Here is a look at another big gold catalyst, plus consumers are broke and desperate.

Another Big Gold Catalyst

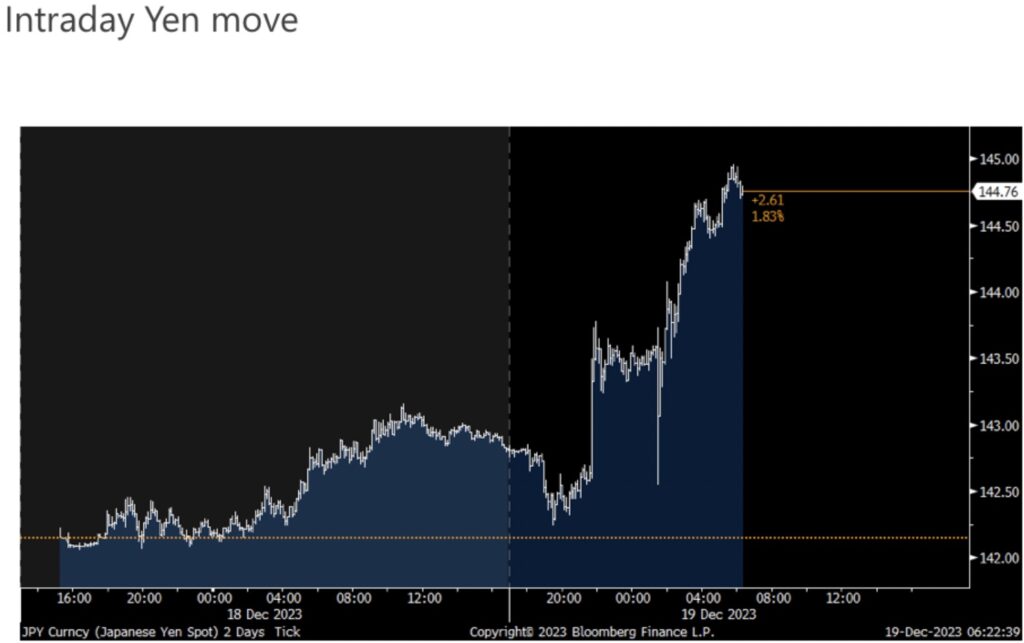

December 19 (King World News) – Peter Boockvar: Just when you thought the BoJ couldn’t be any more dovish and that it was time to finally exit NIRP, they are redefining the word ‘patience’ as Governor Ueda said he needs more time and while nothing was expected overnight, some of us thought the table would be set for January or soon after. No table was set but Ueda also didn’t rule out creating one. JGB yields fell, the yen is getting slammed and the Nikkei was up 1.4%.

As for not ruling anything out in the meetings in early 2024, Ueda said “The probability of the economy achieving self-sustaining inflation is increasing” but “we still need to scrutinize whether a positive wage inflation cycle will fall in place.” Also, “Most policy board members are of the opinion that they need to observe the situation for a little longer.” So close but yet so far?

Confusing the situation in trying to figure out what they will do is while core CPI (just ex food) has been above 2% since April 2022, Ueda said “we have yet to foresee inflation sustainably and stably achieving our target. As such, it’s hard to show now with a high degree of certainty how we can exit.” The only reason logic doesn’t apply here is that the BoJ is apparently afraid of upsetting the financial situation of the Japanese government by raising their funding costs on a debt to GDP ratio of 250%.

The JGB rally helped European and US bonds today.

Canada

In an interview with BNN, the Governor of the Bank of Canada, Tiff Macklem late yesterday said they will likely cut rates next year, confirming what has been priced in but said they need to see “a number of months” of decelerating inflation before they consider when. There wasn’t much of a market response as the CAD is little changed as are short rates.

As sentiment always follows price, now everyone is piling in to stocks as this was an interesting stat from a Bloomberg News story, the SPY ETF on Friday took in $20.8 billion, “the biggest inflow since the fund’s inception in 1993. According to Bloomberg Intelligence, it was the largest one-day flow for any ETF.”

Fear & Greed

Friday was also the day that the CNN Fear/Greed index moved into the ‘Extreme Greed’ category, rising to 80 intraday, the highest since July. It closed yesterday at 77. It was 67 one week ago, 58 one month ago and 39 one year ago. https://www.cnn.com/markets/fear-and-greed

Consumers Are Broke And Desperate

he beauty but also curse for those who choose to use Buy Now, Pay Later is because a credit card is not used, their credit rating is not at risk if they don’t pay. And when you hear that people are using this service just to pay for their weekly groceries, you know some are very stretched and something we heard time and again during retail earnings season. The article in the WSJ yesterday on BNPL, they mentioned a stat I didn’t see a few weeks ago from Adobe Analytics, that “Over Black Friday and Cyber Week, such payment plans accounted for 7.2% of all online sales, a 25% jump from last year” and also a big reason for the drop in credit card usage. Also, according to LexisNexis Risk Solutions said the article that 25% of “all American adult consumers have used Buy Now, Pay Later loans.”

Now these loans can see anything from a zero percent interest rate and up to 36%. That compares with 23% for the average credit card according to the Fed. The article highlighted Paden Brown, a truck driver from Texas who uses Affirm to buy groceries and household essentials. “A recent bill at Walmart was roughly $465, and Affirm offered him a choice of three payment plans. He chose a six month loan with a 36% interest rate that didn’t require a down payment. He has also used the service to buy nearly $4,000 of gaming equipment and $1,100 in tickets to WrestleMania events, both on interest free payment plans with longer timelines.” https://www.wsj.com/personal-finance/credit/buy-now-pay-later-industry-watchdog-groups-beed96c8

Bottom Line

Bottom line and why I brought this up, when you see a retail sales figure, either from the government or from a retailer, dig deeper into the headline number and understand that BNPL is becoming a big factor in sustaining sales for some. That said, it’s clearly the tale of two consumers as those with savings are benefiting greatly from generous interest income that a high fed funds rate is providing, particularly the boomers, while those that aren’t are living on payment plans for many of their expenses.

Meanwhile In The UK

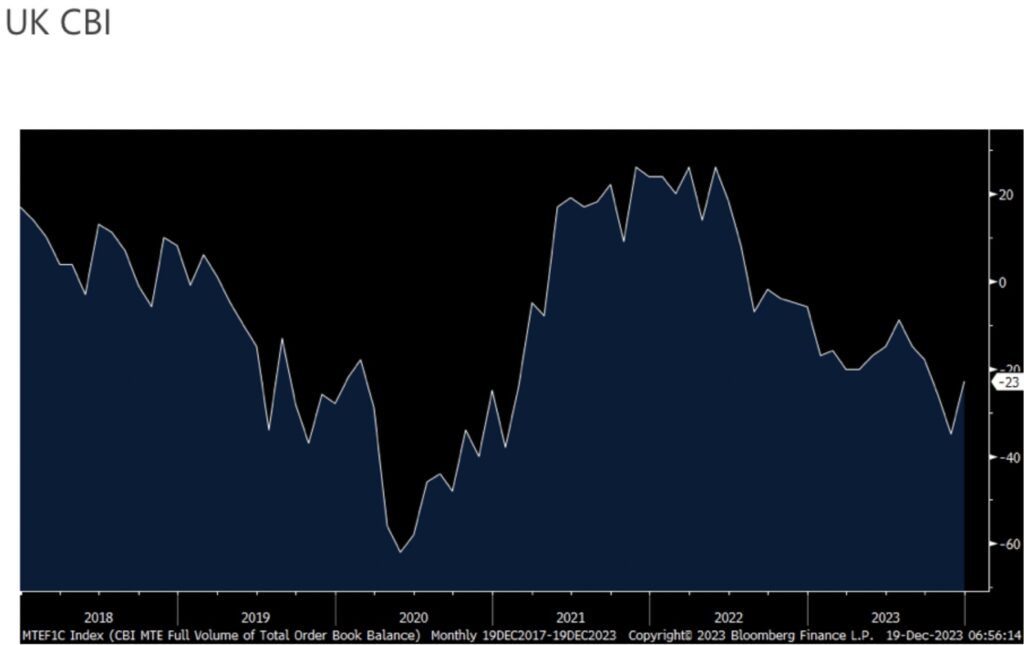

The only thing data wise of note overseas was the UK CBI industrial orders index that I like to follow. The December print was -23 but up from -35 in November and was 6 pts better than expected.

CBI said “Manufacturers reported that output volumes were stable during the final three months of the year – the first time output hasn’t fallen since the quarter to July 2023.” Their chief economist was quoted as saying, “UK manufacturers appear to have ended the year on a stable footing” and “Selling price expectations are the weakest they have been in two years, reflecting ongoing improvements in supply conditions and soft demand.”

As for what 2024 might bring, “The environment for UK manufacturing is likely to remain challenging, with global growth set to remain weak in the year ahead. High interest rates will continue to weigh on household spending, while adding to business costs. And sticky domestic inflation and strong wage growth suggest cuts in UK interest rates are still some way off.” We still like UK stocks and are long some of them. The FTSE 100 has badly lagged this year, up just 2.2% and trades at 10.8x 2024 eps estimates with a 4.3% dividend yield because of its heavy weighting in commodities and financials and little tech.

Also of importance…

Ultra High-Grade Discovery Near Fosterville!!

Great Pacific Gold Corp. (GPAC) just announced a high-grade gold discovery on the Comet Prospect at it’s 100% owned Lauriston Project located in Victoria, Australia. The hit, which recorded a remarkable 5m at 166.35 g/t Gold including 2m at 413 g/t Gold from 95m is the highest-grade hole ever reported from the property, which is immediately south of the Agnico Eagle Fosterville Mine tenements.

Discovery Comes on Last Scheduled Hole on the Project

As stunning as this gold discovery is based on the assays alone, the story behind the hole is just as interesting. In 2022, GPAC drilled 14 shallow holes at Comet and got a lot of information that seemed interesting geologically but did not create much excitement. However, based on an understanding of the Fosterville Mine deposit model, GPAC’s COO and Director, Rex Motton thought that the single best place to test this area for a Fosterville type deposit was where the west dipping faults intersected the anticline, which was deeper than the previous testing. The technical team believed they had determined where the anticline (a geological feature) existed and convinced others within GPAC management to take a single shot at this target in 2023. Incredibly, right where it was predicted grade would potentially pick up, this high-grade discovery was made.

It was the first hole at Comet in 2023 and the very last hole drilled in the GPAC 2023 drill program.

What Next?

GPAC has been very busy preparing for Q1 2024 drilling in Papua New Guinea, where the company has assembled a commanding 2166 sq km land package including 130 sq km to the northwest of and contiguous with K92 Mining’s prolific tenements. While preparing to start exploration in PNG and targeting to get drill contracts signed, road rehabilitation underway and geochemistry started, GPAC has been quietly finishing up a small program in Victoria. Now, with this discovery made right at the end of the year, the company seems to have a lot of options in terms of value creation. GPAC CEO Bryan Slusarchuk notes:

“We are very excited to get going in PNG in a big way in Q1 and are doing a lot of work preparing for this. To have this big discovery hole now in Victoria is a big blessing and the technical team’s assessment of the potential for a big hole at Comet certainly has come to fruition. We are very well funded and between the strong cash position and having less than 85 million shares out, 2024 can be a big year for GPAC shareholders.”

Great Pacific Gold, symbol GPAC in Canada and FSXLF in the US.

ALSO RELEASED: Here Is What To Watch After Dow Hits Record High CLICK HERE

ALSO RELEASED: “A Pretty Big Gamble” With Global Markets, Plus What’s Happening With Car Loans CLICK HERE

ALSO RELEASED: 2024 Is Going To Be A Financial Disaster For The World CLICK HERE

To listen to Alasdair Macleod discuss the wild trading in the gold and silver markets as well as the US dollar and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.