We are now on the road of “a pretty big gamble” with global markets. Plus look at what is happening with car loans.

“A Pretty Big Gamble”

December 18 (King World News) – Peter Boockvar: Former NY Fed president Bill Dudley wrote a piece today for BN titled “Jerome Powell’s Pivot is a Pretty Big Gamble.” He said, “The US Federal Reserve and its chair, Jerome Powell, are betting that they can have the best of both worlds – that they’ll be able to defeat excessive inflation without forcing the economy into recession. I hope it goes well. Unfortunately, there’s still a significant chance it won’t.” Dudley said “Higher for longer is now in the trash bucket.”

Here is Dudley’s main concern after acknowledging what Powell is trying to achieve, “Problem is, the central bank’s dovishness also increases the possibility of no landing at all – that is, overheating and persistent inflation that could undermine the Fed’s credibility, while requiring renewed tightening and a deeper recession to get things back under control…Powell has repeatedly emphasized that the Fed must finish the job, ensuring inflation gets back to 2% and stays there. Yet the more weight he puts on cutting rates to avoid a recession, the greater the risk of failing to control inflation – and of markets getting a bit, unpleasant surprise.”

Trouble In The Auto Market

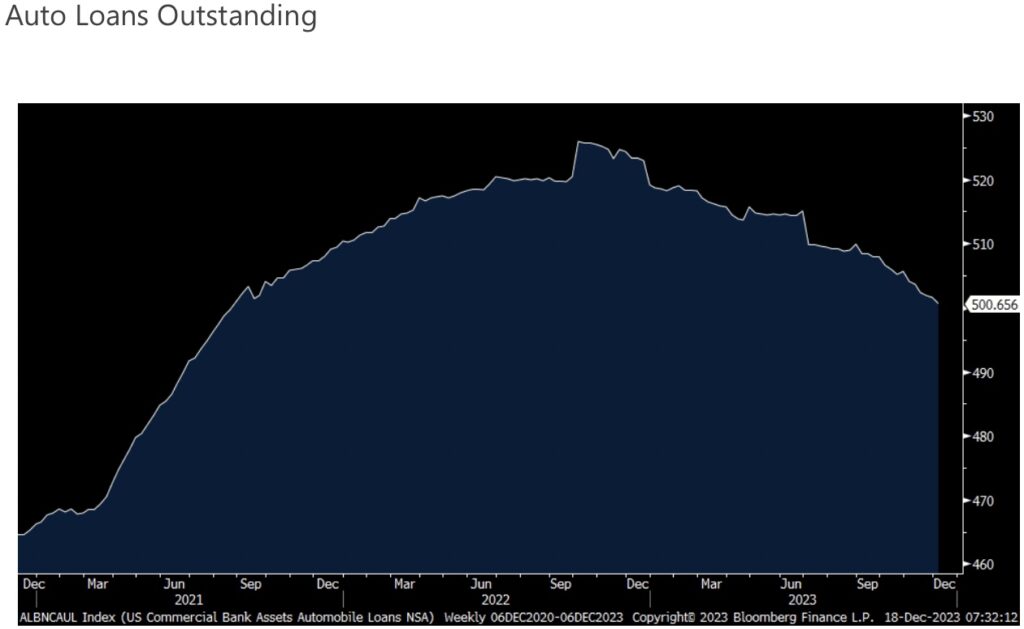

Shifting to the auto sector, expect a slowing of sales in 2024. On Friday, for the week ended 12/6, banks had auto loans outstanding at the smallest level since August 2021.

I also saw a BN article Saturday titled “Underwater car loans surge to the highest level since 2020” as “Negative equity on automobiles is at the highest level in more than three years, with higher prices and borrowing costs hitting owners.”

‘Underwater’ defined here as the loan on the car is bigger than its current value. Sounds familiar with what we saw with homes about 15 years ago. Citing Edmonds in the article, “In November, people with negative equity were underwater by an average of $6,054, the most since April 2020 and well above pre-pandemic averages.” Also from Edmonds, “We’re in this situation where combined with the cost of the vehicles being so high and the interest rates being so historically high, you have a lot of people who are in bad car loans.” I’ll add, business is good for the auto repo person.

With the average interest rate on a new car at 7.4% and at 11.6% for a used car, will 150 bps of Fed rate cuts really move the needle after 15 years of much lower rates? Around the edges maybe but…

Lastly on this, on the industrial side of the economy, it was the auto sector that has been an area of strength as inventories were normalized relative to pre Covid trends. We heard the same from all the semiconductor companies that have autos as an end market customer.

ALSO JUST RELEASED: 2024 Is Going To Be A Financial Disaster For The World CLICK HERE

To listen to Alasdair Macleod discuss the wild trading in the gold and silver markets as well as the US dollar and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.