the hole that we needed to drill at Comet because it mirrored the world famous Fosterville discovery. The geology is remarkably similar to the Fosterville Mine. And he drilled a hole right into that X marks the spot, and he made an amazing discovery. The ultra-high grades will jump out at people, but for people that know the geology of that region, what will also jump out is where structurally this discovery was made, and the big implications of that. And, Eric, because we are extremely well funded, we look forward to unleashing the drills in 2024.” Great Pacific Gold, symbol GPAC in Canada and FSXLF in the US.

ALSO RELEASED: Central Banks And The Global Debt Catastrophe For Governments, Business, And People CLICK HERE

ALSO RELEASED: Another Golden Breakout, Plus Hi-Ho Silver & Silver Stocks And A Game-Changer CLICK HERE

ALSO RELEASED: Silver’s Fantastic Setup, Plus Gold Price In Chinese Yuan Poised To Explode Higher CLICK HERE

ALSO RELEASED: Central Banks Are Going To Print Money And Buy Everything In 2024 CLICK HERE

ALSO RELEASED: Michael Oliver – Here Is Why Gold & Silver Are Now Set To Explode Higher CLICK HERE

ALSO RELEASED: Another Big Gold Catalyst, Plus Consumers Are Broke And Desperate CLICK HERE

ALSO RELEASED: Here Is What To Watch After Dow Hits Record High CLICK HERE

ALSO RELEASED: “A Pretty Big Gamble” With Global Markets, Plus What’s Happening With Car Loans CLICK HERE

ALSO RELEASED: 2024 Is Going To Be A Financial Disaster For The World CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.